UPDATED October 2020 — As the COVID-19 pandemic continues testing the economic strength of the multifamily industry, state and city legislators across the nation are rallying support for emergency rent assistance programs in the form of rent relief funds and other financial resources. The relief comes on top of a national push to establish emergency rental assistance including a new Senate bill that proposes $100 billion in rent relief, as well as the CARES Act which offers renter protections for federally funded rental housing.

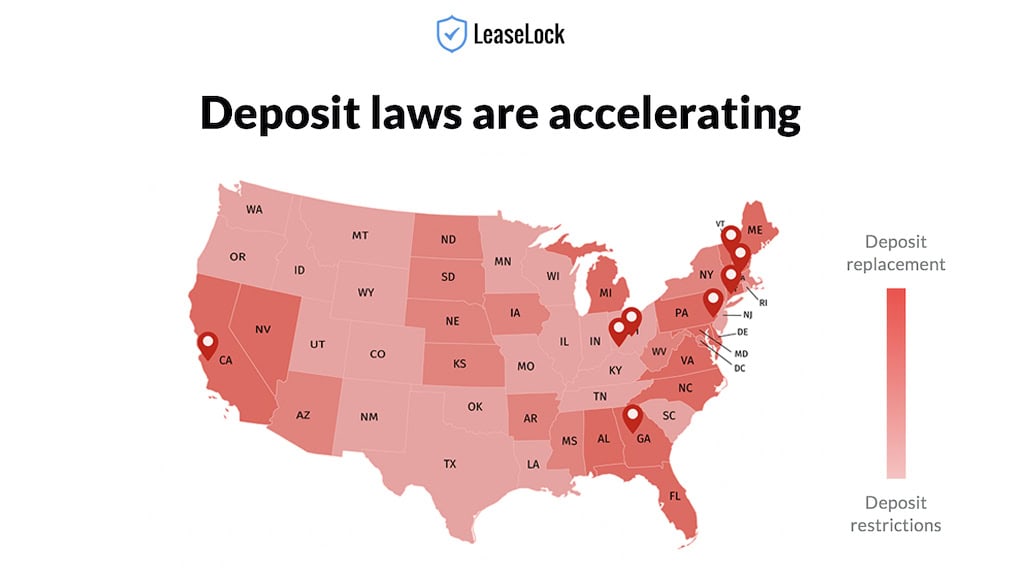

Local and state governments have been proactive in implementing eviction moratoriums and passing security deposit replacement legislation, and apartment operators have devised rent relief programs for their communities. However, there is still a critical need for emergency rent assistance funding to directly aid the rental housing industry. Several cities and states have already launched emergency rent relief funds and are providing financial resources for America’s renters, but a handful do not yet offer dedicated rent assistance programs.

Are Renters Paying Rent During COVID-19?

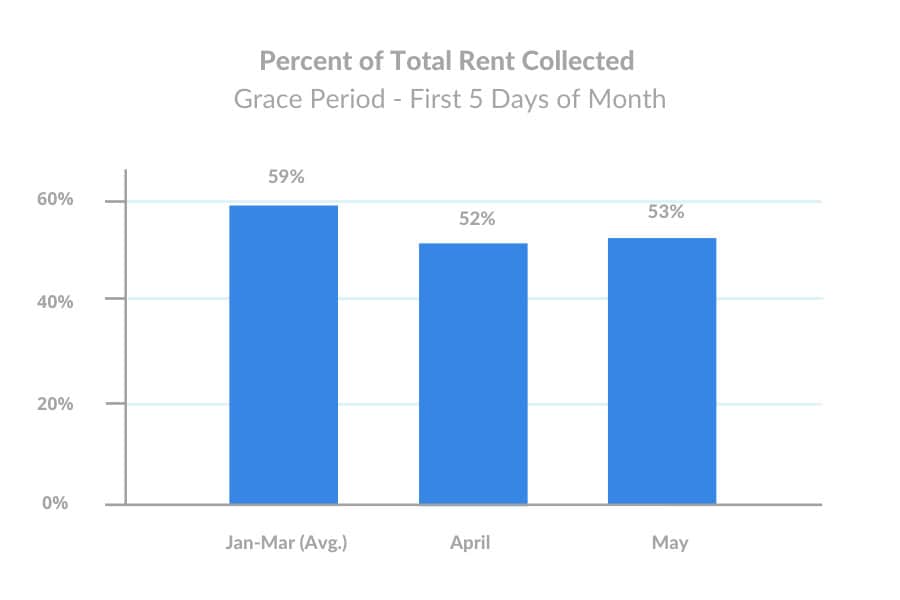

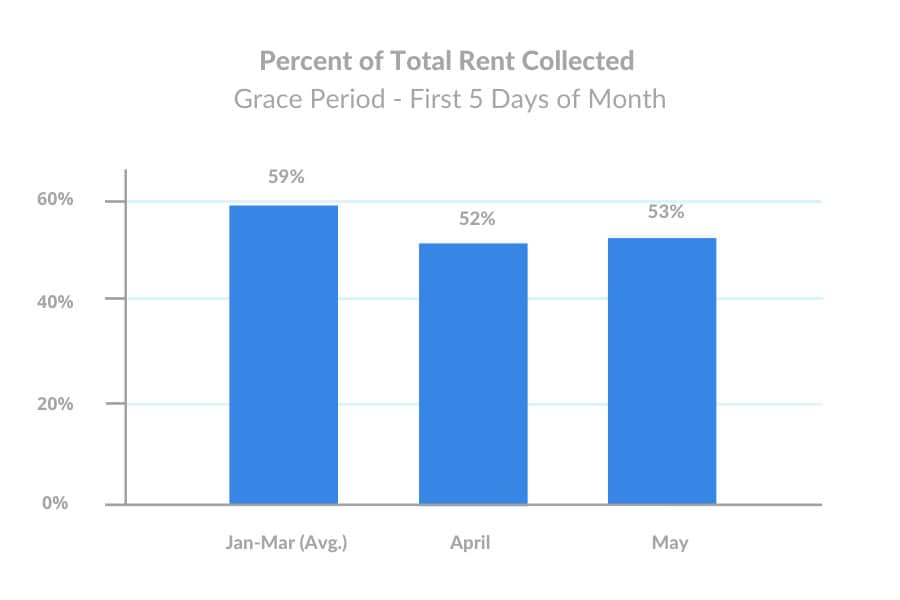

This begs the question—are renters paying rent? April rent payment data showed a slight downward trend but was otherwise not far off the mark from normal rates pre-COVID. Heading into May, initial data suggested the renters were prioritizing paying rent despite gloomy industry forecasts, and a full analysis of payment behavior during the May grace period revealed renters who could pay were doing so, while operators continued to offer payment plans. Ultimately, rent payments are holding steady compared to the average, but the months ahead are less clear.

The multifamily outlook from here on out is rooted in economic uncertainty, both when it comes to renters’ ability to pay rent and operators’ ability to remain flexible with renters. Even though the government is supplying affected renters with stimulus payments and supplemental employment benefits, there’s no telling whether they will continue to put that money toward rent or other essentials, not to mention that funding will eventually run dry.

As Doug Bibby, president of the National Multifamily Housing Council (NMHC), explains,

“For that reason, lawmakers need to act now to enact a direct renter assistance program.”

More than ever, it’s imperative that cities and states prioritize emergency rent assistance programs.

Are Governments Providing Emergency Rent Relief Funds & Financial Assistance Resources?

As the economic effects of COVID-19 rumble through the multifamily housing industry, local and state governments — as well as various organizations and communities — are taking measures to establish emergency rent assistance programs and direct other financial resources to operators and renters.

We cannot leave behind the millions of Americans who could be facing eviction without #RentReliefNow.

I’m introducing a bill that provides $100 billion in emergency rental assistance to help people pay their rent during and after this pandemic.

— Sherrod Brown (@SenSherrodBrown) May 4, 2020

This ever-changing patchwork of local emergency rent relief solutions has created some confusion among apartment operators and renters alike, further underscoring the need for federal funding programs to directly support the rental housing industry and its residents. While not every city and state has created COVID-19 emergency funds for rental assistance specifically, we’ve aggregated a list of state and city emergency funds so that operators are more informed when it comes to the rental relief available to them and their communities.

Cities & States Offering Emergency Rent Assistance Programs & Rent Relief Funds

*NOTE* The emergency rent assistance funds on our list may no longer be available, depending on how quickly the funds were distributed. Visit the sources we provide below to find more information on whether government rental assistance funding is still accessible or if other funding programs exist. To ensure the rental housing industry receives more direct funding, consider contacting your senators and representatives to urge them to support the “Emergency Rental Assistance and Rental Market Stabilization Act.”

Alabama: Rental Assistance Program and Non-Profit & Short-Term Housing Assistance

The JCCEO CSBG Rental Assistance Program was established to meet the emergency needs if households facing a financial crisis due to pandemic-related events. This program provides one-time financial assistance to those who qualify and covers expenses such as rent, water, or prescription medication. Applications are processed within 30 days.

A statewide nonprofit called Alabama Arise directs people to the statewide helpline if they need help paying rental deposits and first month’s rent. Individuals seeking rental assistance should ask for a referral to an agency that receives Homeless Prevention and Rapid Rehousing funds. In addition, the Alabama Department of Human Resources (DHR) Alabama is offering short-term assistance to individuals with low income and who need help paying rent. The Community Action Agency of Northeast Alabama also has a benefit program that offers rent assistance.

Alaska: COVID-19 Housing Relief Fund

For Alaskans struggling to make rent payments, a $10 million rent relief fund was administered by the Alaska Housing Finance Corp with an application deadline of June 26.

Headed by the Rasmuson Foundation and Wells Fargo Foundation, a relief fund was established in partnership with the Alaska Community Foundation and the United Way of Anchorage. The fund will help families pay rent in light of unexpected housing emergencies surrounding the coronavirus.

Anchorage passed an emergency ordinance that will put $1 million toward a housing costs relief fund for residents affected by COVID-19. Juneau has an emergency appropriation in place that sets aside $200,000 for residents who have been laid off or are unable to work due to the pandemic.

Arizona: $5 Million Rental Assistance Funds

The Arizona governor Doug Ducey announced $5 million in rental funding as part of a Rental Eviction Prevention Assistance Program launched by the Arizona Department of Housing. The rental assistance is made available to households on following conditions: 1) primary residence is a rental located in Arizona and 2) have seen a reduction in income due to COVID-19, that when annualized, does not exceed 100 percent of the area median income adjusted for family size for the county in which they reside. As of May 8, the rent relief funds had only been made available to fewer than 400 applicants out of nearly 11,000 renter applications. As of late August, the program is still accepting applications.

Arkansas: Community Rent Assistance Fund

There is currently no statewide emergency rental assistance. However, a community relief fund was set up at First Security Bank to collect donations and an allocation committee will distribute the funds over a 60-day period. The program has since closed.

California: $25 Billion Rental Relief Fund & COVID-19 Emergency Rental Assistance Programs

As of August, California lawmakers still hadn’t come up with an emergency rent relief plan. In May, California State Senator Lena A Gonzalez introduced a Senate Bill in May to protect both renters and rental property owners from financial hardships brought on by COVID-19. The COVID-19 Emergency Rental Assistance Program would provide direct rental payment relief to renters who are unable to pay rent due to the pandemic, as well as property managers who agree to specified terms (i.e., forgoing rent increases and late charges). California lawmakers are also working on two proposals—one is a $25 billion economic relief fund for rent payment assistance and the other is a renter assistance program in which property managers would be asked to forgive rent payments in exchange for tax credits.

A few counties have also allocated or proposed funding for rental assistance. Los Angeles approved a $1+ million program to provide rent subsidies of up to $1,000 per month for up to three months for families who have recently lost jobs, which they hope to be provided as part of the next round of the CARES Act. As of May 13, over $3.7 million was available to residents in designated unincorporated areas. Applications must be received by May 31, 2020.

In addition, the income-based L.A. County COVID-19 Rent Relief program will remain open until Aug. 31. Up to $10,000 will be given to households that meet the program’s income guidelines. Financed through $100 million in federal CARES Act money, its goal is to assist about 9,000 households with half of the available money being directed to residents who live in high-risk eviction ZIP Codes

In Northern California, the city of San Jose, the county, and nonprofits and companies have contributed $11 million to the Santa Clara County Fund to help low-income households pay rent and other crucial bills.

Colorado: $23M Emergency Housing Assistance Program & Property Owner Preservation Program

In Gov. Jared Polis’s executive order, $3 million in state funds was allocated for short-term rental and mortgage assistance. The Colorado Department of Local Affairs’ Division of Housing launched the Property Owner Preservation program to allocate up to $20 million in federal CARES Act funds for rental assistance to landlords on behalf of their tenants. Both programs are accepting applications as of late August.

Earlier this year, Colorado property managers raised $74,000 for a rent relief fund to help renters who lost income or suffered illness due to the pandemic. The Colorado Apartment Association is asking for others to contribute to the national Resident Relief Foundation’s $10 million fund, which will ensure donations from Coloradans will help Colorado residents. In addition, the Colorado Association of REALTORS Foundation announced $125,000 in grants to three Colorado nonprofits to assist residents with housing-related emergencies.

Out of $20 million in CARES Act funds being deployed in Denver, $4 million will support rent and utility assistance

Connecticut: Rental Assistance Program (RAP)

The Connecticut State Department of Housing created the Rental Assistance Program which assists low-income families to afford safe and sanitary housing in the private market, and is designed for families to choose which private rental housing so long as it meets the program requirements. The waitlist is currently closed, but people can register to be notified when it reopens.

District of Columbia: $1.5 Million Federal Home Funds & The Emergency Rental Assistance Program (ERAP)

D.C. Mayor Muriel Bowser announced a new rental assistance effort in which the Department of Housing and Community Development will put $1.5 million in federal home funds toward providing rental assistance funding to low-income renters living in properties financially impacted by COVID-19. There’s also the Emergency Rental Assistance Program provided by the Department of Human Services which helps pay overdue rent, security deposits for new residences, and first month’s rent. Most recently, the D.C. Council passed an emergency coronavirus relief bill on May 19 that requires property managers with five or fewer units to offer alternative rent payment plans.

Delaware: $2 Million Housing Assistance Program

Governor John Carney and Delaware State Housing Authority (DSHA) Director Anas Ben Addi announced a new program to provide $2 million in emergency rental assistance to those affected by the COVID-19 crisis. The Delaware Housing Assistance Program (DE HAP) was structured to provide eligible households up to $1,500 for rent or utility payments made directly to their property owner or utility company.

Florida: $1.8 Million One-Time Rental Assistance & Renters Relief Program

Up to 1,500 families in Orange County, Florida had access to $1.8 million in funding for one-time rental assistance, although the program has since ended after processing applications and paying out benefits. The cities of Hialeah and Miami currently offer a temporary emergency program for renters who lost their jobs due to the pandemic. In Hialeah, a forgivable loan of $1,000 will be given over a 3-month period to 1,000 qualified households.

The city of Miramar is offering an emergency rent and utility assistance program for low income residents dealing with unemployment or pay cuts. Relief payments are to cover a maximum of three past-due rent and utility costs (up to $7,000 per household) and are not required to be repaid by residents.

Georgia: Rent Assistance

Organizations in Atlanta, Decatur, and DeKalb County offer assistance with rent, rental deposits, and food. These organizations include St. Vincent de Paul Georgia, Decatur Emergency Assistance Ministry, and Decatur Cooperative Ministry.

Hawaii: $1.25 Million COVID-19 Rent & Utility Assistance Program

The Aloha United Way organization launched a rent and utility assistance program which has $1.25 million in initial funding. At that amount, it’s estimated to help about 900 families.

Idaho: $825K COVID-19 Response and Recovery Fund

The COVID-19 Response and Recovery Fund for Idaho approved nearly $825,000 in grants for organizations throughout Idaho helping low income individuals and those experiencing housing instability. The grants will go to multiple organizations that will disperse the funds to help with rent assistance among other needs.

Illinois: Emergency Housing Bill & $2 Million Housing Assistance Grant Program

Illinois proposed an emergency housing bill that would cancel rent payments for those experiencing coronavirus-related hardships while also establishing a fund for property managers to recoup lost rental income—the funding would come from the CARES Act. In Chicago, Mayor Lori E. Lightfoot and the Department of Housing created a COVID-19 Housing Assistance Grant program to assist residents who lost their jobs or have otherwise been financially impacted by the COVID-19 pandemic. DOH will deploy $2 million from the Affordable Housing Opportunity Fund to disburse one-time grants in the amount of $1,000 to help with rent and mortgage payments. The fund will award 2,000 individual grants, half of which will be awarded through a lottery system, while the other half will be distributed by non-profit community organizations.

Indiana: Proposed Rental Assistance Program

While there is currently no known statewide programs, a group of Indiana organizations are calling for a rent assistance program to be created from the state’s CARES Act funds in order to help residents with long-term needs.

Iowa: No Known Statewide Programs At This Time

Kansas: $3.2 Million COVID-19 Response & Recovery Fund

The Kansas City Regional COVID-19 Response & Recovery Fund announced that $3.2 million in funding would be released to 72 local nonprofits. Each nonprofit is responsible for handling assistance with housing, including rent, utilities, and other critical human services.

Kentucky: $500K COVID-19 Relief Fund

Mayor Greg Fischer and the Louisville Metro Council allocated $500,000 toward the One Louisville: COVID-19 Relief Fund for rental assistance. Qualified renters could get up to $1,000 per household for rent or utility payments.

Louisiana: $14.7 Million Rental Assistance HUD Grants

From the nearly $15 million in funding awarded by the U.S. Department of Housing and Urban Development (HUD), the Louisiana Housing Authority is providing housing assistance payments for rent, mortgage, and utilities for up to 24 months. The city of New Orleans will receive $10 million in community development block grant funds to help provide rental and utility assistance to low-income residents.

Maine: $5 Million Rent Relief Program

Gov. Janet Mills created a $5 million rent relief program, offering a one-time payment up to $500 in rental assistance for those struggling to pay rent during the pandemic. Funding would be available to households that meet certain income and eligibility requirements and the aid would be paid directly to property managers.

Maryland: Coronavirus Relief Funding

The city of Baltimore will use $13 million in federal relief funding to create a rental assistance program that helps renters pay past-due rent. Howard County will also receive rental relief, with $800,000 in county funding going towards rental assistance and eviction relief.

Massachusetts: $3 Million Rental Relief Fund

While applications may be closed, Boston has dedicated $3 million in City funds to help residents at risk of losing their rental housing due to COVID-19. The funds will help those who do not have access to expanded employment benefits, or experience a significant reduction in their actual income despite receiving unemployment benefits.

Michigan: $1 Million Emergency Rent Assistance Fund

Michigan League for Public Policy has laid out housing policy recommendations, one of which is to “establish a rental assistance fund and manageable provisions for the repayment of rent arrearages to avoid a wave of evictions once the moratorium expires.” Further, the League calls for the state to provide at least $1 million in state funding for emergency housing needs.

Minnesota: $100 Million Emergency State Housing Assistance Grants

The Minnesota House committee approved a $100 million COVID-19 aid program which aims to help low-income renters as well as property managers pay their bills. Minneapolis implemented a $5 million Gap funding plan which allocated $3 million for its emergency rental program to assist low-income residents impacted by the pandemic. The program stopped accepting applications at the end of April.

Mississippi: $1.25 Billion Federal Rental Assistance & Relief Distribution

Mississippi legislators are considering how to distribute $1.25 billion in federal funding to provide rental assistance. A week in May, rental assistance payments were still not operational. Alternatively, renters can seek assistance from the United Way of Southeast Mississippi COVID-19 Relief Program, which awards aid to households to pay rent and utility bills that are past due at the time of application.

Missouri: $9 Million Rent Assistance

Governor Mike Parson announced that Missouri would receive federal funding to support renters impacted by COVID-19. The Missouri Housing Development Corporation is working out details on providing an additional $9 million dollars in rent assistance to those who have experienced an economic setback from COVID-19.

Montana: $430K Emergency Housing Assistance Program

Montana launched a state Emergency Housing Assistance Program to allow families apply for rental and security deposit assistance. Families must have at least one child under the age of 18 and a substantial loss of income due to COVID-19 in order to be eligible. Monthly rental payments or security deposits are to be mailed or deposited directly to the applicant’s property manager. A federal assistance fund will use about $430,000 to launch the relief program.

Nebraska: COVID-19 Relief Fund

The Nebraska Impact COVID-19 Relief Fund was formed to provide direct aid to communities and organizations, including assistance for rent. In the counties of McCook and Red Willow, renters who need help making payments due to losing their job or having their work hours reduced are eligible for assistance from Community Action Partnership.

Nevada: $2 Million Emergency Rental Assistance

Nevada has access to $2 million in settlement funding for emergency rental assistance which will go directly to Nevada families in need of emergency assistance. The funding will go to United Way of Southern Nevada and United Way of Northern Nevada and the Sierra to be distributed to families in need.

New Hampshire: Welfare Program

The New Hampshire Legal Assistance organization advises renters who are unable to pay rent to apply for help at their city’s welfare office. While no statewide programs offer rental assistance, there are proposals for rent assistance payments being considered by the Governor’s Office for Emergency Relief and Recovery.

New Jersey: $100 Million Rental Assistance Program & Rent Suspension

The State Senate passed the 2020 New Jersey Emergency Rental Assistance Program which sets aside $100 million to aid residents affected by coronavirus in satisfying their rental obligations. New Jersey also introduced a bill ensuring residents who ask their property manager for rent relief won’t be denied—renters who request payment suspension need to come to “reasonable repayment structure with their landlord.” The mayor of Newark announced on May 18 the launch of its COVID-19 Tenant Based Rental Assistance Program which is accepting applications for emergency rent grants of up to $1,000.

New Mexico: $1.6 Million Rental Assistance HUD Grants

The U.S. Department of Housing and Urban Development (HUD) awarded $1.6 million to public housing authorities in 14 counties in New Mexico for rental assistance. Additionally, in support of community initiatives, New Mexico Bank & Trust committed $10,000 to the Santa Fe Community Foundation for its response fund, which provides help for emergency rent and utilities assistance.

New York: COVID-19 Emergency Rent Assistance Program

New York State legislators proposed a three-bill package that would waive or suspend rent for individual renters impacted by this crisis, and allocate funds to support small property managers. One bill would suspend rent payments for renters who lost income and also establish a coronavirus rental assistance fund. New York City proposed an $8 million “Renter’s Relief” plan that would require property managers to offer renters the option to put security deposits toward April rent. Participants would have 30 days to start paying back their security deposits.

North Carolina: $117 Million Rental & Utility Assistance Program, $9+ Billion Federal Housing Assistance

In mid-October, the N.C. Housing Opportunities and Prevention of Evictions (HOPE) Program made $117 million in rental and utility assistance available to help North Carolinians. The application is open to renters facing financial hardship as a result of COVID-19. More information on the program as well as the application can be found here. In addition, the North Carolina Housing Coalition has outlined housing priorities and advises that a significant amount of the $9 billion housing funding be put towards emergency rental assistance. Housing advocates are also calling for part of the $5 billion in Community Development Block Grants be allocated to provide rental payments.

In Charlotte, city council members approved plans to set aside $1.05 million from the $5.7 million of federal stimulus funding from the CARES Act for rent relief. The program includes funds for three months of rent for 350 households earning up to 80% of AMI. In partnership with The Housing Partnership, the city of Charlotte also set up an Emergency Rent Assistance Program for those experiencing a delay in paying rent due to COVID-19. If eligible, the funds will be sent directly to the property management company.

North Dakota: COVID Emergency Temporary Rent Assistance

The North Dakota COVID Emergency Rent Bridge program gives temporary assistance to renters suffering financially due the pandemic. The program will pay up to 70% of the lease for up to three months and aims to be available through the summer

Ohio: No Known Statewide Programs At This Time

Oklahoma: No Known Statewide Programs At This Time

Oregon: $8.5 Million Rental Assistance

The Oregon Legislature’s emergency board released $12 million in housing assistance, $8.5 million of which goes to people who lost income and need help paying rent — the funding will go directly to property managers. The remaining money will pay for hotel or motel rooms for specific individuals, such as farmers or those without stable housing. In Portland, $500,000 in emergency federal grants are available to help those who can’t pay rent or utilities due to loss of income.

Pennsylvania: ~$400 Million CARES Act Funds

While nothing is currently in place, Pennsylvania housing advocates have called on the Legislature and Gov. Tom Wolf to prioritize housing assistance in deployment of the $4.9 billion in federal CARES Act funding and allocate at least $400 million for similar housing needs. Alternatively, renters can get help through various emergency funds including the Pennsylvania Apartment Association’s Coronavirus Emergency Assistance Fund, or the PHL COVID-19 Fund.

Philadelphia launched an emergency rental assistance program with the hope of keeping 3,000 families in their homes amid the pandemic. The application window is between May 12 and May 16, and renters must rent an apartment in Philadelphia, have a valid lease signed by the property manager, and have lost income due to COVID-19.

Rhode Island: No Known Statewide Programs At This Time

South Carolina: $5 Million COVID-19 Rental Assistance & $150K Emergency Housing Assistance Fund

South Carolina Housing is providing $5 million in emergency rental assistance to residents facing financial hardship as a result of the pandemic. Eligible households can receive up to $1,500 in relief payments that will be sent directly to property managers. Additionally, United Way of Greenville County launched an Emergency Housing Assistance Fund to help families struggling with unemployment and housing needs. The fund gained an initial investment of $150,000 from the COVID-19 Community Relief Fund.

South Dakota: No Known Statewide Programs At This Time

Tennessee: No Known Statewide Programs At This Time

Texas: $11.3 Million Coronavirus Relief Fund

The $11.3 million in rent assistance has been made easier for residents to access after Gov. Greg Abbot asked HUD to waive some requirements. Rent assistance providers, including nonprofits, local governments, and housing authorities, will be able to apply for the funds to then distribute to renters in need.

Austin’s $1.2 million Relief of Emergency Needs for Tenants (RENT) Program provides one-time emergency rental assistance to renters experiencing financial hardship due to COVID-19. Dallas City Council passed a $13.7 Million Rent Relief Fund to provide rental, mortgage, and utilities assistance. The Houston Mayor proposed $15 million in emergency rental assistance for low-income-to-moderate income residents. San Antonio’s City Council approved a $25 million COVID-19 Emergency Housing Assistance Program to aid residents who need help with rent.

Utah: No Known Statewide Programs At This Time

Vermont: No Known Statewide Programs At This Time

Virginia: $52+ Million Rental Assistance HUD Grants

Over $52 million in federal funding will be spread across Virginia to go towards supporting residents with affordable housing during the pandemic. At the local level, Loudon County residents have access to a $200,000 rental assistance program. In Alexandria, short-term emergency rental assistance is available to renters experiencing housing insecurity due loss of income caused by COVID-19. The funds provide $600 a month for up to three months and go directly to property owners.

Washington: $9 Million Rental Assistance Funds

The Washington State Department of Commerce is providing $9 million to help low-income households pay their rent and energy bills. Benefits give qualified renters up to $1,000 in rental assistance. The Rental Housing Association of Washington provides information on the Low-Income Home Energy Assistance Program (LIHEAP), which is a federally funded block grant meant to assist low-income households meet their home energy needs.

West Virginia: Pandemic Diversionary Cash Assistance (PDCA)

West Virginia is offering a one-time special assistance payment called the Pandemic Diversionary Cash Assistance which provides financial support to families who have temporarily lost or experienced reduced incomes.

Wisconsin: $25 Million Wisconsin Rental Assistance Program & Emergency Rent Fee Suspension Rule

Wisconsin implemented an emergency rule that prohibits property managers from charging late fees for 90 days after the termination of the public health emergency. The city of Milwaukee offers help paying rent to those who lost their job or whose hours were cut through Community Advocates. On May 20, Gov. Tony Evers announced the launch of a $25 million Wisconsin Rental Assistance Program for those who have experienced income loss due to COVID-19. Fueled by the CARES Act dollars, the program will provide up to $3,000 in direct financial assistance for rent and security deposits to be paid directly to property managers.

Wyoming: $500 Million CARES Act Distribution

Gov. Mark Gordon called for a special session on May 15 to distribute federal funding where they are likely to deliberate distributing $500 million of the $1.25 billion the state received through the CARES Act. On the table for discussion is a program that would compensate property managers for unpaid rent.

The Need For Emergency Rent Assistance Nationwide—And Industry Support For Rent Relief Programs

It’s an encouraging sign that many cities and states have implemented or proposed emergency rent assistance programs to aid renters and apartment operators—but local and state funding only goes so far. In fact, NLIHC research estimates that between $76 billion and $100 billion in emergency rental assistance is needed to maintain stable housing among the lowest-income households for the next year during the COVID-19 pandemic. Simply put, more funding is needed on a national scale.

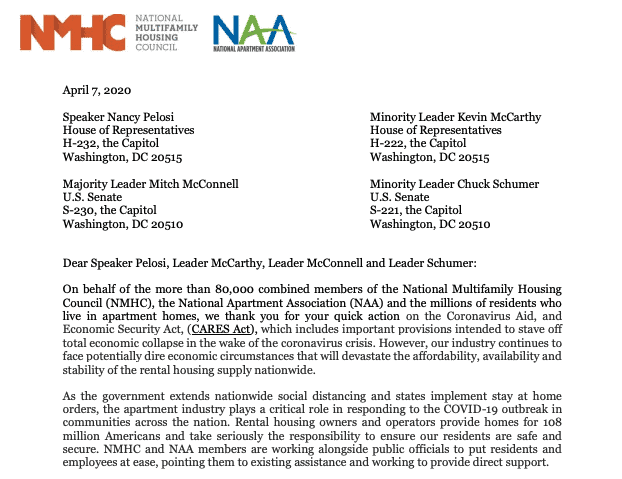

There is currently no federal emergency rental assistance funding in place to address the rental housing industry’s unprecedented financial stresses. The NLIHC, NAA, and NMHC, as well as various other housing advocates, have been proactive in encouraging Congress to address the rent crisis by enacting rental assistance programs to preserve the housing industry.

In their joint letter, NAA and NMHC have outlined provisions that go beyond the CARES Act in providing relief to millions of American renters, including:

- create an Emergency Rental Assistance Program for those who are impacted by the crisis and do not already receive federal housing subsidies;

- clarify that all multifamily firms with 500 or fewer employees may access the Small Business Administration’s (SBA) Paycheck Protection Program (PPP); While the CARES Act is clear in its intent that all small firms should be eligible for PPP loans, the SBA’s implementation guidance has created uncertainty for the real estate industry;

- revise the National Eviction Moratorium to be limited to those negatively impacted by COVID-19;

- expand mortgage forbearance protections to all multifamily properties, not just those with federally backed mortgages; and

- provide financial assistance and protection for all property-level financial obligations such as property taxes, insurance payments and utility services.

The NLIHC is calling on the rental housing industry to urge senators and representatives to cosponsor the “Emergency Rental Assistance and Rental Market Stabilization Act” so that the next stimulus package helps the lowest-income renters.

Additionally, the Resident Relief Foundation, a nationwide nonprofit, has set a goal to raise $10 million in funding to provide rental aid to renters across the U.S. The program also provides financial education to help renters who receive assistance become better prepared for future emergencies.

How To Ask Congress For Emergency Rental Assistance for Renters and Property Owners

The collective effort of organizations like NAA, NMHC, NLIHC, and RRF to name a few, are helping bolster emergency rent assistance programs on the whole, but it’s more important than ever for industry-wide support. Apartment operators, housing professionals, and rental housing organizations need to band together in calling on Congress to immediately pass additional federal relief and stimulus legislation. You can do so by visiting the advocacy calls for action from the NAA and NMHC.