Mid-Month Update: June Rent Payments Remain Steady as Leasing Kicks Back Up

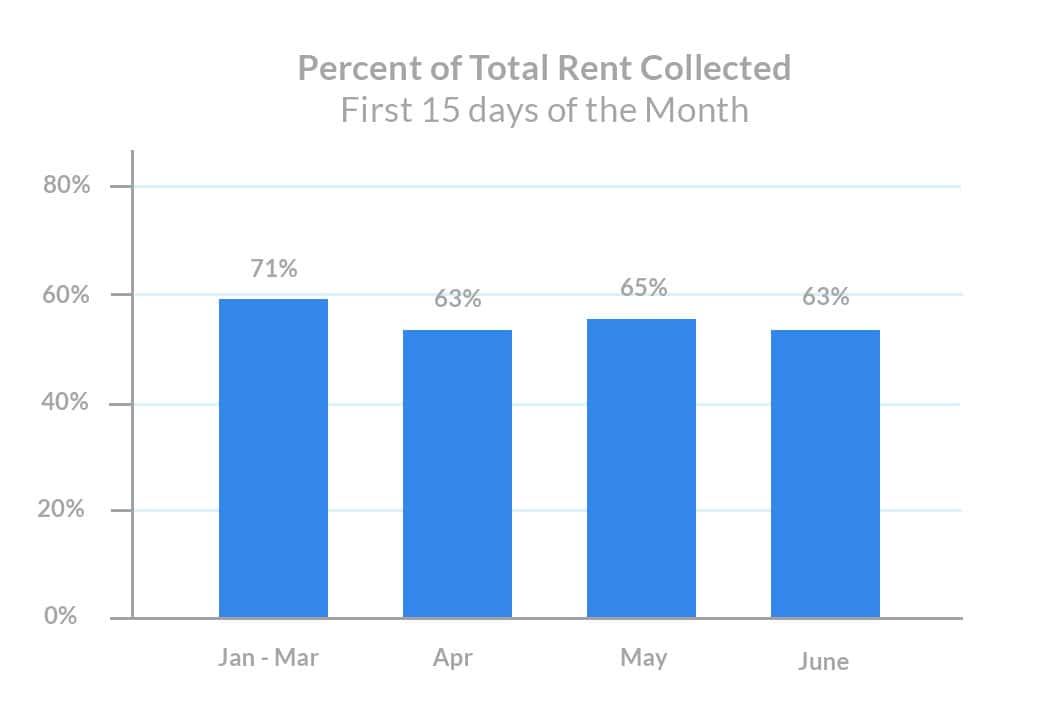

- Percent of total rent collected in mid-June dipped 2% month-over-month.

- Rent collected in June is 8% lower than the 3-month pre-COVID average.

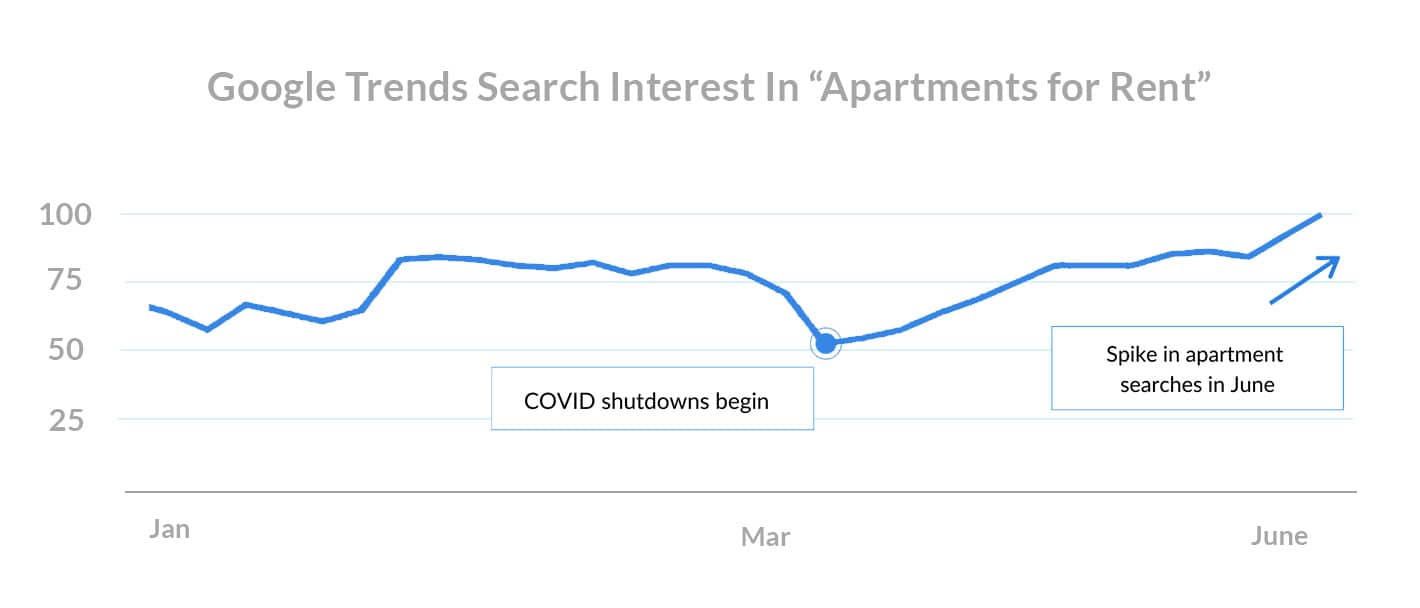

- Search interest in “apartments for rent” spiked, passing up pre-COVID levels.

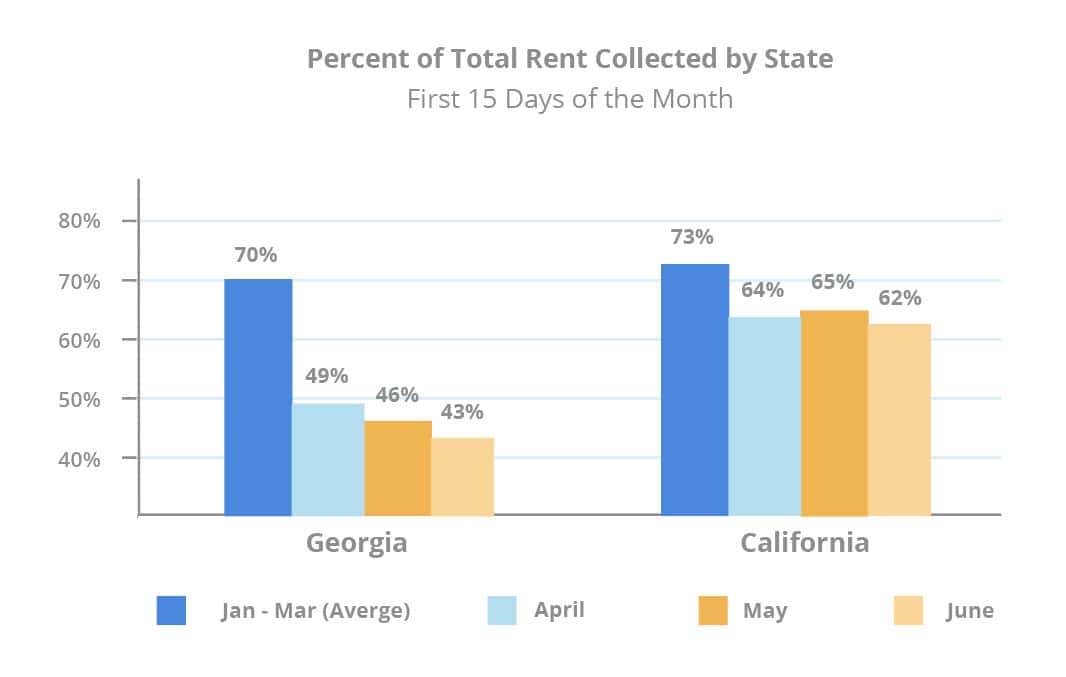

- Total rent collected in both Georgia and California dropped 3% since May.

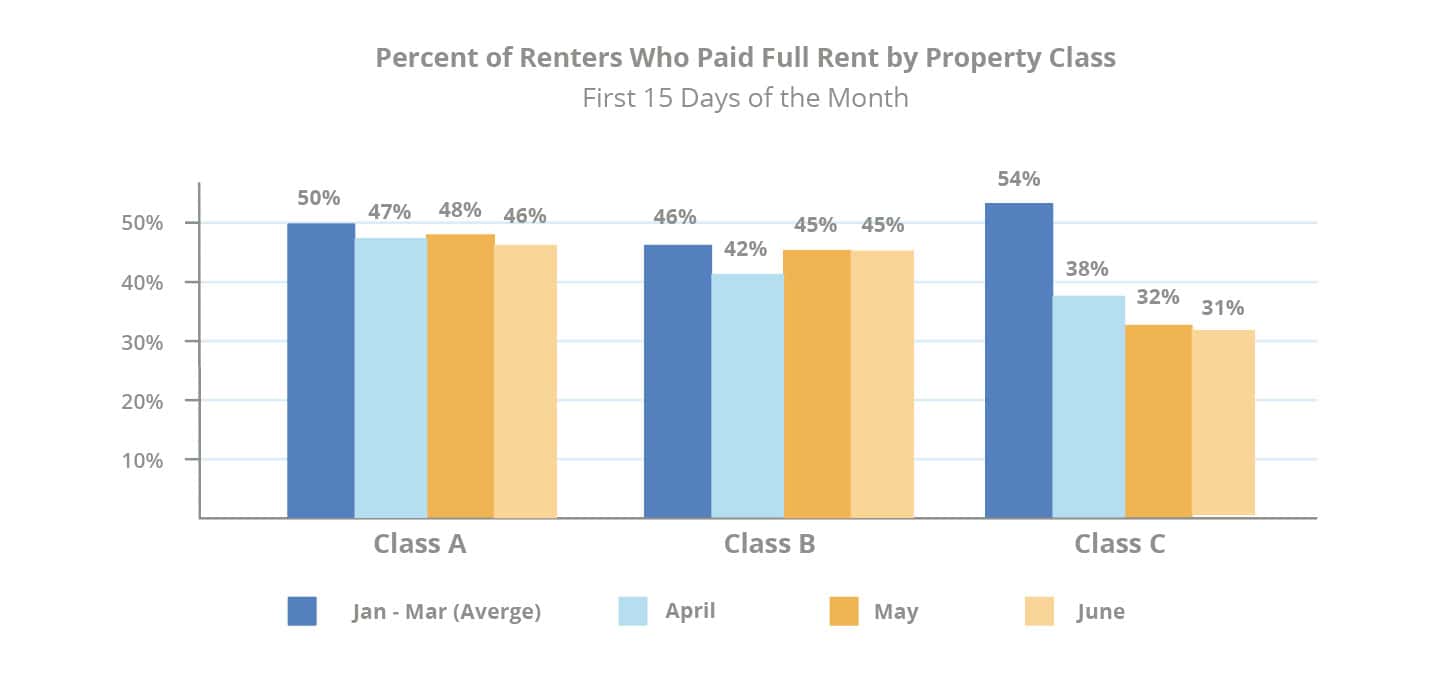

- Class C rent payments have stabilized but are 20% below the average.

Now that we’re halfway through the month, let’s take a mid-month look at rent payment behavior through June 15 to evaluate any shifts since our Rent Payment Report.

Looking at the total percent of rent collected during the first half of June, we see the same percentage of rent payments collected in April — and a very slight 2% dip from May.

Rent payments still have yet to recover to pre-COVID levels — rent collected in June remains 8% lower than the percent of rent collected during the average month.

June Rent Payments Rebounded After a Challenging Start

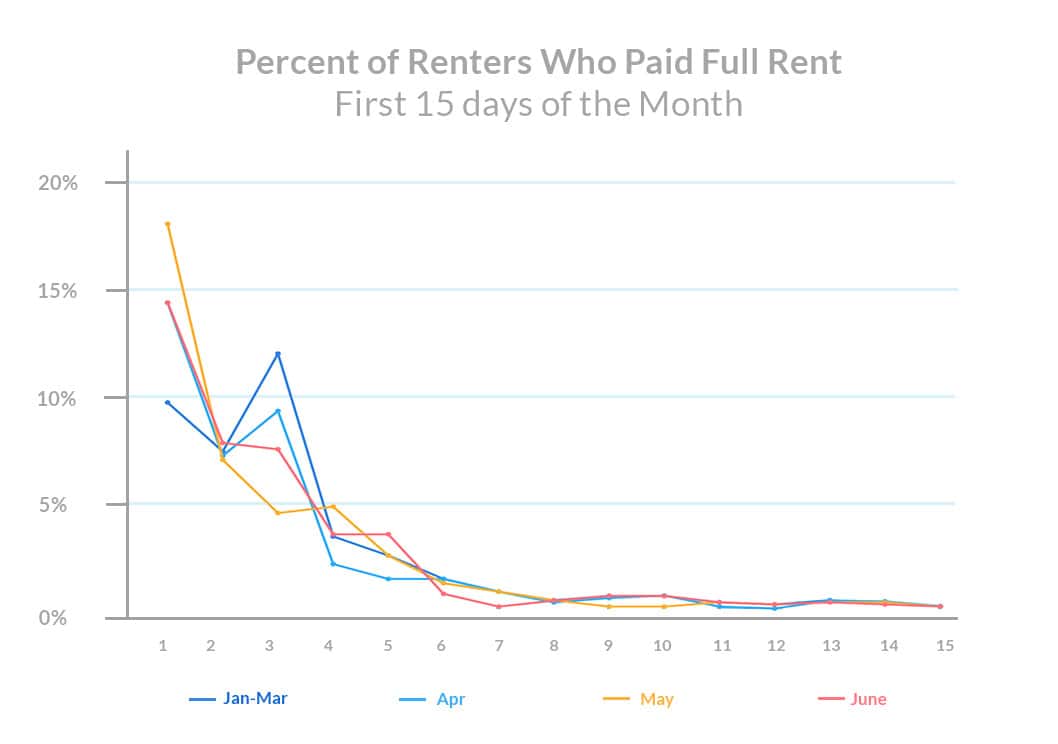

Rent payments on the first of June were lower than in May, although still higher than the average. May especially saw a strong spike in first-day rent payments, as federal relief checks and bolstered unemployment benefits came in.

June renters didn’t show quite as much confidence as they did in May to make a first-day payment, especially after a long weekend of nationwide protests. However on June 3 (Wednesday) and June 5 (Friday) rent payments rebounded. The slow reopening of businesses nationwide, along with the small uptick in the employment rate, may have also helped establish economic confidence as the month wore on.

Leasing is Kicking Back Into High Gear

As we explored in our recent analysis of the new peak leasing season, apartment searches and leasing behavior are starting to recover. Looking again half-way through the month, we see even greater upward growth in searches for “apartments for rent” over the last couple weeks.

Although delayed, the 2020 leasing season appears to be in full swing as more businesses reopen and renters emerge from their homes. Now more than ever, it’s critical for apartment operators to provide an affordable, one-click lease experience, and to meet the needs of today’s renter even better than the competition.

California and Georgia Struggle on a State and County Level

While the nation as a whole appears to be recovering, some regions continue to feel the economic strain.

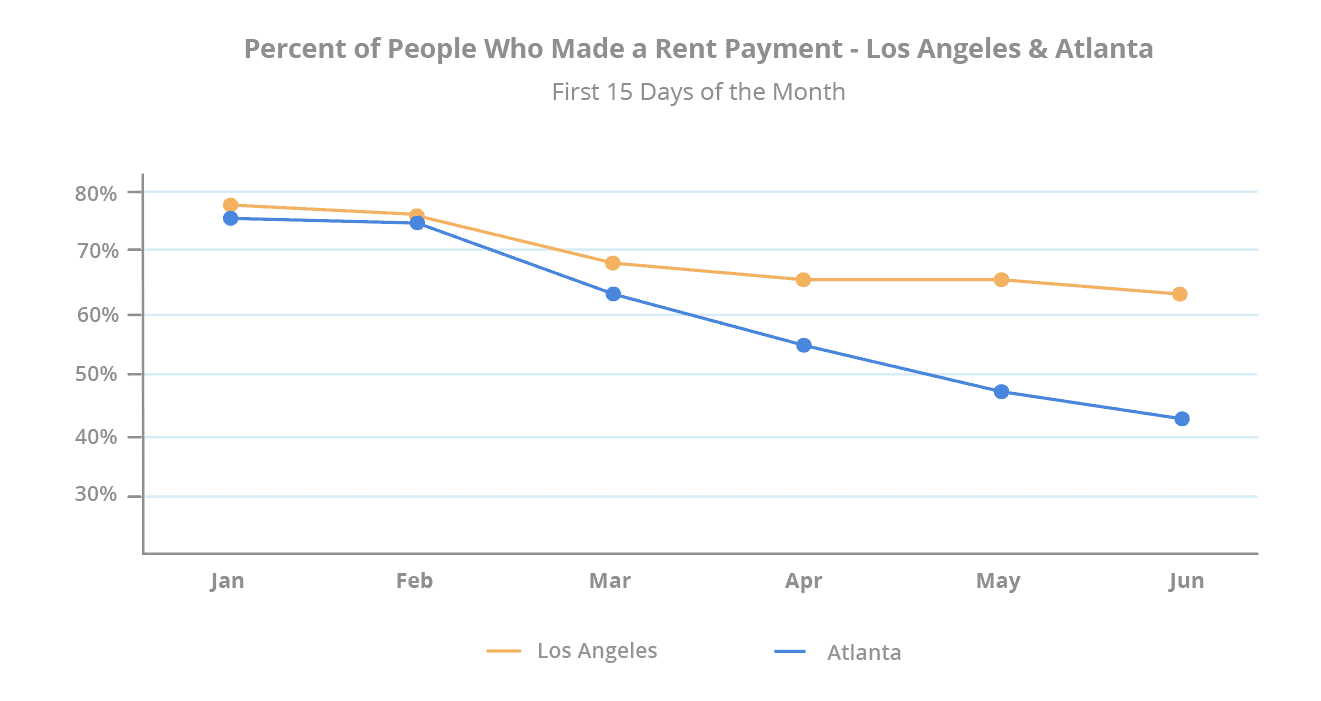

The state of Georgia experienced a significant drop in rent collected immediately after COVID set in — over 20% in April — and has continued on a downward trajectory. While California’s initial drop in rent collected was not as stark, the Golden State showed a 3% drop in rent collected since May, and an 11% drop from the average.

Georgia was famously the first state to re-open its businesses on April 30. The state saw an initial drop-off in new unemployment claims in May but the number of unemployed Georgians remains high. Evidence also suggests that COVID cases are increasing in Georgia, which could cause consumer uncertainty about shopping, dining out, and engaging in economy-boosting behaviors.

Meanwhile California — and major CA metros such as Los Angeles — was an early leader in shelter-in-place orders. We recently explored how Los Angeles renters are struggling to make their rent payments, and that difficulty appears to be continuing.

Atlanta residents are also having a hard time making rent payments. The percent of Atlanta residents who made a rent payment in the first half of June has dropped by a whopping 32% since January, after a slow and steady decline throughout the year.

Class C Rent Payments Remain Low, But Stable

May saw a major drop in rent payments among asset class C, due in part to the wave of service industry lay-offs in April.

However, as businesses began to reopen in May, sectors such as travel and retail saw a major lift in employment according to the Wall Street Journal, which largely affected Class C residents. While Class C rent payments remain low in the first half of June, the major drops seen in previous months have slowed to only a 1% dip.

What Does This Mean for Multifamily This Summer?

In spite of fears about an impending drop in rent payments, it appears that business reopenings and signs of unemployment recovery have stabilized rent payments for now. Although comprehensive rent assistance for residents in need remains a key priority for the industry, operators are also setting their sights on what’s next.

The recent spike in apartment searches suggests that we are entering peak leasing season for 2020. This leasing season is different than ever before, and will require a fresh approach to capture new leases over the competition.

Keep an eye out for in-depth guides on how to attract your share of the market as the summer leasing season ramps up.

Methodology

Rent payment data is actual transactional data sourced from integrations with property management systems in the multifamily industry.

Analysis includes a 119,275 unit sample from 1,029,428 live units under management by LeaseLock clients. Data is nationwide, representing over half of the NMHC Top 10 property managers in the country and all asset classes (A, B and C). Asset class composition: class A (37%), class B (48%) class C (15%).

All data has been anonymized to remove personally identifiable information for renters and property managers.