April 1st Rent Payments: More Partial Payments in Seattle Foreshadow US Rent Behavior Changes

Important statistical note: Despite the measured payment decline based on the sample set, the variance is within normal statistical range. In other words, the decline is not significant enough to attribute specifically to COVID-19 versus normal fluctuations expected across the data set. Please reference full methodology in footnote.

While the effects of shelter-at-home laws, eviction moratoriums, and rising unemployment rates remain to be fully seen, many operators moved quickly to communicate and support residents in the lead up to April. In this analysis we break down actual data on April 1st rent payments exclusively, and zero in on interesting behaviors that played out in Seattle – which may foreshadow where other major metro areas are headed.

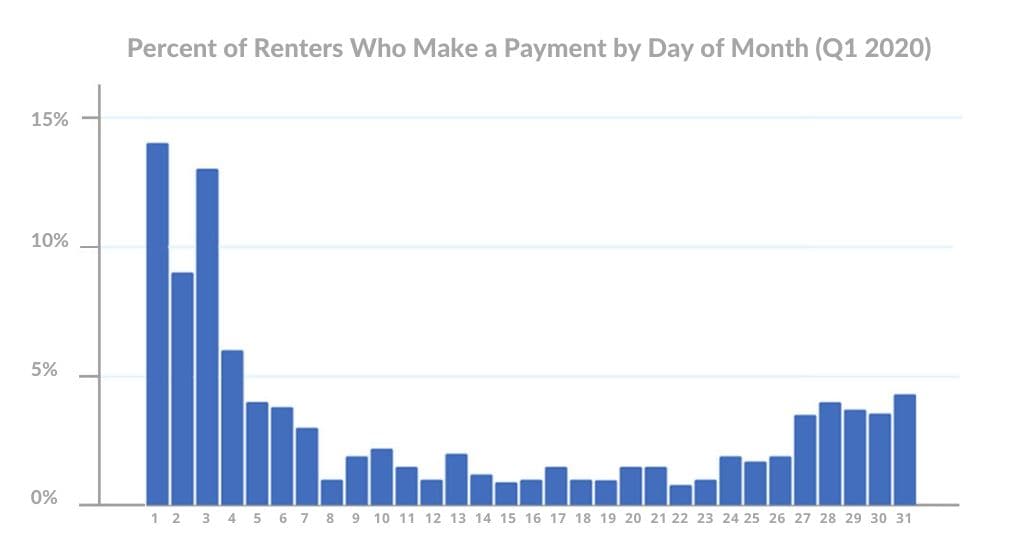

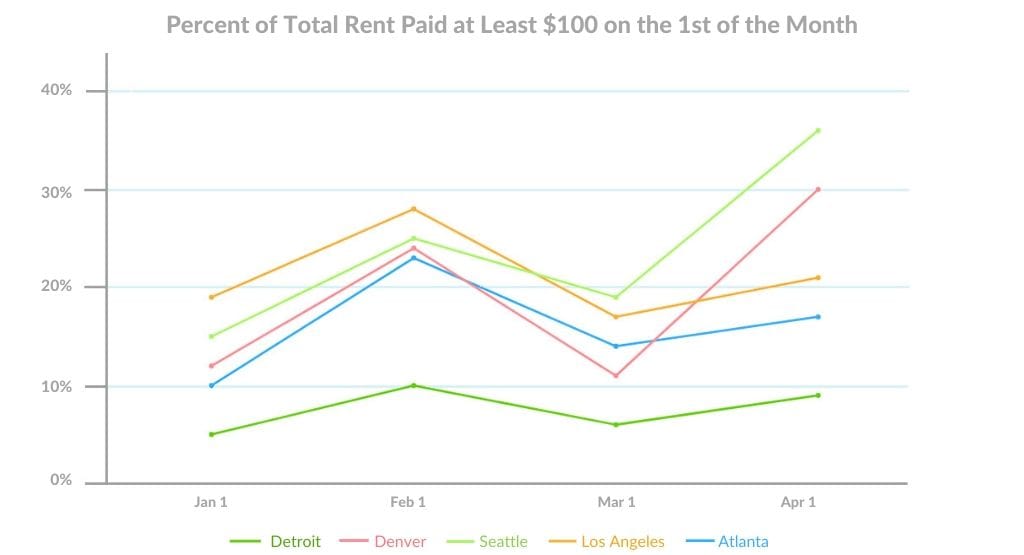

Across the multifamily industry, we see that about 14% of renters make a payment on the first of the month. Many of these are reliable rent payers who regularly pay on the first each month, in some cases through scheduled auto-pay. More recently, however, we also see fluctuations in first-of-the-month payments, especially in relation to partial payments.

Nationwide April 1st Rent Payments Held Steady

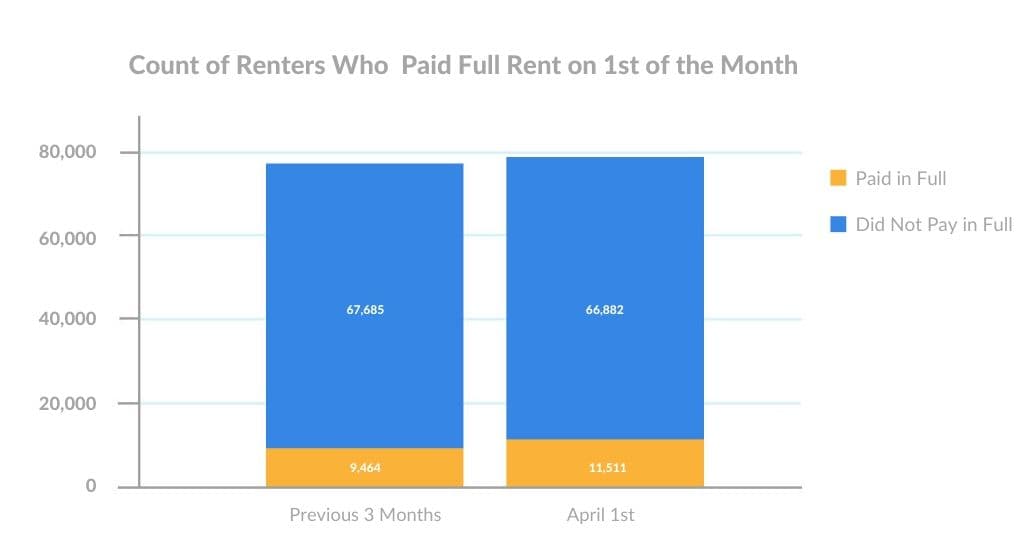

Comparing the percentage of people who paid full rent on April 1st, 2020 to the average who paid full rent on January, February and March 1st combined, we see that April 1st rent payments have not taken a dip — and in fact, have slightly increased on a national level.

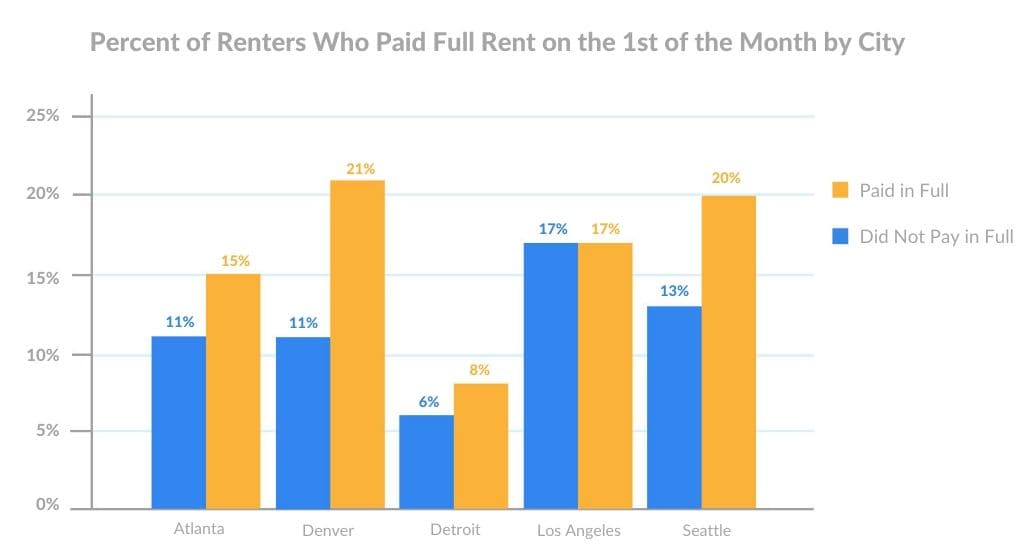

This holds true when looking at select cities across the nation, including Los Angeles, Detroit, and Seattle.

Seattle Sees an Increase in Partial Rent Payments

Seattle, the initial epicenter of the US COVID-19 outbreak — and the first metro area to go on lockdown — demonstrated some unique variations in payment behavior on April 1st. This could foreshadow the economic effects that will hit renters across the nation in the upcoming weeks and months.

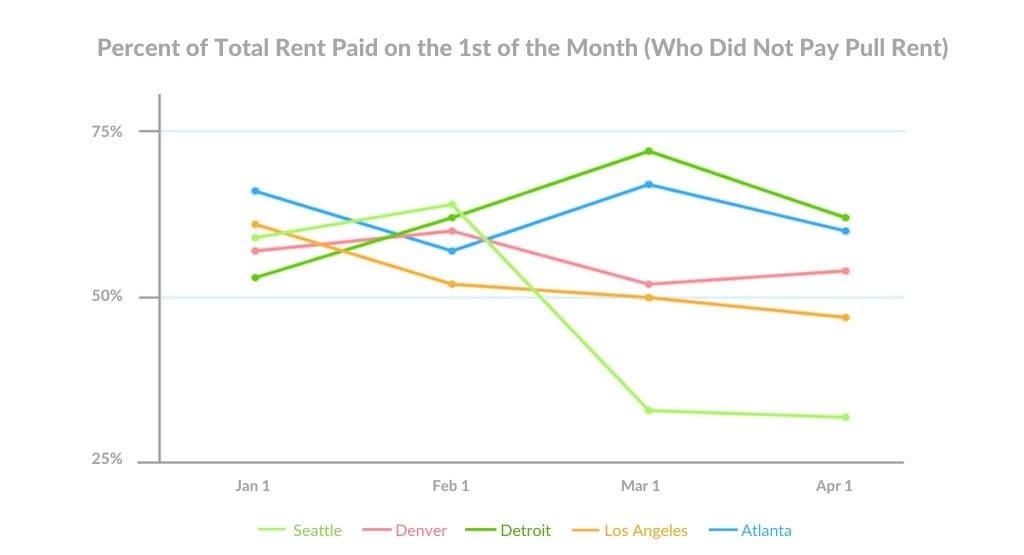

20% of Seattle renters paid rent in full on April 1st (as noted in the chart above) – these likely represent those reliable first-of-the-month rent payers. However, for renters who made a partial payment on the 1st, the percentage of total owed rent they paid on the 1st dropped significantly in March and April. Seattle renters who made a partial payment on April 1st only paid an average of 33% of total rent owed, compared to 61% of rent owed in the beginning of the year.

That being said, the percentage of people who made some form of payment (over $100, to exclude other fees) on the 1st of the month actually rose in Seattle, across many metro areas and nationwide. This suggests that renters are trying to make some form of payment, and also possibly that property managers have been successfully proactive about creating payment plans with affected residents.

What can we take away from this? So far, first-of-the-month rent payment behavior has only shifted minimally on a nationwide scale, but zooming into geographical hotspots forecasts potentially significant shifts in partial rent payment behavior in May.

The good news — with hard-hit regions seeing an increase in payments overall, it suggests the willingness of both apartment operators and renters to find solutions together. We look forward to sharing more rent payment data as it rolls in over the weekend, after the default period ends on April 6th, and again on May 1st.

Update: Preliminary Findings for April 2nd Rent Payments

On the morning of April 3rd, we repulled rent payment data for April 2nd. The percent of renters who paid full rent on April 1-2nd combined, compared to the same period during the 3 previous months, dipped slightly by 1.17%. This fluctuation rate is within the range of normal — as a point of comparison, the percentage of renters who paid full rent during the 1st – 2nd of the month dropped by over 2% between February and March. This demonstrates fairly consistent rent payment behavior thus far, but we expect that numbers will change as we move towards the end of the grace period, so stay tuned.

Methodology

Rent payment data is actual transactional data sourced from direct integrations with property management systems in the multifamily industry.

Analysis includes a 96,268 unit sample from 1,029,428 live units under management by LeaseLock clients. Data is nationwide, representing over half of the NMHC Top 10 property managers in the country and all asset classes (A, B and C). Asset class composition: class A (36%), class B (55%) class C (9%).

All data has been anonymized to remove personally identifiable information for renters and property managers.