Learn about how security deposit alternatives for renters compare to traditional deposits, and explore which offers the best benefits for both parties.

Throw traditional deposit processes out the window with security deposit replacement programs. Read on to see how you can boost occupancy rates today!

Discover the benefits of offering security deposit alternative programs to residents! Boost satisfaction and simplify property management today!

We’re thrilled to announce the launch of our first-ever episode of Unscripted, the podcast where multifamily and rental housing professionals come together to discuss the real stories, challenges, and strategies shaping the industry today.

Looking for a way to bypass traditional security deposits? Zero deposit insurance could be the perfect alternative. Here’s what you need to know.

Looking to keep your resident retention rates high? Follow this guide to provide a positive lease signing process that keeps residents happy.

Traditional security deposits present many challenges for landlords. Depending on how long renters stay, security deposit alternatives can be hassle-free.

Multifamily historically has been slow to embrace technology, but the industry countered that notion with its recent tech renaissance during the pandemic. Almost overnight, tech solutions went from last resort options to first-strike weapons in the industry’s effort to solve emerging issues. These technologies may have been a long time coming, but their fast-tracked implementation demonstrates multifamily can move with agility when need be.

A Growing Multifamily Trend: Avoid, Transfer, & Mitigate Risk With Insurance Technology

Spurred by today’s economic uncertainty, there is another dramatic shift taking place in multifamily – the trend towards insurance technology to manage risk and protect against financial loss. Between resident screening, renters insurance, and lease insurance, savvy operators now leap at the opportunity to engage different risk management tools to avoid, transfer, and mitigate risk throughout the lease lifecycle.

Resident screening helps avoid risk by identifying fraudulent applications and risky renters, and renters insurance programs enable operators to transfer risk to resident policies—both integral to operators’ risk management strategy. Now, more and more are looking to mitigate risk by implementing lease insurance to solve the long-standing failures of security deposits. With lease insurance, operators reduce their exposure to potential loss caused by residents and improve property performance.

In particular, there are three use cases driving operators to replace traditional security deposits with lease insurance as a better loss protection strategy:

- Move-In Affordability for Residents

- Modern Risk Mitigation Solutions for Apartment Communities

- Maximized Revenue & Smarter Risk Assessment for Operators

3 Reasons Multifamily Is Moving Away from Traditional Security Deposits & Surety Bonds Towards Lease Insurance

1. Move-In Affordability for Residents

Economic uncertainty and housing supply shortage accelerated the housing affordability issue for apartment renters nationwide. With 58% of Americans living paycheck to paycheck, a majority of Americans lack the funds to cover an unexpected $1,000 expense. In addition, full-time minimum wage workers can’t afford rent in 93% of U.S. counties, while over half of all US apartment households spend nearly a third of their income on rent.

Record-breaking rent growth has made renting an apartment particularly expensive, especially security deposit costs. This creates a large financial burden for renters but also puts operators in a bind—either they charge deposits to protect against loss and suffer low lease conversion rates or offer lease concessions to attract residents but sacrifice proper protection in the process.

And while surety bonds offer move-in affordability for renters with low-cost monthly payments, these deposit alternatives are a crude form of insurance that offer insufficient protection against rent loss and damage that have poor resident adoption. In this case, operators sacrifice long-term revenue to maintain physical occupancy levels in the short-term.

On the other hand, lease insurance removes the upfront cost posed by security deposits and adequately protects operators against rent loss and damages, all in a resident-friendly format. Instead of using a blanket security deposit amount or a low-cost, high-risk surety bond program, operators can seamlessly deploy lease insurance to both create more affordable move-ins and unlock smarter risk prediction and historical data at the property level to determine optimal insurance coverage. This leads to a better resident experience, higher lease conversion, and increased economic occupancy.

“It’s more important than ever that operators offer an affordable move-in experience for residents while also protecting themselves from potential rent loss. [Lease insurance] enables us to do exactly that [which is] a stronger, more sustainable insurance product relative to surety bonds.” – Ian Bel, managing partner at Olive Tree Holdings

2. Modern Risk Mitigation Solutions for Apartment Communities

Surety bonds and other deposit alternatives have sought to replace outdated, traditional deposits, but even as security deposit legislation spreads nationwide, it’s becoming more apparent how these partial solutions actually introduce new types of risk that create financial, administrative, and regulatory burdens for operators as well as negative leasing experiences for residents.

For example, surety bonds leverage off-system application processes and manual claims forms, creating more administrative work for onsite teams and a clunky process for residents, thus leading to less than 50% resident adoption rates. New deposit laws also present new restrictions and increased deposit administration, adding unnecessary complexity to regulatory compliance. In addition, deposit alternatives leave residents fully liable for claims paid to their property, resulting in displeased renters, negative online reviews, and potential move-out disputes.

“If a prospective resident doesn’t have to go in and deal with their surety depositor to set up their bonds, that helps. Having that lease insurance process integrated into the property management system creates a simple, streamlined process, and has the ability to improve conversion rates.” – Andrew Gordon, Chief Operating Officer at Strata Equity Group

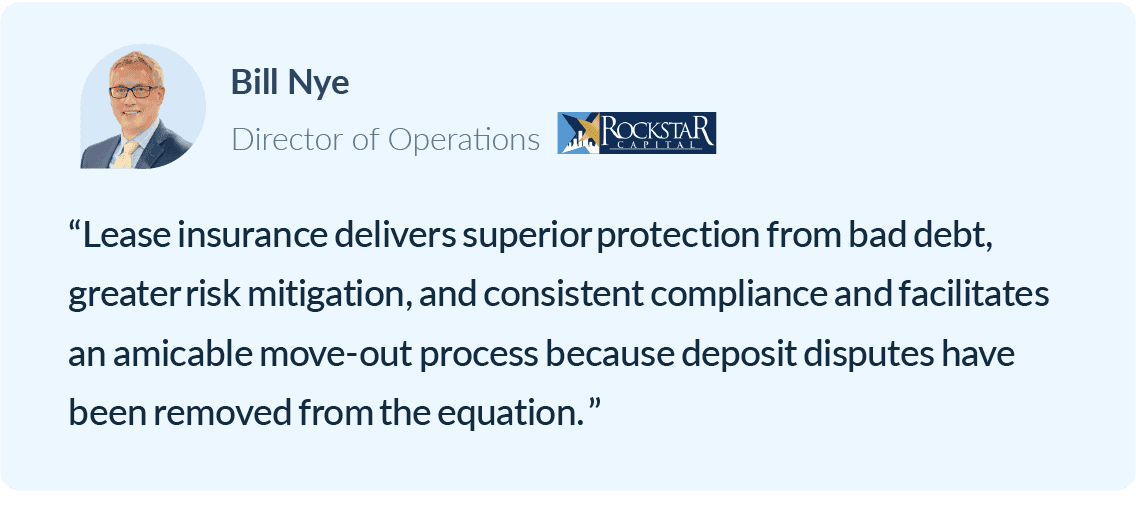

Lease insurance, however, is a modern loss protection solution that replaces traditional deposits and alternatives integrating within the native workflow from the point of application all the way through the move-out claims process. This means property teams are relieved of administrative strain and expedite claims in the leasing office, residents get a hassle-free lease experience with no out-of-workflow applications or surprise deposit deductions, and owners reduce bad debt and increase asset value and NOI.

“[Lease insurance] has proven to be the long-term solution to remove deposits [by delivering] a seamless, accessible, and affordable move-in experience, greater risk mitigation, higher bad debt recovery, and stronger NOI – all things any property management company needs to get right from the beginning.” – Jennifer Staciokas, Executive Managing Director of Property Management for Western Wealth Capital

3. Maximized Revenue & Smarter Risk Assessment for Operators

Balancing the need to maximize NOI with heightened renter affordability concerns along with strong multifamily occupancy rates has prompted many apartment operators to offer concessions (i.e., deposit-free move-ins) to remain competitive.

However, this scenario has negative implications, including insufficient protection when a resident doesn’t pay rent or causes substantial damage to their apartment home. With no way to assess risk and subsequently cover losses, an operator’s economic occupancy diminishes.

“Residents want what they want when they want it and how they want it. We want to incorporate [giving our residents more options] into the way we operate, but we have to mitigate the risk upfront rather than being too proud of 100% occupancy. We’re using screening verifications up front, and [lease insurance] has been a tremendous value on the back end.” – Marcie Williams, CEO at RKW Residential

While some operators opt to utilize surety bonds as a deposit alternative, the risk of economic loss persists. Consider the loss ratio formula of surety bonds: a surety bond program contributes on average $50 in premium to the denominator of the loss ratio equation. This amount is insufficient compared to the average amounts that must be paid out in claims. In this case, the surety bond carrier loses money while the bonding company continues to take on new risk.

Following the pandemic, the industry is likely to experience an influx of claims outflows for months, or even years, to come. As a result, surety bond pools will deplete, leaving operators exposed to a high level of risk and account balances (i.e., bad debt). For this reason, operators need a risk mitigation solution like lease insurance that effectively assesses risk and absorbs account balances to maximize revenue.

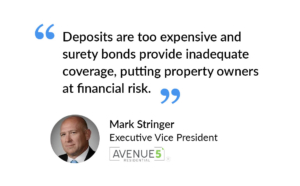

“Frankly, the security deposit is a thing of the past. Financially, they – along with alternatives like surety bonds – don’t make a lot of sense. They don’t correlate to the amount of damage that could be done to a unit or the potential amount of debt. They’re just not relative to the risk.” – Mark Stringer, Executive Vice President for Avenue5 Residential

Risk Prediction Is the Long-Term Solution for Smarter Loss Protection

In today’s economic climate, savvy operators are looking for better risk mitigation solutions and stronger loss protection strategies that address the use cases outlined above: renter affordability, modern risk mitigation solutions, and risk assessment capabilities. This is why more and more are shifting away from expensive, traditional, risk-prone security deposits and surety bonds to affordable, innovative, and data-driven insurance technology solutions, like lease insurance.

“Surety bonds and other alternatives don’t hold a candle to lease insurance. It makes move-in affordable for our residents and dramatically increases our protection against rent loss. In any economic environment it is important we reduce upfront costs for residents while still mitigating financial risk for our communities.” – John Detore, Director of Asset Management at White Oak Partners

Ultimately, the most promising aspect of lease insurance lies in the value of risk prediction. With predictive risk monitoring at its core, LeaseLock’s lease insurance platform can analyze ledger balance trends and billions of risk data points sourced from PMS and third-party data to project potential resident loss and optimize coverage accordingly.

Rather than relying on an arbitrary security deposit amount or partial solutions (e.g., surety bonds) that add layers of risk to leasing, LeaseLock wields the power of data and AI to adapt insurance coverage so operators can rely on optimal revenue protection across their entire portfolio–far more than what’s provided by traditional deposits and bonds.

Conclusion

Operators today need to better manage loss and drive asset value. While lease insurance programs provide stronger loss protection strategies that optimize asset performance, not every program is created equal—operators need a smarter, more sustainable risk mitigation solution. Only lease insurance steeped in AI and data analytics to effectively predict risk can offer this.

We’re still buzzing with excitement from all the amazing events that unfolded at last week’s NAA Apartmentalize 2022. With over 11,000 vendors and attendees, our team was delighted to welcome a constant stream of visitors to our booth and happy to reconnect with industry peers at our hosted events.

While the event was back to pre-pandemic activity, the industry is not returning to its old ways of doing business. Emerging technologies took center stage both during the education sessions and on the trade show floor, proving that technology innovations adopted during the pandemic are here to stay and evolve.

If you missed out on Apartmentalize this year or you just want to relive it, here’s our recap of the top highlights and takeaways from the industry’s premier annual gathering.

1. Modern Renter Demands: The Subscription Economy’s Impact on Rental Housing

The subscription business model has been accelerated by the pandemic and is only becoming more prevalent across various industries. The shift in buying behavior extends across all aspects of life, like entertainment, financial services, food, and housing. In multifamily, renters are avoiding high upfront costs in favor of more flexibility and freedom.

With rent being just a monthly subscription fee paid for an apartment, other elements such as security deposits, move-in costs, and payment options can also benefit from adopting the subscription model.

In our education session, Understanding the Renter’s Economic Mind, our Senior Vice President of Enterprise Sales Ian McIntosh, along with industry experts Jeremy Thomason of CAF Companies and Hugh Cobb of Asset Living, explored the economic drivers of today’s renter and revealed best practices for the implementation of subscription-based amenities.

Here are the key highlights from their discussion:

- Subscription services and fee installments have emerged as the preferred payment method for renters.

- Operators are revisiting and restructuring their paradigms for security deposits, rent payments, amenity fees, and move-in costs to appeal to the economic mind of today’s renters.

- Companies are embracing bundling expenses to streamline the resident experience.

Be on the lookout for our comprehensive recap highlighting the session’s best practices for implementing subscription-based systems, as well as data-centric insights into the modern renter profile.

2. An Epic Multifamily Reunion: Connecting With Old and New Partners

This year’s Apartmentalize was an opportunity for the industry to reconnect, mingle, and forge new relationships. We were as excited as ever to jump right back into the action and have some fun in the sun with old and new partners in San Diego.

As a pre-celebration on Wednesday, LeaseLock hosted a cozy gathering with fifty guests on the beach at Hotel Del Coronado to roast s’mores over the bonfire and enjoy good conversation. Multifamily leaders and long-time LeaseLock partners Doug Bibby and Debbie Phillips stayed late into the night catching up on lost time with our CEO Derek Merrill and CRO Ed Wolff.

Kicking off the official celebrations on Thursday, we rubbed shoulders with 300 industry movers and shakers at our co-hosted happy hour with Friends of NAA. Overlooking the Gaslpamp Quarter and views of the San Diego Bay, we toasted to continued partnerships and success.

But the fun didn’t stop there—at our intimate dinner at the waterfront Sheerwater bistro we were joined by thirty industry titans, including Doug Bibby – President of NMHC, Bob Pinnegar – President of NAA, Hugh Cobb – President of TAA, and Ian Mattingly – President of AAGD, along with some of our amazing board members. As always, we’re grateful for their support and honored that they chose to spend their evening with our team.

3. Trade Show Buzz: New Proptech Propelling the Industry Forward

Attendees brought infectious energy to the exposition floor on Thursday and Friday as innovators came together to share ideas and solutions. The LeaseLock booth and team were met with enthusiastic customers and property operators as we offered a peek under the hood of our data-driven risk engine and AI-powered lease insurance platform.

LeaseLock has been hard at work building our lease insurance technology solution to bring greater predictability to rent. Our team was excited to demonstrate how our technology analyzes risk to optimize coverage so our clients can rely on optimal revenue protection across their entire portfolio.

Our expert advice on loss protection in today’s economic climate proved to be an especially hot commodity among thought leaders, trendsetters, and innovators visiting our booth. We loved the spirited exchange of ideas on how to refine risk management practices and drive property performance, and we left San Diego feeling as committed as ever to revolutionizing the rental housing industry.

The Best One Yet?

Whether it was the warm and sunny weather in San Diego, or the opportunity to finally reconnect with industry peers at the first full return to pre-pandemic activity, the word on the street is this year’s Apartmentalize was the best one yet. Our team couldn’t agree more—we had a blast celebrating and connecting with industry friends, and feel re-energized to get back to work on bringing the future of leasing to renters nationwide.

Thank you to our team, partners, booth visitors, event attendees, multifamily friends, and NAA for making Apartmentalize 2022 one to remember—we can’t wait to see you again at next year’s Apartmentalize 2023!

The Covid-19 pandemic is finally fading away, and the ensuing economic recovery and employment growth have fueled unprecedented demand for apartment homes. That demand has led to off-the-charts rent growth.

To optimize this momentum, operators are seeking competitive advantages in their efforts to land prospective residents. Unfortunately, resident preferences are a moving target. They now prioritize customization, convenience and modern technology in the form of flexible rent payments, deposit-free move-ins and remote work accommodations.

During the recent webinar, Tech Hacks That Boost Lead Conversion Without Sacrificing NOI, moderated by LeaseLock Chief Revenue Officer Ed Wolff, industry leaders explored strategies for meeting current renter preferences.

A Balancing Act: Lease Concessions vs. Economic Occupancy

The key, according to webinar panelists, is balancing incentives and concessions with economic occupancy. While upfront lease concessions may help to fill vacancies, they don’t help to protect against bad debt or bolster property level budgets. In fact, short-term promotions often result in long-term liability by attracting high-risk renters and exposing operators to unrecoverable debt.

Short-Term Promotions = Long-Term Liability

Multifamily management companies are increasingly turning to tech solutions to future-proof their operations while also boosting the volume and quality of leasing funnel activity.

“What we are seeing that is different this year is an influx of leads that are coming into our onsite teams,” said Jennifer Staciokas, Executive Managing Director of Property Management at Western Wealth Capital. “You may think of that as being a positive, but at the same time that requires our onsite teams to handle more leads that may be unqualified.”

Staciokas said Western Wealth Capital (WWC) has deployed lease-nurturing solutions and automation tools like chatbots and voicebots to streamline the applicant screening process.

“It’s all about attracting the right residents,” Staciokas said. “You have to be really mindful of the promotions that you’re offering. You don’t want to sacrifice your collections and your economic occupancy for that quick fix on the front end.”

Marcie Williams, CEO at RKW Residential, said mitigating that risk upfront is essential. At RKW, that has meant retracting some of the tech solutions deployed during the pandemic.

“By allowing prospective residents to tour the apartment by themselves and by allowing them to apply online, what’s happening is it’s increasing fraud,” Williams said. “When we only have one or two apartments available, it really becomes detrimental to our business. We have disabled online leasing and we’re inviting qualified applicants to lease rather than letting anyone do it whenever they want.”

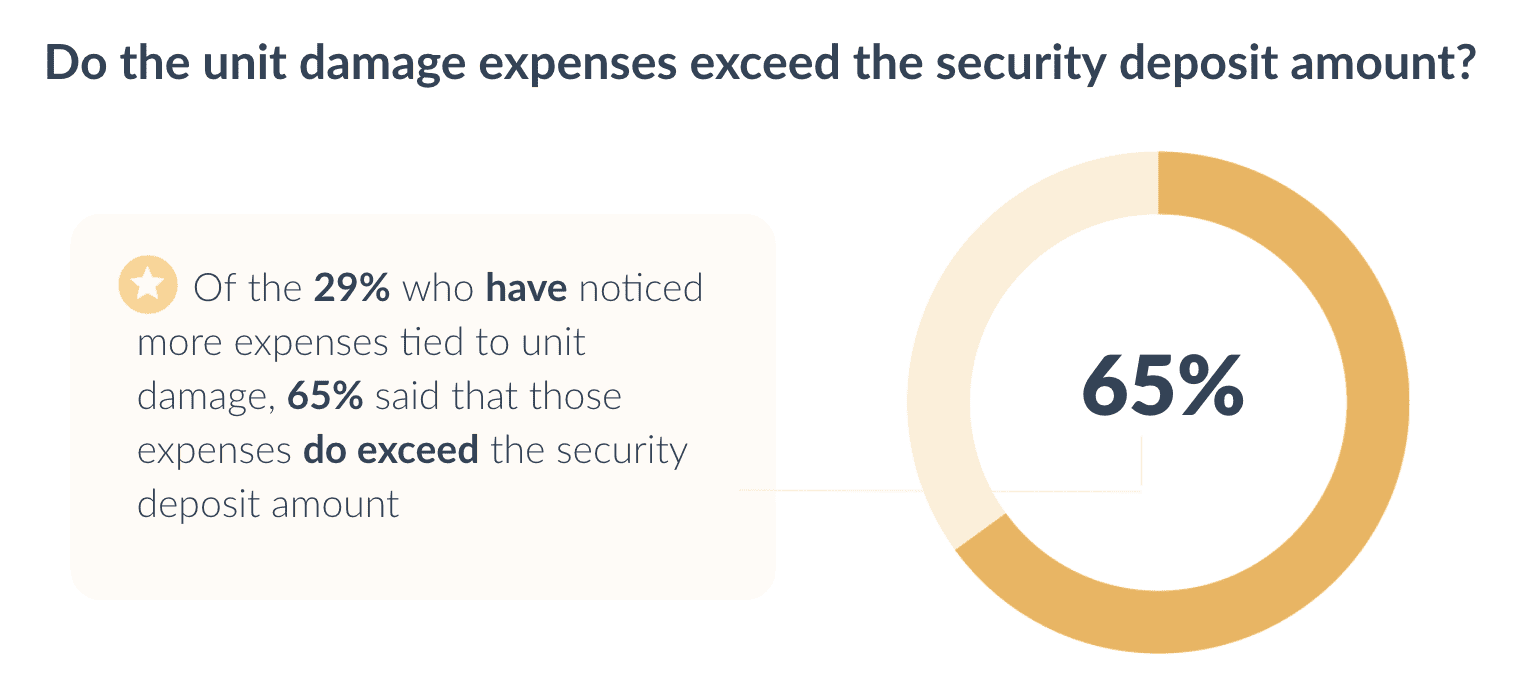

Consider the risk security deposits are meant to protect against — 65% of operators in our 2021 survey said unit damage expenses exceeded the security deposit amount. What happens to operators if the resident doesn’t pay rent or moves out, leaving significant damage behind? In the long-term, move-in incentives introduce risk as promotions like gift cards or first-month-free offers may attract an applicant profile characterized by less financial stability and higher damage risk.

Harnessing Greater Risk Predictability During Economic Uncertainty

Both RKW and WWC shifted their approach to prioritize renewals over new leases, and enhanced their screening processes to include AI screening, ID authentication and pay stub verification. They also implemented LeaseLock to replace security deposits and increase protections against property damage and rent loss.

“Lease insurance was a large initiative of ours last year, just to make sure we have more protection than a traditional security deposit,” Staciokas said. “If you have $500 for a security deposit, and we can now get $2,500 coverage (via lease insurance), that is certainly going to reduce bad debt.”

It also increases flexibility for renters, who may struggle to produce the funds for a security deposit. LeaseLock enables residents to pay a monthly fee in place of prohibitive upfront deposits. Coupling LeaseLock with options like flexible rent payments helps operators meet renter demands for customized payment options, which is crucial as more workers become part of a gig economy.

“Residents want what they want when they want it and how they want it. What has fundamentally changed is how we serve our residents to give them more options,” Williams said. “We want to incorporate that into the way we operate, but we have to mitigate the risk upfront rather than being too proud of 100% occupancy. We’re using screening verifications up front, and LeaseLock has been a tremendous value on the back end.”

Integrated Technology That Delivers True NOI Impact

In today’s multifamily environment, integrated technology solutions that enhance one another and create opportunities for new efficiencies deliver the biggest impact on NOI. Solutions that enable centralization of on-site tasks and non-resident-facing positions, while also solving for specific operational pain points, maximize property performance.

“If the technology cannot integrate, we stop the conversation. If it can’t integrate with all the other systems we’re using, it’s not going to work,” Williams said. “It’s not fair to our teams, especially if we want to retain our talent, because it makes their jobs harder. With all of these technologies and all the tech sprawl, integrating into a platform that is easy for the residents to use and easy for the operators to use is the ultimate game-changer. That’s time and money well spent.”

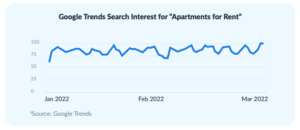

Two years since the start of the pandemic apartment leasing is returning to pre-COVID levels. Data sourced from PMS integrations shows this momentum with a 136% jump in leads and 20% more applications since the same time last year. Google searches for “apartments for rent” have also seen a 22% uptick since the start of 2022.

As a result, multifamily firms are ramping up their efforts to win over prospective residents by adopting new tactics and promotions to attract, convert, and delight renters.

At the same time, however, the industry is facing the ongoing challenge of staff shortages. Leasing success in today’s world also means making day-to-day operations easier for property teams, so adopting leasing technology solutions isn’t a nice to have anymore—it’s a must.

With the wide variety of options available to renters and a market continually saturated with deals and discounts, what should operators deploy to boost lead conversion without sacrificing NOI?

A Balancing Act: How Lease Concessions Hurt Economic Occupancy

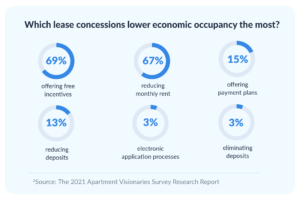

Gift cards, deposit waivers, and first-month-free discounts have historically been popular economic incentives operators leverage to drive lease conversion rate. In our 2021 Apartment Visionaries Survey, 60% of property-level respondents said that offering free incentives improved the likelihood of lease signing; but at what cost?

Among corporate leadership, 69% of respondents cited these financial concessions as hurting economic occupancy the most. This disconnect illustrates that while lease concessions may help draw in residents, converting leads should not be the only objective of your firm’s leasing season strategy.

If the majority of lead conversions are driven by economic incentives, yet economic occupancy suffers—it’s time to reconsider your strategy. To really succeed, operators need a strategy that maximizes NOI, reduces bad debt, and protects economic occupancy.

4 Technology Solutions that Boost Economic Occupancy

For multifamily operators, 2021 was another year filled to the brim with technological acceleration and adoption. Equally, renters are getting savvier and their demand for convenience and flexibility is growing.

Not all technology solutions are created equal, and some can often cause more problems than they solve. It’s paramount that operators invest their time and resources in the right tools to achieve peak performance and drive the biggest returns.

To make your job easier, we have shortlisted four technologies that streamline the leasing process, improve lead-to lease conversion, and ultimately drive NOI:

1. Deposit Replacement Insurtech Platform – A data-driven risk platform that replaces security deposits with lease insurance helps convert leads while also sufficiently protecting properties against rent loss and damage.

2. Chatbot Functions – With the help of chatbots, operators can automate engagements with prospective residents and gather more applicant information upfront, producing higher quality leads.

3. Artificial Intelligence Solutions – AI solutions automate leasing operations and gather insights about different touchpoints renters engage in prior to property visits, helping property managers increase their lead-to-lease conversion rate.

4. Self-Guided Tour Technologies – Most multifamily properties have deployed some form of self-guided tour platform, so this technology has now become a must-have in order to stay competitive.

Free White Paper: 4 Leasing Season Tech Hacks That Boost Lead Conversion Without Sacrificing NOI

To learn more about the four technology solutions and how they can make a real impact on your renter experience and deliver a competitive advantage to drive more lease signings, download the white paper:

Ready for Peak Leasing Season?

Identify where your opportunities are this leasing season with a free NOI assessment. Learn custom insights into bad debt reduction, NOI lift, and asset value appreciation to help you build a successful leasing season strategy and better equip your teams to achieve peak performance:

[cta_button link=”https://leaselock.com/contact-us/?utm_source=whitepaper&utm_medium=cta&utm_campaign=leasing-season-2022″ text=”Free NOI Analysis”]

LeaseLock is proud to serve as a sponsor for the 2022 edition of 20 fo 20, the industry’s leading executive survey on multifamily operations and technology. This year’s report provides a unique executive viewpoint on the current and future state of leasing operations and best-of-breed vs. bundled tech. Featuring 20 conversations with senior multifamily executives, the survey also includes perspectives from Domuso, LeaseLock, AppFolio, Latch, and Anyone Home on trending technology priorities.

As with previous editions, the survey invites operators to recount the previous year and speculate on the upcoming year. While COVID has dominated conversations the past two years, this year’s edition focuses on how companies are exiting the pandemic, with new strategies and technology solutions to address talent management, rent payments, security deposits, AI agents, smart buildings, and centralized leasing.

Read LeaseLock’s sponsored viewpoint below, or download the full 20 for 20 white paper here.

How to Replace Deposits. For Good.

It seems that we are operating in a time of unprecedented innovation in the arena of resident financial services. An impressive tide of innovation is improving resident experiences, increasing affordability and streamlining financial transactions. And the streamlining part is more important than ever, as staff shortages continue to heap stress on property teams.

With hiring conditions so challenging, the problems that most operators are trying to solve are the ones that reduce site team workload. Even when operators identify potential financial opportunities, few will consider exploiting them if they entail additional work.

The good news is that there is a win-win to be had. A growing segment of the multifamily industry has taken a step that creates more affordable move-ins for residents while boosting financial performance for properties. Companies that completely remove security deposits from their communities can reduce administrative overhead with no additional effort from site teams. It may seem too good to be true until we consider the impact security deposits have had on our industry since time immemorial.

Three Reasons Why Deposits Must Go

First, deposits account for most of a community’s bad debt—even in properties that don’t have a bad debt problem. Screening helps properties to mitigate credit risk, but even the strictest credit checks cannot cover lost rent and damage when a resident moves out. Companies collect deposits for this reason, but when a resident leaves with unpaid rent or damage amounting to a dollar value higher than the security deposit, the balance is bad debt.

Second, deposits are becoming increasingly risky and burdensome as more and more legislations apply renter-friendly deposit laws. As one client shared: “We were getting lawsuits every week over a few hundred dollars.” In states where “Renter’s Choice” laws stipulate that operators must offer an alternative to a security product, many operators reach for “deposit alternative” products. But few realize that those products are surety bonds, meaning that the bond provider retains the right to collect on payments from the former resident.

Finally, deposits negatively impact customer experience, both on move-in and move-out. They place a financial hurdle in the leasing process, creating sticker shock in markets where competitors no longer require deposits. And on move-out, nothing guarantees negative online reviews quite like a dispute over a security deposit.

Replacement > Alternative

The trick is to think about the problem the right way. To cut bad debt, minimize risk and workload, and improve customer experience, operators have to seek a complete replacement for deposits, not simply a deposit alternative.

Security deposits are designed as a crude form of insurance against property damage and rent loss. In 2022, we should be solving insurance problems with insurance solutions. That means operators purchasing the level of coverage that they need at a competitive price. They can recoup the cost of the insurance by offering residents a monthly deposit waiver charge.

When offered the choice between a monthly waiver fee or a security deposit, few prospects opt to pay the deposit. With the vast majority of leases insured, deposits become, at worst, a marginal feature of property management. And in an environment where property operations are likely to be stressed for the foreseeable future, deposits are one problem that the industry needs to get off its desk for good.

For access to the full white paper, download your free copy:

[cta_button link=”https://info.leaselock.com/20-for-20″ text=”Get Free Copy”]

Multifamily property teams are often overwhelmed by the growing number of administrative tasks. Technology has proven to be a valuable tool to ensure nothing is overlooked throughout the lease lifecycle, including new solutions that streamline routine processes for residents. But a significant pain point still exists post move-out: claims management.

The Evolution of Claims in Multifamily: Removing Security Deposits to Streamline Operations & Debt Recovery

Between deposit refunds and claims, these time-consuming and contentious tasks can quickly over-burden property teams. Whether managing an eviction or debt recovery, and due to the potential for rent loss (especially during and post COVID-19), site teams can’t afford to commit anything less than their full attention to the issue.

Forward-thinking operators are re-envisioning how they handle claims by moving beyond deposits entirely. As a byproduct, property teams can skip administrative headaches and streamline the debt recovery process. Through lease insurance technology, operators can start the claims process earlier and ease the burden of claims management for overstretched teams. As a bonus, these technology solutions boost onsite team productivity and eliminate long-standing pain points for the industry.

3 Benefits of Optimized Claims

Below are three operational and financial benefits of optimizing the claims process to help properties stay on top of post move-out tasks and prevent revenue from slipping through the cracks:

- Lighter Administrative Workload – Modern claims solutions avoid any out-of-workflow operations for property teams by seamlessly deploying through native property management systems, ensuring property managers don’t have to worry about leaking revenue due to overlooked claims.

- Faster Claims Returns – With lease insurance, operators no longer have to wait months or years for a collections agency to recover funds from residents, meaning operators won’t incur a substantial reduction in recovered revenue once the collections agency deducts its fee.

- Stronger Online Reputation – Replacing deposits with lease insurance not only allows operators to reduce administrative burdens and sidestep collections for quicker payouts but also eliminates a key point of resident contention after move-out, thus helping prevent negative online reviews.

To learn how to achieve maximal bad debt recovery and NOI growth by optimizing claims management, read the full article here.

With staff shortages being a top multifamily challenge, property management companies are looking to adopt processes and systems that improve operations—not strain them. This means operators will sometimes forgo financial opportunities if they think those opportunities will only add to property teams’ workloads.

So how can multifamily operators ease the lift for site teams while also improving financial performance?

The Multifamily Case for Total Deposit Replacement

In our newly released white paper, we explore why the industry needs to remove one particular risky financial instrument (security deposits) and replace with an optimally secure solution (lease insurance). We also outline the drawbacks when operators turn to “deposit alternative” products, as these seemingly “easy” fixes often only exacerbate the problem.

Finally, we describe three key benefits for operators when they completely eliminate deposits, including:

- Significant bad debt reduction

- Drastically less deposit administration and risk

- Improved customer experience

Below is a quick preview of the white paper content — to download, click the button below:

[cta_button link=”https://info.leaselock.com/3-reasons-deposits-need-replacement-not-alternatives” text=”Get Free Copy”]

3 Benefits of Replacing Deposits the Right Way

1. Recover Bad Debt

While many operators may not think bad debt is a problem for their firm, most have at least some level of bad debt. This means there’s an opportunity to convert that bad debt into dollars that fall directly into the operator’s bottom line.

Multifamily communities have primarily managed bad debt via three levers: screening, deposits, and collections. In particular, security deposits are a crude form of insurance that often leave operators with expenses greater than the deposit after move-out, which is why properties accrue bad debt.

To ensure operators don’t miss out on the opportunity to recover bad debt, properties need to instead insure as many leases as possible with a deposit waiver product. Ultimately, this arrangement achieves a powerful win-win of both affordability for residents and significantly more coverage for the owner.

2. Reduce Administration & Risk

On top of being pesky, security deposits introduce a great deal of risk. Renter’s Choice laws that require apartment operators to offer an alternative to a security deposit are restrictive and create additional administrative burdens for property teams, including more compliance complications. As a result, many operators are considering deposit alternatives without understanding the new risk associated with them.

Deposit alternatives that are marketed as “security deposit insurance” leave operators exposed to substantial risk. In many cases, these “insurance products” are actually surety bonds which can create confusion and frustration when the bond company collects on renters after move-out.

Deposit alternatives that are marketed as “security deposit insurance” leave operators exposed to substantial risk. In many cases, these “insurance products” are actually surety bonds which can create confusion and frustration when the bond company collects on renters after move-out.

It’s in the best interest of operators to avoid deposit alternatives and replace deposits with a true insurance program that takes the renter out of the equation, thus minimizing the amount of risk and workload.

3. Improve Customer Experience

In addition to creating administrative headaches, security deposits also have the potential to damage the resident experience. Between sticker shock at move-in and disputes at move-out, this creates a poor customer experience which can lead to negative online reviews for apartment communities.

In addition to creating administrative headaches, security deposits also have the potential to damage the resident experience. Between sticker shock at move-in and disputes at move-out, this creates a poor customer experience which can lead to negative online reviews for apartment communities.

While operators may consider implementing deposit alternatives to solve for this, these partial solutions wind up compounding the problem, as departing residents find out they’re responsible for paying the bond provider and may express their frustration in the form of negative reviews. Further, this method leaves the leasing transaction under the control of a third party, meaning operators are unable to protect the customer experience.

When the operator is insured though, residents don’t have to worry about unforeseen collections. This is another reason why ditching deposits entirely and replacing them with lease insurance is a better, more sustainable solution, as it lets operators control the customer experience.

Free White Paper: 3 Reasons Deposits Need Replacement—Not Alternatives

To learn how to move beyond deposits so your firm can boost financial performance, reduce the workload on your property teams, and improve your customer experience, download the white paper — click here.

As 2021 comes to a close, multifamily operators are gearing up for what’s ahead in 2022. It’s also a time for us to reflect on all we’ve accomplished as an industry, from the opportunities identified to the challenges overcome.

This past year has been full of exciting changes for us at LeaseLock, including a major product advancement. With our latest platform upgrade, we’ve directly addressed client feedback to improve the product experience for our valued customers and ultimately empower more and more operators to eliminate deposits for good — all in the name of elevating asset performance and improving resident experience.

New LeaseLock Product Features

It’s our mission to revolutionize the insurance and multifamily industries by building the world’s leading insurtech platform for real estate. Powered by insurance technology, LeaseLock is the only true deposit replacement solution on the market that gets operators out of the deposit business altogether. We’re doing that by constantly innovating and engineering our AI-powered lease insurance platform, and our latest product advancement is a testament to that commitment.

Here’s a preview of the major innovations we’ve been working on, as well as insights from our clients:

Single Limit Coverage & Exclusion Removals

In addition to rent and damage, LeaseLock now covers partial rent payments, pet damage, utility fees, eviction costs, termination fees, and late fees. The comprehensive protections consolidate coverage under a combined single limit, removing sub limits for damage and aligning with standard operating procedures for move-outs to improve debt recovery.

Faster Claims Payouts & More Flexible Deadlines

Through this upgrade, we’ve drastically improved the claims experience with more flexible deadlines and expedited processing. By taking claims completely in-house, we now deliver claims payouts in as fast as 48 business hours. In addition, all insurance policies are covered by QBE, our trusted global insurance carrier, establishing strength and trust for LeaseLock clients to expand.

AI-Powered Coverage Optimization & Risk Monitoring

We’ve developed a new AI-powered risk platform that optimizes coverage for each asset by analyzing historical financial performance data and continually monitors ongoing risk to adapt coverage. This flexible, customized coverage results in an average of 6x more protection compared to the average deposit or bond, thus reducing bad debt.

No Resident Collections

To top it off, all our new updates come in a resident-friendly format. LeaseLock does not run collections against residents for claims paid to properties — unlike deposit alternatives which do collect against residents for claims paid. With LeaseLock, properties don’t have to worry about unhappy residents writing negative online reviews due to surprise collection attempts.

What Are the LeaseLock Benefits for Multifamily Operators?

Now that we’ve introduced the upgrades to our core lease insurance platform, what key benefits do rental housing operators get with LeaseLock? Due to our industry-leading adoption rate of 92%, clients see the following 3 key benefits:

- Unmatched Coverage, Less Bad Debt – Provides significantly more protection, reduces bad debt, and improves NOI.

- Reduced Deposit Administration & Risk – Drastically minimizes deposit administration while providing greater risk mitigation.

- Better Resident Experience – Delivers a simpler, more affordable move-in experience for residents while protecting your online reputation.

How Does LeaseLock Lease Insurance Work?

Powered by AI, our insurance technology increases coverage and removes uncertainty by replacing security deposits and deposit alternatives with lease insurance. Operators receive $3,000 in rent loss and damage coverage for each new lease with the preferred plan. LeaseLock deploys within the native online leasing checkout, which puts the operator in charge of the transaction and creates a seamless experience — resulting in industry-leading conversion rates.

Claims are simple, with an expedited claims process that is as straightforward as handling cash — without the administrative headaches of cash deposits.

By replacing security deposits with insurance, owners and operators increase coverage levels while cutting risk and making housing more affordable. That’s a powerful win-win for the whole industry, and the reason top operators choose LeaseLock.

Interested in learning more about our latest product upgrade or what LeaseLock can do for you? Request a demo – click here.

In the previous two articles in this series, we outlined two reasons why multifamily operators should consign the use of security deposits to history.

First, we talked about how many operators are missing opportunities to eliminate bad debt and how, even in cases where they don’t have a lot of bad debt, there is usually still free money to be had. By insuring leases instead of burdening operators and renters with security deposits, operators can reduce bad debt risks and eliminate deposit headaches for good.

Next, we looked at the growing risk of deposits and deposit alternatives, explaining how operators get out from under the burden of administrative overhead and risk by replacing deposits completely. In that post, we also highlighted the different risks associated with some popular deposit alternative products.

One impact of security deposits is left for us to talk about, and it may be the most important one. The potential damage that they do to prospect and resident experiences.

Customer Experience at Move-In and Move Out

It is not hard to imagine how security deposits can negatively impact customer satisfaction. In fact, deposit requirements often leave a sour taste in your resident’s mouth, compromising a community’s value proposition and future marketing activities.

The biggest and most obvious issue is affordability. When renting an apartment entails paying a large lump sum upfront (typically equal to one month’s rent), there may be resulting sticker shock for some prospective renters. Deposit requirements shrink the pool of potential renters, and the problem will worsen as more and more competitor properties find ways to reduce deposit-related costs.

The other problem emerges when residents move out. From time to time, residents are surprised when they do not receive some or all of their security deposit refund. These can result in disputes (including legal disputes) when residents disagree with and are unpleasantly surprised by the amount (if any) of their refund.

Surprises like these tend to manifest as negative online reviews left by disgruntled residents. The prominence of online reviews as a data point for renters choosing a place to live has made reputation scores an all-important currency in apartment marketing. Operators need residents to post positive reviews after moving out. To this end, it makes sense to optimize the whole resident experience, not only because it’s the right thing to do but because it’s also in the community’s best interest.

The bottom line is that in a competitive market, no community should want to be more expensive or have lower review scores than its competitors. Security deposits put operators at risk on both fronts.

Why Insurance Is the Better Option

The problems that come with security deposits are exacerbated by some of the “deposit alternatives” that operators are currently considering. As we discussed in our last blog on this topic, most deposit alternatives are based on surety bonds and tend to be positioned as insurance products. Renters who purchase products like surety bonds are therefore led to believe that they are insured against potential damages or losses at the end of their residency, as they would be with a traditional deposit.

Sadly, that isn’t the way these surety bonds work at all: in fact, the bond provider retains the right to pursue the resident for any money that they, the provider, must pay to the multifamily community on behalf of the resident. When a departing resident learns they are responsible for paying the bond provider, it usually comes as a surprise, and is a natural motivation for a negative review, representing an unwelcome and unnecessary risk to the community’s online reputation.

The involvement of third parties in the deposit transaction raises a broader point about the prospect and resident experience. When a third party takes over part of the leasing transaction (which is what happens with most deposit alternatives), they also take a part in controlling the customer experience.

Given the time and effort operators invest in their leasing processes, this is a suboptimal approach and one that can go quite badly for our residents, especially in the case of collections described above.

A much better way of ridding properties of security deposits is to replace them entirely with lease insurance. When the operator is the one who’s insured, there is no need for residents to leave the leasing process (i.e., to go to a third-party site). Operators maintain complete control of the customer experience throughout the entire leasing process. They also enjoy vastly higher adoption rates, with average uptake rates well above 90%*.

The Win-Win

A participation rate over 90%* matters: it means that all but a few leases are ultimately free of deposits. It forms part of the community’s value proposition that all residents can consistently understand. It is a win for the overall customer experience, but above all else, it delivers a powerful win-win.

It’s a win for operators because true lease insurance increases coverage and lowers bad debt while ensuring a consistent and authentic customer experience. It’s a win for residents because it delivers greater housing affordability by removing the burdensome upfront security deposit. It also avoids the risk that a third-party surety bond company will collect on the resident if they (the bond company) has to pay the operator.

Deposit surprises are usually bad, whether it’s sticker shock during the move-in process or a move-out surprise. As we have argued throughout this series, it’s time to replace security deposits altogether. It’s time to embrace true insurance products that can deliver the customer experience and performance improvements that are already benefiting a growing number of multifamily operators.

*Communities adopting LeaseLock’s lease insurance achieve average adoption rates of 92%

In our last blog, we discussed how operators are reducing bad debt by insuring leases instead of taking security deposits. The bad debt that we discussed in that post ought to be enough to motivate any operator to rid themselves of deposits for good — but it is not the only reason to do it.

For operators, security deposits are becoming more burdensome and risky. For residents, some of the alternatives to security deposits are introducing new types of risk. Below, we will seek to understand these risks and how to avoid them.

Security Deposits Are Getting Less Secure

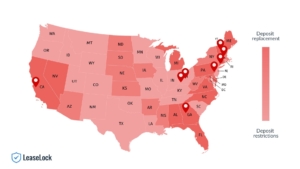

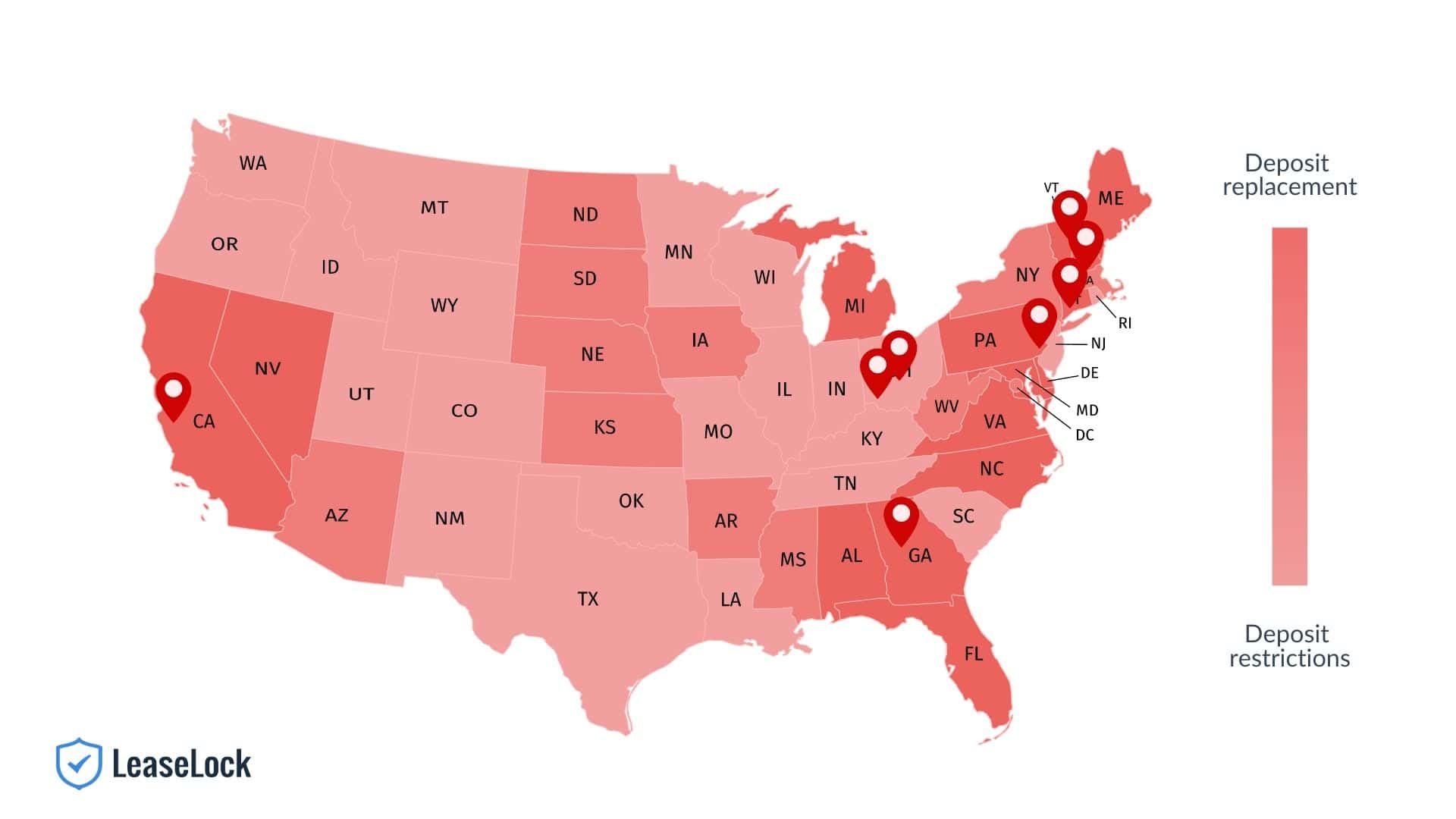

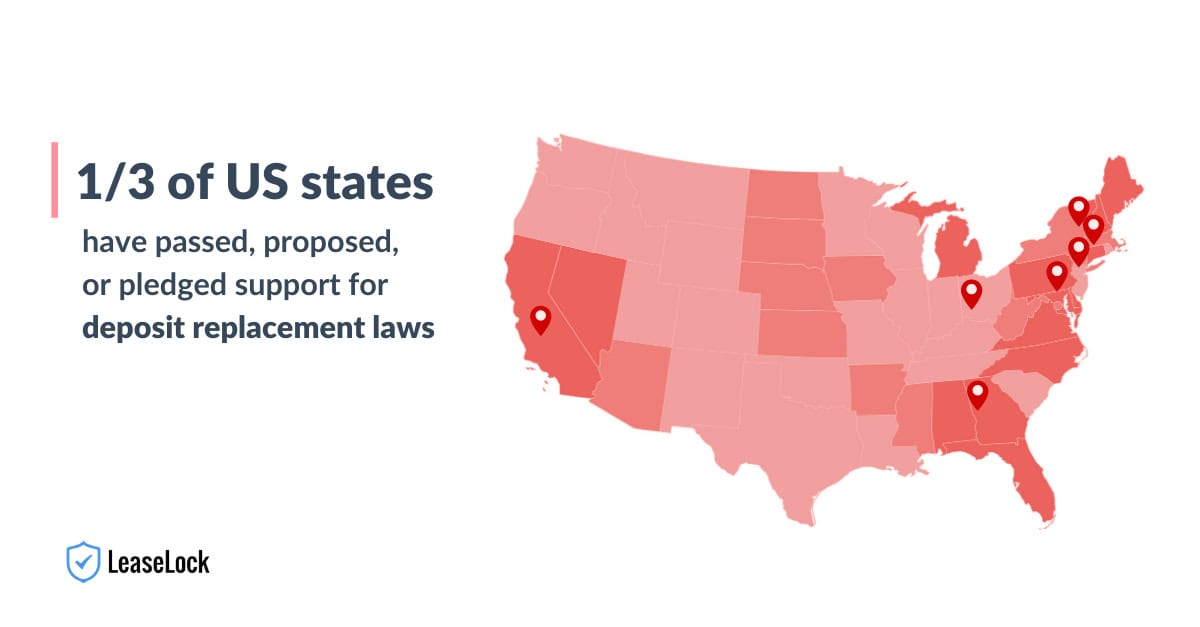

An increasing number of state and city legislatures are adopting laws that mandate that apartment operators offer an alternative to a security deposit (nicknamed “Renters Choice” laws). The intent of these laws is to make rental housing more affordable, which is, of course, a good thing. As with most legislation, however, the devil is in the details.

The laws implemented by states and municipalities apply multiple restrictions to security deposits and vary substantially from legislature to legislature. Some limit the maximum size of a deposit or restrict the window in which deposit refunds must be distributed. In some cases, the laws require operators to offer deposit installment plans. We will not go any deeper into individual laws in this post, but visit the deposit laws section of our blog for more details.

It is not hard to imagine how quickly the rules pile up for a multifamily operator with communities in more than one city. Each new law creates a need for a policy change by the operator, and each policy change adds complexity to the process of deposit administration. The added complexity costs time and increases the likelihood that a property may fail to comply with a new law, resulting in potential lawsuits. As one senior leader of a major multifamily operator recently told us, “we are now being sued every week over $500 deposits.”

The growing risk and administrative burden of deposits is a concern already on the radar of most operators. A growing number are looking to find deposit alternatives, often because the laws say that they have to. But what relatively few operators understand is the new risk associated with some popular forms of deposit alternative.

Read the Fine Print!

A recent article in urban development publication Shelterforce summarized the developing story of deposit alternatives. It’s a story that multifamily operators should take the time to understand. “Renters Choice” laws have been becoming more frequent but are still relatively new (Cincinnati’s was the first, dating back to April 2020).

Because the legislation is recent, the level of understanding about how some deposit alternatives work is still relatively low. For example, only the most diligent renters will spot that the products being marketed directly to them as “insurance” actually leave them exposed to substantial risk. The article points out how most security deposit alternatives do not provide renters with protection from claims, adding “tenants using products like Rhino remain fully liable for any claims paid to their landlords.”

Although deposit alternatives are marketed as “insurance products,” in reality, they are “surety bonds,” i.e., they guarantee the bonded party’s contractual obligations (the renter’s financial obligations to their landlord). Unlike insurance products, the premium paid to the provider does not guarantee a level of coverage. Rather, if the landlord files a claim, the bond company pays the landlord but may then seek repayment from the renter. Given that the product is marketed to the resident as an “insurance” product, this comes as an unpleasant surprise, especially since it can impact their credit score.

Why Partial Solutions Don’t Help

The best way for operators to avoid the problems described above is to replace deposits with insurance. Replacing deposits, rather than just offering an alternative, means driving the highest possible participation in a true insurance program. High participation minimizes the number of leases subject to deposits and the associated risk and workload. Deposit alternative products tend to have relatively low, usually less than 50% adoption rates, which leaves most leases unchanged.

Insurance exists to shift risk from the policyholder to the carrier, and this is not how surety bonds work. In considering deposit alternatives, many operators misunderstand that it is their risk that is being covered (not the renter’s). Therefore, the correct way to replace security deposits is for the operator to insure their leases, effectively taking the renter out of the equation.

As we mentioned in our last post, operators can recoup the cost of the insurance from the resident by offering them an insurance waiver product (usually a small monthly fee that covers the cost that the operator is paying to insure the lease). The critical difference with this arrangement is that the fee is a transaction between the renter and the landlord, and does not make the renter liable for claims in the way that surety bonds do.

Through true lease insurance, rather than surety bonds, operators can maximize coverage while removing the possibility of the provider collecting on a resident after move-out. This has important implications for resident experience, which is a topic to which we cover in our next post.

In today’s multifamily market, the issue of bad debt is not always top of mind. Eye-popping year-over-year rent increases and uncomfortably high occupancies create a natural tide of financial optimism. If you asked most operators, they’d tell you, “We don’t have a bad debt problem.”

But consider for a moment what that means. Thinking that you do not have a bad debt problem does not mean that you do not have bad debt; it means that the bad debt is at a level that your organization finds acceptable. It may not be a problem per se, but in the vast majority of cases, bad debt is an opportunity.

Is Bad Debt a Problem or an Opportunity?

The simple example above shows a regular, mid-priced 300 unit multifamily community. A “normal” level of bad debt is typically in the 2% range, or about $80,000 per year for this property. That may be an acceptable level of bad debt, but it’s still a significant amount of money that should be yours, but isn’t realized. It’s a check that an operator could be writing to investors each month but isn’t.

Yet, time and again, operators leave the opportunity untapped because it “Isn’t a big enough problem.” But should that matter if it’s an easy problem to solve?

How Multifamily Manages Bad Debt Today

There are three levers available to multifamily operators to manage bad debt: 1) screening, 2) deposits and bonds, and 3) collections.

- Screening – Screening is a vital step in the leasing process, and one that goes some way towards reducing the likelihood of bad debt. But there is a limit to how strict your screening criteria can be. Imagine trying to address the $80k/year of bad debt in the illustration above through tighter screening. The community’s criteria would have to be restrictive to the point of not allowing enough signed leases to fill the community.

- Deposits – Inevitably, there will be instances where a resident will leave owing debt or having done costly damage to their unit. It is for cases such as these that operators have collected deposits since time immemorial. But what happens when the deposit amount does not cover the damage or the lost rent? That is how the $80k in our example accumulates. Even when surety bonds are offered as an alternative to deposits, they only cover the total amount of the security deposit. And low resident adoption of a bond program leaves many of the community’s leases “protected” by what was meant to be replaced in the first place (security deposits).

- Collections – Collections can sometimes claw back some of the cost of damages and lost rent, but recovery rates greater than 10% are rare in our industry. And when recoveries are made, they have to be shared with the collections agency. So the impact on bad debt is usually minimal.

Replace Security Deposits & Surety Bonds, Recover Bad Debt

Of the three bad debt levers mentioned above, only one offers the opportunity to recover the $80k in our example. It involves a fundamental rethink of the security deposit. The rethink entails seeing deposits (and surety bonds) for what they really are: a crude form of insurance. Operators collect a large and somewhat arbitrary upfront payment from the resident, then must either return the full deposit amount after move-out (oftentimes including accrued interest) or a reduced deposit amount when things go wrong, depending on any outstanding rent or damage against the leased unit. But when they go wrong, they frequently leave the operator with expenses greater than the deposit, which is why properties using deposits still have bad debt.

The deposit is at the same time large enough to be prohibitively expensive for many renters and still insufficient to cover the losses against which it is meant to protect! And even if a bond is raised higher than the deposit amount, it increases the resident’s cost and offsets the affordability intended.

Here is another way to think about it: when you need to insure against a given outcome, you should do so with an insurance product. We all purchase many types of insurance, and they are usually delivered by companies that specialize in quantifying risk, predicting appropriate levels of coverage and making sure that coverage is accessible through competitive premiums. That is how insurance is supposed to work, and that is how operators should handle the problem they are currently using security deposits and surety bonds to address.

The best way to reduce the $80k in bad debt in our example above is to insure as many leases as possible at the time of leasing the apartment. Instead of asking prospects to scrape together a month’s rent upfront to secure the apartment, or selling surety bonds to each prospective resident, the property can instead insure the lease, which greatly increases coverage, which in turn lowers bad debt.

The property can recoup the insurance cost by offering a deposit waiver product for which the resident pays a modest monthly fee. This arrangement achieves the powerful win-win of affordability for the resident and greatly improved coverage for the owner. And when the vast majority of a community’s leases are insured in this way, that bad debt opportunity is converted into dollars that fall straight to the operator’s bottom line.

When former apartment residents look back on their living experiences and assess their satisfaction, their lasting sentiments rest heavily on the final interactions they have with their apartment communities. So, why are so many renter relationships tainted after move-out?

Security Deposit Disputes Create Negative Move-Out Experiences Which Damage Your Online Reputation

Residents’ final impressions are often based on their move-out bills.

Renters who expect their entire security deposit to be refunded, or who incur unanticipated charges upon move-out, are left with a bitter taste in their mouth no matter how legitimate the charges might be. Unfortunately for apartment managers, parting on poor terms often leads to negative reviews from former residents. Even the happiest current renter can become a one-star reviewer after they receive the final billing statement.

In today’s marketplace, online reviews and ratings are an essential component of public relations for apartment managers, and move-out reviews from disgruntled former residents can severely damage a brand’s online reputation. Considering 85% of renters have indicated that online reviews influence their leasing decisions, the impact of negative feedback focused on the move-out experience and disputed charges may be greater than most properties expect.

An Innovative Solution to Prevent Security Deposit Disputes, Boost Renter Satisfaction, & Protect Brand Reputation

To help ensure that happy residents remain satisfied during the move-out process, many operators are removing costly security deposits and surety bonds altogether. After all the hard work that onsite teams put in to meet residents’ needs, those efforts shouldn’t be erased by billing conflicts on the back end. Property managers deserve positive feedback from the residents whose living experiences they cultivated, and renters deserve the opportunity to look back fondly at their leasing experience.

Quite simply, security deposits create an adversarial relationship between managers and residents that culminates at move-out. Residents routinely expect to have their deposits refunded in full at move-out, and they often count on those refund dollars to make the deposit at their next apartment. Management teams rely on those same deposits to cover cleaning costs and damages, and have little other recourse to recoup those costs.

Because a full refund is not always a reality, security deposits and deposit alternatives set managers up for failure from the moment they are collected. When renters are faced with receiving deposit deductions or repaying a bonding company, they take to Yelp, Google, Facebook, ApartmentRatings.com, ILSs, and other sites to vent their grievances.

Thus, in order to avoid move-out disputes and damaged relationships caused by deposits and surety bonds, operators should implement true deposit replacement technology.

Using Deposit Replacements to Eliminate Move-Out Charges

Many operators are turning to an integrated insurtech solution known as Zero Deposit lease insurance that removes security deposits from operating infrastructure. Unlike surety bonds, which merely present deposit alternatives, lease insurance replaces deposits with insurance technology and provides apartment operators enhanced protection on every single lease.

“The multifamily industry is changing,” explains Marcie Williams, president at RKW Residential. “Replacing security deposits with lease insurance enables us to meet the affordability needs of our residents, simplify the leasing process, and protect our assets in an uncertain economy.”

Deposit replacement technology removes a major hurdle in the application process, as well as the inherent conflict at the conclusion of the lease. In addition, lease insurance deploys seamlessly at check-out and provides operators with far more coverage against damage or bad debt than traditional deposits and bonds.

Improve the Move-Out Experience With Zero Deposit

By offering a Zero Deposit move-in, operators avoid administrative and financial hassles related to deposit deductions and move-out charges. In turn, renters are more likely to write positive reviews touting the simplicity and affordability of both the move-in and move-out experience.

Happy residents can become happy reviewers. More importantly, when residents don’t have complaints about move-out fees, damage charges, or cleaning expenses, it means they also don’t have a reason to post negative move-out reviews that can drive down property ratings. Instead, operators can benefit from reviews that positively reflect their apartment communities.

Deposit replacement solutions like lease insurance facilitate a seamless start-to-finish renter experience, which improves resident satisfaction and brand reputation. When prospective residents do their homework on a community, that bolstered brand reputation sets the property apart and ultimately results in more lead-to-lease conversions and increased revenue for your organization.

Instead of continuing to fight the old security deposit battle, operators should look for solutions that empower them to improve renter sentiment at their communities.

With legislation around the eviction moratorium, rent relief programs, and security deposits constantly evolving, Texas property owners and operators need to stay up-to-date on the latest rental housing laws. What are the biggest challenges facing both operators and their residents, and what do multifamily experts in the region have to say? What does the newest security deposit bill passed in May 2021 mean for the industry?

States continue to roll out rental assistance programs, and a wave of security deposit legislation is sweeping across the nation, so we invited esteemed industry experts from AMLI Residential and Madera Residential to discuss key concerns, including:

- How to navigate federal and state eviction moratoriums

- Tips for accessing rent assistance

- Analysis of state security deposit bill

- Options to replace security deposits

- What this legislation means for multifamily operators and what’s required to be compliant

[cta_button link=”#anchor” text=”Watch Webinar”]

Disclaimer: The information contained in this article is provided for informational purposes only, and should not be construed as legal advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this article without seeking legal or other professional advice. The contents of this article contain general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content on this site. This article contains links to other websites. We are not responsible for the privacy practices or the content of such websites, and we do not endorse such sites.

Texas Eviction Moratoriums & Rent Assistance Program

The CDC eviction moratorium is set to expire June 30, 2021. As of March 31, the Texas Supreme Court’s 34th Emergency Order, which applied the provisions of the CDC moratorium to Texas courts, has expired. This means eviction proceedings can take place, barring where local government protections apply.

To help make sense of the various regulations, we hosted an educational presentation and expert panel to help inform apartment operators in the state of Texas — below is a recap of the webinar.

Federal Rent Assistance

The CAA and ARPA bring a combined total of $45 billion in federal funding to cover rental arrears. Based on population, the program allocates $1.3 billion in funding for Texas.

Note: For the full letter of the law, access CAA here and ARPA here.

CAA & ARPA Funding Eligibility Requirements

The eligibility criteria for both the CAA and ARPA funding programs require that:

- Combined household total gross income cannot exceed 80% the area median income for the location where the property is located.

- Household must demonstrate a risk of homelessness or instability.

- Household has experienced loss of income due to Covid-19.

Texas Tent Relief Program

The 2021 Texas Rent Relief Program (TRRP) — which is intended to distribute the $1.3 billion in federal funding available in Texas — is currently available and being distributed. Those interested in applying should visit texasrentrelief.com.

Applicants are eligible for up to 15 months of assistance, covering past due rent from the previous 12 months and future rental assistance for three months. While there is no maximum grant allowance per household, rent may not exceed $4,600 per month. Units that exceed the limit are not eligible for assistance from the Texas Rent Relief Program.

Operators can begin the process of applying for funds themselves, but renter participation is required in order for an application to be accepted. For a list of program FAQs, visit here.

Texas Eviction Diversion Program

The Texas Eviction Diversion Program (TEDP) is a voluntary program that allows eligible landlords and tenants to mutually agree on a resolution to an eviction case before displacing a resident. The program was created to prevent evictions that are already on court dockets, as a last resort to keep renters in apartments.

TEDP is a program specific to Texas, and is designed to encourage mediation to resolve past-due rent issues between operators and their residents, rather than evict or displace renters. Applicants are given funding priority over those utilizing the Texas Rent Relief Program, making this an attractive option for operators. For a full list of program requirements, visit here.

SB 1783: The New Texas Security Deposit Law

In May 2021, new security deposit legislation was passed in Texas, marking a big win for both operators and renters in the state. Effective September 1, 2021, SB 1783 codifies the current practice of utilizing a small monthly deposit waiver fee instead of a large upfront deposit upon move-in. The bill outlines the following:

- If the property requires a security deposit, operators can instead choose to offer the renter an option to pay a fee in lieu of a security deposit, however there is no mandate that operators offer such an option

- The fee must be memorialized in an agreement and signed by both the property and renter (this requirement could be covered through a lease addendum)

- The fee can either be recurring monthly or payable on any schedule so long as it’s agreed to between the renter and property

- The statute also specifically states that an operator may use the fee to purchase insurance covering renter defaults like unpaid rent and physical damage to a unit under the lease (otherwise known as lease insurance)

SB 1783 specifically says that the fee collected under this section is not a security deposit, meaning the fee does not need to comply with the security deposit statute.

What the New Texas Deposit Law Means for Multifamily

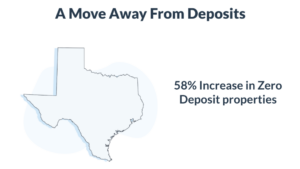

A Move Away From Deposits

Considering today’s economic climate, it’s increasingly important for operators to meet the needs of renters who are dealing with financial strain. Most Texas operators understand that renters prefer not to pay large upfront deposits. In the great state of Texas, we’ve seen more and more operators try to address affordability by charging, sometimes, only $100 for deposits.

What’s the issue with this approach? It doesn’t mitigate risk. So, what happens when these security deposits aren’t enough?

Lately, we’ve seen a trend to move away from deposits toward risk fees. But these fees do not always provide sufficient coverage for operators in relation to the risk they’re taking on. Operators need better backend protection, which is why across the country, we’re seeing rapid movement toward deposit replacement solutions, like Zero Deposit lease insurance, to protect against rent loss.

In fact, since the start of 2020, there’s been a 58% increase in Zero Deposit properties across Texas.

How SB 1783 Is Different From Renter’s Choice Laws

Legislation like SB 1783 takes Renter’s Choice laws — which require deposit alternatives like surety bonds be offered — a step further in eliminating the issues associated with deposits and their alternatives. In other words, deposit replacement laws provide apartment operators true deposit replacement solutions while leaving it up to the operator to determine the best deposit replacement option.

Ultimately, deposit replacement laws like SB 1783 enable operators a secure way to choose a deposit solution like lease insurance while also creating more affordable move-ins for renters.

SB 1783 marks an important victory for the multifamily industry. LeaseLock supports legislation that gives operators a true — and secure — choice in selecting deposit solutions that they determine is best for their properties and which, at the same time, can make renting more affordable for their residents.

Top Operator Concerns With Security Deposits & Deposit Alternatives

More operators are seeking out deposit solutions more than ever before. Some key concerns operators are looking to tackle include:

- Administrative burdens for both onsite staff and accounting teams

- Increased risk exposure if the renter defaults prior to having paid the full deposit amount

- Complexities that slow the leasing process due to administrative burdens and compliance issues

- Compliance issues for owners with properties across several states and cities — each with its own legal requirements.

The Security Deposit Solutions Market

Operators should understand the key differentiators between the deposit solutions available: deposit replacements and deposit alternatives.

Security Deposit Alternatives

Deposit alternatives (i.e., surety bonds) create operational complexity as they require onsite training, third-party applications, and background checks and/or FICO scores. Because they’re out-of-workflow, deposit alternatives often lead to low adoption.

Security Deposit Replacements

Deposit replacement solutions (i.e., lease insurance) totally eliminate deposits. Lease insurance eases administrative burdens, streamlines back-office workflows, and provides significantly more protection for rent and damages compared to traditional deposits and deposit alternatives.

Texas Rental Housing Laws Expert Panel Discussion

LeaseLock hosted an educational webinar and expert panel session on the many legislative challenges facing owners and operators in Texas. Moderated by our very own Ed Wolff – Chief Revenue Officer, the panel featured industry thought leaders, Jeffery Lowry – Chief Operating Officer at Madera Residential and Traci Hall – President – West Region at AMLI Residential.

Below is a preview of the panel questions covered:

- As the pandemic ends and eviction moratoriums are lifted, how can operators properly prepare for eviction filings?

- Renters and operators are feeling overwhelmed and confused about applying for rent relief — what can operators do to help direct residents to rental assistance?

- How should operators think about risk mitigation in today’s economic climate?

- Renter fraud has become a more pressing issue across all asset classes — how are operators addressing this?

- What types of tools should operators have in their tech stack that integrate into the workflow to maximize efficiency and reduce disruptions?

To access a recording of the of the rental housing laws presentation and panel, fill out the form below:

Illinois property owners and operators are constantly navigating ever-changing rental housing laws. With new legislation around rental assistance and security deposits, what do these policies mean for multifamily in the Chicago region and Illinois as a whole?

In light of new rental assistance programs, as well as a wave of security deposit legislation sweeping across the nation, we pulled together an expert panel to discuss key concerns and challenges facing Illinois owners and operators, including:

- How to navigate federal and state rent assistance

- State and local security deposit laws

- The right options to replace security deposits for apartment residents

- What this legislation means for multifamily operators and what’s required to be compliant

Note: Download the full webinar recording by filling out the form at the end of this post.

Disclaimer: The information contained in this article is provided for informational purposes only, and should not be construed as legal advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this article without seeking legal or other professional advice. The contents of this article contain general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content on this site. This article contains links to other websites. We are not responsible for the privacy practices or the content of such websites, and we do not endorse such sites.

Illinois Rental Assistance Programs & Security Deposit Laws

From complicated rental assistance programs to tightening security deposit laws, keeping up with ever-changing legal landscape is no easy task. To help, we hosted an educational presentation and panel to help inform apartment operators in the state of Illinois — below is a recap of the webinar.

The Letter of the Law: Federal Rent Assistance