Leasing Season Panel: Multifamily Experts Share Top Leasing Hacks

The Covid-19 pandemic is finally fading away, and the ensuing economic recovery and employment growth have fueled unprecedented demand for apartment homes. That demand has led to off-the-charts rent growth.

To optimize this momentum, operators are seeking competitive advantages in their efforts to land prospective residents. Unfortunately, resident preferences are a moving target. They now prioritize customization, convenience and modern technology in the form of flexible rent payments, deposit-free move-ins and remote work accommodations.

During the recent webinar, Tech Hacks That Boost Lead Conversion Without Sacrificing NOI, moderated by LeaseLock Chief Revenue Officer Ed Wolff, industry leaders explored strategies for meeting current renter preferences.

A Balancing Act: Lease Concessions vs. Economic Occupancy

The key, according to webinar panelists, is balancing incentives and concessions with economic occupancy. While upfront lease concessions may help to fill vacancies, they don’t help to protect against bad debt or bolster property level budgets. In fact, short-term promotions often result in long-term liability by attracting high-risk renters and exposing operators to unrecoverable debt.

Short-Term Promotions = Long-Term Liability

Multifamily management companies are increasingly turning to tech solutions to future-proof their operations while also boosting the volume and quality of leasing funnel activity.

“What we are seeing that is different this year is an influx of leads that are coming into our onsite teams,” said Jennifer Staciokas, Executive Managing Director of Property Management at Western Wealth Capital. “You may think of that as being a positive, but at the same time that requires our onsite teams to handle more leads that may be unqualified.”

Staciokas said Western Wealth Capital (WWC) has deployed lease-nurturing solutions and automation tools like chatbots and voicebots to streamline the applicant screening process.

“It’s all about attracting the right residents,” Staciokas said. “You have to be really mindful of the promotions that you’re offering. You don’t want to sacrifice your collections and your economic occupancy for that quick fix on the front end.”

Marcie Williams, CEO at RKW Residential, said mitigating that risk upfront is essential. At RKW, that has meant retracting some of the tech solutions deployed during the pandemic.

“By allowing prospective residents to tour the apartment by themselves and by allowing them to apply online, what’s happening is it’s increasing fraud,” Williams said. “When we only have one or two apartments available, it really becomes detrimental to our business. We have disabled online leasing and we’re inviting qualified applicants to lease rather than letting anyone do it whenever they want.”

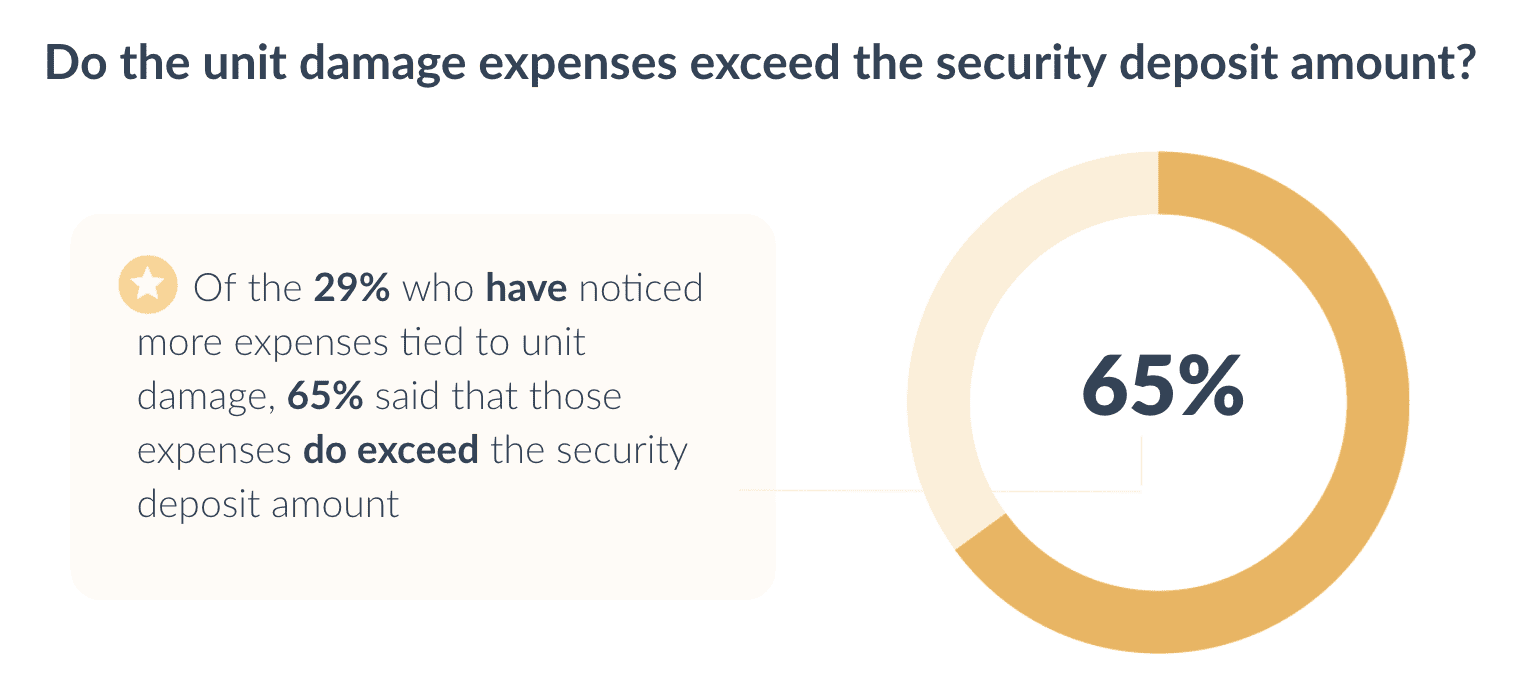

Consider the risk security deposits are meant to protect against — 65% of operators in our 2021 survey said unit damage expenses exceeded the security deposit amount. What happens to operators if the resident doesn’t pay rent or moves out, leaving significant damage behind? In the long-term, move-in incentives introduce risk as promotions like gift cards or first-month-free offers may attract an applicant profile characterized by less financial stability and higher damage risk.

Harnessing Greater Risk Predictability During Economic Uncertainty

Both RKW and WWC shifted their approach to prioritize renewals over new leases, and enhanced their screening processes to include AI screening, ID authentication and pay stub verification. They also implemented LeaseLock to replace security deposits and increase protections against property damage and rent loss.

“Lease insurance was a large initiative of ours last year, just to make sure we have more protection than a traditional security deposit,” Staciokas said. “If you have $500 for a security deposit, and we can now get $2,500 coverage (via lease insurance), that is certainly going to reduce bad debt.”

It also increases flexibility for renters, who may struggle to produce the funds for a security deposit. LeaseLock enables residents to pay a monthly fee in place of prohibitive upfront deposits. Coupling LeaseLock with options like flexible rent payments helps operators meet renter demands for customized payment options, which is crucial as more workers become part of a gig economy.

“Residents want what they want when they want it and how they want it. What has fundamentally changed is how we serve our residents to give them more options,” Williams said. “We want to incorporate that into the way we operate, but we have to mitigate the risk upfront rather than being too proud of 100% occupancy. We’re using screening verifications up front, and LeaseLock has been a tremendous value on the back end.”

Integrated Technology That Delivers True NOI Impact

In today’s multifamily environment, integrated technology solutions that enhance one another and create opportunities for new efficiencies deliver the biggest impact on NOI. Solutions that enable centralization of on-site tasks and non-resident-facing positions, while also solving for specific operational pain points, maximize property performance.

“If the technology cannot integrate, we stop the conversation. If it can’t integrate with all the other systems we’re using, it’s not going to work,” Williams said. “It’s not fair to our teams, especially if we want to retain our talent, because it makes their jobs harder. With all of these technologies and all the tech sprawl, integrating into a platform that is easy for the residents to use and easy for the operators to use is the ultimate game-changer. That’s time and money well spent.”

Leave a Reply

Want to join the discussion?Feel free to contribute!