Illinois Rental Laws: The Guide to Rent Assistance & Deposit Legislation

Illinois property owners and operators are constantly navigating ever-changing rental housing laws. With new legislation around rental assistance and security deposits, what do these policies mean for multifamily in the Chicago region and Illinois as a whole?

In light of new rental assistance programs, as well as a wave of security deposit legislation sweeping across the nation, we pulled together an expert panel to discuss key concerns and challenges facing Illinois owners and operators, including:

- How to navigate federal and state rent assistance

- State and local security deposit laws

- The right options to replace security deposits for apartment residents

- What this legislation means for multifamily operators and what’s required to be compliant

Note: Download the full webinar recording by filling out the form at the end of this post.

Disclaimer: The information contained in this article is provided for informational purposes only, and should not be construed as legal advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this article without seeking legal or other professional advice. The contents of this article contain general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content on this site. This article contains links to other websites. We are not responsible for the privacy practices or the content of such websites, and we do not endorse such sites.

Illinois Rental Assistance Programs & Security Deposit Laws

From complicated rental assistance programs to tightening security deposit laws, keeping up with ever-changing legal landscape is no easy task. To help, we hosted an educational presentation and panel to help inform apartment operators in the state of Illinois — below is a recap of the webinar.

The Letter of the Law: Federal Rent Assistance

The federal funding sources include the Consolidated Appropriations Act (CAA) and the American Rescue Plan Act (ARPA). The CAA provides about $25 billion while the ARPA brings roughly $20 billion for a combined total of $45 billion in federal funding to cover rental arrears. Funding is provided to states based on population, meaning Illinois will eventually receive a combined $900 million.

For the full letter of the law, access CAA here and ARPA here.

CAA & ARPA Funding Eligibility Requirements

The eligibility criteria for both the CAA and ARPA funding programs require that:

- Combined household income must not exceed 80% the area median income for the location where the property is located.

- Household must demonstrate a risk of homelessness or instability.

- Household has experienced loss of income due to Covid-19

Illinois Rental Payment Program

So, what are the next steps for operators and residents who need access to rent assistance? The 2021 Illinois Rental Payment Program (which is intended to distribute the ~$900 million in federal funding allocated for Illinois) is not yet available as the state is not currently accepting applications. Those interested in applying should check back here in May for updates.

In the meantime, we know that applicants are eligible for up to 15 months of assistance, covering past due rent from the previous 12 months and future rental assistance for the next three months, with a maximum grant amount of $25,000 per household.

Operators can work together with renters to start the application process, but renter participation is required in order to qualify.

Illinois Security Deposit Law

The Illinois Security Deposit Return Act does not put a limit on the maximum security deposit amount that operators can collect. When making deductions, operators have 30 days from the date of move-out to return it and written notice is required. When returning the full amount, operators have 45 days from the date of move-out to return the funds and no written notice is required.

At the local level, both Cook County and the city of Chicago have restrictive laws on how security deposits can be collected, managed, as well and how and when they must be returned.

Cook County Deposit Law

The Cook County RTLO (Residential Tenant and Landlord Ordinance) caps security deposits at 1.5 month’s rent and reduces the time for returning a deposit from 21 days to 30 days.It also requires operators to give renters the option to pay any portion of the security deposit in excess of one month’s rent, in no more than six equal installments no later than six months after the effective date of the lease.

Chicago Deposit Law

The Chicago RLTO (Residential Landlord & Tenant Ordinance) requires that landlords:

- Provide a written receipt for security deposit funds

- Disclose where security deposit funds are held

- Avoid commingling of deposit funds

- Pay annual interest on deposits

- Provide appropriate evidence of repairs

- Return deposit funds in a timely manner

The Rising Tide of Security Deposit Legislation

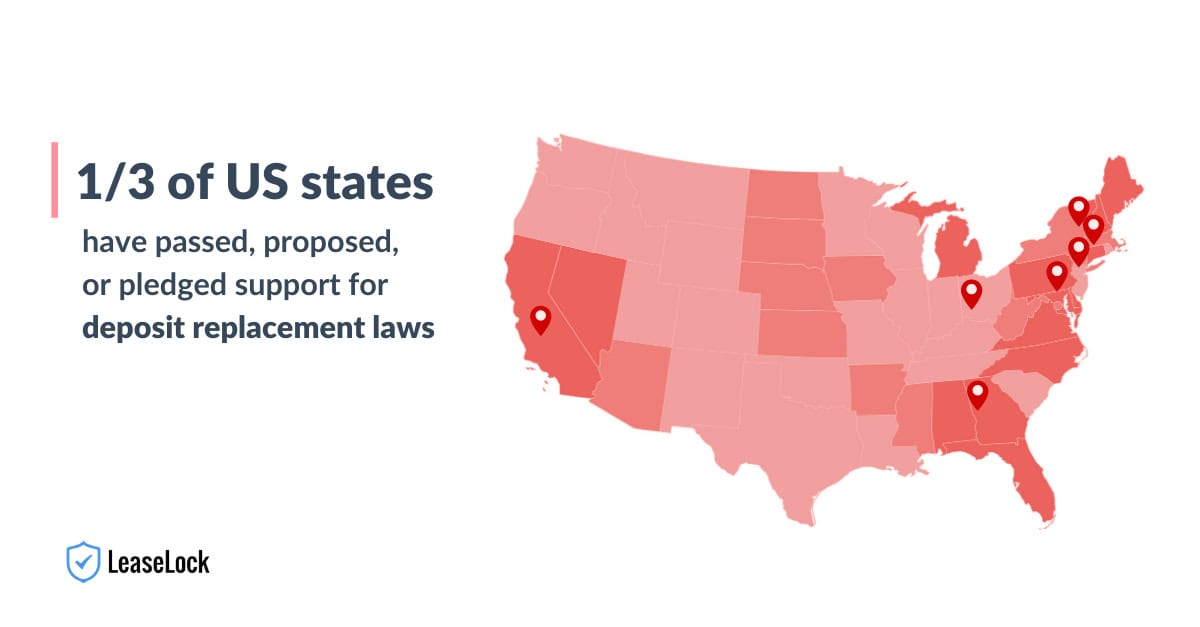

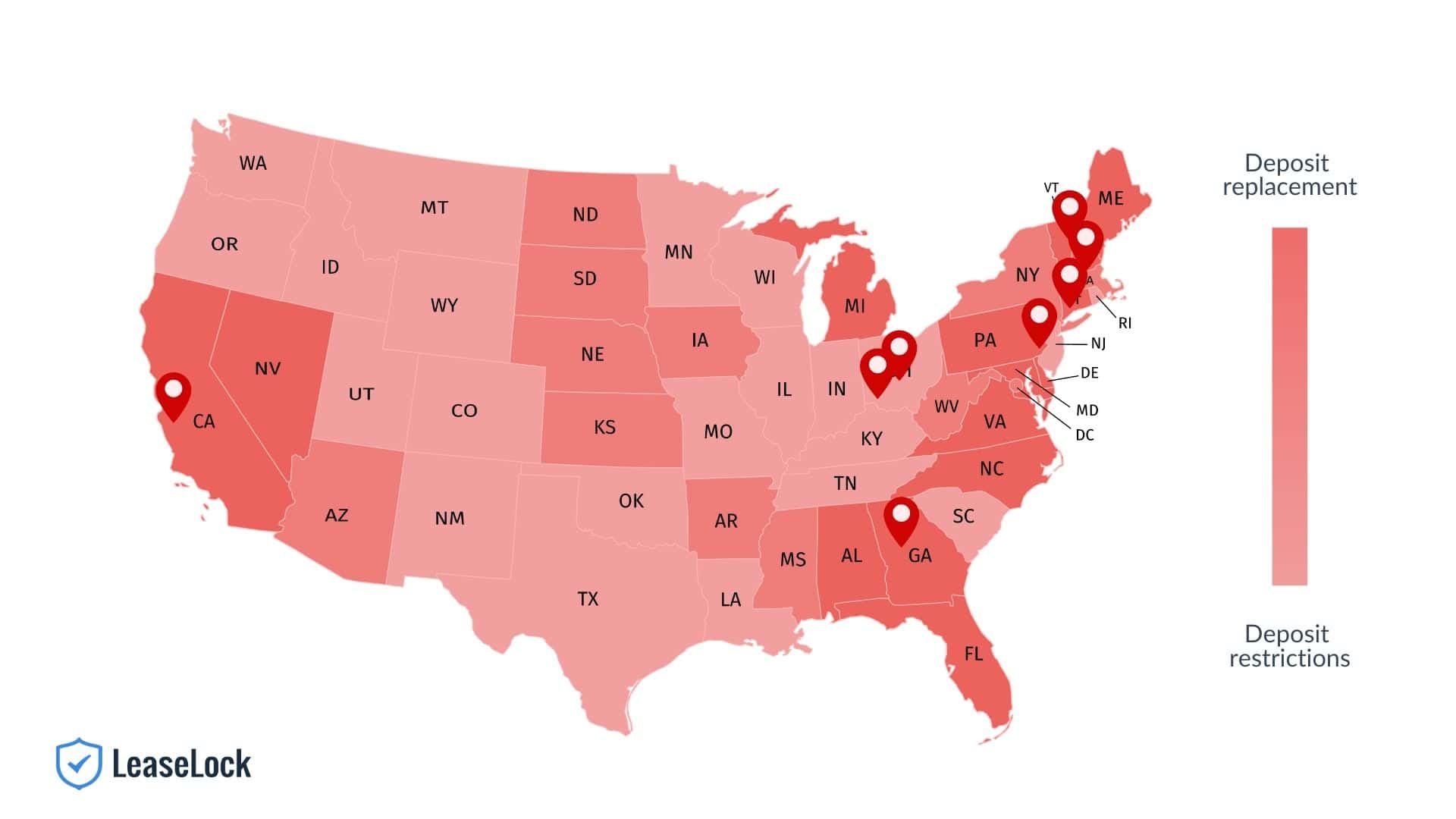

Deposit laws started cropping up decades ago, primarily in the form of deposit restrictions, as we see is the case in Illinois. Deposit restriction laws regulate the maximum deposit amount and the number of days to return a deposit. But in the last year, lawmakers have begun to shift away from deposits entirely.

More than one-third of US states have passed, proposed, or pledged support for deposit replacement laws including California, Delaware, Florida, Maryland, Michigan, North Carolina, Ohio, Pennsylvania, and Virginia. This movement is also happening at the local level, including in Atlanta, Baltimore, Cincinnati, Columbus, Philadelphia, New York City, and Santa Cruz.

Deposit replacement laws provide apartment operators true deposit replacement solutions, rather than imposing more restrictive deposit regulations.

To view a full list of state and city deposit laws, click here.

The Drawbacks of Deposit Laws

The ever-changing legal landscape of security deposits is just one of the many challenges that apartment operators face today. In light of this, more operators are seeking deposit solutions in order to address concerns like leasing delays, administrative burdens, increased risk exposure, and compliance issues.

The Security Deposit Solutions Landscape

It’s important to understand deposit solutions are not all alike, and operators should be aware of key differences between deposit replacements and deposit alternatives.

Security Deposit Alternatives

Deposit alternatives (i.e., surety bonds) can address the legal requirements of new deposit laws, but they also create operational complexity. Alternatives usually require onsite training, third-party applications, and background checks and/or FICO scores. They’re also out-of-workflow which leads to low adoption. This means they’re still subject to the legal restrictions, which defeats the reason why operators are moving away from deposits.

Security Deposit Replacements

Deposit replacements (i.e., lease insurance) eliminate deposits completely and replace them with lease insurance. Through deep property management system integrations, lease insurance eases administrative burdens, streamlines back-office workflows, and provides more protection for rent and damages. No deposits means operators are not subject to the legal requirements.

Illinois Rental Housing Laws Expert Panel Discussion

LeaseLock recently hosted an educational webinar and expert panel session on the various legislative challenges facing owners and operators in the state of Illinois. Moderated by our very own Ed Wolff – Chief Revenue Officer, the panel of multifamily experts included Tom Benedetto – Director of Government Affairs at Chicagoland Apartment Association, Kortney Balas – VP of Information Management at JVM Realty, and Delight Merrill – Director of Property Management at Redwood Capital Group.

Here’s a preview of the panel questions covered:

- How can the apartment industry support innovation and legislative changes that streamline requirements and lower costs for both owners and renters?

- What are owner and operators’ most pressing concerns around the tightening of rental housing restrictions like deposit laws?’

- What tools should property owners and operators have in their tech stack that integrate into the workflow, especially to maximize efficiency and reduce disruptions?

- The pandemic has brought about economic uncertainty — let’s discuss what operators should do to properly manage risk and protect NOI.

- What’s the biggest challenge as an owner/operator today in regards to ensuring your residents get rental assistance?

Access a recording of the of the panel session — fill out the form below: