California Rental Laws: What to Know About SB 91, Rent Control, Deposit Laws & More

California lawmakers extended a statewide eviction moratorium through June 2021 and passed an emergency measure to deliver $2.6 billion in rent relief. Local jurisdictions in San Diego and Los Angeles counties have also passed their own eviction moratoriums.

With strict rent control in cities such as Santa Monica, and tightening security deposit legislation across the state, what do these California rental laws mean for property owners and property management companies in the region?

California’s Eviction Moratorium, Rent Relief, Rent Control, Deposit Laws & More

Having trouble keeping up with California’s eviction moratorium, rental assistance, rent control, and security deposit laws? We recently hosted a webinar to educate apartment operators based in California, and below is a recap of what we covered.

Disclaimer: The information contained in this article is provided for informational purposes only, and should not be construed as legal advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this article without seeking legal or other professional advice. The contents of this article contain general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content on this site. This article contains links to other websites. We are not responsible for the privacy practices or the content of such web sites, and we do not endorse such sites.

The Letter of the Law: SB 91 Tenant Relief Act

SB 91 was passed on Jan 31, 2021, and extends the protections under AB 3088 (also known as the Tenant Relief Act). Originally set to expire on Jan 31, 2021, the eviction moratorium now extends through June 30, 2021.

The Southern California Rental Housing Association (SCRHA) has been proactive in educating housing providers on how to navigate the Tenant Relief Act and provides their perspective on SB 91:

“Housing providers should pay careful attention to all the details of the eviction protection law/SB 91. There are many moving parts and potential pitfalls with mandatory notifications, specific language in pay or quit notices, and the immediate application of just cause protections for most California renters. With anti-displacement a top priority for elected leaders, ending a tenancy has become more complicated. Housing providers should rely on professional associations to help guide them and consult with legal counsel prior to taking decisive action.”

Note: Access SB 91 in its entirety here.

Eviction Moratorium Extension

What does SB 91 mean for rental housing providers? In effect, the moratorium extension prevents properties from evicting renters for nonpayment of rent through June 30, 2021.

However, it is subject to a few exceptions, including any renter default that occurred prior to March 1, 2020.

Under SB 91, properties can’t evict a renter due to nonpayment of rent if:

- The Renter provides a declaration of COVID-19 financial impact; and

- The Renter pays at least 25% of rent by June 30th, 2021 (for rent amounts due between September 2020 and June 2021)

$1.4 Billion Rental Assistance Program

SB 91 also allocated $1.4 billion in emergency rental assistance, which provides up to 80% of rental assistance to eligible households. It’s important to note that:

- Operators must waive the full balance due

- Operators will have to forfeit the 20% of rent

Eligible households must qualify — if they fail to meet eligibility requirements, then the renter must pay 25% of rent by June 30, 2021 in order to avoid eviction. Either the property or renter may apply.

Household Eligibility Requirements

To receive up to 80% of assistance for rent amounts due, a household must qualify, meaning they must meet all 3 of the following criteria:

- At least one person in the household must qualify for unemployment or must experience financial hardship, reduced income, or increased costs;

- At least one person in the household must show risk of homelessness or instability; This would include past due utility bill, rent demand notice, etc.; and

- Household income must be at or below 80% of area median household income (AMI) in the area the property is located.

Operator Participation Requirements

What are operators required to do in order to participate in the California rental assistance program?

1. Properties have a duty to participate, meaning operators must:

- Make a good faith effort to investigate

- Provide assistance to renters who may qualify

- Cooperate with renter’s efforts to obtain rental assistance under SB 91

2. Properties must provide documentation showing compliance with SB 91 when making a debt collection complaint.

3. If a renter owes COVID-related rent debt as of February 1, 2021, an operator must provide a Notice of Tenant Rights no later than February 28, 2021, even if the operator has no intention of pursuing an eviction case at this time.

How Does SB 91 Impact Statewide Rent Control?

SB 91 extends AB 1482 (statewide rent control) by expanding the just-cause eviction requirements and temporarily extending to all types of rental properties. All renters are also covered from their first day of tenancy. Renters who don’t comply with tenant requirements under SB 91 can still be evicted, but operators must adhere to any local government ordinance in place.

The California Tenant Protection Act (AB 1482) went into effect on Jan 1, 2020, putting an annual rent increase cap at 5% plus inflation per year or 10% without inflation, whichever is less — making it one of the strongest rent control statutes in the US.

More recently, California Proposition 21 was defeated during the 2020 November election, thus prohibiting rent control on housing that was first occupied after Feb 1, 1995, and housing units with distinct titles.

In Los Angeles County, the Rent Stabilization Ordinance went into effect on April 1, 2020, which limits rent increases above the allowable limit (3%) within a 12 month period, and provides just cause eviction protections for most residential rental units.

California is one of 5 states that has cities with some form of residential rent control law. Many Southern California communities already have rent control laws in place, including Santa Monica, West Hollywood, Beverly Hills, Glendale, Culver City, Inglewood, Los Angeles, and unincorporated neighborhoods of LA County.

Rent control is top of mind in California, and there are also new laws cropping up that further restrict use of security deposits — SB 91 is an example.

Deposit Laws Are Accelerating Nationwide

Deposit restriction laws regulate the maximum deposit amount and the number of days to return a deposit — something the multifamily industry is no stranger to. In the last year, the industry has begun to shift away from deposits.

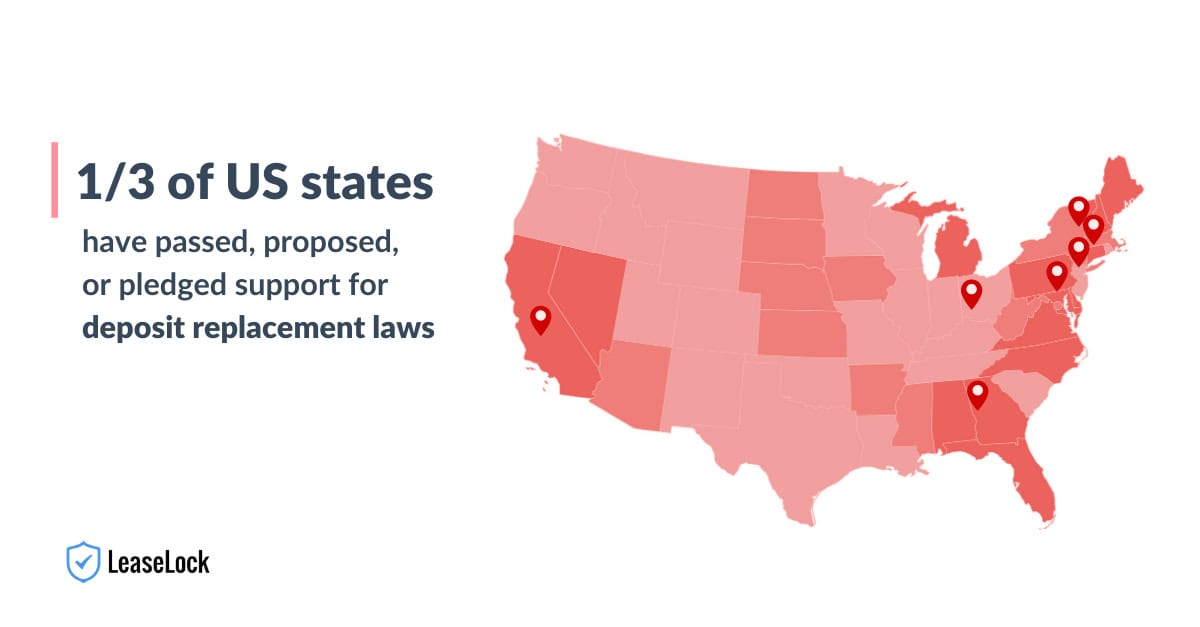

About one-third of US states have passed, proposed, or pledged support for deposit replacement laws including California, Delaware, Florida, Michigan, North Carolina, Ohio, Pennsylvania, and Virginia. Cities including Atlanta, Cincinnati, Columbus, Philadelphia, New York City, and Santa Cruz have also taken action.

Deposit replacement laws take deposit legislation a bit farther by giving apartment operators true deposit replacement solutions, as opposed to implementing more restrictive deposit regulations.

View a full list of state and city deposit restrictions and deposit replacement laws here.

3 Challenges Created by Deposit Laws

Multifamily operators and owners have dealt with an array of different challenges over the years, and changing deposit legislation is only one of them. But in the last year, a growing number of operators are seeking deposit solutions in light of these deposit laws. Some of the key concerns operators are looking to address include:

- Leasing Delays – Operators must inform residents of the deposit alternatives options, and renters can shop these options before getting the property’s approval. This can slow down leasing activity significantly.

- More Work for Onsite Teams – Properties must review and approve multiple insurance policies while still managing security deposit accounting. Onsite teams will also have to track deposit installment payments for renters who choose to go that route.

- Increased Risk – Deposit installment plans increase operators’ exposure to financial risk if the renter defaults prior to having paid the full deposit amount.

Operators Seek Deposit Solutions

As the industry shifts toward total deposit replacement, it’s important that the market understand deposit solutions come in the form of deposit replacements and deposit alternatives.

Security Deposit Alternatives

Deposit alternatives — like surety bonds — can address the legal requirements of new deposit laws, but they also create operational complexity. Deposit alternatives typically require onsite training, third-party applications, background checks and/or FICO scores, and out-of-workflow management. In other words, traditional security deposits are still in place, and therefore still subject to the legal restrictions.

Security Deposit Replacements

Deposit replacements — like lease insurance — replace deposits completely. Lease insurance leverages deep property management system integrations which streamlines back-office workflows and provides increased protection for rent and damages. Operators who replace deposits entirely are therefore not subject to the legal requirement.

What Top Operators Are Saying About Deposit Laws

Several leading operators recognize the need to move away from surety bonds, including Kelli Jo Norris – President of Goodman Real Estate, Michael Roos – Managing Director of Asset Management at ColRich, and Kevin Huss – Vice President of Revenue Management at Harbor Group.

Navigating the Deposit Legislation Landscape

When operators rely on security deposits and deposit alternatives, they’re subject to the inherent variability of deposit legislation. But when they implement lease insurance software that automatically ejects deposits from enterprise operating infrastructure, they can avoid the legal requirements of the various deposit laws, both passed and pending.

California Rental Laws Webinar for Apartment Operators

LeaseLock recently held an educational webinar on California rental laws, led by our very own Reichen Kuhl – President & Chief of Legal, Ed Wolff – Chief Revenue Officer, and Carl Stockholm – VP of Enterprise Sales for the West Region.

Fill out the form below to get view a recording of the webinar: