For too long, security deposits have been an albatross around the apartment industry, burdening both residents and operators.

For renters, deposits are an expense few can afford. A study by CareerBuilder found that 78% of U.S. workers were living paycheck to paycheck, meaning nearly 8 out of 10 renters don’t have the savings to pay for an upfront deposit, the average cost of which is $500 to $750. That study was also conducted before the pandemic, which has plunged many into deeper financial distress.

For operators, deposits are a major administrative hassle. They can lead to significant tensions when residents become frustrated with the amount of their deposit refund, and lead to more negative online reviews. To add insult to injury, operators often find that deposits are an inadequate defense against rent loss and unit damage.

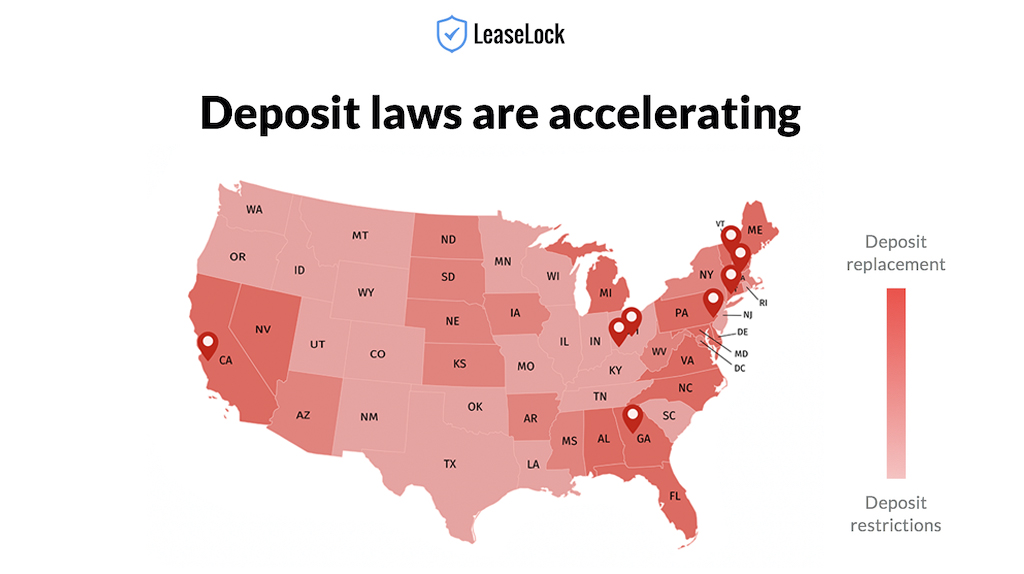

Fueled primarily by growing concerns about housing affordability, jurisdictions across the country have passed — or are considering — deposit legislation mandating the offering of security deposit replacements and alternatives.

Given the growing momentum behind this movement, operators are left asking: What are the differences between deposit replacements and deposit alternatives? And which is better? We explore both of these issues below.

Given the growing momentum behind this movement, operators are left asking: What are the differences between deposit replacements and deposit alternatives? And which is better? We explore both of these issues below.

Security deposit replacements differ from deposit alternatives in that they seek to completely remove and replace costly deposits with more affordable options such as lease insurance. The goal of a deposit replacement is to help both renters and operators by 1) giving renters an affordable, deposit-free move-in and 2) providing properties enhanced protection.

Recently, Atlanta passed deposit replacement legislation which allows renters to request “rental security insurance” or monthly installment payments. The Atlanta bill takes security deposit legislation one step farther than most deposit laws by providing apartment operators with deposit replacement solutions, rather than simply tightening deposit regulations.

Examples of security deposit alternatives include surety bonds, rent guarantees, deposit installment solutions, and credit authorization services.

It’s important to keep in mind that deposit alternatives do not get rid of deposits entirely. Rather, an apartment community offers them in addition to traditional deposits. The aim of deposit alternatives is to give renters a choice in how their money is managed and to offer a cheaper move-in experience.

However, alternatives can still present operators with a considerable administrative burden, and require significant onsite training.

Cincinnati’s new Renter’s Choice Law offers residents affordability help through deposit alternatives. Specifically, the law mandates that if an operator requires a security deposit, a deposit alternative must be offered as well. The available alternatives include a surety bond, an installment plan to pay the full deposit, or a smaller upfront deposit that cannot exceed 50% of the first month’s rent.

To better understand the differences between deposit replacements and alternatives, let’s consider their benefits and drawbacks.

First, the pros and cons of deposit replacements:

And, the pros and cons of security deposit alternatives:

There is a real hunger in the apartment industry to move away from traditional security deposits.

Deposit alternatives are billed as improving the affordability of move-in, and they do that. But they still present administrative stress, and the protection they offer against damage and unpaid rent can be seriously lacking – especially in the pandemic.

A deposit replacement like lease insurance offers the double benefits of a much cheaper move-in for residents and truly comprehensive financial protection.

As legislators across the country consider how to tackle deposits, they would be wise to follow Atlanta’s example and ensure their laws pave the way for total deposit replacement.