Top 3 Multifamily Challenges: How to Navigate Them in 2022

A panel of experts recently discussed how to overcome the industry’s most pressing issues in the webinar, “Multifamily Top 3 Challenges: How to Navigate Them in 2022.” Moderated by LeaseLock CRO Ed Wolff, the discussion featured Jennifer Staciokas, Executive Managing Director of Property Management for Western Wealth Capital and Terresa Porizek, Managing Director of Talent Development, Property Management, at Greystar.

Below is a recap of the panel discussion in which top operators share the strategies they’ve employed to combat top industry challenges and the solutions they recommend moving forward.

The Top Multifamily Challenges in 2022

In the 2021 Rental Housing Market Study for Apartment Visionaries, we examined the biggest obstacles facing owners and operators. Designed in a partnership with Grace Hill, the study discovered that the primary asset problems are:

- hiring and retention

- rent delinquency and bad debt

- new and changing legislation

It’s unsurprising that employment was the problem cited the most — a trend that has plagued nearly every industry. Delinquent rent and bad debt is also top-of-mind for multifamily owners and operators, especially as rent assistance runs out.

“The second [biggest challenge] was delinquent rent and mitigating bad debt,” said Ed Wolff, LeaseLock’s Chief Revenue Officer, who moderated the panel. “No surprise based on the unprecedented time we’ve experienced over the last two years starting with COVID.”

Owners and operators also expressed concern over the ever-changing legislative landscape. Between eviction moratoriums, rent control, emergency rent assistance, and security deposit laws, legislative changes leave operators and their residents exposed to unnecessary headaches and risky financial situations.

New Strategies & Solutions to Combat Age-Old Multifamily Challenges

We know the best way to address persistent issues is letting go of long-held standards, such as a single rent payment at the beginning of the month and security deposits. Only through embracing fresh attitudes and exploring new options can we solve the industry’s problems.

Reducing Delinquent Rent With Flexible Rent Payments

The industry needs tech solutions that protect properties while also reducing the upfront financial burden for residents in order to lower bad debt and reduce delinquency, thus resulting in more revenue for operators. By creating a win-win for both sides of the equation, firms will see healthier financial performance and happier residents in the long-run.

Regarding delinquency, panelists explained the importance of seeking out creative ideas that appeal to residents while still helping operators maximize NOI. For example, a healthy portion of Western Wealth Capital’s portfolio is workforce housing, and Staciokas said their communities found great success in moving residents to flexible rent payments.

“It’s so old-school to think about only paying rent on the first of the month,” Staciokas commented. “We were able to offer a lot of our residents the ability to pay at any point in time throughout the month. It was a win-win. For us, we get the money in the bank on the first of the month. The resident ha[s] the flexibility to pay when it [is] suitable for their schedule, and it [keeps] them there longer.”

Protecting Against Bad Debt With Deposit Replacements

Many communities have changed their perspective on the role and effectiveness of security deposits, which rarely cover the costs of repairs or unpaid rent for which they were created. In fact, of respondents from our survey who reported more expenses tied to unit damage in 2021, 65% said that those expenses exceeded the security deposit amount. This means operators have to spend more money to recover those costs or just eat them if it’s not worth the effort.

As a result, many communities are turning to deposit replacements like lease insurance, which not only eases the administrative and financial hassles of security deposits, but also creates an effective marketing tool for properties to set themselves apart from neighboring communities. Lease insurance reduces bad debt by providing better coverage and drastically reducing the administrative burden and financial risk for apartment communities.

With the economic impact of the pandemic still reverberating across the country, many families may be unable to afford an upfront security deposit. But by eliminating this barrier and replacing it with a small, monthly fee, operators are more likely to attract potential residents, Staciokas said. Further, by combining flexible rent payments and lease insurance, operators can achieve significant reduction in bad debt as well as NOI growth.

Alleviating Administrative Burdens to Tackle Talent Problems

When it comes to hiring and talent retention, operators should prioritize employee appreciation, optimize training methods, and improve hiring protocols to establish a workplace environment that values innovation and creates efficient and consistent processes. This will increase associate satisfaction and engagement, which translates into long-term resident retention.

Solutions like flexible rent payments and deposit replacements are useful in improving resident retention by giving renters more freedom with their money while also protecting a community’s reputation. Staciokas said that some of the biggest complaints she has seen with resident reviews are associated with the return of a security deposit. By eliminating this requirement, communities can reduce the chances of one-star reviews fueled by deposit disputes. This helps alleviate stress in the leasing office, which can in turn relieve the hiring and talent retention issue.

Eliminating Deposits to Mitigate Legislative Headaches

With legislation changing constantly, operators need to invest in strategies and solutions that help their firm maintain compliance, reduce administrative headaches, and mitigate regulatory risk.

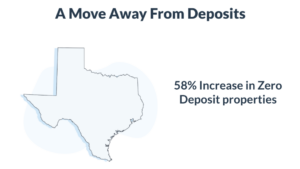

For instance, there’s been a major shift away from deposits in which legislators in various states and municipalities have either pledged support, proposed, or passed deposit legislation which seeks to provide residents more options in the form of deposit alternatives. However, these “Renter’s Choice” laws mandate that apartment operators offer an alternative to a security deposit, adding complexity to the deposit administration process as well as risk.

On the other hand, deposit replacement laws like the bill passed in Texas go a step further than Renter’s Choice laws by giving operators a secure way to choose a deposit solution while also creating more affordable move-ins for renters.

Staciokas encouraged operators to look at companies that will handle credit reporting on lease payments. This offers an incentive for residents to make payments, and community managers can market that as a reward for current and future residents, which assists with risk mitigation.

New deposit laws continue to crop up, signaling that the current system of traditional deposits doesn’t work. By rethinking the problem as a way to empower both renters and operators alike, the industry can begin to finally eliminate the growing risk of deposits.

Reframe Today’s Challenges As Tomorrow’s Opportunities

As the industry tackles the top challenges in 2022, it helps to view each one through the lens of opportunity. This attitude, combined with other impactful strategies and technology solutions, has the power to help operators address all three of the top multifamily challenges.