LeaseLock 2021 Highlights by the Numbers

As 2021 comes to a close, LeaseLock would like to reflect on the significant growth we have achieved alongside our clients, partners, advisors, supporters, and colleagues. From raising $52 million in Series B, to surpassing $2 billion in leases insured, to releasing a major platform upgrade, we are one step closer to eliminating deposits for good from the rental housing industry.

In 2022, LeaseLock remains committed to delivering the first and only true deposit replacement product powered by AI. To that end, we will continue to bring revolutionary change to the multifamily industry with integrity and innovation.

Let’s look back at the many highlights from 2021!

$52M Series B

We started the year off strong by raising $52 million to invest in engineering the only AI-driven insurtech product for housing operators that completely eliminates deposits. Today, the funding continues to help us fulfill our vision of expanding our insurtech platform to meet increasing market demand while furthering our incredible growth.

$2B Insured Leases

After hitting our first milestone of $1 billion in leases insured in record time in March 2021, we promptly topped that by surpassing the $2 billion mark six months later. The two milestones demonstrate the industry movement away from deposits and deposit alternatives as more operators realize lease insurance is the only way out of the deposit game.

AI-Powered Product Upgrade

It’s our mission to build a better future for multifamily, and our enhanced lease insurance platform is a testament to that commitment. We asked what our clients wanted, so we happily delivered major advancements to our AI-powered risk platform, including:

- Single limit coverage & exclusion removals

- Faster claims payouts & more flexible deadlines

- AI-powered coverage optimization & risk monitoring

- No resident collections for claims paid

- All policies backed by QBE with a $40B balance sheet

With this newly released upgrade, our clients are empowered to elevate asset performance and improve resident experience. Here’s what they have to say:

“The ability to assess the required coverage levels for individual assets and deploy customized protection plans is game-changing.” – Mark Stringer, EVP at Avenue5 Residential

“This model is also much more renter-friendly, eliminating resident collections for claims paid by the carrier to the property, thereby preserving resident satisfaction and reputation scores.” – Marcie Williams, President at RKW Residential

400% Growth in Homes on Platform

In 2020, we saw 100% quarterly growth in homes on platform. Over the course of 2021, more and more operators are realizing the benefits of ditching deposits and surety bonds, resulting in 400% growth in homes on platform year-over-year. LeaseLock also experienced a 55% increase in Zero Deposit launches from the previous year.

20+ New Multifamily Portfolios

In 2021, LeaseLock added many new enterprise PMC and ownership groups including Western Wealth Communities and Rockstar Capital. This builds on our existing list of NMHC Top 50 operator clients including Greystar, Pinnacle, Alliance, Avenue5, The Bainbridge Companies, LMC and RKW, as well as top ownership clients including Goldman Sachs, ColRich, GoldCor, Olive Tree, TruAmerica, White Oak, Trinsic, and Goodman Real Estate.

90% Average Resident Adoption

Being automatically embedded in every online lease checkout, LeaseLock clients see adoption rates of 90% on average.* This enables operators to control the customer experience throughout the entire leasing process while increasing coverage and lowering bad debt much more effectively than deposits or their alternatives, creating a powerful win-win for both operators and their residents alike.

*Clients see an average 90% resident adoption rate when LeaseLock is implemented correctly.

6x More Coverage

LeaseLock deploys AI to optimize coverage by asset — an average of nearly $3000 coverage which is 6x the protection of a traditional $500 deposit — resulting in significantly less bad debt and increased NOI.

7 New Advisory Board Members

LeaseLock is honored to have a select group of advisory board members who graciously lend their thought leadership, guidance, and support. This year, we were fortunate to welcome seven industry leaders to our advisory board — below is the full roster:

We also had a chance to spotlight a couple of multifamily titans — check out the Q&A interview series with Jennifer Staciokas and Marcie Williams for a healthy dose of industry trends and expert advice!

Top 250 Fintech Company

LeaseLock is honored to be named one of the CB Insight Top 250 most promising private fintech companies using technology to transform financial services. The 2021 Fintech 250 cohort was selected from a pool of 17,000+ companies and has raised approximately $73.8B in aggregate funding across nearly 1,200 deals since 2016.

4 Major Company & Employee Awards

We are proud to be recognized as a leader in both the insurtech and multifamily spaces, as well as in company culture. Two individuals were tabbed leaders in their respective specialties. Here’s a summary of our achievements:

- Finovate Finalist for Best Insurtech Solution – Given to a fintech, FI, or insurance provider with an excellent new solution in the insurtech space, the Finovate award named LeaseLock one of five finalists.

- NAA Best Places to Work Finalist – Awarded to member organizations that foster a culture of collaboration, innovation, and hard work, the 2021 NAA Best Places to Work Awards named LeaseLock a finalist after scoring above the cumulative average of all surveys within each contest.

- NAA Excellence Award Finalist – Recognized for his many accomplishments and unwavering dedication to improving the rental housing industry, our very own Ed Wolff was selected as a finalist for the 2021 NAA Excellence Award in the Supplier Achievement category.

- Los Angeles Business Journal Leaders in Law Finalist – Our very own in-house legal expert, Max Garrison, was named a finalist for the Leaders in Law Growing Company of the Year for his exceptional legal contributions and role in the success of LeaseLock’s success.

Industry-Leading Research Report

We published our first annual market study, an original survey analysis conducted in partnership with Grace Hill. The 2021 Apartment Visionaries Study surveys nearly 300 multifamily leaders on their primary asset performance issues and uncovers interesting trends around new solutions and priorities for the industry. Get a copy of the report here.

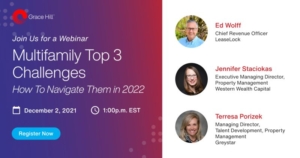

6 Thought Leadership Webinars

We participated in a total of six industry webinars this year. Most notably, we partnered with NAA and Grace Hill to reveal key findings from our Apartment Visionaries Study and share insights on the top 3 multifamily challenges. We also hosted four educational webinars covering topics ranging from deposit legislation to budget season. Find the full list of webinar recordings here.

7 Industry Podcasts

Our team of executive leaders lent their voice to several podcasts:

- Alejandra Cremades Podcast – President and founder Reichen Kuhl tells the story of his journey into entrepreneurship, from participating in the Amazing Race to getting denied for an apartment.

- Multifamily Review Podcast – CEO and founder Derek Merrill talks with Michael Avent about how LeaseLock is powering the only insurtech platform for enterprise real estate to help the world find home.

- Apartment Academy Podcast – CRO Ed Wolff sat down with host Daniel Cunningham to discuss why multifamily is moving toward a Zero Deposit marketplace that uses AI-driven lease insurance.

- Voice of FinTech Podcast – Derek Merrill joins David Yakobovitch to share how LeaseLock is harnessing the power of data and AI to eliminate security deposits for good.

- The Insurance Podcast Show – Derek Merrill speaks with Peter Tessier and Curt Wyatt about startup lessons, finding your niche, and our data-centric approach to insurtech innovation.

- FNO InsureTech Podcast – Derek Merrill tells host Lee Boyd how LeaseLock utilizes an AI-powered solution to power a faster, simpler, more affordable rental transaction.

- Apartment Rebels Podcast – Ed Wolff chats with Jude Chiy about pursuing his passion for technology, his multifamily expertise, and why security deposits are going extinct.

SOC 2 Type 2 Certification

At LeaseLock, we take data and privacy matters very seriously. By earning our SOC 2 compliance certification, we reaffirmed our integrity and commitment to security, meaning our clients mitigate the risk for their properties by choosing to work with us.

Leave a Reply

Want to join the discussion?Feel free to contribute!