We’re still buzzing with excitement from all the amazing events that unfolded at last week’s NAA Apartmentalize 2022. With over 11,000 vendors and attendees, our team was delighted to welcome a constant stream of visitors to our booth and happy to reconnect with industry peers at our hosted events.

While the event was back to pre-pandemic activity, the industry is not returning to its old ways of doing business. Emerging technologies took center stage both during the education sessions and on the trade show floor, proving that technology innovations adopted during the pandemic are here to stay and evolve.

If you missed out on Apartmentalize this year or you just want to relive it, here’s our recap of the top highlights and takeaways from the industry’s premier annual gathering.

1. Modern Renter Demands: The Subscription Economy’s Impact on Rental Housing

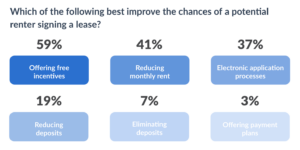

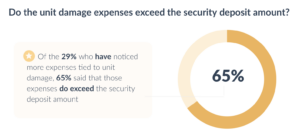

The subscription business model has been accelerated by the pandemic and is only becoming more prevalent across various industries. The shift in buying behavior extends across all aspects of life, like entertainment, financial services, food, and housing. In multifamily, renters are avoiding high upfront costs in favor of more flexibility and freedom.

With rent being just a monthly subscription fee paid for an apartment, other elements such as security deposits, move-in costs, and payment options can also benefit from adopting the subscription model.

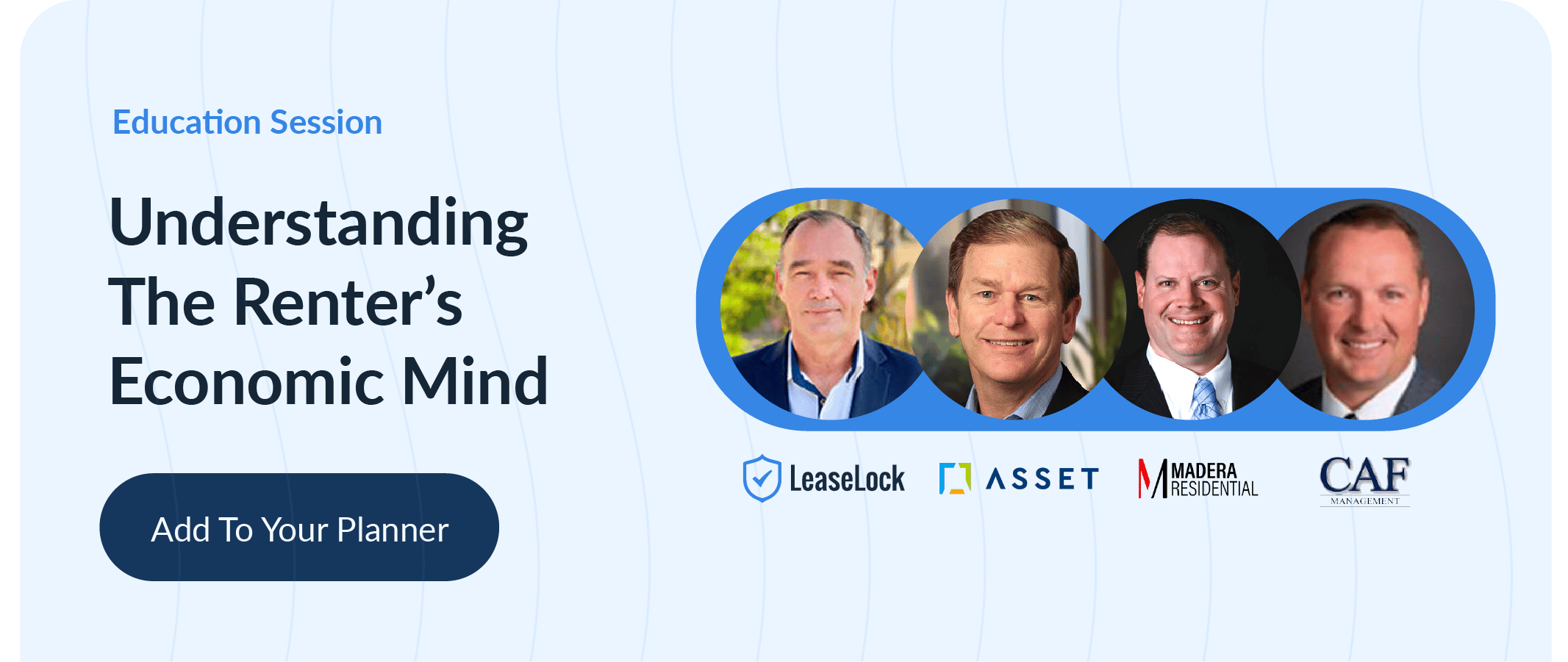

In our education session, Understanding the Renter’s Economic Mind, our Senior Vice President of Enterprise Sales Ian McIntosh, along with industry experts Jeremy Thomason of CAF Companies and Hugh Cobb of Asset Living, explored the economic drivers of today’s renter and revealed best practices for the implementation of subscription-based amenities.

Here are the key highlights from their discussion:

- Subscription services and fee installments have emerged as the preferred payment method for renters.

- Operators are revisiting and restructuring their paradigms for security deposits, rent payments, amenity fees, and move-in costs to appeal to the economic mind of today’s renters.

- Companies are embracing bundling expenses to streamline the resident experience.

Be on the lookout for our comprehensive recap highlighting the session’s best practices for implementing subscription-based systems, as well as data-centric insights into the modern renter profile.

2. An Epic Multifamily Reunion: Connecting With Old and New Partners

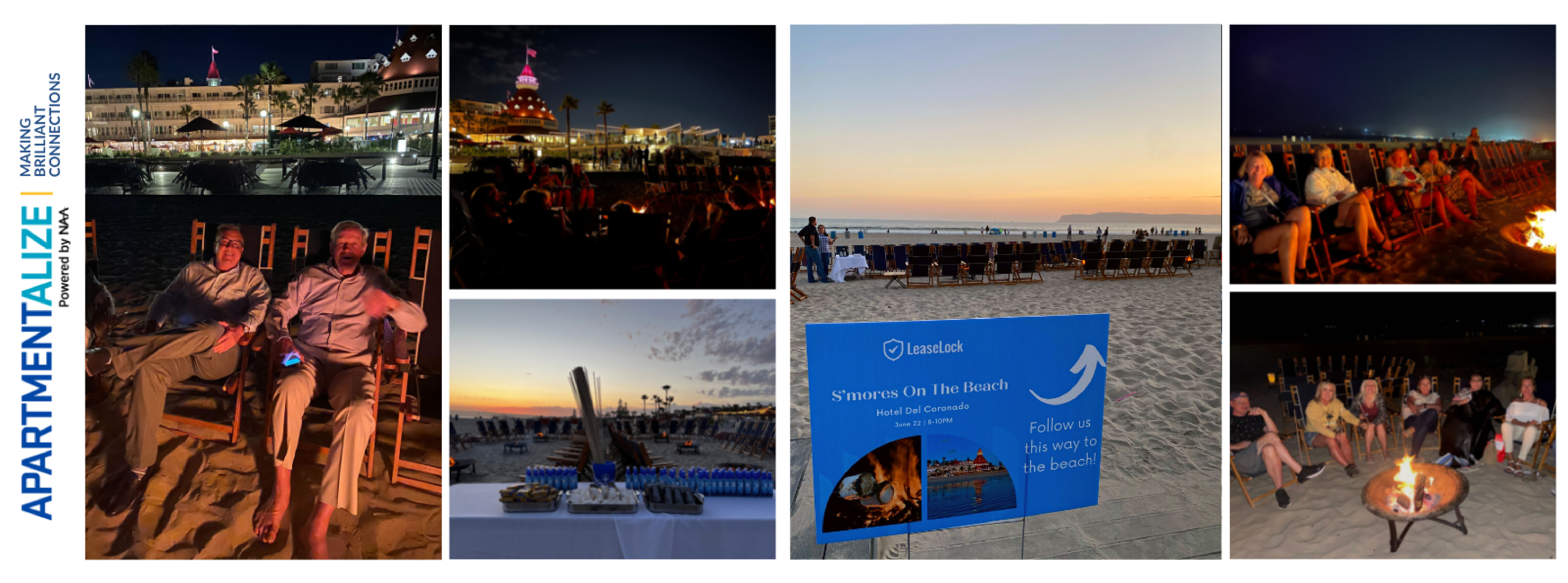

This year’s Apartmentalize was an opportunity for the industry to reconnect, mingle, and forge new relationships. We were as excited as ever to jump right back into the action and have some fun in the sun with old and new partners in San Diego.

As a pre-celebration on Wednesday, LeaseLock hosted a cozy gathering with fifty guests on the beach at Hotel Del Coronado to roast s’mores over the bonfire and enjoy good conversation. Multifamily leaders and long-time LeaseLock partners Doug Bibby and Debbie Phillips stayed late into the night catching up on lost time with our CEO Derek Merrill and CRO Ed Wolff.

Kicking off the official celebrations on Thursday, we rubbed shoulders with 300 industry movers and shakers at our co-hosted happy hour with Friends of NAA. Overlooking the Gaslpamp Quarter and views of the San Diego Bay, we toasted to continued partnerships and success.

But the fun didn’t stop there—at our intimate dinner at the waterfront Sheerwater bistro we were joined by thirty industry titans, including Doug Bibby – President of NMHC, Bob Pinnegar – President of NAA, Hugh Cobb – President of TAA, and Ian Mattingly – President of AAGD, along with some of our amazing board members. As always, we’re grateful for their support and honored that they chose to spend their evening with our team.

3. Trade Show Buzz: New Proptech Propelling the Industry Forward

Attendees brought infectious energy to the exposition floor on Thursday and Friday as innovators came together to share ideas and solutions. The LeaseLock booth and team were met with enthusiastic customers and property operators as we offered a peek under the hood of our data-driven risk engine and AI-powered lease insurance platform.

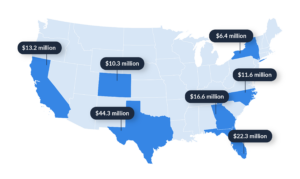

LeaseLock has been hard at work building our lease insurance technology solution to bring greater predictability to rent. Our team was excited to demonstrate how our technology analyzes risk to optimize coverage so our clients can rely on optimal revenue protection across their entire portfolio.

Our expert advice on loss protection in today’s economic climate proved to be an especially hot commodity among thought leaders, trendsetters, and innovators visiting our booth. We loved the spirited exchange of ideas on how to refine risk management practices and drive property performance, and we left San Diego feeling as committed as ever to revolutionizing the rental housing industry.

The Best One Yet?

Whether it was the warm and sunny weather in San Diego, or the opportunity to finally reconnect with industry peers at the first full return to pre-pandemic activity, the word on the street is this year’s Apartmentalize was the best one yet. Our team couldn’t agree more—we had a blast celebrating and connecting with industry friends, and feel re-energized to get back to work on bringing the future of leasing to renters nationwide.

Thank you to our team, partners, booth visitors, event attendees, multifamily friends, and NAA for making Apartmentalize 2022 one to remember—we can’t wait to see you again at next year’s Apartmentalize 2023!