Original Research: The 2021 Apartment Visionaries Survey Report by Grace Hill & LeaseLock

After conducting a joint industry study, LeaseLock and Grace Hill are excited to release the official survey analysis. The 2021 Apartment Visionaries Research Report surveys nearly 300 multifamily operators on their primary asset performance issues, as well as the success of the technology solutions they implemented across the five stages of the apartment leasing process.

While rental housing owners have increasingly deployed technology to bolster and streamline operations, the study shows that the solutions which best resolve common pain points haven’t necessarily received the corresponding resources required to realize their full benefit. That said, the industry’s unprecedented embrace of technology solutions should serve it well as it evolves to meet the needs and demands of the modern renter.

Overall, study revealed several under-explored avenues to help drive leads, lead-to-lease conversions, bad debt recovery, resident experience, and renewals, which we highlight below.

Key Findings From the 2021 Apartment Visionaries Survey

With the completion of the data analysis, we’ve highlighted the major findings so that you — an industry visionary — can walk away with actionable insights for your firm heading into 2022.

Biggest Operator Challenges in 2021

Operators cite hiring / retaining talent, delinquent rent / bad debt, and new / changing legislation as the main challenges in 2021.

Top NOI Opportunities in 2022

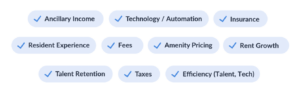

Corporate level respondents cite ancillary income, technology / automation, and talent retention represent key areas of opportunity for maximizing NOI growth next year. Among those who cited “hiring / talent retention” as a top challenge, a plurality (39%) indicated that technology could be used to address this talent issue. Below is a sampling of the core themes across responses:

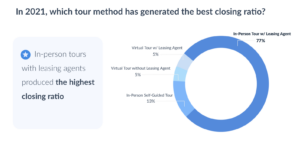

Leading Apartment Tour Type

Most apartment tours were conducted in-person with a leasing agent. In fact, 67% of respondents report that in-person agent-guided tours accounted for more than half of total tours in 2021. Nearly 80% say this tour method also produced the best closing ratios.

Most Powerful Leasing Strategies

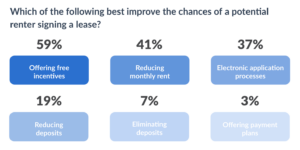

While free incentives have negative implications for economic occupancy, operators tend to lean on free incentives to drive lease signings. Nearly 60% of property-level respondents said that offering free incentives improved the likelihood of lease signing the most, followed by 41% who cited reducing monthly rent.

Among corporate leadership though, 69% cite this lease concession as hurting economic occupancy the most. On the other hand, only 3% indicated that eliminating deposits hurts economic occupancy.

Rent Loss & Bad Debt Prevention Solutions

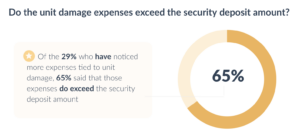

Properties need to look into risk mitigation strategies and tech solutions that double as an incentive for renters while also protecting against bad debt. Of those who reported more expenses tied to unit damage, 65% said that those expenses exceeded the security deposit amount.

Rent Assistance & Resident Experience Improvements

Of the 58% who said they applied for and received ERAP, 40% said that those funds are not sufficient in covering rent loss. This means operators should continue to support the industry’s efforts to ensure rent assistance is distributed efficiently and effectively, while investing in solutions that protect their organization against rent loss and negative online reviews, all while improving the resident experience.

Leave a Reply

Want to join the discussion?Feel free to contribute!