Sun Belt Rent Growth Rebounds in 2025, Led by Tampa and Houston | May 21, 2025

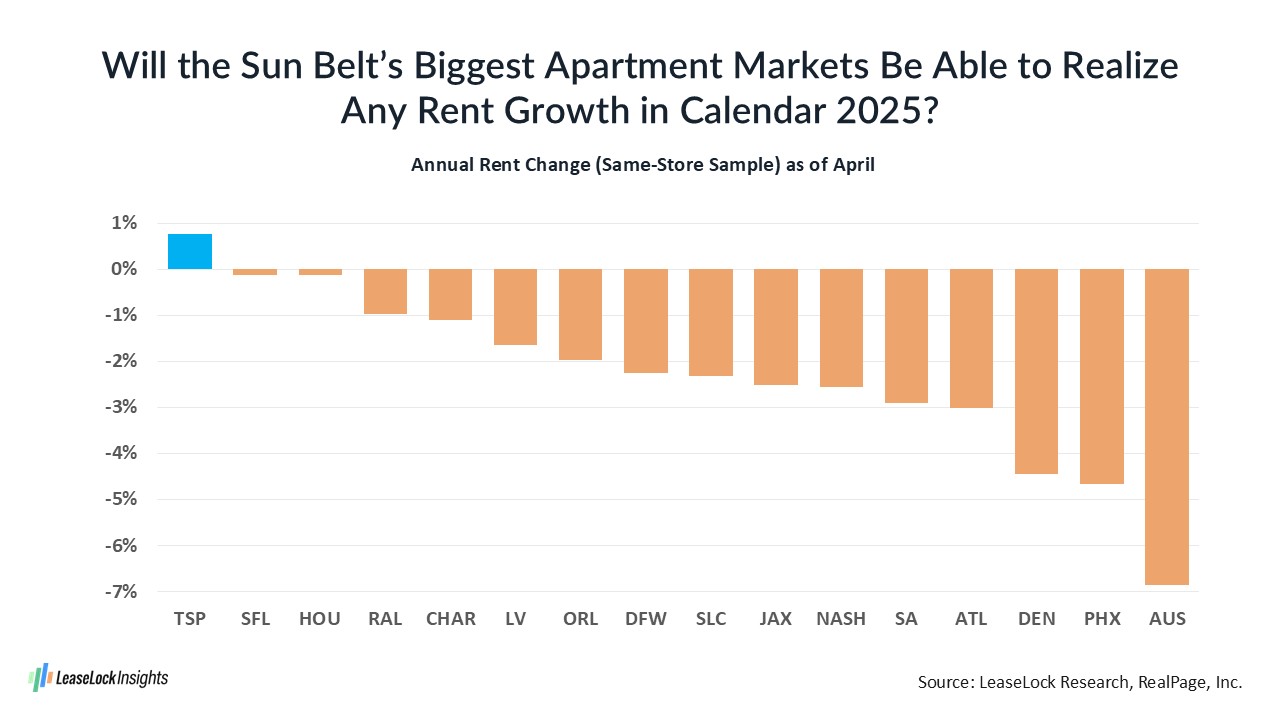

Today’s apartment rents in metro Tampa-St. Petersburg are up about 1% from year-ago pricing. Thus, the area is the first of the big construction centers across the Sun Belt and Mountain-Desert zone to move from rent cuts to rent growth. With demand proving strong at the same time that ongoing construction is down roughly 40% from its recent peak, Tampa-St. Pete appears to be a bellwether for broader Sun Belt rent growth in 2025, with accelerating pricing power expected through year-end.

Can other Sun Belt and Mountain-Desert markets experience similar momentum over the next few months?

That’s certainly the expectation for South Florida and Houston, where today’s rents are basically flat relative to year-ago pricing and where construction has moved from aggressive to more moderate levels. Houston, in particular, is well positioned in the 2025 Sun Belt rent growth narrative, thanks to rapid job gains and strong housing absorption.

Raleigh-Durham and Charlotte are another pair of markets that appear on track to post positive rent change outcomes by the end of this year, improving from the annual cuts of about 1% seen at present. Building activity remains quite substantial in these two areas, as ongoing construction will grow the existing inventory by more than 8% in Charlotte and by roughly 5% in Raleigh-Durham. But demand that’s coming in at stunning levels suggests that the markets will be able to handle all these additions without too much pain.

With annual rent cuts at less than 2% right now, Las Vegas and Orlando are candidates to realize at least a tiny bit of rent growth by the end of 2025. However, with the hospitality sector forming such big shares of their economies, spending shifts stemming from plunging consumer confidence and dropping international tourism suggest some vulnerability to those outlooks. Don’t be surprised if they don’t gain further pricing momentum just ahead.

Dallas-Fort Worth, Salt Lake City, Jacksonville, and Nashville are spots where apartment rents have backtracked a little more than 2% during the past year. Essentially breakeven metro average pricing seems like the most likely outcome when 2025 draws to a close, with a mix of neighborhood-level winners and losers seen in each area.

Today’s rent performance laggards are San Antonio, Atlanta, Denver, Phoenix, and Austin, with prices off 3% to 7% on a year-over-year basis. It’s a long shot to expect that any of these markets will manage to achieve overall rent bumps in calendar 2025, although the drawdowns in construction activity might be enough to yield emerging performance stabilization in some neighborhoods.

While not every metro will see upward movement, the broader trend toward Sun Belt rent growth in 2025 is gaining momentum—especially in metros where supply moderation and job recovery are taking hold.

About LeaseLock

LeaseLock is the only true lease insurance program for rental housing. Our AI-powered underwriting solution – LeaseLock Shield™ – harnesses the power of machine learning to determine the best coverage for each property and portfolio’s specific needs. The result is ultimate protection from write-offs and legal risk as well as reduced operational burden. With over $10 billion in leases insured, LeaseLock is delivering significant benefits to both renters and investors while reshaping the way the industry manages risk. LeaseLock is dedicated to improving housing accessibility by removing financial barriers for renters while protecting against risk.