What Is Lease Insurance, And Why Do Apartment Operators Need It?

Lease insurance—what exactly is it?

In the multifamily industry, apartment lease insurance is a completely new insurtech product designed to totally eliminate costly security deposits, drawn-out surety bond applications, and confusing guarantee programs, all of which are burdensome for both residents and operators. LeaseLock deploys lease insurance through its Zero Deposit Platform and unlike common “deposit alternatives” in the rental housing market, lease insurance is designed to replace security deposits with seamless insurance technology and provide apartment operators enhanced protection on every single lease.

How Does Apartment Lease Insurance Work?

Instead of paying a costly upfront deposit upon move-in, renters pay a small monthly deposit waiver fee along with their rent. In turn, the property is protected against missed rent and damages with customized coverage.

One of the defining features of lease insurance is that it’s the only product designed to protect the property management company and asset owner — meaning properties gain remarkably more coverage than they would with a traditional deposit, which significantly reduces bad debt.

Top Benefits of Lease Insurance

Lease insurance offers several key benefits, including:

- Superior coverage

- Renter affordability

- Native lease integration

- Improved online reputation

1. Stronger Protection Against Unexpected Events and Market Disruptions

The COVID-19 pandemic and subsequent recession have led to industry-wide uncertainty. Luckily, lease insurance has been the answer to many operators’ financial concerns. Built on a sustainable loss ratio model, lease insurance eliminates operational risk and provides customized insurance coverage against rent loss and damage on every lease with the preferred plan.

2. Affordable Move-Ins Drive More Traffic and Higher Conversion Rates

Renter affordability has been front and center, especially since the pandemic. As more renters search for affordable living options, security deposits are no longer a viable option for many. Lease insurance, however, eliminates security deposits entirely, meaning properties can attract more prospective renters, accelerate move-ins, and increase conversion rates.

For example, CFO and COO at ROCO Real Estate Damon Evert explained the benefits of replacing deposits with lease insurance after the company achieved an increase of 10 to 20 leads per property per week: “It’s something that should give us a strong advantage when it comes to competing for prospects.”

3. Deep Technology Integration Delivers Results Through Automation

The pandemic accelerated technological change, and with that, automation and integration have emerged as top priorities for operators as they hunt for future-proof technology solutions. Leasing operations have shifted online, and in response, operators are looking for ways to streamline their processes, not add additional steps (i.e., surety bonds create administrative burdens for on-site teams).

From move-in to move-out, Zero Deposit lease insurance software is natively embedded in online lease checkout, lease execution, monthly billing and accounting, receivables and automated claims, and property performance metrics. This enables operators to eliminate deposits portfolio-wide and drive net operating income—without any additional work for onsite teams.

4. More Positive Community Reviews

Another advantage of apartment lease insurance has to do with renter experience and online reputation. COO at Bell Partners Cindy Clare explains, “Considering security deposits can also create upfront affordability issues and disputes at move-out, the benefits just don’t outweigh the challenges.”

All in all, lease insurance helps improve the resident experience which can translate into a more favorable online reputation.

Lease Insurance Vs. Security Deposit Alternatives

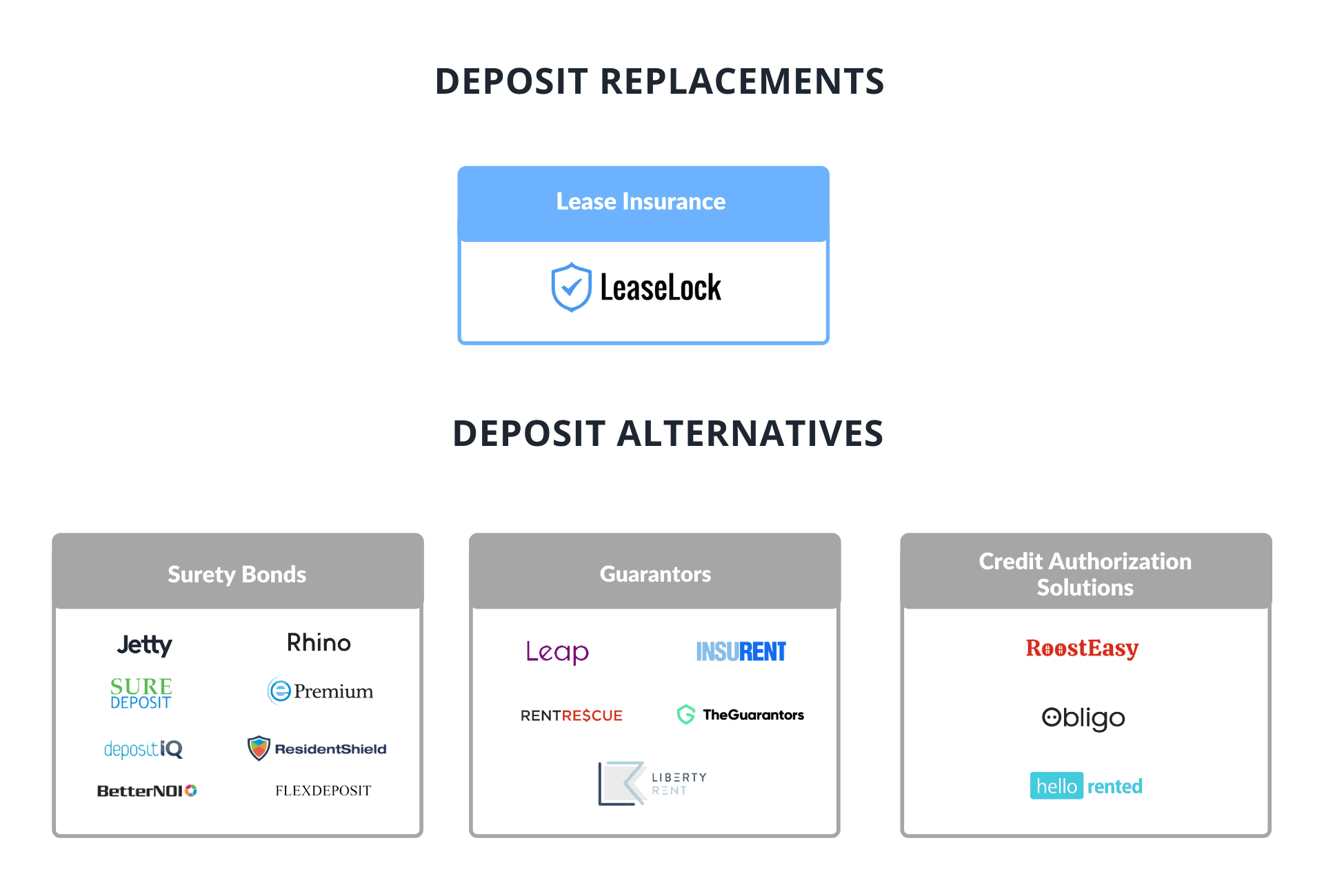

Lease insurance is a security deposit replacement that completely eliminates deposits. On the other hand, security deposit alternatives are offered in addition to traditional deposits. Deposit alternatives include surety bonds, rent guarantees, deposit installment solutions, and credit authorization services.

Whereas lease insurance requires no applications or approvals, deposit alternatives such as surety bonds require extensive onsite training on “selling” the solution to renters, which creates friction in the leasing process — and results in low adoption rates. Lease insurance, however, offers native lease checkout integration which creates “zero touch” deployment. Because of this, lease insurance can drive over 90% adoption rates and functions as a true deposit replacement, eliminating the burdens associated with deposit administration and liability.

In addition to workflow differences, lease insurance and deposit alternatives differ in the protection they offer. Lease insurance provides enhanced, customized property protection while leading alternatives are generally designed to cover up to the cost of the deposit. This means operators are able to reduce bad debt significantly at each property with lease insurance.

Why Multifamily Is Replacing Security Deposits With Lease Insurance

Multifamily may be reluctant to embrace change, but the pandemic has shuffled the industry along in adopting new technologies, processes, and priorities to meet the demands of modern renters. Today’s renter experience should be easy, fast, and affordable.

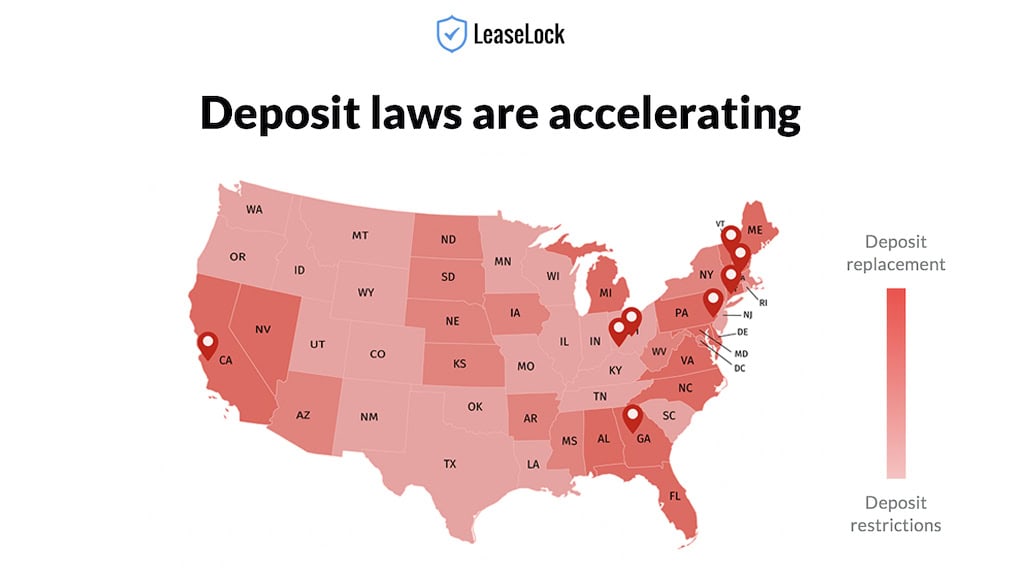

On top of this, security deposit legislation has played a pivotal role in accelerating an industry movement away from security deposits. States have adopted deposit laws that require property managers to offer deposit alternatives in addition to traditional security deposits. In Pennsylvania, a proposed bill goes one step further in providing operators with complete deposit replacement solutions rather than just tightening deposit regulations.

The multifamily industry needs a sustainable software platform that future-proofs their communities by eliminating deposits for good. Deposit replacement solutions like the Zero Deposit Platform should be automated and deeply integrated within leasing checkout and property management systems, create an affordable leasing experience for renters, and generate NOI lift for the property. Lease insurance was designed from the ground up to accomplish this.