As Vacancies Rise, Class A Properties Seek a Competitive Edge

The pandemic has impacted multifamily in a range of ways, and all operators face a unique set of challenges. While the economic effects of the pandemic hit Class C residents notoriously hard, all asset classes have been affected by different market forces.

For example, Class A apartments have been especially hard-hit by renter movement away from dense urban centers, toward more affordable rental options. How are owners and operators adapting to rising vacancies and slumping rents at these Class A properties?

Class A Vacancy Grows as Renters Flee Urban Areas

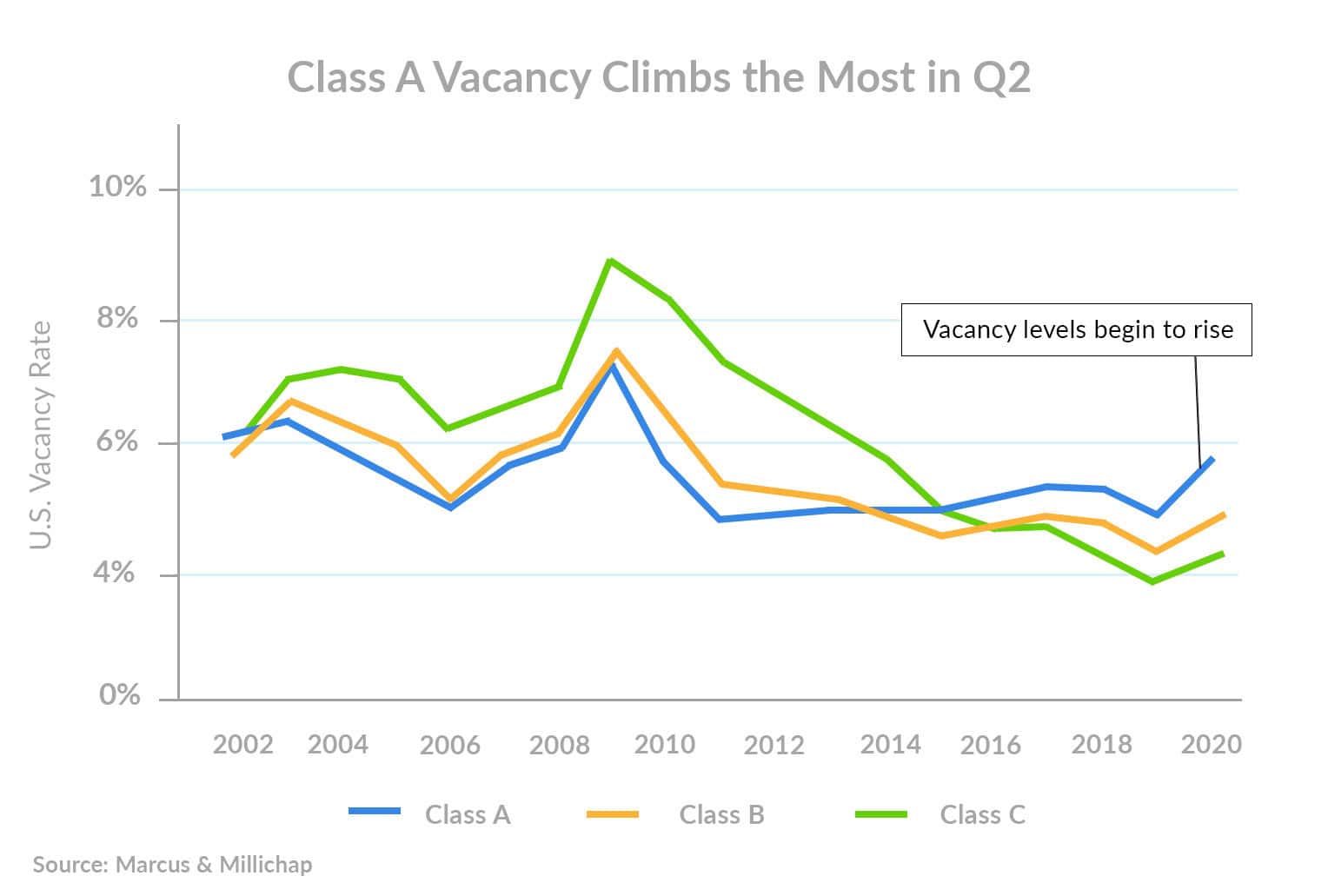

According to a study by Marcus & Millichap, COVID has increased vacancy levels in Class A properties specifically, as residents flee higher-priced cities for more affordable options.

Vacancy rose to 5.7% amid Class A properties between the first and second quarter of 2020, propelled by renters seeking lower-cost housing. This vacancy comes after a swell of Class A units were recently added to the market in early 2020, which lead to even greater unit availability.

The average Class A rent also fell 1.5% in the second quarter, an even steeper drop than was seen across the average rental market. Dense, gentrified and high-priced areas like San Francisco, New York City, Chicago, Austin, Orlando, and Atlanta suffered the greatest cuts to rent growth.

How Operators are Driving New Leases Despite Class A Apartment Vacancies

In light of these challenges, operators are implementing creative solutions to get more renters in the door. According to a recently published Zillow Report, concessions have nearly doubled to combat a softening rental market.

The most popular concession is free weeks of rent, followed by reducing or eliminating security deposits. Other less popular options include offering gift cards, free parking, and waiving fees.

Balancing Concessions and Risk at Class A Properties

No question, concessions are a popular way to drive leads. Cutting one month’s rent or offering a $99 deposit feels like an enticing way to attract renters in a down economy — so operators are willing to absorb these costly concessions in the hopes they will be worth the boost in occupancy.

However, several owners and operators at Class A properties are also finding creative ways to offer an affordable move-in without exposing themselves to bad debt, or hurting their bottom line.

Prominent Greystar-managed owners eliminated costly security deposits for residents this year — without absorbing additional financial risk— by deploying LeaseLock’s Zero Deposit software platform.

After marketing their communities as Zero Deposit, these Class A properties saw a 5.3% increase in closing ratio, while increasing their protection against missed rent and damage with over $5,000 of coverage on 92% of new leases.