Class C Residents Show Signs of Growing Financial Strain

- Class C rent payments dropped 17 percentage points MoM

- Class C residents are faring worse than both Class A & B

- Leads at Class C properties are up, but signed leases have tapered off

Class C properties are usually the hardest hit during economic downturns, and this pandemic-caused recession is no exception. With the $600 unemployment bonus set to run out at the end of July and many Class C renters already showing signs of financial insecurity, the outlook for Class C properties remains uncertain.

As Bob Pinnegar, president and CEO of the National Apartment Association, explains, “Class C properties are a cause for concern.”

Class C Rent Payments Weaken More In July

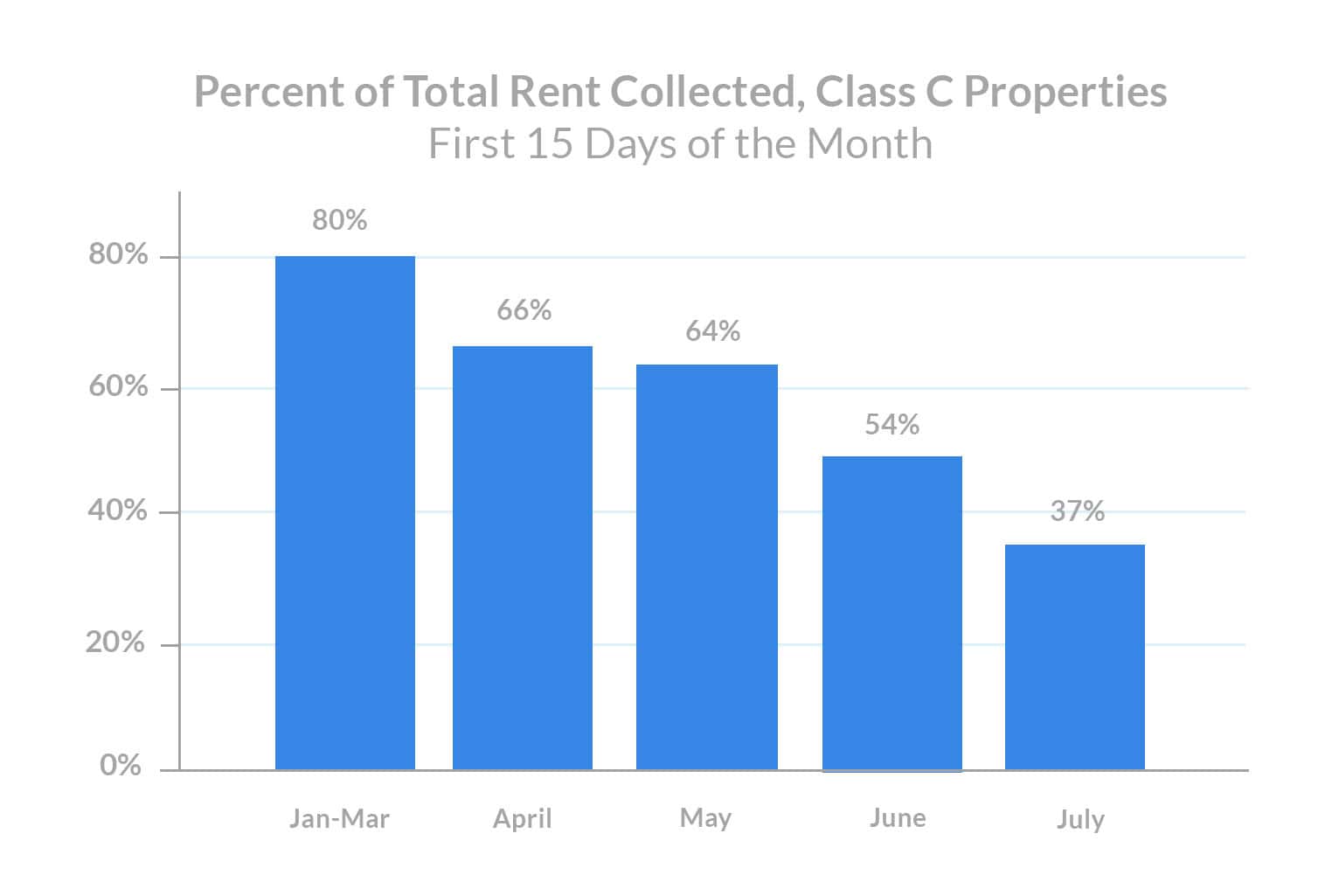

On July 1st, Class C started the month with a very slight bump in rent payments, likely due to reopening-induced economic boosts in June. At the close of the July grace period, however, Class C renters began to show signs of distress, with rent payments 8% lower than the previous month.

Halfway through July—a couple weeks shy of bolstered federal benefits due to expire—Class C rent payments have remained alarmingly low. Compared to the same time period in June, the percentage of rent collected at Class C properties has dipped 17 percentage points and remains more than 40 percentage points below the pre-COVID average.

Class C Apartments Fare Worse Than Other Asset Classes

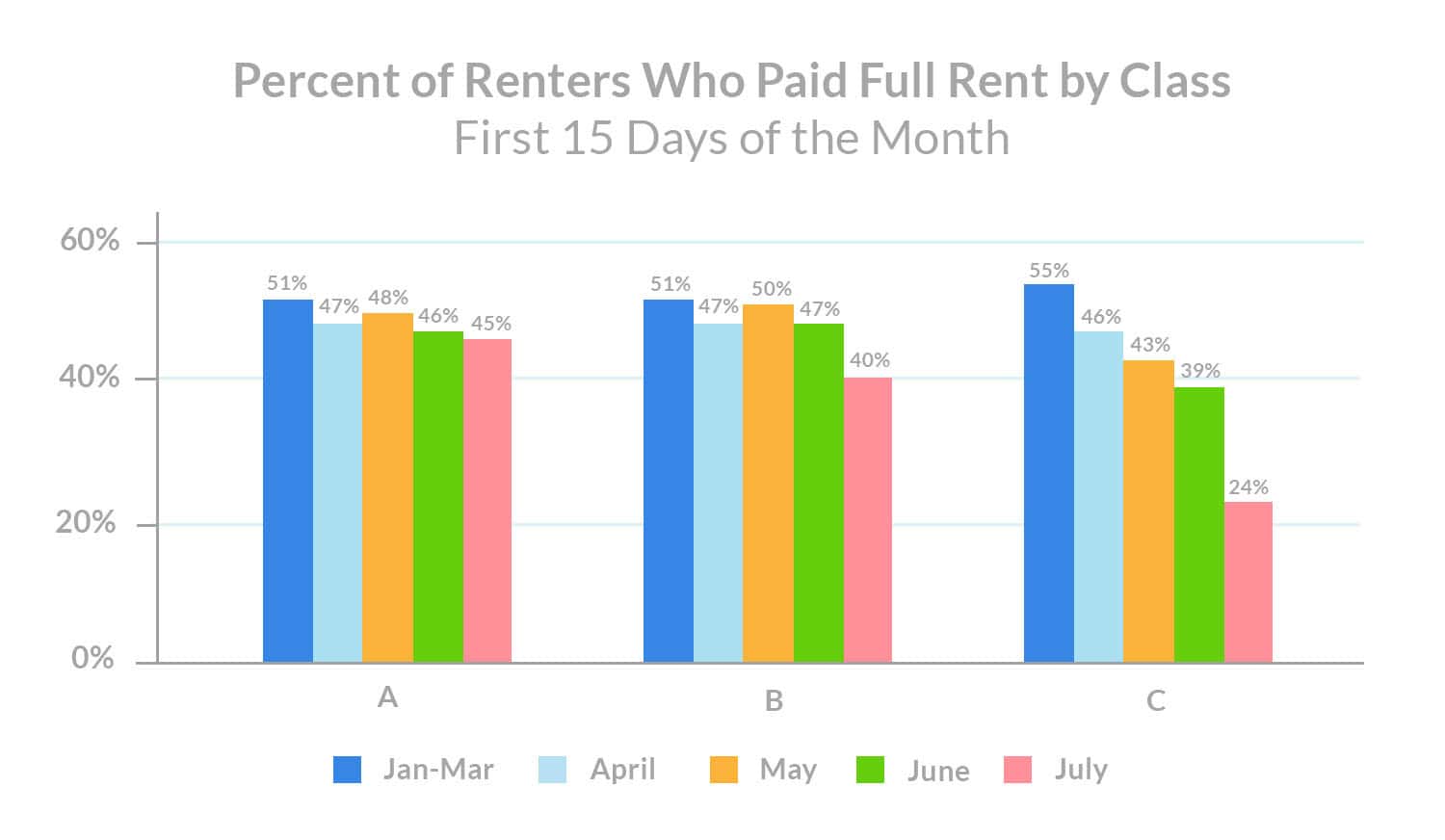

Looking at full rent payments, Class C properties have seen a 15 percentage point drop since last month, and are 31 percentage points lower than the average. On the other hand, Class B rent payments have only slightly declined month-over-month, while Class A rent payments have mostly recovered by mid-month. Class C renters have no doubt fared worse in the last few months since COVID struck, and they remain the most vulnerable without the aid of federal benefits.

California Rent Payments Worsen Across Class C Properties As Texas Holds Steady

The situation with Class C apartments in California has worsened each month since the initial dip after COVID. The latest decrease puts California rent payments 35 percentage points below the month prior, indicating deep financial strain among the state’s more vulnerable renter populations who already face a housing affordability crisis. On top of this, California rent relief efforts have been slow to go into effect, and the rollback of the state’s reopening has likely exacerbated financial hardship for many renters.

Class C rent payments in Texas sit at 85% in July, only 1 percentage point lower than last month. Overall, Texas has remained steady since experiencing a slight drop after COVID struck. This could be due to rent assistance programs being implemented early on and on an ongoing basis across various local jurisdictions.

Class C Renters Seeking More Affordable Options, But Nervous to Sign Leases

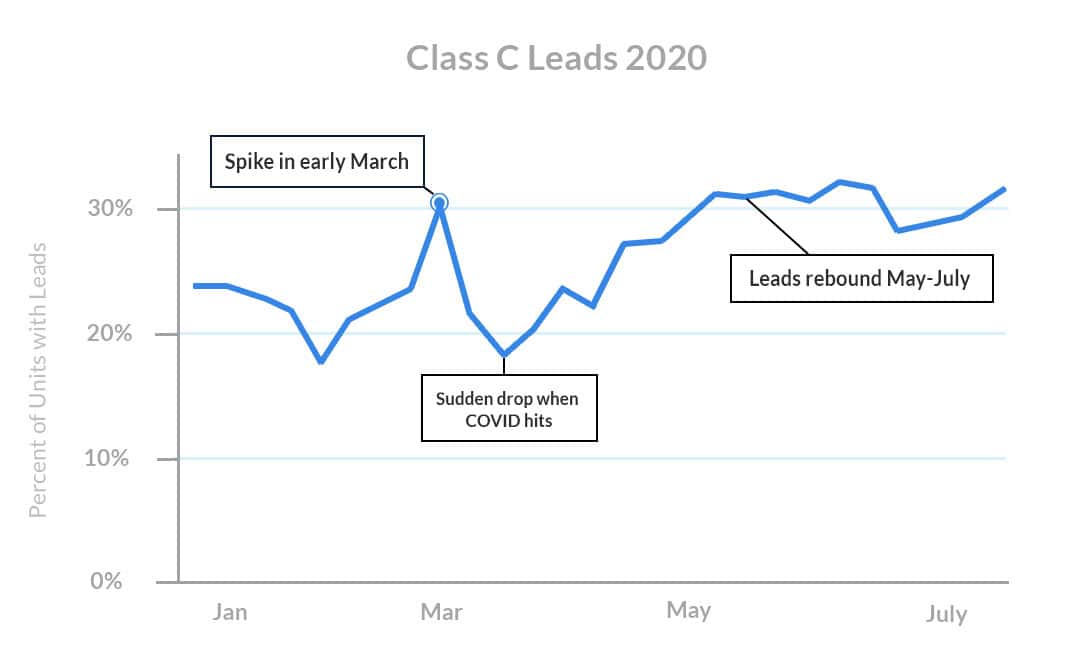

Class C renters face a tough financial situation, meaning many are on the search for cheaper apartment options. We see this reflected in our data, with apartment leads across Class C properties bouncing back after the initial shutdown, and maintaining higher than normal ranges. This also aligns with the new peak leasing season, in which renters who were previously on lockdown or hesitant to move, are now venturing out to find new and/or more affordable housing.

Despite the lag in leasing activity, Class C apartment communities are seeing a surge in leads through the summer months, indicating a strong desire to move among this renter group.

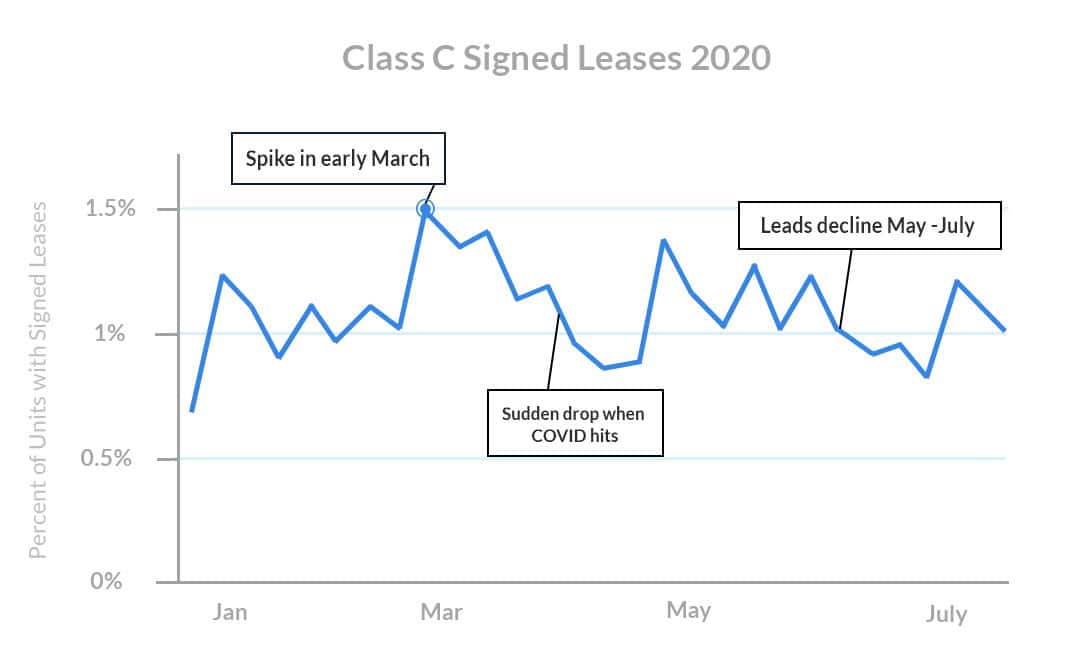

When we look at lease signings across Class C properties, we don’t see the same pattern as leads. Instead, lease signings have never recovered to the pre-COVID peak and have tapered off through the summer. Knowing there’s strong interest among Class C residents to move — yet fewer lease signings — suggests that they’re likely struggling to make ends meet and may be nervous to pull the trigger, especially considering the costs of moving (first month’s rent, security deposits, moving costs etc.).

Class C Renters In Dire Need of Comprehensive Rent Assistance

While renters across all asset classes are in need of more rent assistance, Class C properties are the most vulnerable in the face of economic instability, expiring benefits, a high unemployment rate, and a lack of rent relief. President Trump and the Senate are finally talking through a new relief bill, and legislators and multifamily experts are rallying to gain more comprehensive rent assistance — something that the rental housing industry has tirelessly advocated for — but the funding has been insufficient to prop up American renters through the crisis.

Bob Pinnegar has expressed his support for a federal rent assistance program, saying, “The government must step in with effective housing policy, like direct emergency rental assistance, to ensure families remain in their homes and rental housing providers can continue to provide quality housing.”

The status of Class C apartments hangs in the balance, and multifamily must continue fighting for better protection as the pandemic wears on.

Important statistical note: Despite the measured payment fluctuations based on the sample set, the variance is within normal statistical range. In other words, the changes are not necessarily significant enough to attribute specifically to COVID-19 versus normal fluctuations expected across the data set. Please reference full Methodology below.

Methodology

Rent payment data is actual transactional data sourced from integrations with property management systems in the multifamily industry.

Analysis includes a 105,070 unit sample from 1,029,428 live units under management by LeaseLock clients. Data is nationwide, representing over half of the NMHC Top 10 property managers in the country and all asset classes (A, B and C). Asset class composition: class A (37%), class B (48%) class C (15%).

All data has been anonymized to remove personally identifiable information for renters and property managers.