Happy budget season! Multifamily communities and corporate teams are starting their annual budgeting and forecasting exercises, but what’s different this year? As we edge out of the pandemic, what budget season best practices can multifamily operators employ to ensure a happier, smoother budget process?

We hosted a webinar panel with industry experts from top operators to get insider tips on how to budget around uncertainty and bad debt — two areas that all owners and operators will need to focus on for the upcoming year. To help fellow budgeters prepare, our panel discussion focuses on:

– Key goals for budget season teams

– Top budgeting challenges and opportunities

– Ways to mitigate risk and maximize asset performance

– How to improve accuracy, reduce expenses, and boost revenue

Below is a recap of the topics and conversations we covered during our panel, featuring Christine Bright – Regional Manager at Topaz Asset Management, Yetta Tropper – Executive Director at PGIM Real Estate, and our very own, Kevin Huss.

[cta_button link=”#anchor” text=”Watch Webinar”]

What Are the Major Multifamily Budgeting Challenges?

With all the uncertainty and unknown variables, this year is not a budget-as-usual scenario.

Apartment Demand & Rent Growth

Economic recovery and employment growth have fueled unprecedented demand for apartments as the worst of the pandemic appears to be behind us, leading to rent growth that’s off the charts. Operators are left wondering if this trend will continue, or if regression is expected.

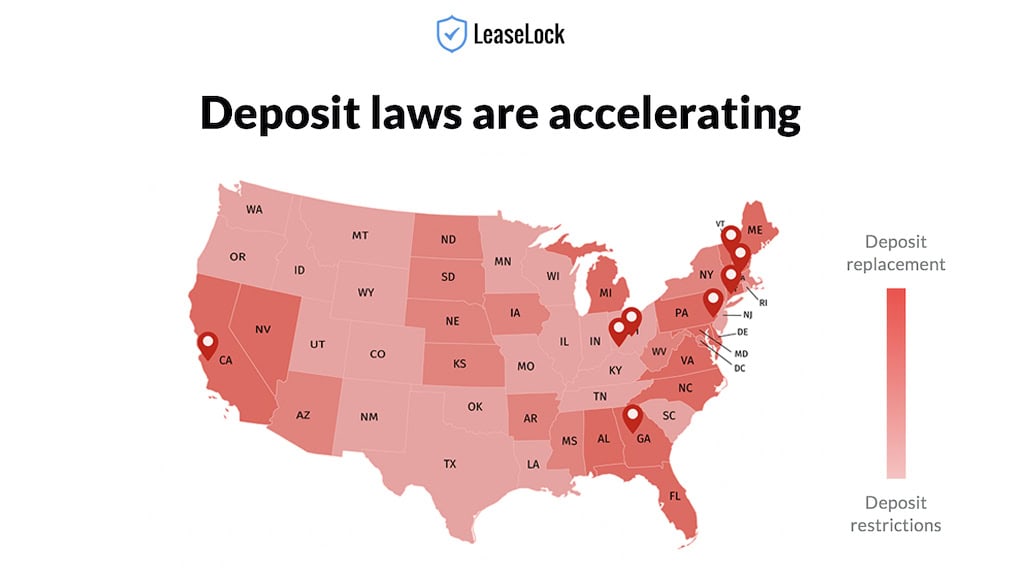

Evolving Legislative Landscape

Legislation has been constantly changing. Between a patchwork of eviction moratoriums, several extensions of the federal moratorium, and various rent assistance programs, it will be interesting to see what happens once eviction filings resume. There’s also been a relatively underwhelming rollout of emergency rent assistance funds — of the roughly $45 billion allotted, only $1.5 billion has been disbursed thus far. Are operators prepared to help residents take advantage of these programs?

Rent Delinquency

Related to the ever-changing legislative landscape is rent delinquency. How many residents are delinquent or will become delinquent? Will residents who are behind on rent be able to catch up? Operators need to focus on strategies to minimize delinquency rates, meaning they’ll need to be diligent in assisting their residents access the funds available to them.

New Renter Profiles

Operators also have to consider new renter behaviors. For example, many residents are signing for longer lease terms, using flexible rent payment solutions, shifting to remote work, and/or relocating to more affordable markets. All these factors contribute to a strong multifamily market.

Lease Concessions

Since the pandemic, operators have leaned heavily into financial concessions and economic incentives. Which lease concessions can operators offer without sacrificing income? It will be extra important this year and next to balance concessions against economic occupancy.

These are just some of the many challenges and questions that operators will need to think about and address this budget season.

What Are the Areas of Opportunity for Multifamily Budgeting Teams?

The multifamily industry has learned many lessons during the pandemic, which now present as unique opportunities in 2022.

Due to healthy economic growth, recovery is well underway. In the first half of 2021, evictions were expected to climb, vacancies to soar, and rental rates to potentially drop. However, the opposite of this happened due to eviction moratoriums being extended. Now we’re seeing incredible rent growth, strong occupancy, and stable vacancy levels. In addition, rising home prices are creating more demand for rentals, properties are selling like hotcakes, cap rates are getting squeezed, and there are bidding wars for apartments.

While the end of this book seems to be nearing, we still don’t know exactly what that will look like. How can apartment owners and operators prepare and capitalize on the positives? Moral of the story — they’ll need to control the controllables. Operators have learned to operate with fewer resources and lower expenses.

If the market is already experiencing healthy rent growth and occupancy, then what’s next? Moving forward, NOI improvement strategies will continue to be a focal point — operators need to double down on reducing bad bad debt and creating new channels of ancillary income.

How to Optimize Your Multifamily Budgeting Process: New Budgeting Priorities

This year, it will be especially important to focus on two new budgeting priorities. First, how can you mitigate risk? Second, how can you maximize asset performance and value? Essentially, operators need to pivot to budget around uncertainty and bad debt.

While the worst of the pandemic seems to be behind us, multifamily budgets should still account for best and worst-case scenarios. We can’t predict the full impact of COVID on 2022 budgets, but we can plan ahead to have a more secure understanding of the year ahead. Knowing the challenges and opportunities will help yield more accurate results, manage uncertainty, control bad debt, and protect NOI.

8 Best Practices For Budgeting Around Uncertainty & Bad Debt

To more effectively control bad debt and boost NOI, operators should dial in on the following budget season best practices:

1. Create New Budget Categories – By creating new budget categories, your team can identify the biggest value drivers. Historically, if you’ve had a catch-all income or expense account, consider creating more accounts to create transparency.

2. Budget With Flexibility in Mind – Being flexible is something we’ve all been forced to do during COVID. By taking a flexible approach to budgeting, your team can deliver more accurate projections.

3. Adapt to Evolving Team Roles – If the pandemic taught us anything, it was that we’re all capable of adapting for success. This means operators should continue to stay agile and proactive as your team’s roles and needs change.

4. Diversify Ancillary Income Streams – Tap into ancillary income channels that create incremental value and reduce bad debt. In other words, identify efficient sources of NOI and create income with little to no expense to your property (e.g., Zero Deposit lease insurance).

5. Invest in AI and Virtual Leasing – We all know that leasing has gone virtual. If you haven’t already adopted virtual leasing (e.g., virtual tour platforms or automated payment solutions), you’re losing out on key ways to optimize leasing and improve your organization’s returns.

6. Take Advantage of Rent Assistance Programs – On top of reducing delinquency, capitalizing on rent relief can help improve renewal rates which has a downstream effect on occupancy and rent growth.

7. Leverage PMS & 3rd-Party Data – Consulting market data will help improve budgeting accuracy and reveal areas that your organization can save on costs and minimize risk.

8. Offer Concessions Responsibly – Draw in residents while protecting economic occupancy. This means finding ways to boost your bottom line without leaving your property exposed. There are also other ways to reduce move-in costs for your residents — it doesn’t need to be a concession.

Future-proof your budgeting strategy to mitigate risk and protect NOI—download the multifamily guide on the 7 Building Blocks for Better Budgets:

[cta_button link=”https://info.leaselock.com/budget-building-blocks-multifamily-guide” text=”Get the Guide”]

Industry Experts Share Multifamily Budgeting Insights

In our educational webinar “Budgeting Around Uncertainty and Bad Debt,” our expert panel discusses budget season best practices, trends, and strategies, featuring our budgeting pros, Christine Bright, Yetta Tropper, and Kevin Huss. Here is a preview of the panel questions covered:

- In what core ways is budget season different this year from last?

- Considering how things have changed, what type of budget variances are operators seeing or anticipating?

- Based on what we’ve learned in 2020, how have staffing changes evolved?

- What steps can operators take to increase occupancy, lower expenses, boost bottom line, and better forecast changes?

- How are operators benchmarking revenue growth for next year?

- Operators have played it safe this year — how can they be more aggressive in 2022?

To access a recording of the entire panel session, fill out the form below:

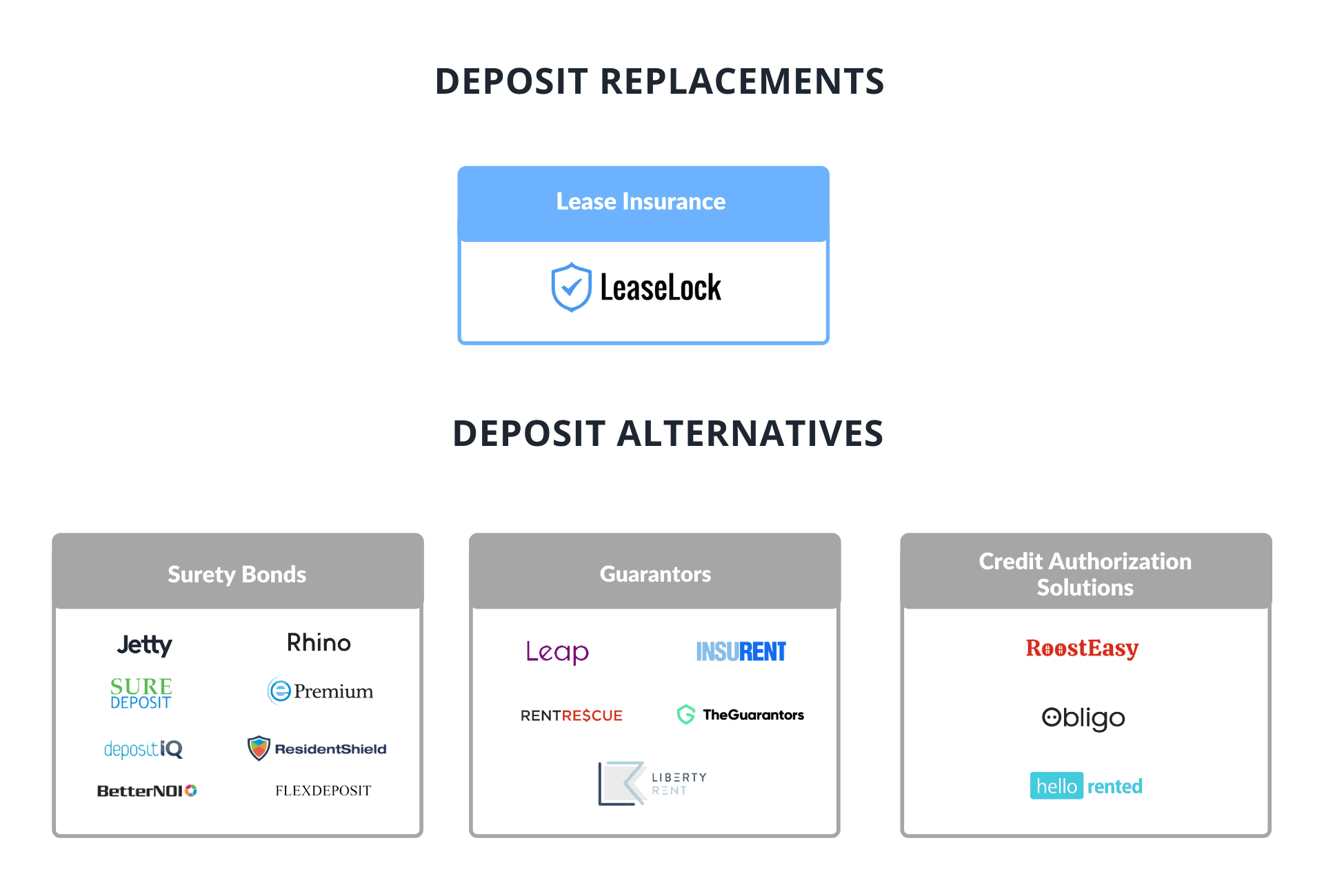

Compared to security deposits and deposit alternatives like surety bonds, lease insurance offers 3x more protection on average against rent loss and damages. This shields apartment communities from economic uncertainty. As President at RKW Residential Marcie Williams points out, “Replacing security deposits with lease insurance enables us to protect our assets in an uncertain economy.”

Compared to security deposits and deposit alternatives like surety bonds, lease insurance offers 3x more protection on average against rent loss and damages. This shields apartment communities from economic uncertainty. As President at RKW Residential Marcie Williams points out, “Replacing security deposits with lease insurance enables us to protect our assets in an uncertain economy.”

Managing director of asset management at Trinsic Sheri Thomas notes, “We pride ourselves on being an innovative apartment company that provides the highest level of convenience for our residents. Replacing the security deposit cost barrier with lease insurance delivers a frictionless and automated leasing process.”

Managing director of asset management at Trinsic Sheri Thomas notes, “We pride ourselves on being an innovative apartment company that provides the highest level of convenience for our residents. Replacing the security deposit cost barrier with lease insurance delivers a frictionless and automated leasing process.” When renters don’t have to worry about security deposit deductions or repaying bonding companies (who may run collections on unpaid expenses), they’re more likely to write positive reviews. These reviews often emphasize the affordability of a zero-deposit move-in, as well as the ease of the move-out experience.

When renters don’t have to worry about security deposit deductions or repaying bonding companies (who may run collections on unpaid expenses), they’re more likely to write positive reviews. These reviews often emphasize the affordability of a zero-deposit move-in, as well as the ease of the move-out experience.

Operators are also realizing that deposit alternatives like surety bonds don’t provide sufficient coverage. While they offer renter affordability,

Operators are also realizing that deposit alternatives like surety bonds don’t provide sufficient coverage. While they offer renter affordability,