Rental application fraud is rising fast. Spot red flags and safeguard your property by taking a deep drive into this guide today.

Discover resident screening best practices in this helpful guide. Protect your property and finances with improved evaluation strategies.

Learn about lease insurance costs and how they compare to traditional deposits. Explore potential savings, value, and ROI for property managers.

Learn how lease protection insurance for property managers simplifies operations, reduces risk, and promotes accessibility. Step-by-step guide included!

Learn how lease insurance and fair housing principles align to reduce financial barriers, promote inclusivity, and simplify leasing for both parties.

Discover how LeaseLock’s Advisory Services team streamlines Zero Deposit™ adoption, empowers leasing teams, and enhances portfolio performance with tailored strategies and expert support for rental housing operators

Discover why lease insurance is the best alternative to security deposits. Gain flexibility, protection, and a simpler process for property managers.

Learn why lease insurance offers better protection than surety bonds, providing broader coverage, flexibility, and faster claims resolution.

We’re thrilled to announce the launch of our first-ever episode of Unscripted, the podcast where multifamily and rental housing professionals come together to discuss the real stories, challenges, and strategies shaping the industry today.

Looking for a way to bypass traditional security deposits? Zero deposit insurance could be the perfect alternative. Here’s what you need to know.

Looking to keep your resident retention rates high? Follow this guide to provide a positive lease signing process that keeps residents happy.

Traditional security deposits present many challenges for landlords. Depending on how long renters stay, security deposit alternatives can be hassle-free.

Learn about the ins and outs of rental deposit insurance in property management and explore why it’s essential for property management.

Multifamily historically has been slow to embrace technology, but the industry countered that notion with its recent tech renaissance during the pandemic. Almost overnight, tech solutions went from last resort options to first-strike weapons in the industry’s effort to solve emerging issues. These technologies may have been a long time coming, but their fast-tracked implementation demonstrates multifamily can move with agility when need be.

A Growing Multifamily Trend: Avoid, Transfer, & Mitigate Risk With Insurance Technology

Spurred by today’s economic uncertainty, there is another dramatic shift taking place in multifamily – the trend towards insurance technology to manage risk and protect against financial loss. Between resident screening, renters insurance, and lease insurance, savvy operators now leap at the opportunity to engage different risk management tools to avoid, transfer, and mitigate risk throughout the lease lifecycle.

Resident screening helps avoid risk by identifying fraudulent applications and risky renters, and renters insurance programs enable operators to transfer risk to resident policies—both integral to operators’ risk management strategy. Now, more and more are looking to mitigate risk by implementing lease insurance to solve the long-standing failures of security deposits. With lease insurance, operators reduce their exposure to potential loss caused by residents and improve property performance.

In particular, there are three use cases driving operators to replace traditional security deposits with lease insurance as a better loss protection strategy:

- Move-In Affordability for Residents

- Modern Risk Mitigation Solutions for Apartment Communities

- Maximized Revenue & Smarter Risk Assessment for Operators

3 Reasons Multifamily Is Moving Away from Traditional Security Deposits & Surety Bonds Towards Lease Insurance

1. Move-In Affordability for Residents

Economic uncertainty and housing supply shortage accelerated the housing affordability issue for apartment renters nationwide. With 58% of Americans living paycheck to paycheck, a majority of Americans lack the funds to cover an unexpected $1,000 expense. In addition, full-time minimum wage workers can’t afford rent in 93% of U.S. counties, while over half of all US apartment households spend nearly a third of their income on rent.

Record-breaking rent growth has made renting an apartment particularly expensive, especially security deposit costs. This creates a large financial burden for renters but also puts operators in a bind—either they charge deposits to protect against loss and suffer low lease conversion rates or offer lease concessions to attract residents but sacrifice proper protection in the process.

And while surety bonds offer move-in affordability for renters with low-cost monthly payments, these deposit alternatives are a crude form of insurance that offer insufficient protection against rent loss and damage that have poor resident adoption. In this case, operators sacrifice long-term revenue to maintain physical occupancy levels in the short-term.

On the other hand, lease insurance removes the upfront cost posed by security deposits and adequately protects operators against rent loss and damages, all in a resident-friendly format. Instead of using a blanket security deposit amount or a low-cost, high-risk surety bond program, operators can seamlessly deploy lease insurance to both create more affordable move-ins and unlock smarter risk prediction and historical data at the property level to determine optimal insurance coverage. This leads to a better resident experience, higher lease conversion, and increased economic occupancy.

“It’s more important than ever that operators offer an affordable move-in experience for residents while also protecting themselves from potential rent loss. [Lease insurance] enables us to do exactly that [which is] a stronger, more sustainable insurance product relative to surety bonds.” – Ian Bel, managing partner at Olive Tree Holdings

2. Modern Risk Mitigation Solutions for Apartment Communities

Surety bonds and other deposit alternatives have sought to replace outdated, traditional deposits, but even as security deposit legislation spreads nationwide, it’s becoming more apparent how these partial solutions actually introduce new types of risk that create financial, administrative, and regulatory burdens for operators as well as negative leasing experiences for residents.

For example, surety bonds leverage off-system application processes and manual claims forms, creating more administrative work for onsite teams and a clunky process for residents, thus leading to less than 50% resident adoption rates. New deposit laws also present new restrictions and increased deposit administration, adding unnecessary complexity to regulatory compliance. In addition, deposit alternatives leave residents fully liable for claims paid to their property, resulting in displeased renters, negative online reviews, and potential move-out disputes.

“If a prospective resident doesn’t have to go in and deal with their surety depositor to set up their bonds, that helps. Having that lease insurance process integrated into the property management system creates a simple, streamlined process, and has the ability to improve conversion rates.” – Andrew Gordon, Chief Operating Officer at Strata Equity Group

Lease insurance, however, is a modern loss protection solution that replaces traditional deposits and alternatives integrating within the native workflow from the point of application all the way through the move-out claims process. This means property teams are relieved of administrative strain and expedite claims in the leasing office, residents get a hassle-free lease experience with no out-of-workflow applications or surprise deposit deductions, and owners reduce bad debt and increase asset value and NOI.

“[Lease insurance] has proven to be the long-term solution to remove deposits [by delivering] a seamless, accessible, and affordable move-in experience, greater risk mitigation, higher bad debt recovery, and stronger NOI – all things any property management company needs to get right from the beginning.” – Jennifer Staciokas, Executive Managing Director of Property Management for Western Wealth Capital

3. Maximized Revenue & Smarter Risk Assessment for Operators

Balancing the need to maximize NOI with heightened renter affordability concerns along with strong multifamily occupancy rates has prompted many apartment operators to offer concessions (i.e., deposit-free move-ins) to remain competitive.

However, this scenario has negative implications, including insufficient protection when a resident doesn’t pay rent or causes substantial damage to their apartment home. With no way to assess risk and subsequently cover losses, an operator’s economic occupancy diminishes.

“Residents want what they want when they want it and how they want it. We want to incorporate [giving our residents more options] into the way we operate, but we have to mitigate the risk upfront rather than being too proud of 100% occupancy. We’re using screening verifications up front, and [lease insurance] has been a tremendous value on the back end.” – Marcie Williams, CEO at RKW Residential

While some operators opt to utilize surety bonds as a deposit alternative, the risk of economic loss persists. Consider the loss ratio formula of surety bonds: a surety bond program contributes on average $50 in premium to the denominator of the loss ratio equation. This amount is insufficient compared to the average amounts that must be paid out in claims. In this case, the surety bond carrier loses money while the bonding company continues to take on new risk.

Following the pandemic, the industry is likely to experience an influx of claims outflows for months, or even years, to come. As a result, surety bond pools will deplete, leaving operators exposed to a high level of risk and account balances (i.e., bad debt). For this reason, operators need a risk mitigation solution like lease insurance that effectively assesses risk and absorbs account balances to maximize revenue.

“Frankly, the security deposit is a thing of the past. Financially, they – along with alternatives like surety bonds – don’t make a lot of sense. They don’t correlate to the amount of damage that could be done to a unit or the potential amount of debt. They’re just not relative to the risk.” – Mark Stringer, Executive Vice President for Avenue5 Residential

Risk Prediction Is the Long-Term Solution for Smarter Loss Protection

In today’s economic climate, savvy operators are looking for better risk mitigation solutions and stronger loss protection strategies that address the use cases outlined above: renter affordability, modern risk mitigation solutions, and risk assessment capabilities. This is why more and more are shifting away from expensive, traditional, risk-prone security deposits and surety bonds to affordable, innovative, and data-driven insurance technology solutions, like lease insurance.

“Surety bonds and other alternatives don’t hold a candle to lease insurance. It makes move-in affordable for our residents and dramatically increases our protection against rent loss. In any economic environment it is important we reduce upfront costs for residents while still mitigating financial risk for our communities.” – John Detore, Director of Asset Management at White Oak Partners

Ultimately, the most promising aspect of lease insurance lies in the value of risk prediction. With predictive risk monitoring at its core, LeaseLock’s lease insurance platform can analyze ledger balance trends and billions of risk data points sourced from PMS and third-party data to project potential resident loss and optimize coverage accordingly.

Rather than relying on an arbitrary security deposit amount or partial solutions (e.g., surety bonds) that add layers of risk to leasing, LeaseLock wields the power of data and AI to adapt insurance coverage so operators can rely on optimal revenue protection across their entire portfolio–far more than what’s provided by traditional deposits and bonds.

Conclusion

Operators today need to better manage loss and drive asset value. While lease insurance programs provide stronger loss protection strategies that optimize asset performance, not every program is created equal—operators need a smarter, more sustainable risk mitigation solution. Only lease insurance steeped in AI and data analytics to effectively predict risk can offer this.

We’re still buzzing with excitement from all the amazing events that unfolded at last week’s NAA Apartmentalize 2022. With over 11,000 vendors and attendees, our team was delighted to welcome a constant stream of visitors to our booth and happy to reconnect with industry peers at our hosted events.

While the event was back to pre-pandemic activity, the industry is not returning to its old ways of doing business. Emerging technologies took center stage both during the education sessions and on the trade show floor, proving that technology innovations adopted during the pandemic are here to stay and evolve.

If you missed out on Apartmentalize this year or you just want to relive it, here’s our recap of the top highlights and takeaways from the industry’s premier annual gathering.

1. Modern Renter Demands: The Subscription Economy’s Impact on Rental Housing

The subscription business model has been accelerated by the pandemic and is only becoming more prevalent across various industries. The shift in buying behavior extends across all aspects of life, like entertainment, financial services, food, and housing. In multifamily, renters are avoiding high upfront costs in favor of more flexibility and freedom.

With rent being just a monthly subscription fee paid for an apartment, other elements such as security deposits, move-in costs, and payment options can also benefit from adopting the subscription model.

In our education session, Understanding the Renter’s Economic Mind, our Senior Vice President of Enterprise Sales Ian McIntosh, along with industry experts Jeremy Thomason of CAF Companies and Hugh Cobb of Asset Living, explored the economic drivers of today’s renter and revealed best practices for the implementation of subscription-based amenities.

Here are the key highlights from their discussion:

- Subscription services and fee installments have emerged as the preferred payment method for renters.

- Operators are revisiting and restructuring their paradigms for security deposits, rent payments, amenity fees, and move-in costs to appeal to the economic mind of today’s renters.

- Companies are embracing bundling expenses to streamline the resident experience.

Be on the lookout for our comprehensive recap highlighting the session’s best practices for implementing subscription-based systems, as well as data-centric insights into the modern renter profile.

2. An Epic Multifamily Reunion: Connecting With Old and New Partners

This year’s Apartmentalize was an opportunity for the industry to reconnect, mingle, and forge new relationships. We were as excited as ever to jump right back into the action and have some fun in the sun with old and new partners in San Diego.

As a pre-celebration on Wednesday, LeaseLock hosted a cozy gathering with fifty guests on the beach at Hotel Del Coronado to roast s’mores over the bonfire and enjoy good conversation. Multifamily leaders and long-time LeaseLock partners Doug Bibby and Debbie Phillips stayed late into the night catching up on lost time with our CEO Derek Merrill and CRO Ed Wolff.

Kicking off the official celebrations on Thursday, we rubbed shoulders with 300 industry movers and shakers at our co-hosted happy hour with Friends of NAA. Overlooking the Gaslpamp Quarter and views of the San Diego Bay, we toasted to continued partnerships and success.

But the fun didn’t stop there—at our intimate dinner at the waterfront Sheerwater bistro we were joined by thirty industry titans, including Doug Bibby – President of NMHC, Bob Pinnegar – President of NAA, Hugh Cobb – President of TAA, and Ian Mattingly – President of AAGD, along with some of our amazing board members. As always, we’re grateful for their support and honored that they chose to spend their evening with our team.

3. Trade Show Buzz: New Proptech Propelling the Industry Forward

Attendees brought infectious energy to the exposition floor on Thursday and Friday as innovators came together to share ideas and solutions. The LeaseLock booth and team were met with enthusiastic customers and property operators as we offered a peek under the hood of our data-driven risk engine and AI-powered lease insurance platform.

LeaseLock has been hard at work building our lease insurance technology solution to bring greater predictability to rent. Our team was excited to demonstrate how our technology analyzes risk to optimize coverage so our clients can rely on optimal revenue protection across their entire portfolio.

Our expert advice on loss protection in today’s economic climate proved to be an especially hot commodity among thought leaders, trendsetters, and innovators visiting our booth. We loved the spirited exchange of ideas on how to refine risk management practices and drive property performance, and we left San Diego feeling as committed as ever to revolutionizing the rental housing industry.

The Best One Yet?

Whether it was the warm and sunny weather in San Diego, or the opportunity to finally reconnect with industry peers at the first full return to pre-pandemic activity, the word on the street is this year’s Apartmentalize was the best one yet. Our team couldn’t agree more—we had a blast celebrating and connecting with industry friends, and feel re-energized to get back to work on bringing the future of leasing to renters nationwide.

Thank you to our team, partners, booth visitors, event attendees, multifamily friends, and NAA for making Apartmentalize 2022 one to remember—we can’t wait to see you again at next year’s Apartmentalize 2023!

Apartmentalize 2022 is the biggest event in rental housing and if you don’t have a solid plan in place it can be overwhelming to navigate, but not to worry—we’ve got you covered!

As a California based company and a team who’s attended the event several years in a row, we know a thing or two about navigating the exposition floor, maximizing connections, and having fun like a local. With nearly 400 exhibitors, dozens of educational sessions, endless networking opportunities, and plenty of entertainment options, here’s three ways to get the most out of your time at Apartmentalize:

1. Attend Education Sessions to Stay on Top of Industry Trends

In the ever-changing landscape of emerging technologies, legislation, and trends, every rental housing professional needs to stay informed. With over 80 educational sessions (some of which take place at the same time), attendees should plan ahead and pick the most relevant ones.

Take a look at the full list of education sessions and utilize your NAA Planner to add the sessions to your calendar and stay on top of your schedule during the event.

A Session You Don’t Want to Miss: Understanding The Renter’s Economic Mind

Don’t miss the opportunity to hear from multifamily veterans Hugh Cobb, Dave Marcinkowski, and Jeremy Thomason. Our SVP of Enterprise Sales, Ian McIntosh, will be moderating a lively discussion on the economic drivers of modern renters and best practices for implementing subscription-based amenities. This session will uncover how, when and where renters prefer to spend their money. Leave empowered to appeal to your renters’ new preferences.

2. Plan Your Visits With Exhibitors

With your education sessions planned, make sure to give yourself enough time for booth visits, appointments, and networking on the expo floor. Decide which exhibitor booths to visit ahead of time. Use the interactive Floor Plan tool to search by exhibitor, booth number, or product category. Your NAAPlanner will allow you to save exhibitors to your custom show agenda.

As the days on the exposition floor can be hectic, we also recommend finding time for deeper one-on-one conversations by scheduling appointments with your vendors of choice in advance.

Connect With LeaseLock at Booth 1613

Attending Apartmentalize is a wonderful opportunity to learn more about the latest industry trends and technologies that are transforming the rental housing industry.

Our deposit replacement technology is doing just that—by taking deposits out of leasing, we’re fundamentally changing the way multifamily operators manage risk. Our AI analyzes billions of risk data points to better predict future rent loss and generate revenue protection across entire portfolios. This translates into customized coverage by asset, which is optimized against changing risk.

If dropkicking deposits sounds like a stress reliever for you, come meet us at Booth 1613. We’ve got plenty to share, from stress-free solutions, to swag, and exciting giveaways. Our team is eager to share bright ideas, make brilliant connections, and have fun in the sun in San Diego, so schedule some time with us below.

3. Fun Events to Attend at Apartmentalize 2022

Don’t forget to fit in fun activities during the event to unwind and connect with industry peers and partners. Consider attending these special evening events:

S’mores On The Beach at Hotel Del Coronado

Your trip to San Diego won’t be complete without a stop at the beach to dip your toes in the ocean—that’s why we’re hosting a fun hang out on a private beach at the iconic Hotel Del Coronado on Wednesday, June 22. Join us for a gathering with fellow peers, fun conversations, and roasted marshmallows as the sun sets. RSVP below.

[Jun 15, 2022 Update]: All the available spots for our S’Mores on the Beach event have been filled. If you still want to meet with our team during the event, schedule some time with us here.

Rooftop Happy Hour at HardRock Hotel – Limited Capacity

Stop by the jointly hosted happy hour by Friends of NAA at FLOAT Rooftop Lounge. Meet us for welcome cocktails, hors d’oeuvres, and the best views of the city to kick off the event. Be sure to RSVP below as spots are limited and filling up quickly.

Friday Night Farewell Party

Close out the conference with a bang at the San Diego’s historic Gaslamp Quarter. The National Apartment Association is hosting a block party in two full blocks dedicated for Apartmentalize attendees. It will feature 13 restaurants, musical acts, photo opportunities, games, and activity stations. Find the event’s full details here.

With the onset of the pandemic, the usually innovation-averse multifamily industry was forced to embrace new technologies. Today, those automations and technology platforms are becoming the standard in property management.

While artificial intelligence (AI) remained at the tail end of technology implementation, the industry is finally realizing its potential roles in improving leasing, operations, and property performance. Below, our in-house technology and engineering expert explains the foundation of AI, its impact on risk management, common misconceptions, data challenges, and integrated solutions.

Interview With Multifamily Engineering Executive: 4 Takeaways to Unleash the Power of AI Risk Management

With two decades building software solutions and creating and scaling cloud-based statistical analysis system (SAS) solutions in the multifamily space, our chief technology officer Sudip Shekhawat is no stranger to innovation.

“AI goes back well beyond 20-25 years, when all we knew about AI came from ‘The Terminator’. We really just didn’t exactly know how to use it. To me, ‘augmented intelligence’ sums it up better. That says that anything you can do as a human being we can augment the intelligence positions through machine learning and machine processes.”

While twenty years ago artificial intelligence was out of reach for many operators, today it’s a necessity, offering tools to streamline business operations and accelerate growth. Shekhawat dispels some common misconceptions about AI technology and discusses the main challenges and opportunities ahead:

1. Data Is the Foundation of AI & Machine Learning

Thanks to self-driving vehicles and the widespread use of chatbots, most people now have a basic idea of how the technology works. However, AI is still often confused with analytics applications, or misunderstood as technology that is too complex and out of reach. Shekhawat reminds us that AI is all about data.

“It’s critical to remember that without data, there is no AI. The recording of data and the access to those recordings, as well as the digitization of more processes helps us to build AI and enhance machine learning. We are sitting on this wealth of data supplied by property management systems. There is an immense amount of untapped potential in that data.”

2. Data-Driven AI Is Transforming Risk Management

AI gained its first foothold in multifamily in leasing and marketing, but the opportunities to optimize operations through AI go much further.“There has been a lot of focus on using AI for human interactions in the leasing offices and organizationally, with chatbots, as well as lead generation and lead management,” Shekhawat explained.

“It’s making more inroads to creating better customer experiences, increasing operating efficiencies and improving decision making. With better decision-making, we can optimize asset performance and better manage risk. That’s where I think AI is going, taking on risk management.”

Shekhawat believes that through the use of AI in fintech and insurtech platforms, multifamily companies can make more accurate forecasts for their assets. When AI has access to the data and analytics, machine learning can drastically improve the process of underwriting, asset insurance and claims.

“The application for AI in insurtech has been developing a faster claims process and quicker fraud detection,” Shekhawat said. “Those are two areas where other industries have seen great success with AI.”

3. Multifamily Data Protection Challenges

While AI has the potential to continually improve property performance, the increasing data volume can create challenges for the industry in terms of data storage and protection. Shekhawat illustrates this concept with a good example.

“Virtually all property management is through software right now. Each transaction, each event is being recorded somewhere and generating a data point. Each day, we get exponentially more data points. With so much data, the challenge is how to store and access the data securely.”

Increasing data volume can slow down data analysis and make it difficult to determine which data points to prioritize. Operators are strategically deploying AI to run multiple scenarios, significantly streamlining the process to identify the most optimal business approaches.

“AI enables you to make decisions faster because you’re not looking at the data on a granular level. You’re not just looking at raw data over a set period of time. AI should save time and impact the bottom line. It should continue optimizing and improving asset value.”

4. Overcoming Data Gaps Through Fully Integrated Solutions

When it comes to integrations and the ability to overcome data gaps, it’s important to select the right AI supplier/partner who can bridge the gap.

“Do they have sound and seamless integrations, or is that going to take time to develop? Are they aligned with your organization’s long-term focus? These are questions that must be answered. Suppliers must be data driven, think data first, and be a data organization. As suppliers, we have the responsibility of solving for missing data points.”

Moving forward, multifamily must seek out opportunities in the lease lifecycle that are optimizable through AI. It is imperative to look outside the industry for potential solutions and partnerships. Most importantly, organizations need the right processes and people in place to collect and record the important data required to effectively derive the benefits of AI.

“Fifteen years back, somebody said, ‘Data is the new oil.’ They were so right. Now, what you do with the data is the new oil. Data and AI technology will enable firms to make more informed decisions, but I think AI is still in its infancy in multifamily. We have a lot of runway yet to be covered.”

To get full insights from the industry analytics and business intelligence veteran, read the full article here.

The Covid-19 pandemic is finally fading away, and the ensuing economic recovery and employment growth have fueled unprecedented demand for apartment homes. That demand has led to off-the-charts rent growth.

To optimize this momentum, operators are seeking competitive advantages in their efforts to land prospective residents. Unfortunately, resident preferences are a moving target. They now prioritize customization, convenience and modern technology in the form of flexible rent payments, deposit-free move-ins and remote work accommodations.

During the recent webinar, Tech Hacks That Boost Lead Conversion Without Sacrificing NOI, moderated by LeaseLock Chief Revenue Officer Ed Wolff, industry leaders explored strategies for meeting current renter preferences.

A Balancing Act: Lease Concessions vs. Economic Occupancy

The key, according to webinar panelists, is balancing incentives and concessions with economic occupancy. While upfront lease concessions may help to fill vacancies, they don’t help to protect against bad debt or bolster property level budgets. In fact, short-term promotions often result in long-term liability by attracting high-risk renters and exposing operators to unrecoverable debt.

Short-Term Promotions = Long-Term Liability

Multifamily management companies are increasingly turning to tech solutions to future-proof their operations while also boosting the volume and quality of leasing funnel activity.

“What we are seeing that is different this year is an influx of leads that are coming into our onsite teams,” said Jennifer Staciokas, Executive Managing Director of Property Management at Western Wealth Capital. “You may think of that as being a positive, but at the same time that requires our onsite teams to handle more leads that may be unqualified.”

Staciokas said Western Wealth Capital (WWC) has deployed lease-nurturing solutions and automation tools like chatbots and voicebots to streamline the applicant screening process.

“It’s all about attracting the right residents,” Staciokas said. “You have to be really mindful of the promotions that you’re offering. You don’t want to sacrifice your collections and your economic occupancy for that quick fix on the front end.”

Marcie Williams, CEO at RKW Residential, said mitigating that risk upfront is essential. At RKW, that has meant retracting some of the tech solutions deployed during the pandemic.

“By allowing prospective residents to tour the apartment by themselves and by allowing them to apply online, what’s happening is it’s increasing fraud,” Williams said. “When we only have one or two apartments available, it really becomes detrimental to our business. We have disabled online leasing and we’re inviting qualified applicants to lease rather than letting anyone do it whenever they want.”

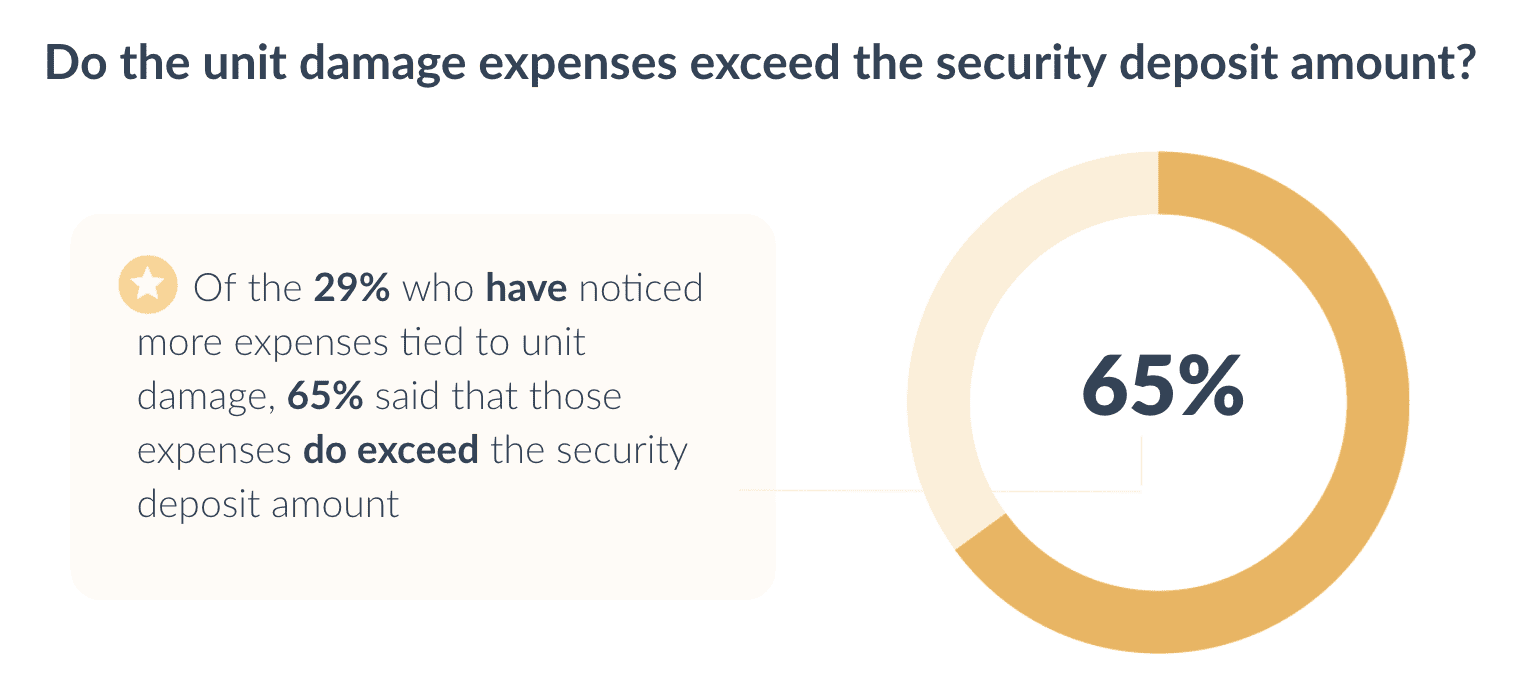

Consider the risk security deposits are meant to protect against — 65% of operators in our 2021 survey said unit damage expenses exceeded the security deposit amount. What happens to operators if the resident doesn’t pay rent or moves out, leaving significant damage behind? In the long-term, move-in incentives introduce risk as promotions like gift cards or first-month-free offers may attract an applicant profile characterized by less financial stability and higher damage risk.

Harnessing Greater Risk Predictability During Economic Uncertainty

Both RKW and WWC shifted their approach to prioritize renewals over new leases, and enhanced their screening processes to include AI screening, ID authentication and pay stub verification. They also implemented LeaseLock to replace security deposits and increase protections against property damage and rent loss.

“Lease insurance was a large initiative of ours last year, just to make sure we have more protection than a traditional security deposit,” Staciokas said. “If you have $500 for a security deposit, and we can now get $2,500 coverage (via lease insurance), that is certainly going to reduce bad debt.”

It also increases flexibility for renters, who may struggle to produce the funds for a security deposit. LeaseLock enables residents to pay a monthly fee in place of prohibitive upfront deposits. Coupling LeaseLock with options like flexible rent payments helps operators meet renter demands for customized payment options, which is crucial as more workers become part of a gig economy.

“Residents want what they want when they want it and how they want it. What has fundamentally changed is how we serve our residents to give them more options,” Williams said. “We want to incorporate that into the way we operate, but we have to mitigate the risk upfront rather than being too proud of 100% occupancy. We’re using screening verifications up front, and LeaseLock has been a tremendous value on the back end.”

Integrated Technology That Delivers True NOI Impact

In today’s multifamily environment, integrated technology solutions that enhance one another and create opportunities for new efficiencies deliver the biggest impact on NOI. Solutions that enable centralization of on-site tasks and non-resident-facing positions, while also solving for specific operational pain points, maximize property performance.

“If the technology cannot integrate, we stop the conversation. If it can’t integrate with all the other systems we’re using, it’s not going to work,” Williams said. “It’s not fair to our teams, especially if we want to retain our talent, because it makes their jobs harder. With all of these technologies and all the tech sprawl, integrating into a platform that is easy for the residents to use and easy for the operators to use is the ultimate game-changer. That’s time and money well spent.”

The rapid advancements of technology in the multifamily industry demand decision makers to develop a working knowledge of their capabilities. In order to improve operations while streamlining workflow, operators need to deploy technology solutions that seamlessly work as one. That’s where understanding whether or not the proptech solutions are interfacing or completely integrated becomes essential—the difference can make a huge impact on a team’s efficiency and daily processes.

Why Integrate, Not Just Interface?

An interface—also known as an information bridge—is interconnection between products where systems communicate under limited capacity. Data is maintained in multiple locations and requires some form of manual administration. The relationship doesn’t allow data to sync in real-time, which leads to inconsistencies and inaccuracies.

Unlike an interface, software integration combines products to function as a single source solution. Operating from the same database instead of passing information across a shared boundary, integrated products combine data, reporting and workflow across a single platform to provide a unified user experience. Integration allows all system components to seamlessly connect and work together; thus improving capabilities through automation and accelerating workflow performance.

5 Essential Questions to Ask When Shopping for Proptech Solutions

At the rate the multifamily industry is modernizing, most operators are looking for a system built from components that act and perform as one. A firm grasp of what a proptech solution can and can’t do is therefore vital before deployment.

Below are the five essential questions multifamily operations should ask potential supplier partners to reveal a product’s true capabilities:

- Is the product compatible with the property management system? To avoid tech silos, solutions must include two-way communication with property management systems (PMS) and other best-in-breed tools. The impact of proptech is optimized when access and controls are centralized.

- How does the product fit into the existing workflow? A fully integrated system will seamlessly expand the capabilities of the existing workflow, reducing the amount of required training and support. An interfaced product may function completely differently than native software, requiring the user to switch back and forth between applications or to get product-specific training.

- What steps are required to synchronize and exchange data? An integrated platform will automatically update across the system in real-time with a single data entry, whereas a software interface will require either periodic updates in multiple locations, or regularly scheduled synchronization.

- Is mapping maintenance required? While truly integrated proptech shares codes with existing applications, interfacing products may need to be mapped in order to enable syncing and transfer data, and those mapping directories need to be continually monitored, maintained, and updated.

- Is the solution scalable? Integrated products automatically scale alongside the property or portfolio, unlike interface-based proptech which typically needs to be manually updated on both sides of the information bridge as the property or company grows.

To learn more about the important differences between interfacing and integrating products as well as get examples of fully integrated proptech solutions, read the full article here.

Two years since the start of the pandemic apartment leasing is returning to pre-COVID levels. Data sourced from PMS integrations shows this momentum with a 136% jump in leads and 20% more applications since the same time last year. Google searches for “apartments for rent” have also seen a 22% uptick since the start of 2022.

As a result, multifamily firms are ramping up their efforts to win over prospective residents by adopting new tactics and promotions to attract, convert, and delight renters.

At the same time, however, the industry is facing the ongoing challenge of staff shortages. Leasing success in today’s world also means making day-to-day operations easier for property teams, so adopting leasing technology solutions isn’t a nice to have anymore—it’s a must.

With the wide variety of options available to renters and a market continually saturated with deals and discounts, what should operators deploy to boost lead conversion without sacrificing NOI?

A Balancing Act: How Lease Concessions Hurt Economic Occupancy

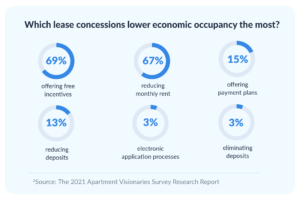

Gift cards, deposit waivers, and first-month-free discounts have historically been popular economic incentives operators leverage to drive lease conversion rate. In our 2021 Apartment Visionaries Survey, 60% of property-level respondents said that offering free incentives improved the likelihood of lease signing; but at what cost?

Among corporate leadership, 69% of respondents cited these financial concessions as hurting economic occupancy the most. This disconnect illustrates that while lease concessions may help draw in residents, converting leads should not be the only objective of your firm’s leasing season strategy.

If the majority of lead conversions are driven by economic incentives, yet economic occupancy suffers—it’s time to reconsider your strategy. To really succeed, operators need a strategy that maximizes NOI, reduces bad debt, and protects economic occupancy.

4 Technology Solutions that Boost Economic Occupancy

For multifamily operators, 2021 was another year filled to the brim with technological acceleration and adoption. Equally, renters are getting savvier and their demand for convenience and flexibility is growing.

Not all technology solutions are created equal, and some can often cause more problems than they solve. It’s paramount that operators invest their time and resources in the right tools to achieve peak performance and drive the biggest returns.

To make your job easier, we have shortlisted four technologies that streamline the leasing process, improve lead-to lease conversion, and ultimately drive NOI:

1. Deposit Replacement Insurtech Platform – A data-driven risk platform that replaces security deposits with lease insurance helps convert leads while also sufficiently protecting properties against rent loss and damage.

2. Chatbot Functions – With the help of chatbots, operators can automate engagements with prospective residents and gather more applicant information upfront, producing higher quality leads.

3. Artificial Intelligence Solutions – AI solutions automate leasing operations and gather insights about different touchpoints renters engage in prior to property visits, helping property managers increase their lead-to-lease conversion rate.

4. Self-Guided Tour Technologies – Most multifamily properties have deployed some form of self-guided tour platform, so this technology has now become a must-have in order to stay competitive.

Free White Paper: 4 Leasing Season Tech Hacks That Boost Lead Conversion Without Sacrificing NOI

To learn more about the four technology solutions and how they can make a real impact on your renter experience and deliver a competitive advantage to drive more lease signings, download the white paper:

Ready for Peak Leasing Season?

Identify where your opportunities are this leasing season with a free NOI assessment. Learn custom insights into bad debt reduction, NOI lift, and asset value appreciation to help you build a successful leasing season strategy and better equip your teams to achieve peak performance:

[cta_button link=”https://leaselock.com/contact-us/?utm_source=whitepaper&utm_medium=cta&utm_campaign=leasing-season-2022″ text=”Free NOI Analysis”]

LeaseLock is proud to serve as a sponsor for the 2022 edition of 20 fo 20, the industry’s leading executive survey on multifamily operations and technology. This year’s report provides a unique executive viewpoint on the current and future state of leasing operations and best-of-breed vs. bundled tech. Featuring 20 conversations with senior multifamily executives, the survey also includes perspectives from Domuso, LeaseLock, AppFolio, Latch, and Anyone Home on trending technology priorities.

As with previous editions, the survey invites operators to recount the previous year and speculate on the upcoming year. While COVID has dominated conversations the past two years, this year’s edition focuses on how companies are exiting the pandemic, with new strategies and technology solutions to address talent management, rent payments, security deposits, AI agents, smart buildings, and centralized leasing.

Read LeaseLock’s sponsored viewpoint below, or download the full 20 for 20 white paper here.

How to Replace Deposits. For Good.

It seems that we are operating in a time of unprecedented innovation in the arena of resident financial services. An impressive tide of innovation is improving resident experiences, increasing affordability and streamlining financial transactions. And the streamlining part is more important than ever, as staff shortages continue to heap stress on property teams.

With hiring conditions so challenging, the problems that most operators are trying to solve are the ones that reduce site team workload. Even when operators identify potential financial opportunities, few will consider exploiting them if they entail additional work.

The good news is that there is a win-win to be had. A growing segment of the multifamily industry has taken a step that creates more affordable move-ins for residents while boosting financial performance for properties. Companies that completely remove security deposits from their communities can reduce administrative overhead with no additional effort from site teams. It may seem too good to be true until we consider the impact security deposits have had on our industry since time immemorial.

Three Reasons Why Deposits Must Go

First, deposits account for most of a community’s bad debt—even in properties that don’t have a bad debt problem. Screening helps properties to mitigate credit risk, but even the strictest credit checks cannot cover lost rent and damage when a resident moves out. Companies collect deposits for this reason, but when a resident leaves with unpaid rent or damage amounting to a dollar value higher than the security deposit, the balance is bad debt.

Second, deposits are becoming increasingly risky and burdensome as more and more legislations apply renter-friendly deposit laws. As one client shared: “We were getting lawsuits every week over a few hundred dollars.” In states where “Renter’s Choice” laws stipulate that operators must offer an alternative to a security product, many operators reach for “deposit alternative” products. But few realize that those products are surety bonds, meaning that the bond provider retains the right to collect on payments from the former resident.

Finally, deposits negatively impact customer experience, both on move-in and move-out. They place a financial hurdle in the leasing process, creating sticker shock in markets where competitors no longer require deposits. And on move-out, nothing guarantees negative online reviews quite like a dispute over a security deposit.

Replacement > Alternative

The trick is to think about the problem the right way. To cut bad debt, minimize risk and workload, and improve customer experience, operators have to seek a complete replacement for deposits, not simply a deposit alternative.

Security deposits are designed as a crude form of insurance against property damage and rent loss. In 2022, we should be solving insurance problems with insurance solutions. That means operators purchasing the level of coverage that they need at a competitive price. They can recoup the cost of the insurance by offering residents a monthly deposit waiver charge.

When offered the choice between a monthly waiver fee or a security deposit, few prospects opt to pay the deposit. With the vast majority of leases insured, deposits become, at worst, a marginal feature of property management. And in an environment where property operations are likely to be stressed for the foreseeable future, deposits are one problem that the industry needs to get off its desk for good.

For access to the full white paper, download your free copy:

[cta_button link=”https://info.leaselock.com/20-for-20″ text=”Get Free Copy”]