Sept 1st Rent Payments Dip After CDC Announces Eviction Halt — Still No Federal Rent Relief

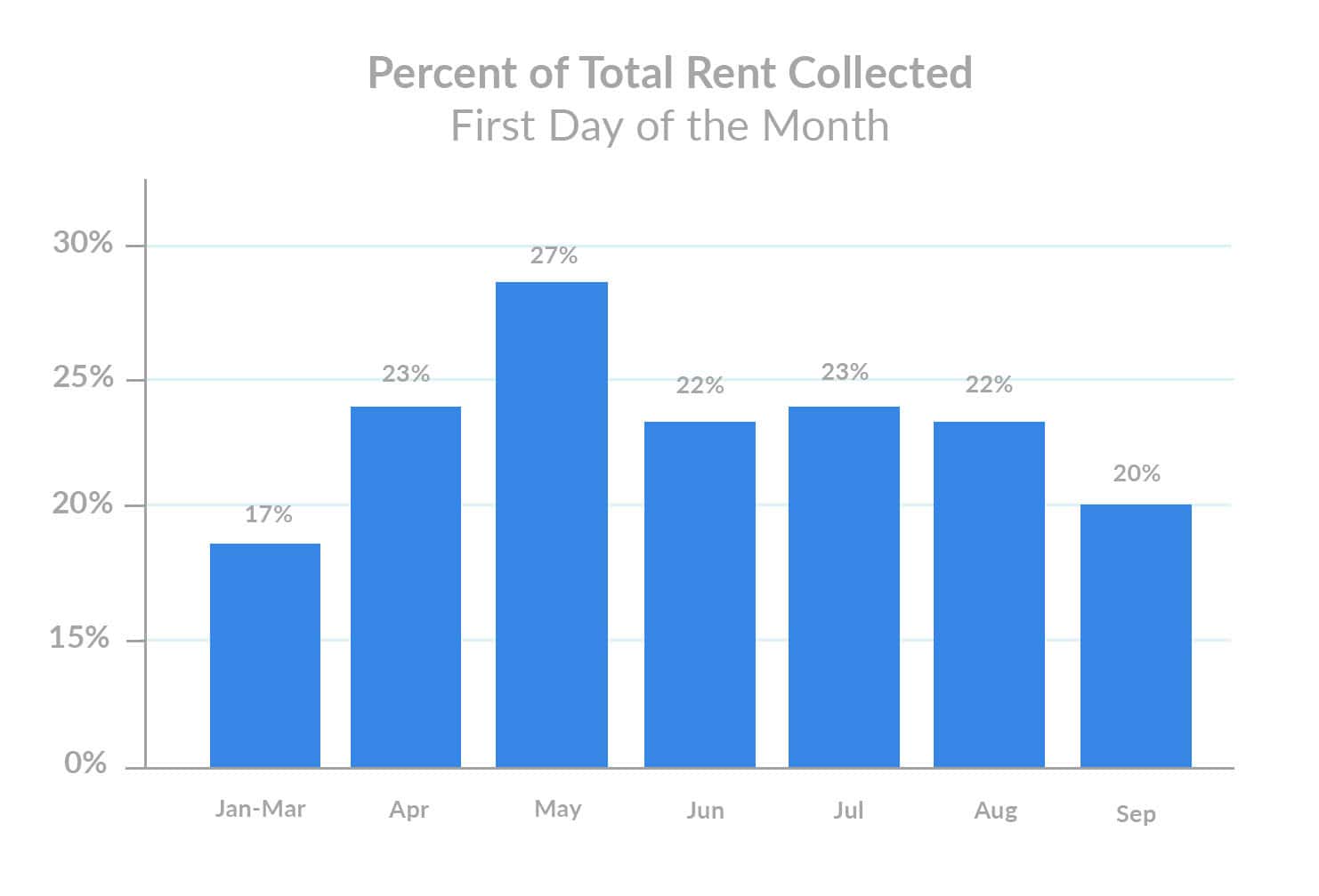

- Percent of September 1st rent collected dropped 2 percentage points MoM.

- Percent of renters who paid full rent on first-of-month hit a new post-COVID low.

- First-day rent payments dipped across all asset classes.

On the heels of a federal eviction halt issued by the CDC, September 1st rent payments have slightly weakened. While President Trump implemented a reduced round of unemployment benefits in August, there remains no comprehensive rent assistance program to supplement renter and operator protections.

After a decline in August 1st rent payments following the conclusion of the $600 weekly unemployment bonus, the multifamily industry has continued lobbying for emergency rent relief, but to no avail. In response to the Trump Administration’s eviction ban, Robert Pinnegar, President and CEO of the National Apartment Association (NAA), made a pleading statement:

“The National Apartment Association (NAA) is deeply concerned by this action and given that it remains uncoupled with robust emergency rental assistance, we understand the devastating effects a national eviction moratorium will have on the apartment industry, housing affordability and America’s 40 million apartment residents.”

Half a year since the onset of the COVID-19 pandemic, we now assess how America’s renters are making September 1st rent payments.

September 1st Rent Payments Slip More As Jobless Benefits Lag

Signs of financial insecurity have become more prominent since June, and September has continued the downward trend. Overall, first-day September rent payments have dropped 2 percentage points since August, but remain 3 points above the pre-COVID average at 20%.

President Trump reduced and extended the unemployment stimulus in early August. The extension is likely to help prop up renters who have been hardest hit, but unemployed individuals weren’t expected to be cut checks until late August. While retroactive to August 1st, benefits may not be sent in some states until September or October (states have until September 10, 2020 to apply for FEMA approval).

It’s worth noting that first-day rent payers represent a reliable segment of renters who regularly pay on the first of the month. Since we first began tracking rent payment behavior in April, we’ve seen a pattern of first-of-month rent payments coming in at a higher percentage than throughout the grace period. On September 1st, however, the percent of renters who paid full rent has hit an all-time low post-COVID.

This further substantiates the need to implement a federal rent assistance program in order to support financially insecure renters and enable owners to meet financial obligations.

New Eviction Moratorium Comes Without Federal Stimulus Package, Leaving Apartment Industry Hanging

On the night of September 1st, the Trump Administration announced an unexpected eviction moratorium ordered by the CDC which prevents evictions for nonpayment of rent starting Friday, September 4th. With an expiration date of December 31st, the order protects renters with annual income levels at or below $99,000 or $198,00 for dual income households.

The order comes as a surprise to the rental housing industry. As such, the NAA delivered a statement:

“This action risks creating a cascade that will further harm the economy, amplify the housing affordability crisis and destroy the rental housing industry.”

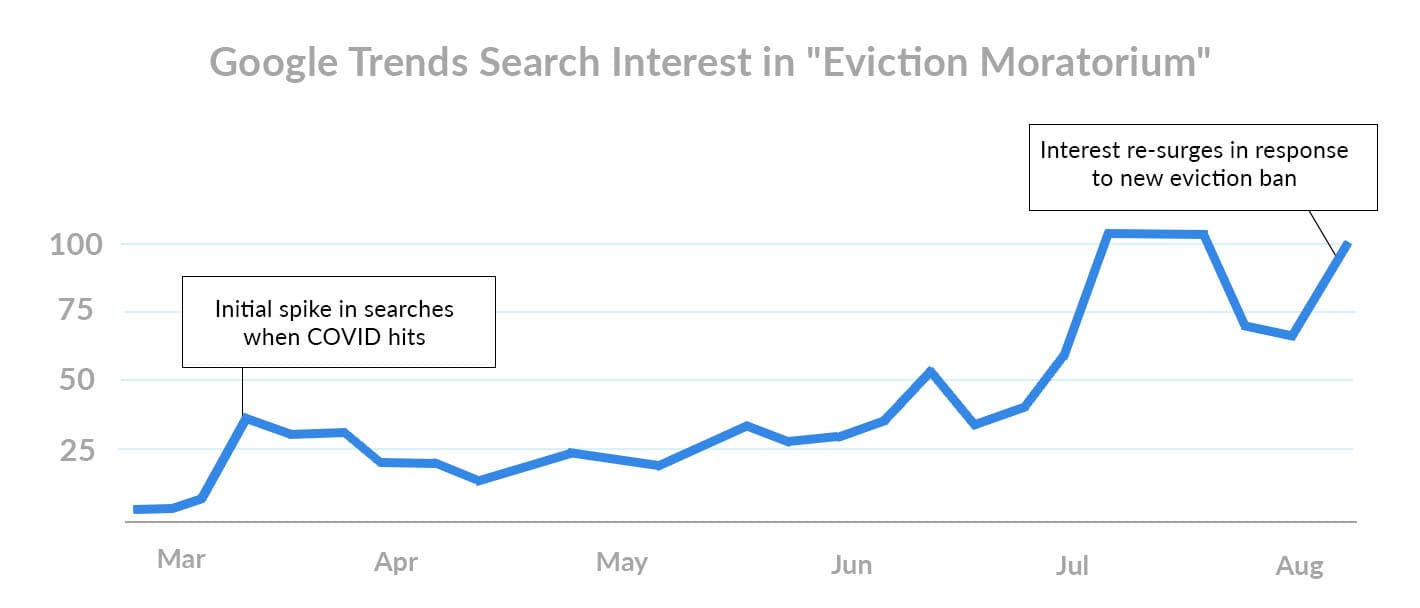

In light of the news, search interest for “eviction moratorium” spiked again. With the rollercoaster of eviction legislation at the local, state, and federal levels, the latest ban adds to the confusion and further burdens the apartment industry.

In late August, 1 million unemployment claims were filed. The pace at which the unemployment picture is improving has slowed slightly, meaning emergency rent assistance programs across that nation have remained critical — although insufficient — to jobless renters.

Rent Payments Dip Across All Asset Classes, Highlighting Housing Affordability Crisis

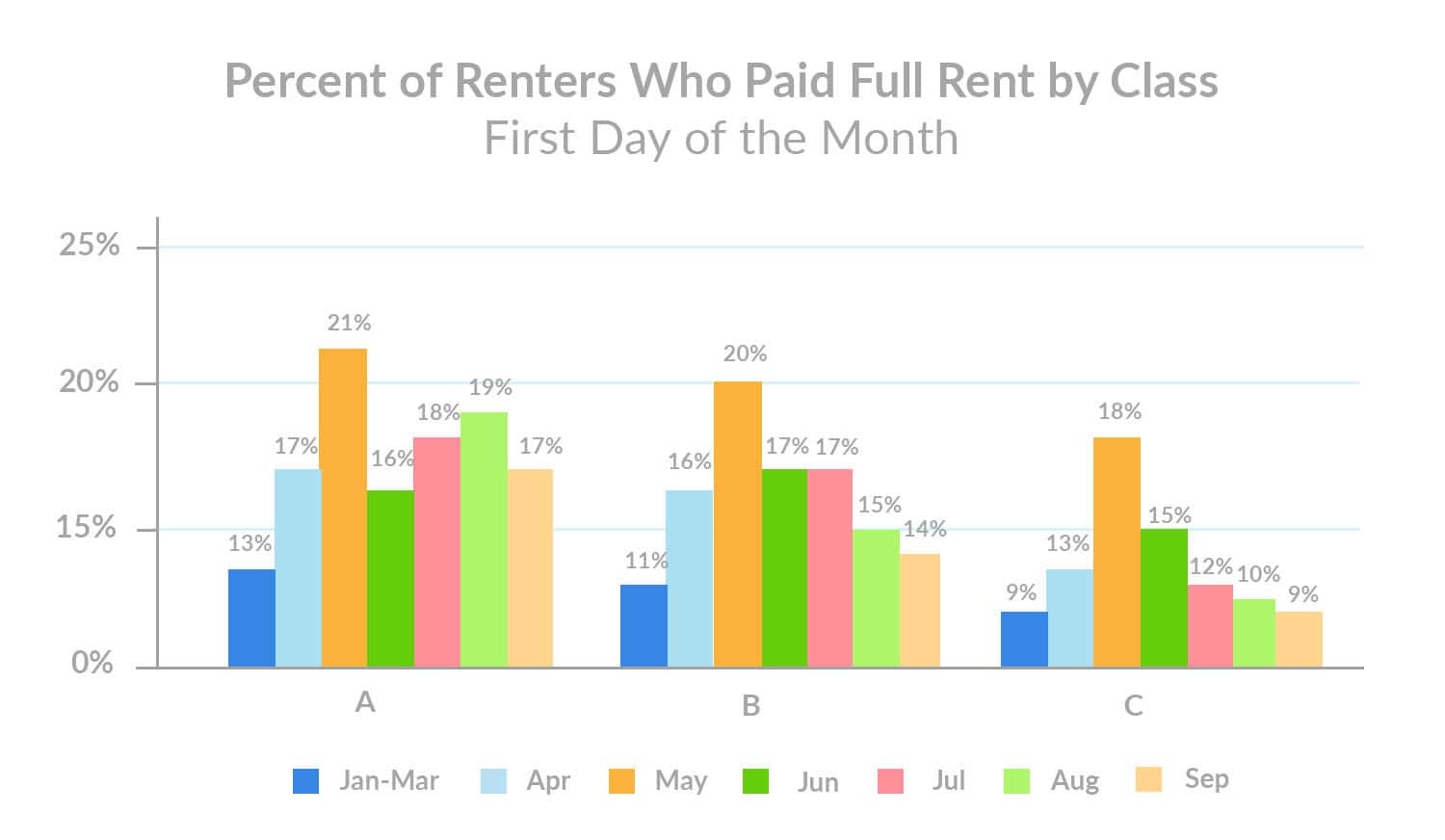

Class C properties have been a cause for concern lately with declining rent payments, however, all asset classes have seen month-over-month dips on September 1st.

Class A first-day rent payments experienced a 2 percentage point decrease from August, while Class B fell 1 percentage point — both sit a few points above the pre-COVID average, but indicate financial strain nonetheless.

The most vulnerable renter segment — Class C residents — showed a dip in rent payments, too. First-day rent payments at Class C properties slipped 1 percentage point from August, holding at the pre-COVID average. These numbers are expected to taper off through the grace period due to delayed and reduced weekly unemployment assistance, as well as the absence of comprehensive rent relief. This jeopardizes the affordable housing supply.

California and Texas Rent Payments Weaken

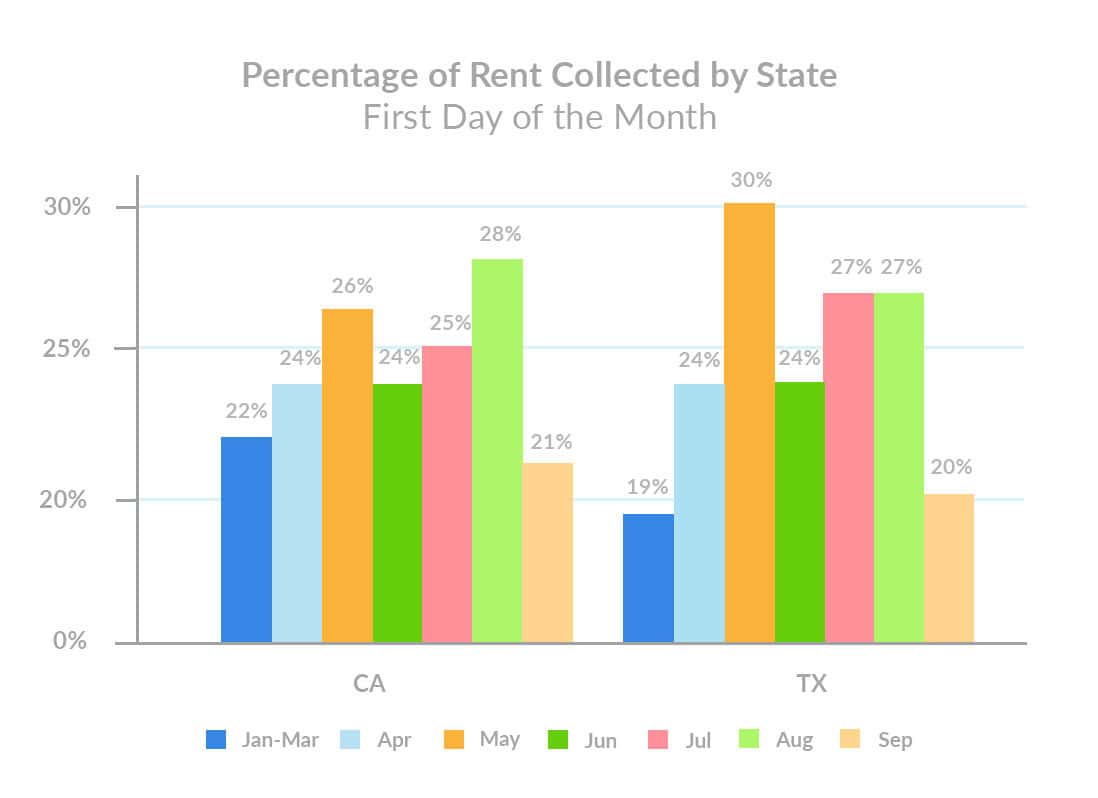

Renters in California continue struggling to make first-day rent payments in September, with the percent of renters who paid full rent falling 7 percentage points since last month. On the same day, Governor Newsom signed the COVID-19 Tenant Relief Act, which prohibits evictions for renters with legitimate pandemic-related hardships. Texas rent payments also dropped 7 percentage points month-over-month, holding only slightly above the average.

Even with a $10 million legal defense fund and a $100 million rent relief program, the percent of Los Angeles renters who paid full rent on September 1st dropped 4 points since August. Dallas also echoed Texas’s weakening rent payment behavior, seeing a 3 point drop after a strong performance last month. A new CARES Act short-term rent assistance program in Dallas is set to “open in the coming weeks,” meaning relief could be delayed.

Multifamily Concerned By Lack of Universal Rent Relief—September Grace Period Likely To Drop

While those unfamiliar with the multifamily industry may assume the eviction ban is good news, the National Multifamily Housing Council has expressed dissent. Doug Bibby, president of the NMHC, explained to the New York Times,

“Not only does an eviction moratorium not address renters’ real financial needs, a protracted eviction moratorium does nothing to address the financial pressures and obligations of rental property owners.”

And as unemployed renters across the nation await reduced benefits to be dispersed, it’s likely rent payment behavior will bear more and more uncertainty in the months to come. That’s why it is crucial that multifamily lobbies for a universal rent assistance package to prevent a rental housing collapse.

Important statistical note: Despite the measured payment fluctuations based on the sample set, the variance is within normal statistical range. In other words, the changes are not necessarily significant enough to attribute specifically to COVID-19 versus normal fluctuations expected across the data set. Please reference full Methodology below.

Methodology

Rent payment data is actual transactional data sourced from integrations with property management systems in the multifamily industry.

Analysis includes a 105,070 unit sample from 1,029,428 live units under management by LeaseLock clients. Data is nationwide, representing over half of the NMHC Top 10 property managers in the country and all asset classes (A, B and C). Asset class composition: class A (39%), class B (43%) class C (18%).

All data has been anonymized to remove personally identifiable information for renters and property managers.

Leave a Reply

Want to join the discussion?Feel free to contribute!