April Rent Payments Trend Downward: Data Suggests Impact Across Several US Markets

Important statistical note: Despite the measured payment decline based on the sample set, the variance is within normal statistical range. In other words, the decline is not significant enough to attribute specifically to COVID-19 versus normal fluctuations expected across the data set. Please reference full methodology in footnote.

As we move towards the end of the 5-day rent payment grace period, the data trend suggests that fewer American renters will make April rent payments on time compared to previous months. This downward trend first observed in cities like Seattle is starting to reveal itself in other major metro areas such as Los Angeles – as we’ll explore below.

Although the first day of the month (April 1) saw a slight uptick in rent payments — a mix of both reliable full-payment renters and good faith partial-payment renters — the trend has since moved downwards.

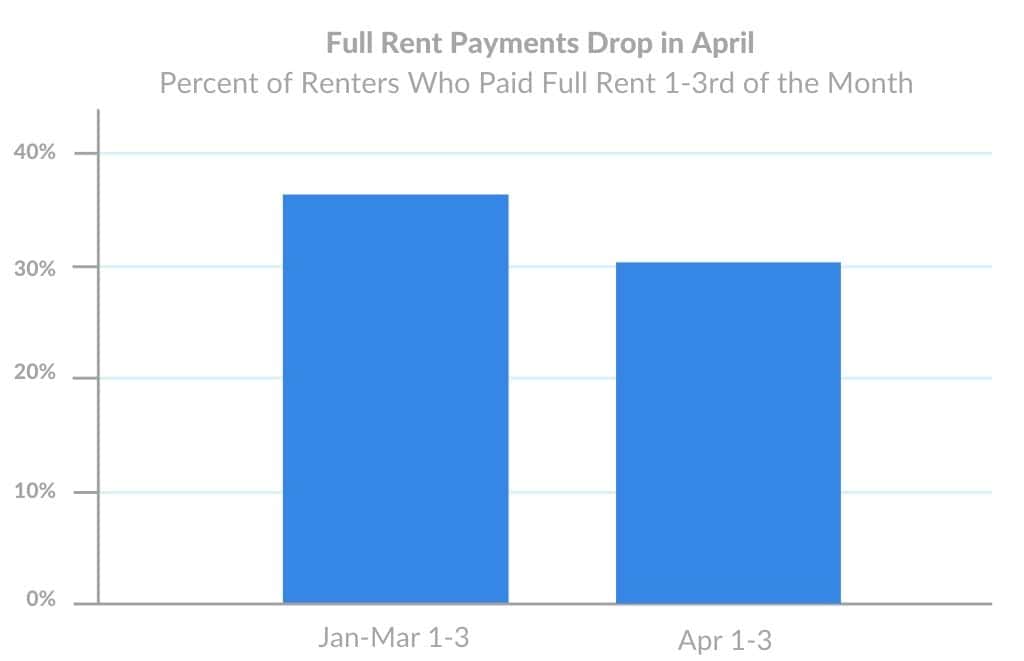

By the second day of the month (April 2), there was a slight decrease in full rent payers (-1.17%) when compared to the same period in January through March. By the third day (April 3), the percent of renters who made full payments over the first three days of the month (April 1-3) dropped by 5%.

The percent of renters who made partial payments dropped even lower over the same period in April — by 7.5%. While it’s still too early to conclude the number of renters who will default in April, the data suggests a continued downward trajectory moving into Monday, April 6, when the grace period ends.

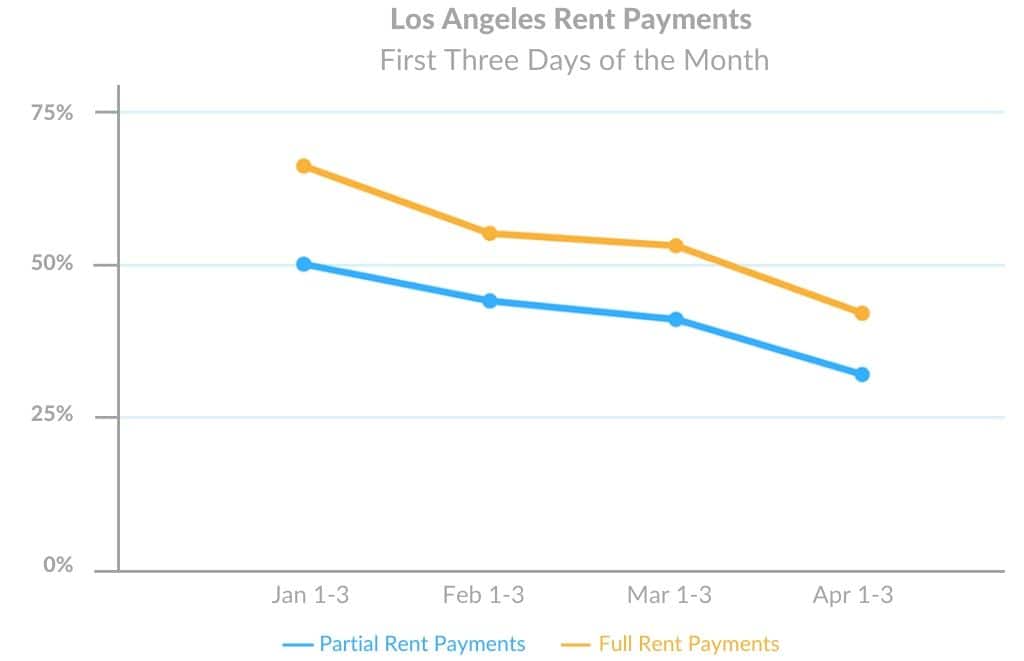

A range of major US cities are seeing a similar downturn, with Los Angeles in particular seeing a steeper than average drop in April rent payments thus far.

Los Angeles was one of the early leaders in implementing a “shelter in place” order, beginning March 19 — nearly a week before most major metros. The percentage of renters who paid full rent on the first 3 days of April compared to the same period in March dropped by 8%, while the percentage of renters paying partial rent dropped by 10%. This decline in rent payments in a single month may be due in part to the early shelter-in-place measure, along with the eviction moratorium passed on March 23rd.

Beyond our measured data set, senior executives across the multifamily industry are self-reporting to LeaseLock better-than-expected payment trends across many US markets for April rents. Executives continue to communicate a spirit of preserving occupancy once eviction moratoriums are lifted, and we are measuring that in the data through observation of more partial payments (suggesting deferred payment plans are being deployed, among other resident support programs, aimed at helping residents impacted by COVID-19 retain occupancy).

We will be taking another look at rent payment behavior after the grace period ends, and will release the full Rent Payment Report on April 7th. To get regular rent payment data updates, subscribe to our COVID-19 Rent Loss Alerts if you haven’t already.

Methodology

Rent payment data is actual transactional data sourced from direct integrations with property management systems in the multifamily industry.

Analysis includes a 96,268 unit sample from 1,029,428 live units under management by LeaseLock clients. Data is nationwide, representing over half of the NMHC Top 10 property managers in the country and all asset classes (A, B and C). Asset class composition: class A (36%), class B (55%) class C (9%).

All data has been anonymized to remove personally identifiable information for renters and property managers.