Rent Control and Construction: Lessons From Seattle | May 27, 2025

It’s been well documented that the introduction of rent control in any form tends to slow housing construction.

Most recently, we’ve seen those drop-offs in development across places like St. Paul, MN, and Portland, OR, repeating the patterns established in spots such as New York City and the key California markets that have had some sort of rent control regulations or rent stabilization laws for a long time.

Important to consider when weighing the impact of rent control, areas where a pullback in development has occurred are spots where building was already really tough to do, whether because of limited land availability, high construction costs or other in-place regulatory restrictions.

What happens when rent control is introduced in an area that’s actually a comparatively busy construction zone that developers favor for its rapid economic growth and attractive renter demographics?

We’re about to find out, measuring what happens in metro Seattle now that rent control for some housing has been enacted across the state of Washington.

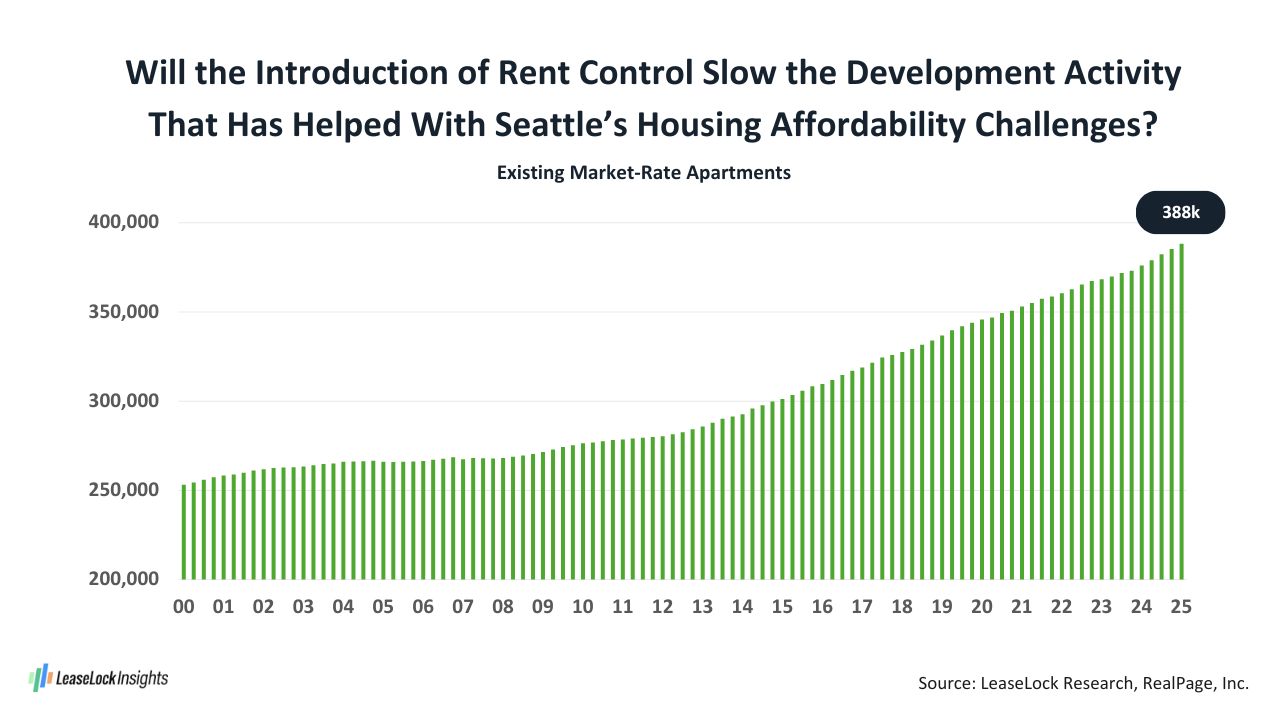

Measuring stats posted since the apartment sector began its recovery from the Great Financial Crisis of the late 2000s, metro Seattle has added roughly 113,000 market-rate apartments, growing the existing base of product by a whopping 41% from the late 2009/early 2010 total. There are Sun Belt locations that have experienced more aggressive building, notably the expansion volume of about 81% in Austin and Charlotte, roughly 74% in Nashville, and around 64% in Salt Lake City and Raleigh-Durham. But a 41% stock increase for a coastal market is stunning expansion, matching or even exceeding the increases posted in Sun Belt locations like Phoenix (41%), Houston (36%) and Atlanta (33%).

With so much building in metro Seattle leading to a constant flow of additions moving through initial lease-up, annual rent growth for new leases was held to about 4% on average in the 2010+ period. While that’s still a hair over the 3.6% U.S. norm, it’s clearly less than the pricing results that would have registered if construction activity/product availability had been held down to the levels seen in other locations along the West Coast.

It now seems like metro Seattle is positioned to experience housing construction that will trend downward over time. But the market probably won’t register the near-complete shutdown of building that emerged in some locations following the introduction of rent control.

Among the influences on these expectations, the metro’s economic growth prospects still look very promising, and it’s hard to ignore that much of the local populace consists of the country’s best-educated and highest-paid workers.

Also, the Washington state legislators didn’t go way over the top in establishing rent growth regulations. Allowable annual increases for the product subject to rent control rules are set at the local inflation rate plus 7%, topping out at 10%. That’s way under the typical yearly price bump seen historically. Furthermore, price adjustments are not limited when a unit turns over, and new construction is exempt from the rules for 12 years.

If legislators leave those restrictions in place and don’t go back in the short term to lower allowed price increases, metro Seattle could remain fairly attractive for many housing sector investors.

About LeaseLock

LeaseLock is the only true lease insurance program for rental housing. Our AI-powered underwriting solution – LeaseLock Shield™ – harnesses the power of machine learning to determine the best coverage for each property and portfolio’s specific needs. The result is ultimate protection from write-offs and legal risk as well as reduced operational burden. With over $10 billion in leases insured, LeaseLock is delivering significant benefits to both renters and investors while reshaping the way the industry manages risk. LeaseLock is dedicated to improving housing accessibility by removing financial barriers for renters while protecting against risk.