Breaking News: Proposed Pennsylvania Bill Makes Major Leap Towards Eliminating Deposits

Security deposits have long been the bane of renters and apartment operators alike, and a recently proposed Pennsylvania bill has taken a giant step towards eliminating them entirely.

What Does New Pennsylvania Security Deposit Legislation Mean for Operators?

Building off the recent Cincinnati Renter’s Choice Law, which requires landlords to offer deposit alternatives, a new Pennsylvania bill goes further to lay the groundwork for total deposit replacement.

In light of mounting renter affordability concerns in the face of COVID-19, this foreshadows a flood of deposit replacement laws to come. Here’s what this bill means for multifamily operators and their residents, and how it compares to other deposit regulations we’re seeing sweep across the country.

The Rising Tide of Deposit Laws

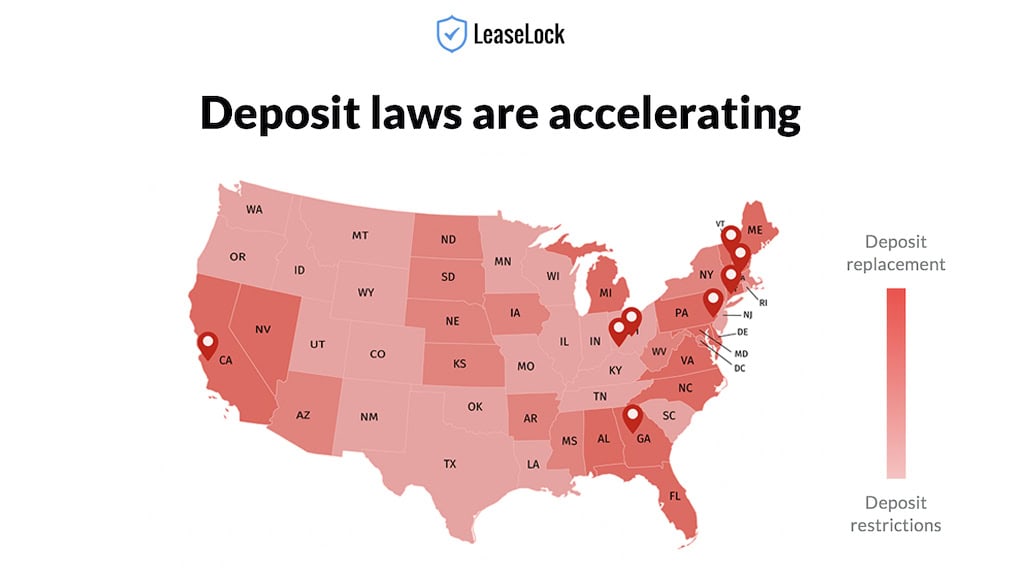

Legislators have been tightening the law around security deposits for years now. There are two forms of laws governing security deposits:

- Deposit restrictions: These laws involve tightening caps on deposit amounts, requiring deposit installment plans, and regulating how quickly deposit funds must be returned.

- Deposit replacement: These laws seek to replace security deposits with new solutions, such as lease insurance. Cincinnati began this movement by mandating deposit alternatives. However more recent legislation, such as the Pennsylvania bill, shows a growing movement toward replacing security deposits entirely.

While deposit restrictions have escalated for years, more recent deposit replacement laws signal a future where residents, operators, and property owners all benefit from a wholesale move away from deposits completely.

What Operators Need to Know About the Pennsylvania Bill

Similar to the Cincinnati law that recently went into effect, if an apartment operator requires a security deposit, a deposit alternative or payment plan must be offered as well. However, this bill also gives operators the choice to eliminate security deposits entirely through lease insurance.

Choices include:

- Deposit installment plans: The resident can pay the security deposit over the course of three months, at minimum.

- Lease insurance: Operators may offer lease insurance, which effectively eliminates security deposits entirely and insures the property on every new lease (although residents may still elect for a deposit). Unlike a deposit or surety bond, the typical lease is protected with over $5,000 coverage for rent loss and damage. Because the property is the insured party (not the resident), regulatory burdens are eliminated for operators at the site level.

- Surety bonds: Residents may bring their own deposit alternative, the primary example being a bond in which the renter is party to the insurance contract. With a surety bond, the renter pays a non-refundable percentage of the bond amount at move-in, which goes into a claims fund (where losses are managed at the property or carrier level). Bonds typically cover up to the amount of the deposit. With the renter party to the insurance contract, operators must manage additional consumer regulatory requirements related to insurance.

Additional requirements:

Security Deposit: For security deposits and installment plans, properties cannot collect more than two months’ rent upfront, which must then be held in escrow. The property is required to return remaining funds (and any interest acquired in escrow) to the resident within 30 days.

Lease Insurance: There are no such additional requirements for lease insurance, as no deposit is collected and the property is the insured party.

Surety Bond: Resident-sourced insurance products (such as surety bonds) create additional administrative requirements for apartment operators. Upon move-out, property managers must provide residents with:

- A copy of any claim filed

- Statements of the claims status

How This Bill Differs from Other Security Deposit Regulations

Both lawmakers and the multifamily industry have spent years putting band-aids on the broken security deposit system.

Cities like Seattle, Portland, and Chicago have aimed to treat symptoms of the problem by passing tighter restrictions on security deposits, requiring installment plans and lowering security deposits caps.

The Cincinnati Renters Choice law, as suggested by its namesake, was focused on giving renters choices. While inching closer to the goal line, the Cincinnati law fell a bit short of eradicating security deposits at-large.

Why Pennsylvania Bill Marks Growing Movement Towards Deposit Replacement

The next phase of legislation we see in Pennsylvania is now moving closer toward treating the root problem (rather than just the symptoms) by laying the groundwork to eliminate deposits entirely.

Renter affordability was already top-of-mind for lawmakers prior to COVID-19, and will undoubtedly accelerate this movement as the economic impact of the crisis ripples across the country.

The new Pennsylvania security deposit legislation shows lawmakers are paying attention and continuing to evolve legislation toward full replacement of security deposits as a financial instrument in rental housing. There is agreement among residents, operators, and owners that deposits need to go. Recent legislation suggests that deposits may be headed toward extinction faster than we all thought.