December 1st Rent Payments Uptick — Class C Properties Still Struggling

- Percent of rent collected on December 1st jumped 2 points MoM.

- First-day rent payments slipped across Class C properties.

- Lawmakers propose new $908 billion stimulus plan.

Last month was marked by uncertainty — a resurgent COVID pandemic, a complicated presidential election outcome, and stalled conversations around a new stimulus package all correlated with a dip in November 1st rent payments.

Following a shaky November though, lawmakers introduced a COVID relief proposal worth about $908 billion on Tuesday, and December 1st rent payments have rebounded. This is positive news for the multifamily industry, which has been under severe pressure to support both themselves and American renters impacted by economic fallout during the pandemic.

As bipartisan lawmakers revisit stimulus package negotiations to hopefully push through Congress, the rental housing industry is watching closely. Bob Pinnegar, president of NAA, expressed urgency, telling GlobeSt.com, “We are pleased that the latest COVID-19 relief proposal acknowledges this need, and look forward to working with our leaders to ensure the unique needs of the industry and our residents are addressed.”

It’s time to investigate how rent payment behavior by region and asset class is shaping up in the final month of 2020.

Strong December 1st Rent Payments Indicate Boosted Renter Morale

The larger part of 2020 has been dominated by declining rent payments, but the percent of total rent collected on the first of December increased 2 percentage points since November.

The uptick is a welcome change among the multifamily community who has grown accustomed to wavering rent payments. And while first-of-the-month payers tend to make timely payments on the first of each month, the small jump indicates a wind of change as far as financial security among renters.

Multifamily Pulling for Rent Relief By End of Year

Even if the election results and the prospect of rental assistance by the year’s end have restored renters’ confidence to pay rent, lawmakers and industry leaders understand the dire need for a stimulus package to pass still.

Since the 2020 election in November, legislative talks were at an impasse until December 1st when the $908 billion relief package was proposed. However, Senate Majority Leader Mitch McConnell has already rejected the measure, instead calling for a “targeted relief bill” that would hopefully be approved by Congress before December 11th.

In the meantime, rental housing providers and renters are hanging on a dangerous financial cliff. If Congress does not pass a new stimulus deal, many renters receiving unemployment benefits will no longer have assistance at the end of the month — the same time the nationwide eviction moratorium is set to terminate — and apartment operators will be forced to continue supporting the nation’s renters alone.

Relying on multiple eviction moratoriums and various rent assistance funds to protect America’s renters is simply inadequate in the face of an economic crisis and global pandemic.

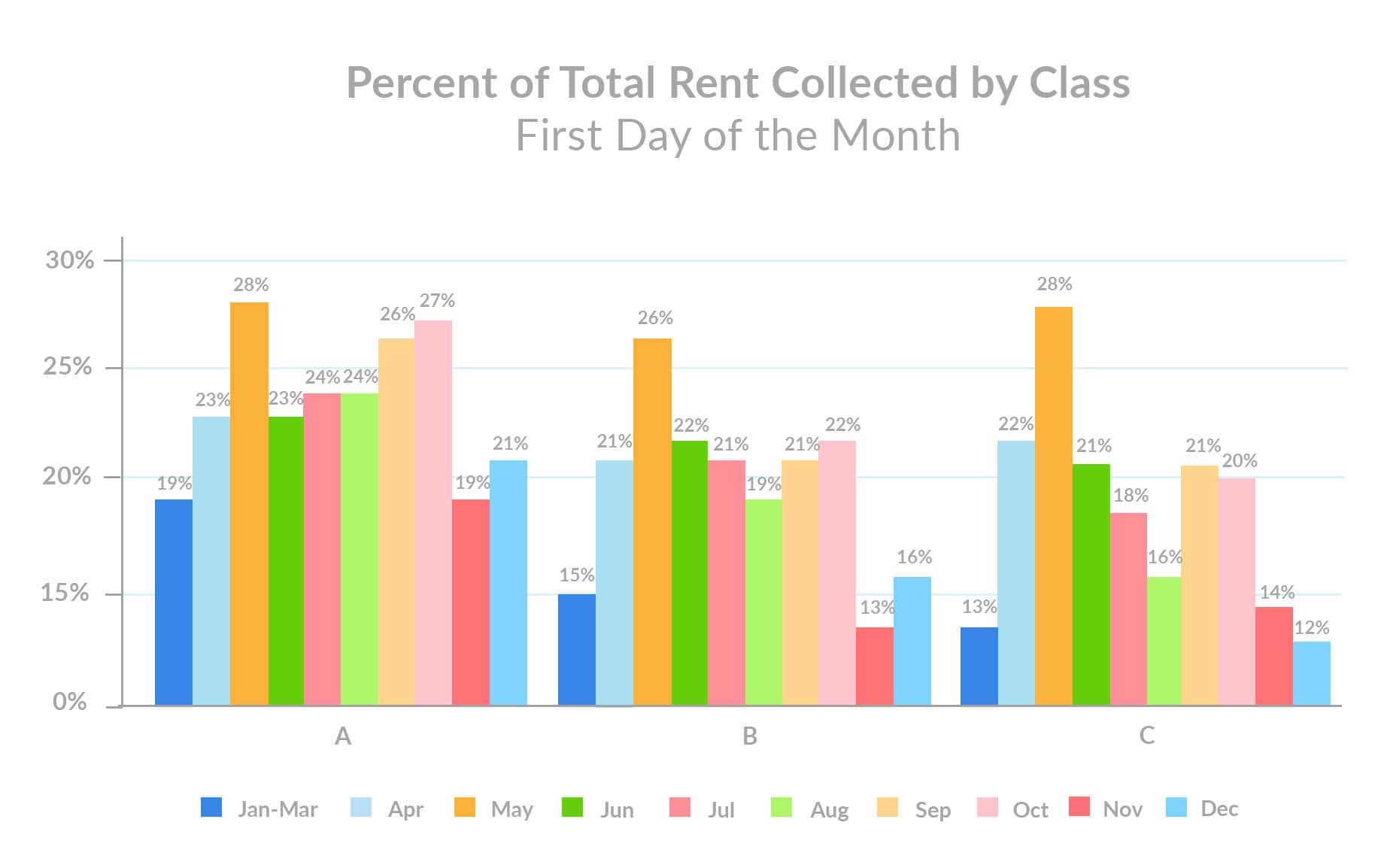

Class C Renters Struggle as Class A & B Properties Recover

The percent of total rent collected on the first-of-the-month has seen a month-over-month bump at both Class A and Class B properties. Class C properties, on the other hand, have experienced a 2-point drop since November.

Class B and Class A properties also saw notable falloff in rent payments on November 1st, but both have recovered on December 1st.

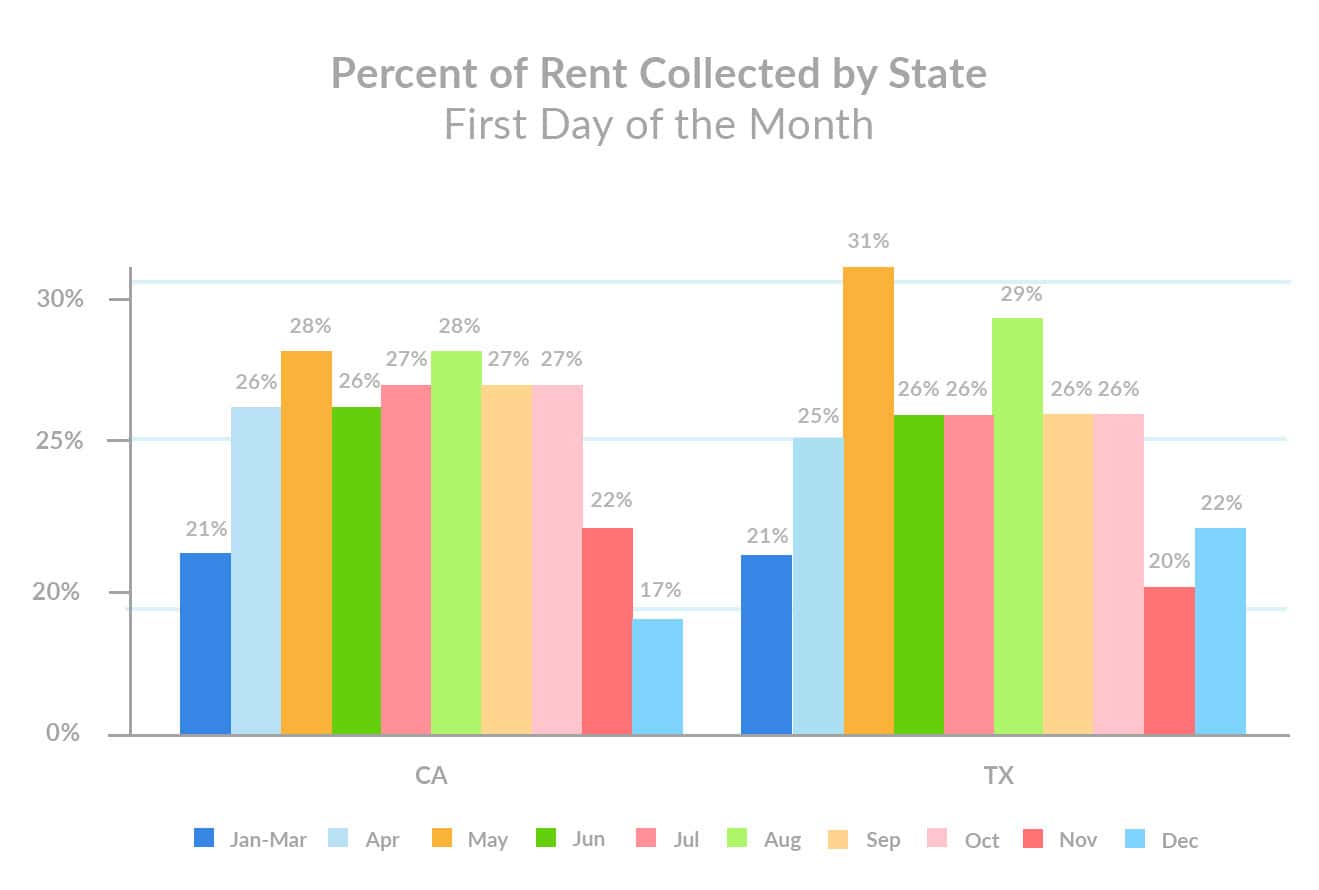

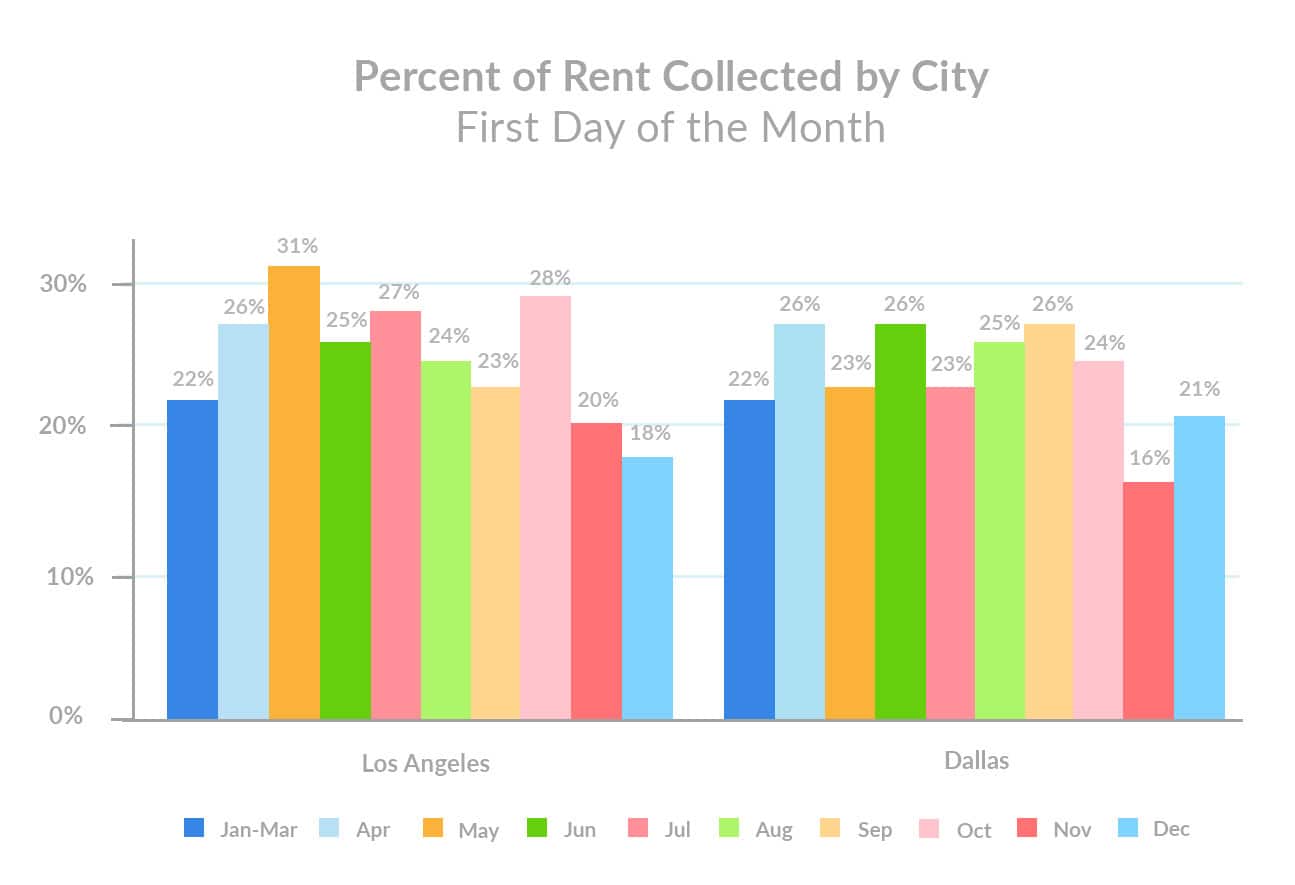

California Rent Payments Slip, Texas Rent Payments Pick Up

On the west coast, California renters are feeling the pain of an ongoing housing crisis compounded by a lack of state rent relief. The state logged a 5-point decrease in percent of rent collected on December 1st.

In Texas, rent assistance may be the critical difference between a significant drop last month and an uptick this month. On December 1st, the percent of rent collected climbed 2 points, surpassing the pre-COVID average.

At the local level, Los Angeles rent payments have mirrored the state’s decline, with the percent of rent collected on the first-of-the-month slipping 2 points. Dallas reversed its downward trend from last month, ticking up 2 points in percent of rent collected on December 1st and hovering just above the 3-month pre-COVID trending average.

Amid Worsening Pandemic, Lawmakers & Multifamily Leaders Sound the Alarm for Fiscal Relief

2020 may be winding down, but the focus on rent payment behavior is far from dissipating out of view. Apartment housing leaders will look to usher along legislative talks around emergency rent relief while providing support to renters in need. For now, we will continue monitoring rent payments through the grace period and remainder of the month.

Important statistical note: Despite the measured payment fluctuations based on the sample set, the variance is within normal statistical range. In other words, the changes are not necessarily significant enough to attribute specifically to COVID-19 versus normal fluctuations expected across the data set. Please reference full Methodology below.

Methodology

Rent payment data is actual transactional data sourced from integrations with property management systems in the multifamily industry.

Analysis includes a 105,070 unit sample from 1,029,428 live units under management by LeaseLock clients. Data is nationwide, representing over half of the NMHC Top 10 property managers in the country and all asset classes (A, B and C). Asset class composition: class A (39%), class B (43%) class C (18%).

All data has been anonymized to remove personally identifiable information for renters and property managers.