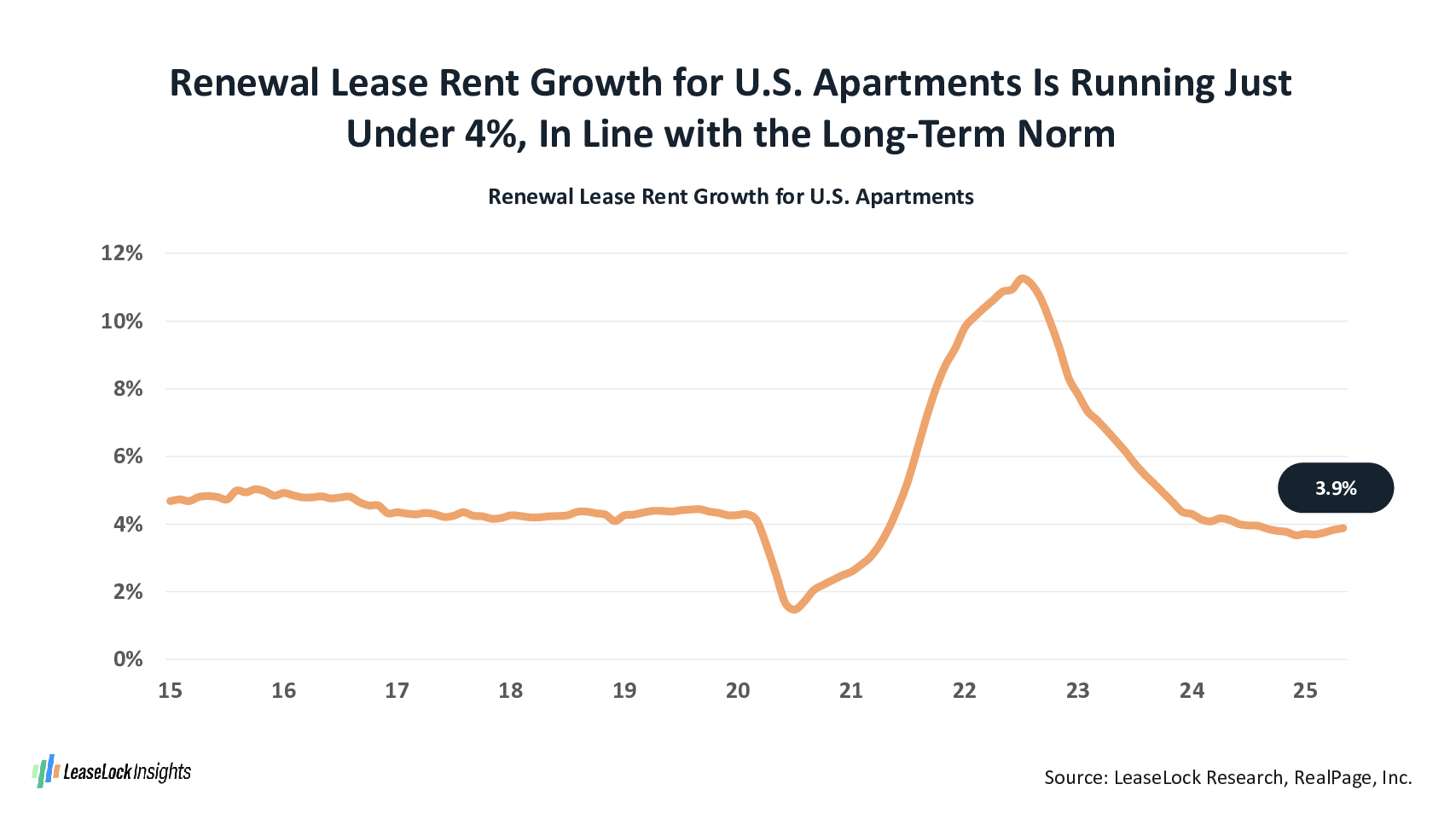

While move-in lease rent growth for apartments – currently sluggish at about 1% across the U.S. as a whole — grabs the headlines, more robust renewal lease pricing near 4% is what’s really driving the revenue performance stats for most rental housing owners and operators. As operators face softening conditions for new leases, renewal lease rent growth in 2025 is proving to be the stabilizing force behind rental housing revenue performance.

Influencing the importance of renewal lease pricing, resident retention at initial lease expiration has been trending upward for more than a decade and now is setting records for many companies. Over the past year, roughly 55% of apartment renters opted to stay in place when their initial leases were fulfilled, according to RealPage data. Firms really working that renter retention strategy are getting meaningfully stronger results. For example, the major apartment REITs (real estate investment trusts) are reporting resident turnover for only about a third of their units, averaging results cited in their latest round of earnings calls.

May’s renewal lease price growth came in at 3.9%, again looking at RealPage info. That’s the 18th consecutive month of renewal lease rent growth averaging right around the 4% mark. Very similar results were posted throughout the 2010s decade, looking back to when economic growth and construction came in at comparatively stable “normal” levels.

There is some correlation between renewal lease pricing power and move-in lease rent growth across metros. Markets currently outperforming the U.S. norm on both measures include the San Francisco Bay Area metros, New York and Northern New Jersey, Washington, DC (yes, even with some federal government job cuts) and low construction Midwest locations like Chicago and Kansas City. At the other end of the spectrum, Austin and Phoenix are notable laggards for renewal lease rent growth at the same time that they are suffering price cuts for new move-in leases.

However, renter behavioral patterns and property operational practices do tend to keep average renewal lease price growth within a somewhat limited range. The size of price increase that a renter generally happy with his or her living experience will accept without shopping for housing alternatives doesn’t vary all that much across markets. Furthermore, resident background screening for initial move-in prospects generally qualifies those new residents with rent-to-income ratios that can accommodate at least one annual rent increase that aligns with the individual market’s past pricing norm.

About LeaseLock

LeaseLock is the only true lease insurance program for rental housing. Our AI-powered underwriting solution LeaseLock Shield™ harnesses the power of machine learning to determine the best coverage for each property and portfolio’s specific needs. The result is ultimate protection from write-offs and legal risk as well as reduced operational burden. With over $14 billion in leases insured, LeaseLock is delivering significant benefits to both renters and investors while reshaping the way the industry manages risk. LeaseLock is dedicated to improving housing accessibility by removing financial barriers for renters while protecting against risk.