Reduced Mobility and Market Conditions Drive Record Lease Lengths | April 15, 2025

Lease length is an interesting apartment market performance metric that maybe doesn’t get the attention that it deserves.

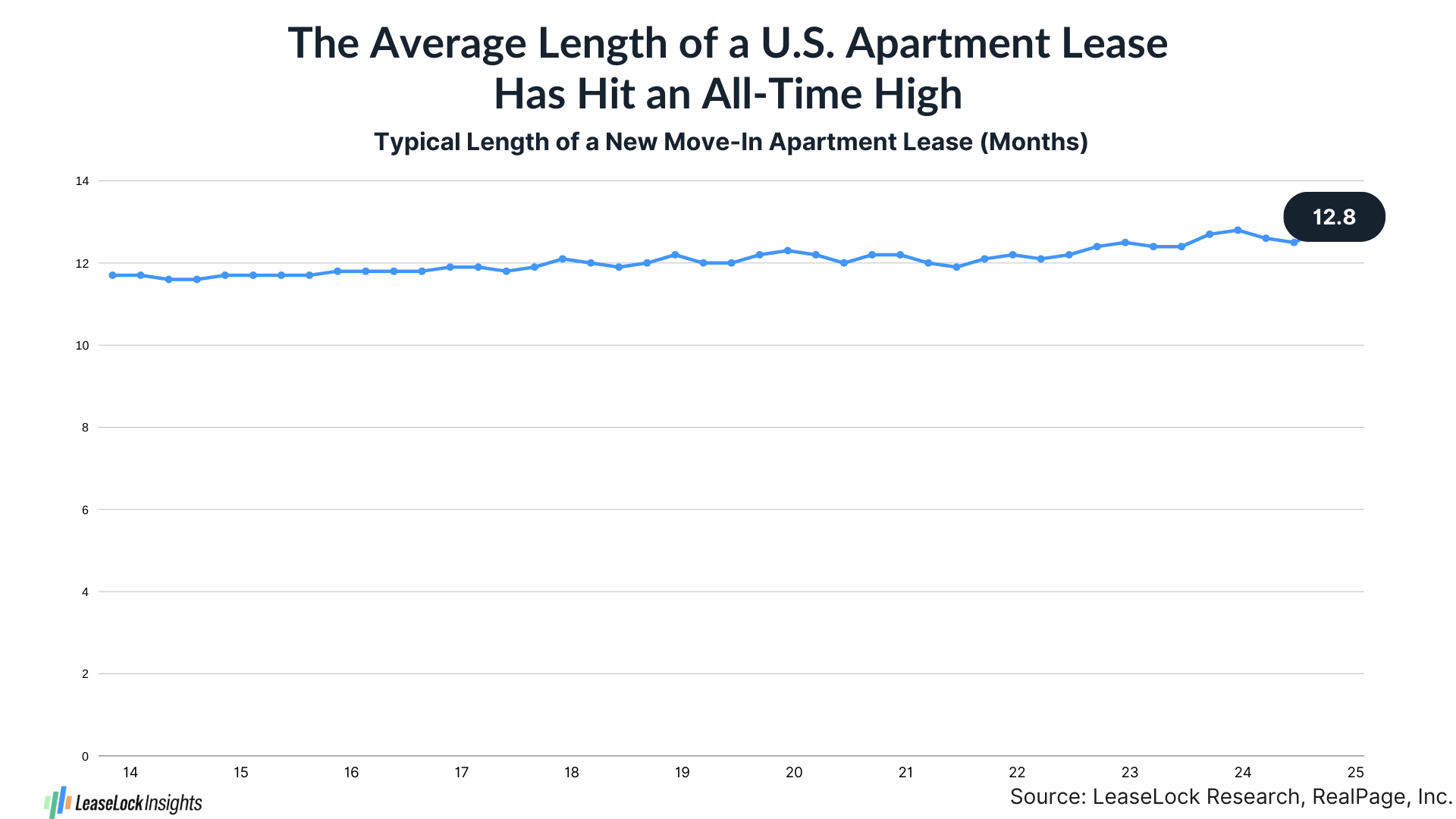

For renters moving into apartments so far during 2025, the typical lease length has reached an all-time high of 12.8 months, according to RealPage, Inc. stats.

Several factors are influencing the tendency of renters to stay in one place for longer.

First, lesser household mobility is simply a long-term trend that’s been seen over the course of the past decade or so. While lifestyle choices certainly come into play when moving decisions are being made, the fact that typical renter age is getting older is the real driver behind more households staying put for longer. Older renters adjust household configuration less frequently, and their more established careers tend to result in fewer job changes.

Second, it’s a good time in the market cycle for renters to push for longer leases. Temporarily aggressive apartment completion volumes are keeping rent increases lower than normal in much of the country, but that wave of deliveries is already moving past peak. With price growth likely to accelerate in most places, renters benefit by locking in today’s rents for as long as they can.

Third, many apartment owners and operators are emphasizing a heads-on-beds strategy right now. They’re looking to maximize occupancy at present and to sustain that tight occupancy on into the future.

Reflecting its chronic product shortage, New York tends to register the nation’s longest typical lease length. Right now, the average lease runs for 13.5 months, a figure that’s also registered in neighboring Northern New Jersey.

Markets adding big blocks of new apartment supply also tend to log relatively long move-in leases, a signal of renters taking advantage of discounts. The average lease length is at least 13 months in construction leaders that include Jacksonville, Orlando, Denver, Atlanta, Charlotte, Columbus, Austin, Phoenix and Raleigh-Durham.

Average lease term comes in a little shorter than the U.S. norm in a handful of building hot spots, including Nashville and especially Salt Lake City and Seattle. In Seattle’s case, however, big construction in and around downtown does lead to considerably longer lease terms in the urban core than in the suburbs.

Among the country’s 50 largest metros, Sacramento is the only place where the average term for a move-in lease is a little under 12 months.

How do the variances in job performance by industry influence the housing sector? The top wage earners obviously are more likely to be able to afford single-family home purchase. At the same time, they help fuel demand for luxury apartments, whereas those earning middle-range to bottom-end salaries are the core audience for Class B and C rentals.

Given the number of upscale new apartment deliveries moving through the initial lease-up process right now, rental market fundamentals would really benefit from a rebound in growth of Professional/Business Services, Finance and Information jobs.

About LeaseLock

LeaseLock is the only true lease insurance program for rental housing. Our AI-powered underwriting solution – LeaseLock Shield™ – harnesses the power of machine learning to determine the best coverage for each property and portfolio’s specific needs. The result is ultimate protection from write-offs and legal risk as well as reduced operational burden. With over $10 billion in leases insured, LeaseLock is delivering significant benefits to both renters and investors while reshaping the way the industry manages risk. LeaseLock is dedicated to improving housing accessibility by removing financial barriers for renters while protecting against risk. Brand Positioning 1.1 — About Us Please reference the following boilerplates in short, medium, and long lengths.