November 1st Rent Payments: New Stimulus Package in Limbo

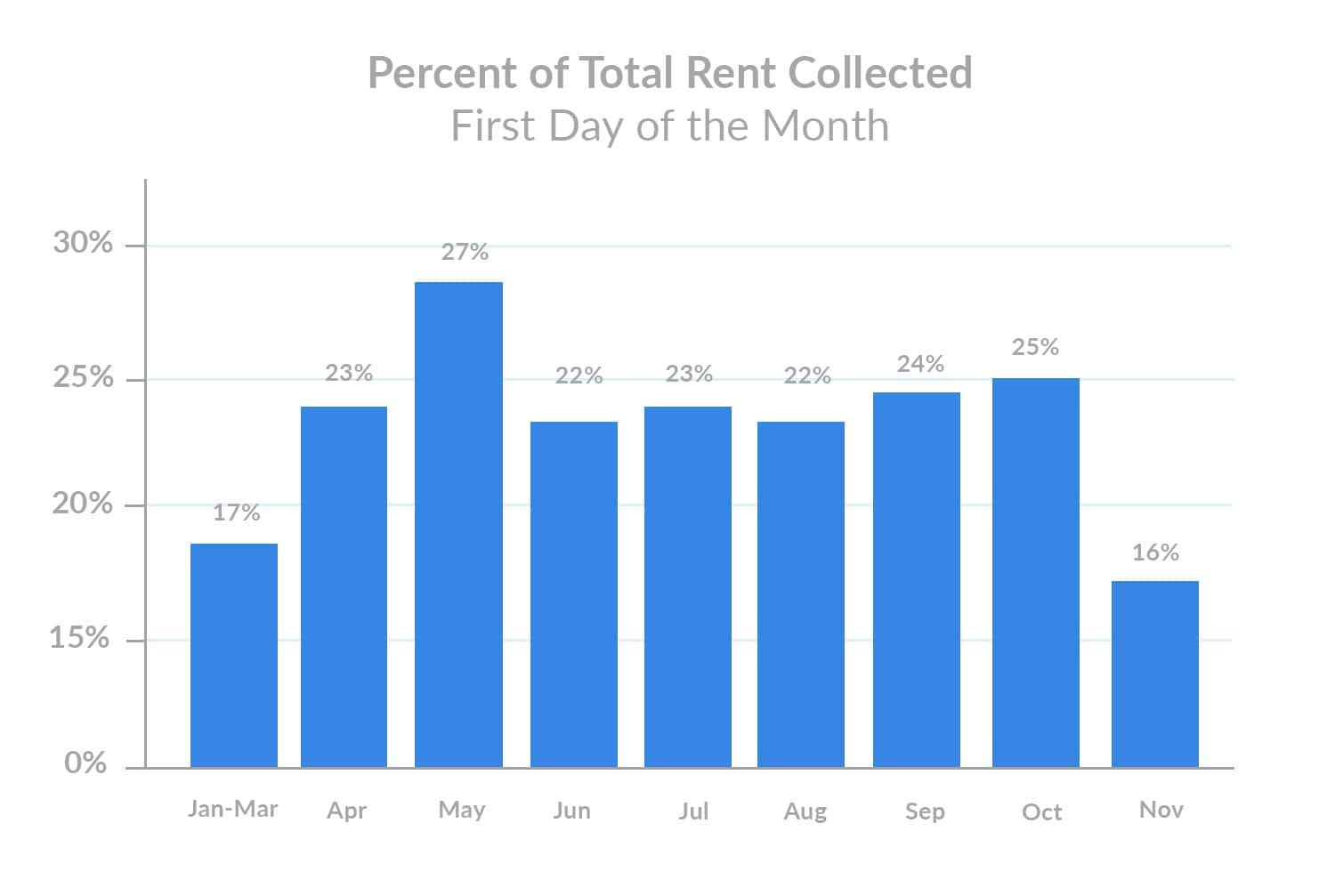

- Percent of November 1st rent collected dropped 9 points MoM.

- First-day rent payments slipped across properties of all asset classes.

- Congress has yet to pass another COVID relief bill.

The US presidential election is today, coronavirus cases are surging globally, and talks of a new stimulus package are at a stalemate, all contributing to large scale uncertainty. But how have these events impacted rent payment behavior in the apartment housing industry?

Our monthly analysis indicates that, similar to previous months, November 1st rent payments dipped. It’s important to note that the first of the month landed on a weekend, meaning some renters may have waited to pay on a weekday. Nonetheless, the trend speaks for itself—apartment operators still need comprehensive rent relief to directly support residents.

Multifamily leaders continue to put up a dedicated fight for rental assistance, and with the added political and economic strains we face today, advocacy for long-term solutions is mission-critical to propping up the rental housing industry.

Now, let’s analyze how November 1st rent payments are holding up across region and asset class compared to previous months.

Lower November 1st Rent Payments Without Pre-Election Deal

The House passed a revised HEROES Act last month, including $50 billion in rental assistance and an eviction ban extension. Despite signs of legislative progress, October 1st rent payments reflected financial insecurity among renters.

This month, November 1st rent payments have declined again, holding one percentage point below the pre-COVID average.

Pending Election Results, New Stimulus Bill Should Help Strengthen Rent Payments

Of course, the contents of a new relief package hinge on the outcome of the election. If Congress passes the slimmed-down version of the HEROES Act, it should be great news for rental housing providers and renters alike. If Congress fails to pass another COVID stimulus deal though, many of those receiving unemployment benefits will lose assistance at the end of next month, the same time the nationwide eviction moratorium is due to expire.

The timeline for a new relief bill remains uncertain, and the leftover CARES Act benefits will continue to dry up through the end of the year. On top of this, varying eviction laws and spotty rent assistance funds are unlikely to quell the storm of financial unpredictability.

Without knowing what the next rent relief package will include and when it will pass, the rental housing industry can only continue shouldering most of the relief efforts.

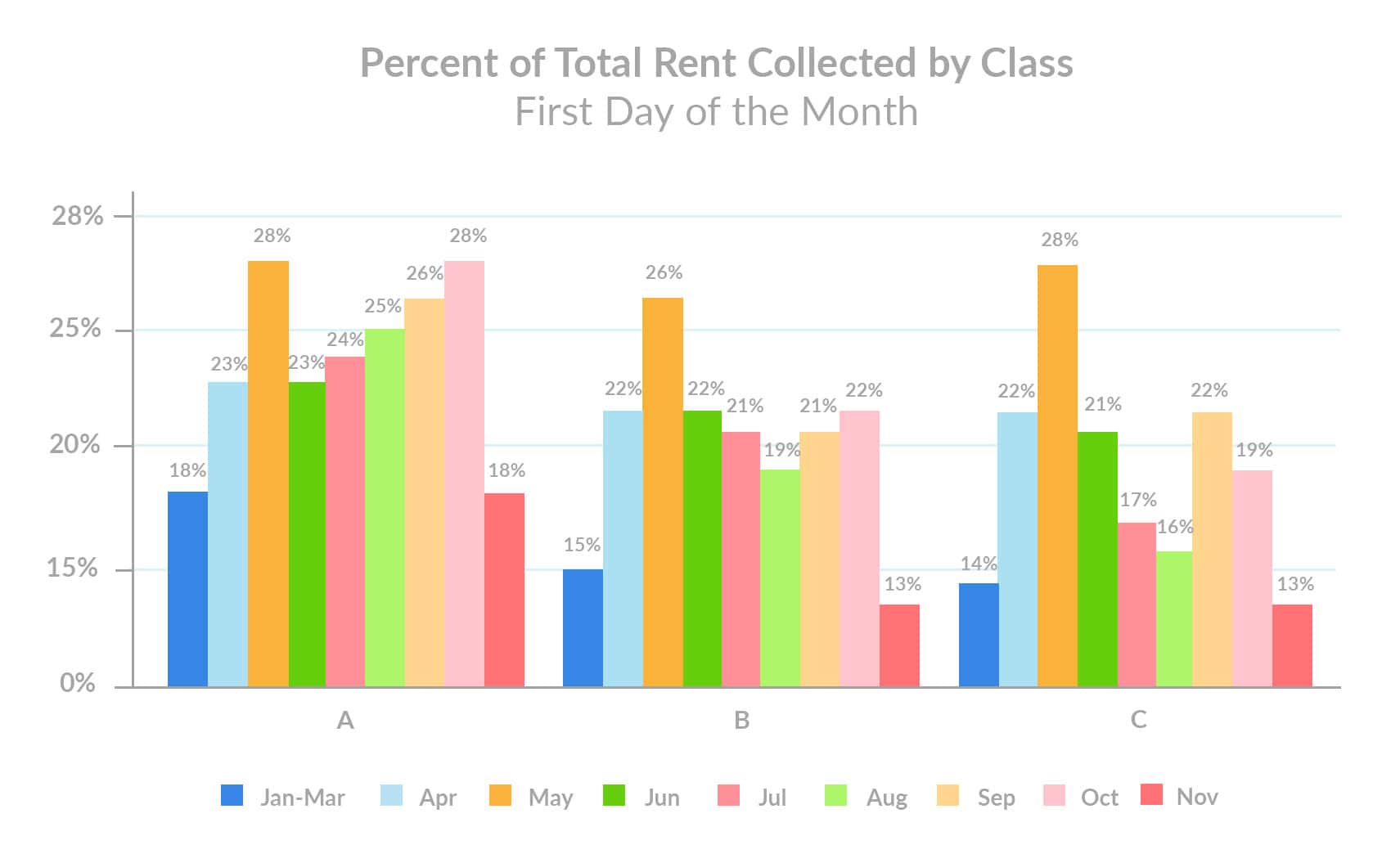

All Asset Classes Experienced Dips

Renters at Class C properties have struggled to make rent during the pandemic, but Class B and Class A properties have shown signs of financial stress as well.

On November 1st, rent payments for all asset classes saw month-over-month dips, with Class A and Class B registering the biggest drops. Class C rent payments fell 6 percentage points compared to October 1st. This strain has pushed operators to implement creative solutions to balance lease concessions and financial risk — especially at Class A properties.

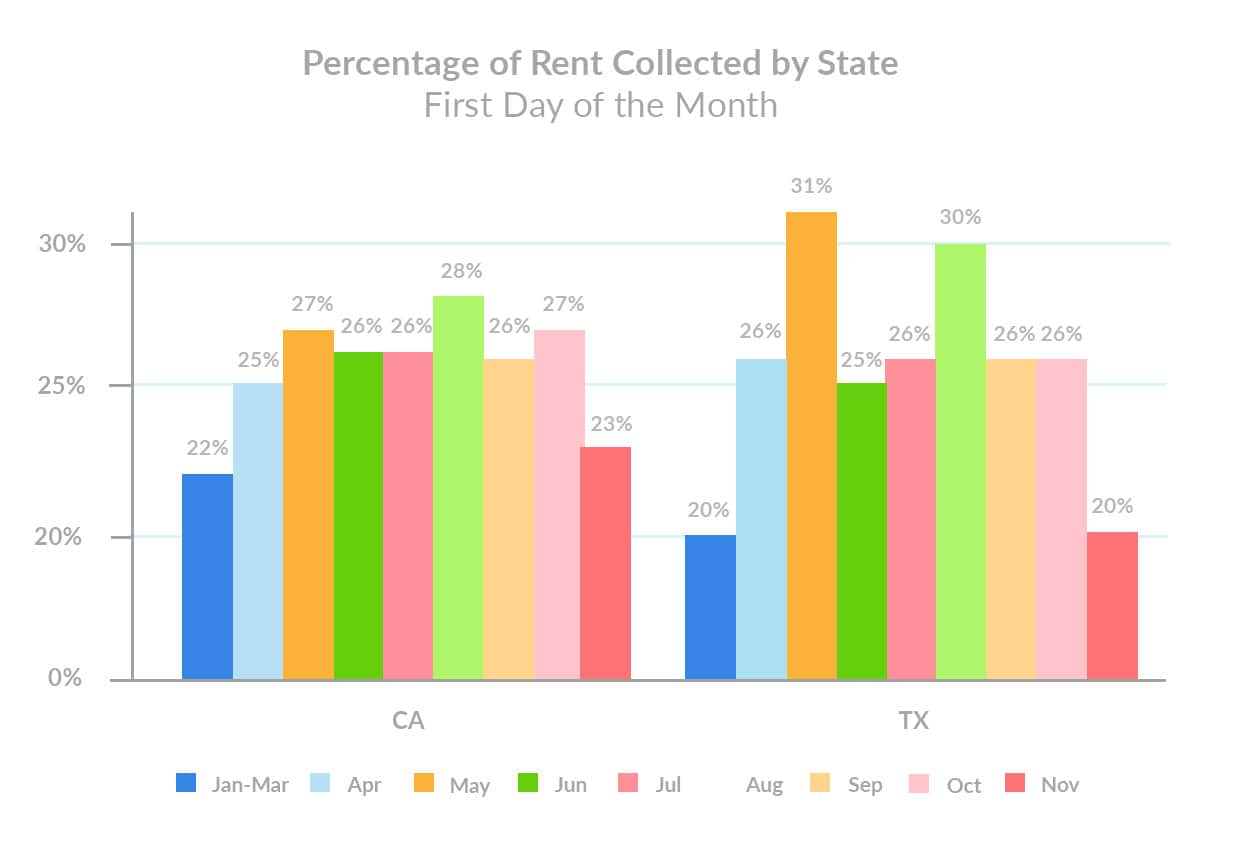

California and Texas Rent Payments in a Holding Pattern

Renters in both California and Texas have shown signs of struggle. In the Golden State, the percentage of rent collected for the first-of-the-month declined 4 points since last month. In the Lone Star State, the percent of rent collected fell 6 points, returning to the pre-COVID average.

In the Los Angeles metro, where the housing affordability crisis has been magnified, the percent of rent collected dropped 3 points below the pre-COVID average. Dallas rent payments also dropped from last month, and currently sit 6 points below the average.

Multifamily Awaiting Emergency Rent Relief, Shifts Focus to Sustainable Solutions

No doubt, the election has distracted from rent payment behavior, but several key issues like emergency rental assistance, unemployment benefits, and eviction moratoriums remain center stage as apartment operators and American renters wait for crucial next steps. Throughout the remainder of the November grace period, and as the election results pan out, we will continue to track rent payment behavior to support the multifamily industry.

Important statistical note: Despite the measured payment fluctuations based on the sample set, the variance is within normal statistical range. In other words, the changes are not necessarily significant enough to attribute specifically to COVID-19 versus normal fluctuations expected across the data set. Please reference full Methodology below.

Methodology

Rent payment data is actual transactional data sourced from integrations with property management systems in the multifamily industry.

Analysis includes a 105,070 unit sample from 1,029,428 live units under management by LeaseLock clients. Data is nationwide, representing over half of the NMHC Top 10 property managers in the country and all asset classes (A, B and C). Asset class composition: class A (39%), class B (43%) class C (18%).

All data has been anonymized to remove personally identifiable information for renters and property managers.