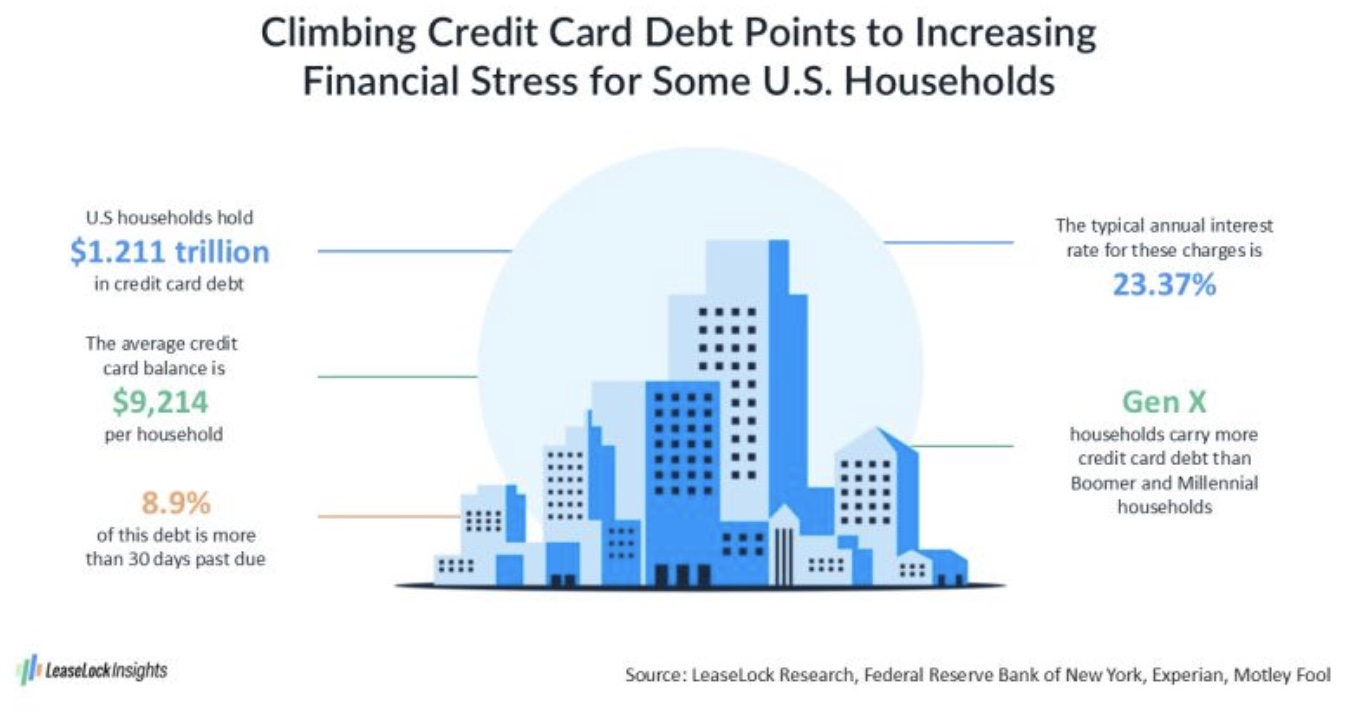

In his latest analysis, Willett highlighted data from the Federal Reserve Bank of New York (FRBNY) showing that U.S. household credit card debt has surged to $1.211 trillion—a 7% increase year-over-year and a 57% jump since 2021. He also pointed out that credit card delinquencies are rising, with nearly 9% of balances now more than 30 days past due and over 7% exceeding 90 days past due. While these figures are still below Great Recession levels, they mark a significant shift from the low delinquency rates seen in 2021-2022.

This increase in debt and delinquencies carries major implications for the multifamily sector. As credit card interest rates now exceed 23% on average—making this form of debt significantly more expensive—renters who rely on credit to cover expenses may struggle to keep up with rent payments. The article notes that this financial strain could lead to higher eviction risks, stricter lease approval criteria, and even declining renewal rates as renters adjust to economic pressures.

Willett’s ongoing analysis provides valuable context for multifamily professionals navigating today’s uncertain financial landscape. His LinkedIn updates continue to be a key resource for tracking the intersection of macroeconomic trends and rental housing dynamics.