The Nation’s Hospitality-Fueled Economies Appear Vulnerable

Hospitality Job Growth Stalls, Putting Housing Performance at Risk

As the U.S. economy loses some steam overall, keep an eye on what’s happening in metros where the hospitality sector plays an especially big role in the business mix.

When households experience financial stress or simply become uncertain about their financial prospects, leisure travel and restaurant dining usually are among the first spending cutbacks made. Thus, the hospitality sector’s performance can lose momentum very quickly.

Furthermore, if inflation is registered as economic growth slows, that’s really a blow for many hospitality workers. Typical pay in the field is modest, so workers in the sector see their budgets getting stretched by even just a mild bump in prices.

Shifting immigration policies further exacerbate the hospitality industry’s vulnerabilities right now, partly because so many hospitality workers are foreign-born but also because our stance on immigration is discouraging visits from international tourists.

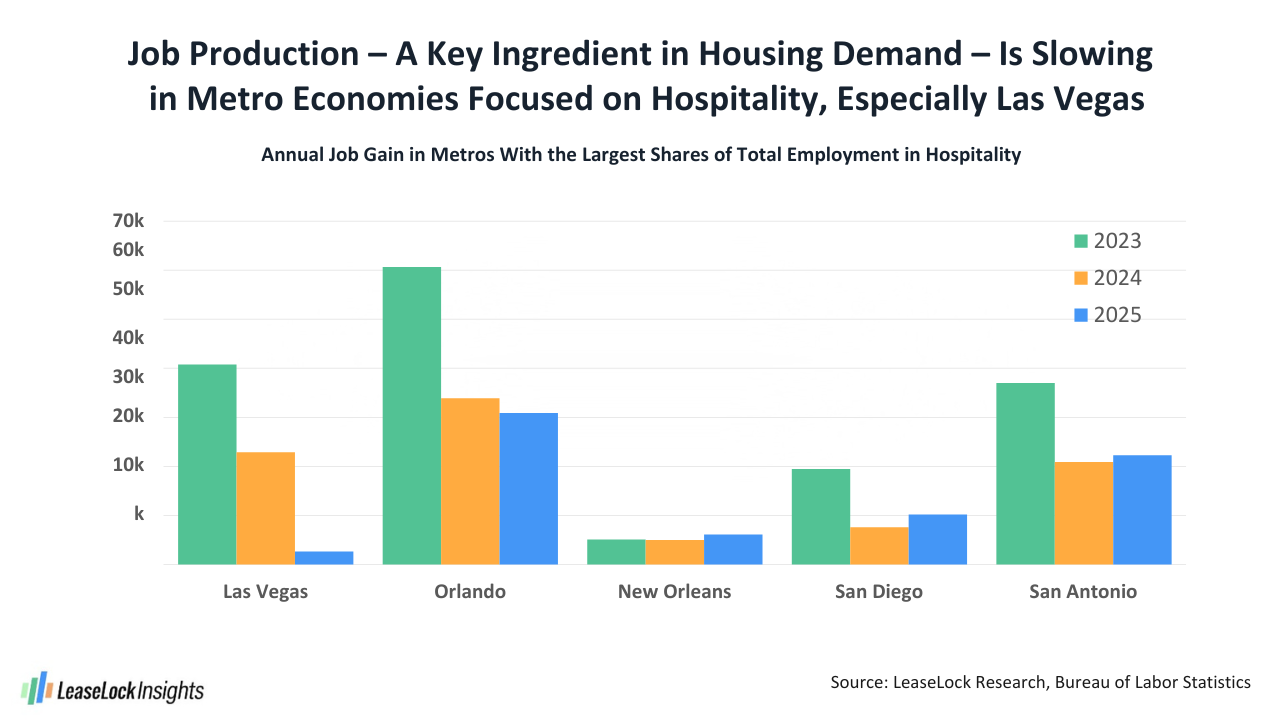

The biggest concentration of hospitality jobs in any local U.S. economy registers in Las Vegas, and job production there is nearing a standstill. Bureau of Labor Statistics (BLS) info shows that the annual growth pace registered during the first half of 2025 slowed to just 3,000 jobs, down from expansion totaling 23,000 jobs in 2024 and 41,000 jobs in 2023.

The impact of limited economic momentum is showing up in the real estate market’s performance fundamentals. While for-sale home pricing is holding stable so far, local realtor reports place unsold available inventory at double the volume offered a year ago. RealPage stats on the apartment market indicate relatively balanced supply and demand so far this year, but product absorption is being achieved at the expense of pricing power. After rents held flat in late 2024 to early 2025, the prices for move-in leases now are off nearly 3% year-over-year.

Looking at other metros with hospitality sectors that are especially big drivers of the overall economic performance, job expansion levels are tapering mildly across Orlando, San Diego and San Antonio.

Apartment rent cuts are getting a bit deeper than they were earlier in both Orlando, now at an annual loss of 3%, and San Diego, now backtracking at a 1% annual pace. San Antonio’s year-over-year rent drop of roughly 4% is the steepest in the group, but that figure is a hair smaller than the earlier pace of decline.

New Orleans is another hospitality-heavy local economy. Overall job production there is minimal, but there’s no change in momentum, according to BLS data. Apartment rents in the metro are backtracking at an annual rate of about 1% in the RealPage dataset.

The nation’s key hospitality-influenced markets tend to be attractive apartment investment targets over the long term (New Orleans perhaps less than the other locations discussed). But they do seem to face some headwinds during the immediate future, suggesting performances that could trail below the national norm.

About LeaseLock

LeaseLock is the only true lease insurance provider for rental housing. Our AI powered underwriting program, LeaseLock ShieldTM, predicts risk and optimizes coverage for properties and portfolios. Owners and operators gain notable profit protection while accelerating leasing, minimizing burden, and removing reputation and legal risk. With over $14 billion in leases insured, LeaseLock is reshaping the way the rental housing industry manages financial risk, while delivering significant benefits to renters. As an accredited GRESB partner, LeaseLock is dedicated to improving housing accessibility by offering renters greater financial flexibility while protecting properties against the risk of bad debt.