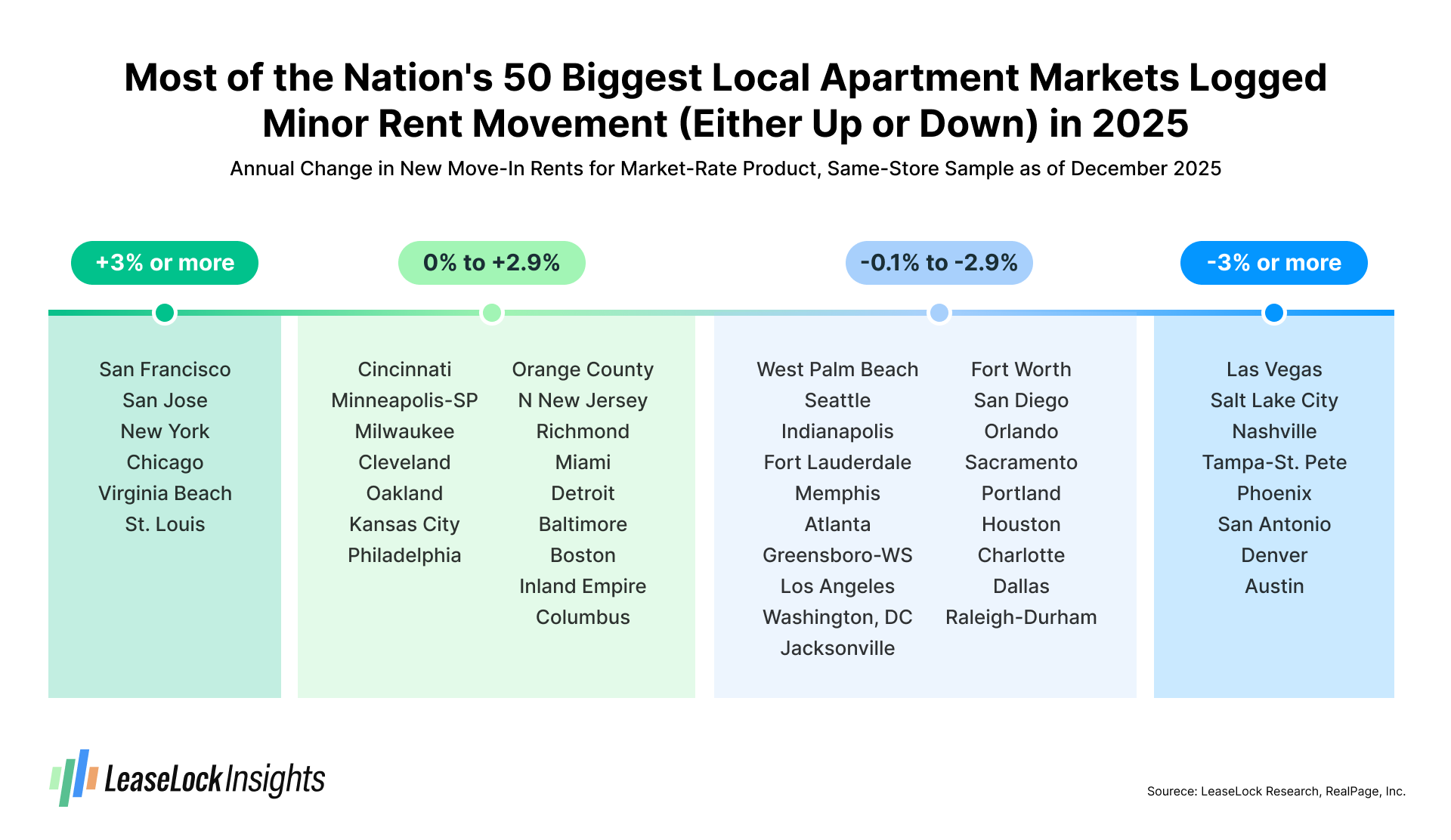

Four Tiers of Apartment Rent Growth Across U.S. Metros

Apartment rent growth across the United States stalled in 2025, falling short of earlier expectations as housing providers prioritized occupancy over pricing amid ongoing economic uncertainty.

Market-rate apartment rents declined 0.4 percent year over year in Realpage, Inc.’s December results. Other sources of info also tended to show minimal change, although some did report pricing up a tiny bit rather than down slightly.

Despite the flat national picture, metro-level outcomes varied meaningfully. Minor rent shifts were recorded in 36 of the nation’s 50 largest apartment markets. Within that group:

- 17 metros posted rent growth ranging from 0 percent to +2.9 percent

- 19 metros recorded rent declines between -0.1 percent and -2.9 percent

- At the extremes, six metros achieved rent growth of more than 3 percent

- Eight metros experienced rent cuts exceeding 3 percent

These outcomes form four distinct tiers of apartment rent growth by metro.

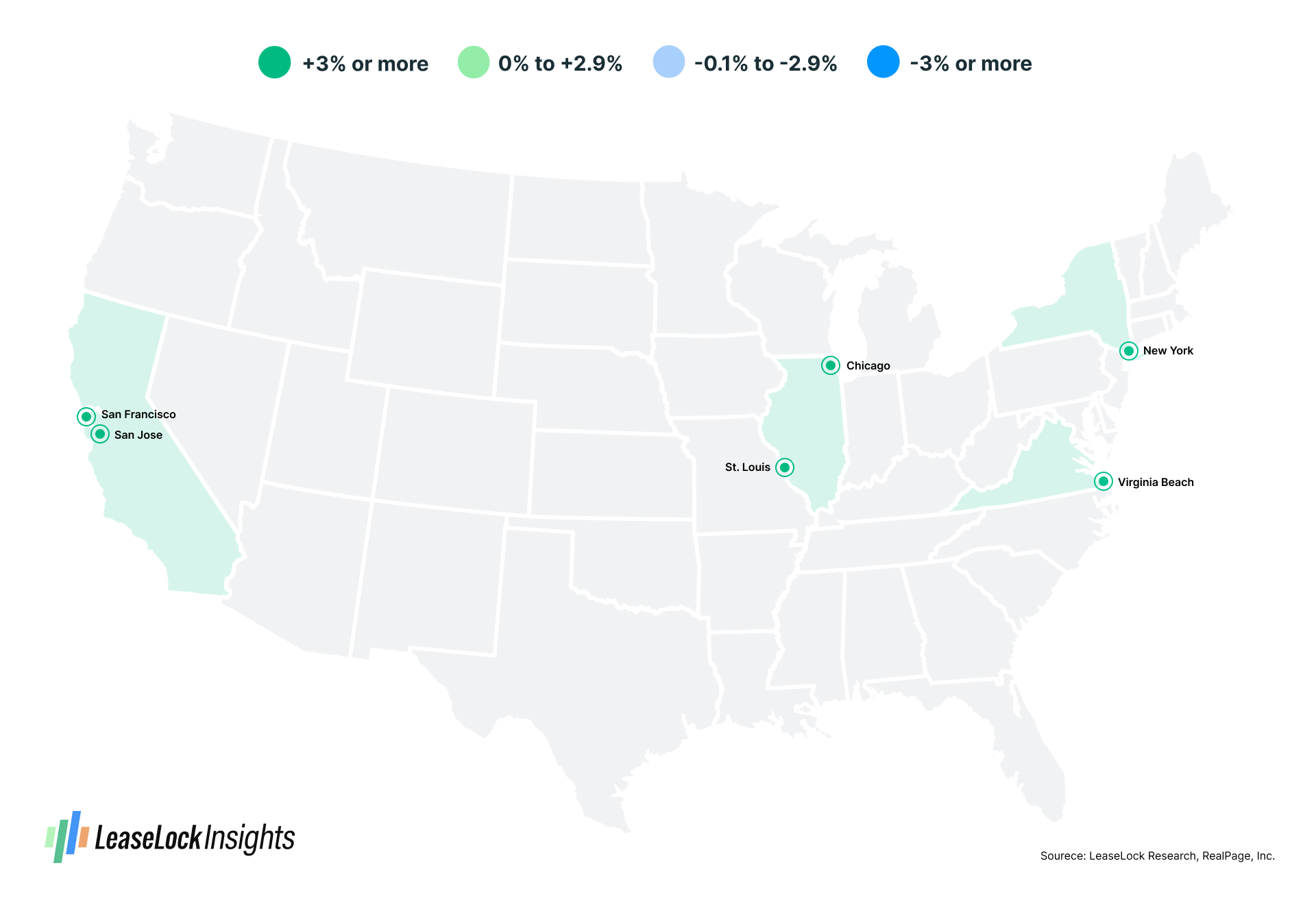

Tier 1: Rent Growth Leaders

A small number of markets delivered standout rent growth in 2025. San Francisco was the clear leader, with move-in rents rising by just over 8 percent, more than double the 3 to 4 percent growth recorded by the next-best performers.

Other top-tier rent growth markets included:

- San Jose

- New York

- Chicago

- Virginia Beach

- St. Louis

Most of these metros appear positioned to remain among the strongest rent growth performers in 2026. St. Louis, however, warrants caution due to its comparatively weaker economic footing. From one month to the next, St. Louis is bouncing back and forth from slight job loss to minor employment additions.

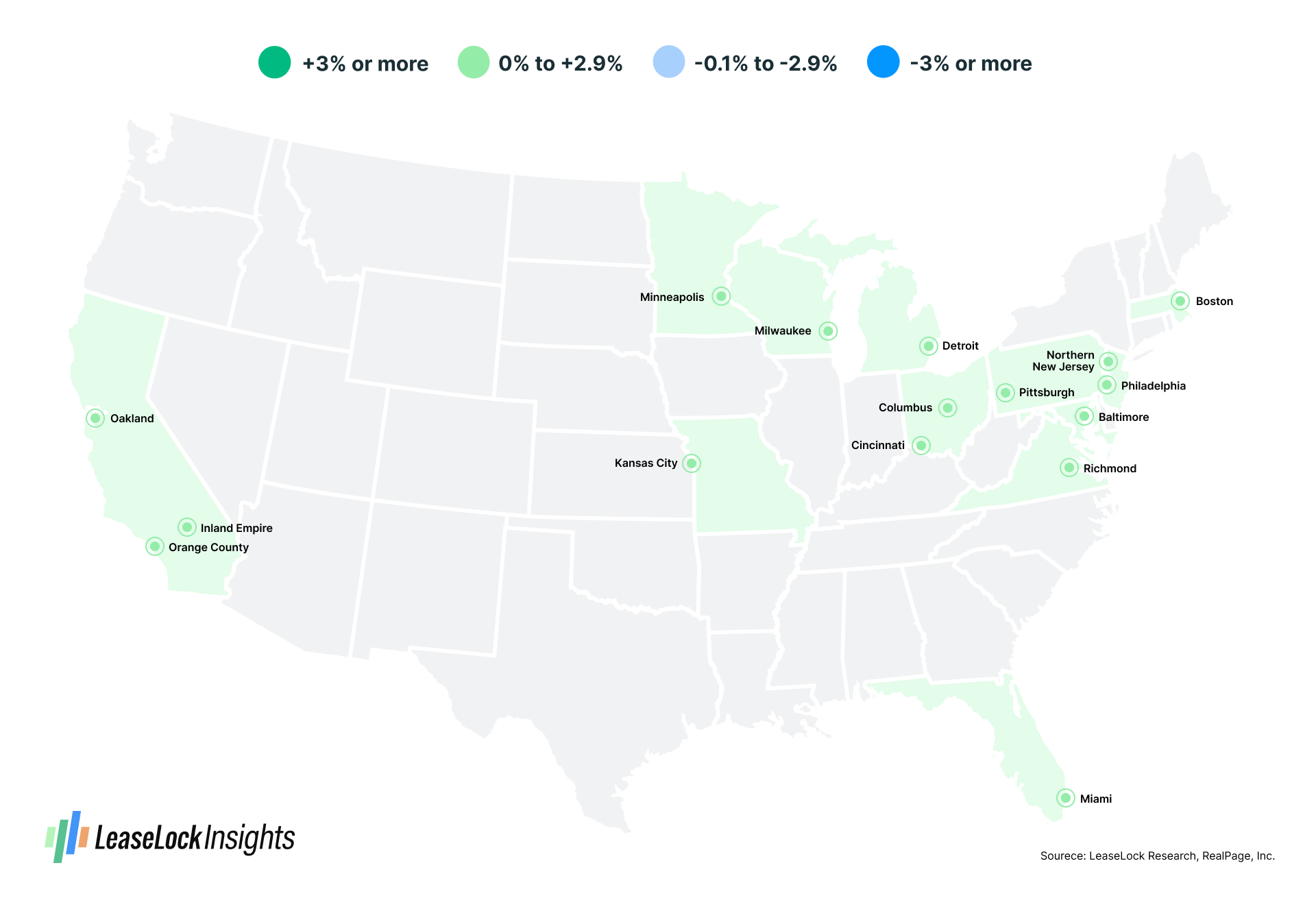

Tier 2: Modest Rent Growth Markets

Most major metros in the Midwest and Northeast/Mid-Atlantic regions posted moderate rent increases in 2025. In these markets, apartment demand has been adequate but not exceptional. Construction volumes remain limited, meaning only modest absorption is needed to maintain balance.

Most of these markets should stay in the second tier. If there are ones that can move up, the key candidates are Philadelphia and Columbus.

Northern New Jersey also merits attention. Recent construction in Jersey City has delivered a sizable inventory of new communities that offer a lower-cost alternative to Manhattan living, influencing regional rent dynamics.

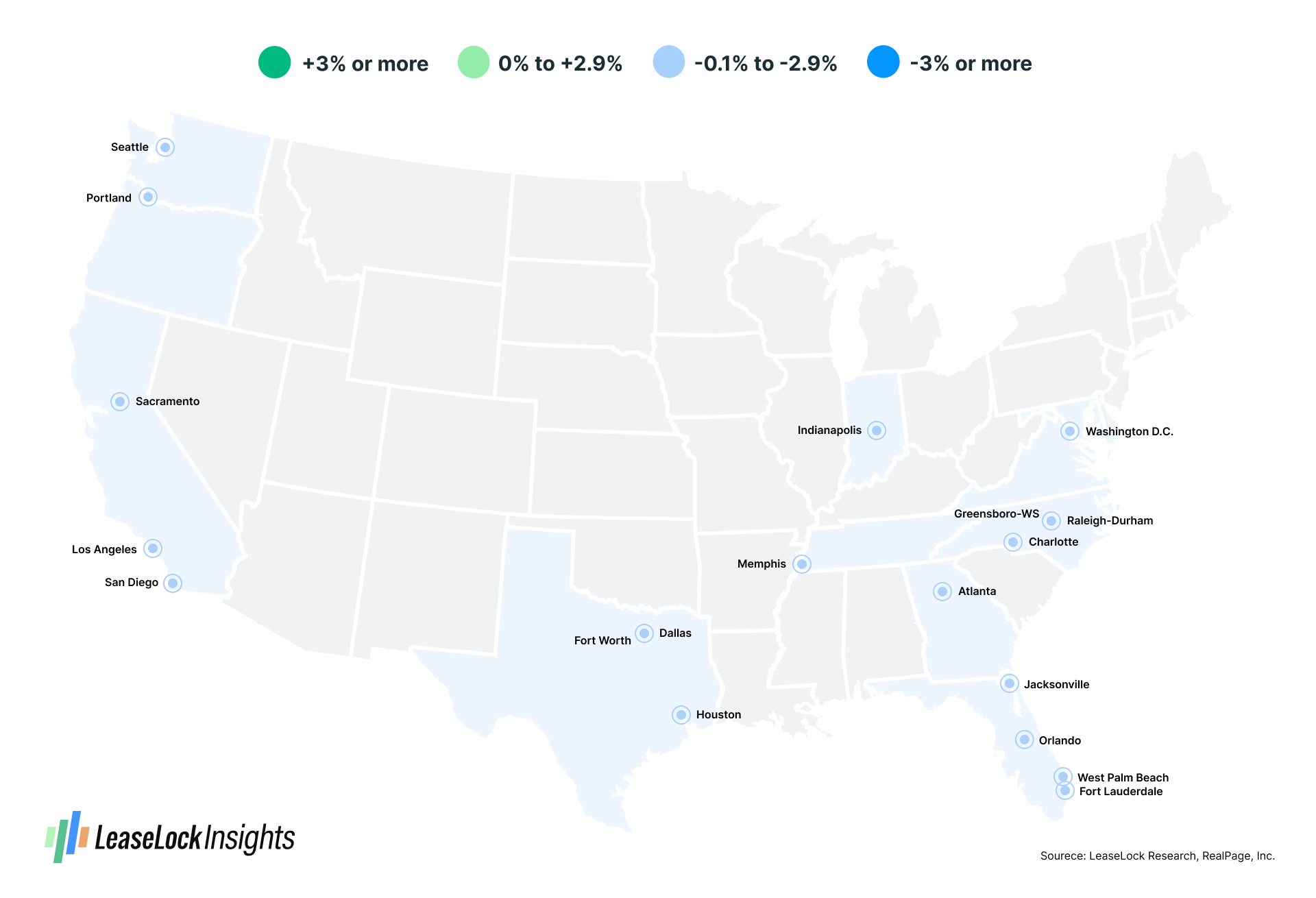

Tier 3: Mild Rent Cut Markets

The group of metros posting slight rent declines in 2025 is heavily concentrated in Sun Belt development centers, along with several West Coast markets.

These locations appear primed to regain momentum in 2026. As new deliveries slow, properties in initial lease-up should rely less on concessions. Additionally, projects completed over the past two years are expected to benefit from concession burn-off following earlier periods of aggressive rent discounting.

Most markets in this tier are good candidates to achieve modest rent growth in 2026. Atlanta, Fort Worth, and Washington, DC may see the strongest rebound, as deliveries are projected to decline by approximately 40 percent year over year. Washington, DC could also see upside demand if federal government job cuts experienced in 2025 are not repeated.

Other markets with solid demand prospects include Seattle, Charlotte, Dallas, and Raleigh-Durham, though all will continue to have to deal with meaningful new supply..

Tier 4: Rent Growth Laggards

Rent cuts were more pronounced in a subset of markets during 2025. Move-in rents declined:

- 3 to 4 percent in Las Vegas, Salt Lake City, Nashville, and Tampa-St. Pete

- About 5 percent in Phoenix and San Antonio

- Approximately 7 to 8 percent in Denver and Austin

While rent declines are expected to moderate in most of these metros during 2026, reaching flat or positive growth may be challenging. Nashville stands out as the most plausible exception. It’s supported by a roughly 40 percent drop in scheduled deliveries, with some high-demand suburbs adding only a handful of new units. However, Nashville’s heavy reliance on tourism introduces risk, as hospitality-driven markets are currently seeing slower job growth.

The Big Picture for Apartment Rent Growth

After stagnation in 2025, apartment rent growth for move-in leases is expected to improve in 2026. Forecasts from leading data providers generally center around 2 percent annual growth, though results could slightly exceed that mark.

Concession burn-off may play a larger role than anticipated, and the industry’s shift toward all-in pricing, which incorporates fees previously charged outside of base rents, could further boost measured rent growth.

The takeaway for operators and asset managers is clear: rent growth in 2026 will be uneven and highly metro-specific, rewarding localized strategy, disciplined supply management, and close attention to renter affordability.

About LeaseLock

LeaseLock is the only true lease insurance provider for rental housing. Our AI powered underwriting program, LeaseLock ShieldTM, predicts risk and optimizes coverage for properties and portfolios. Owners and operators gain notable profit protection while accelerating leasing, minimizing burden, and removing reputation and legal risk. With over $14 billion in leases insured, LeaseLock is reshaping the way the rental housing industry manages financial risk, while delivering significant benefits to renters. As an accredited GRESB partner, LeaseLock is dedicated to improving housing accessibility by offering renters greater financial flexibility while protecting properties against the risk of bad debt.