Household Credit Card Debt Surges 57% Since 2021 | March 11, 2025

The Federal Reserve Bank of New York’s quarterly reporting on household debt provides a helpful snapshot of U.S. household finances. For those of us in the housing industry, the numbers offer early insights into financial shifts that may alter the ability of households to meet their housing payment obligations.

Current metrics generally don’t fall into red flag territory, but it’s worth noting how quickly some households are running up credit card debt at the same time that payment delinquencies are beginning to rise.

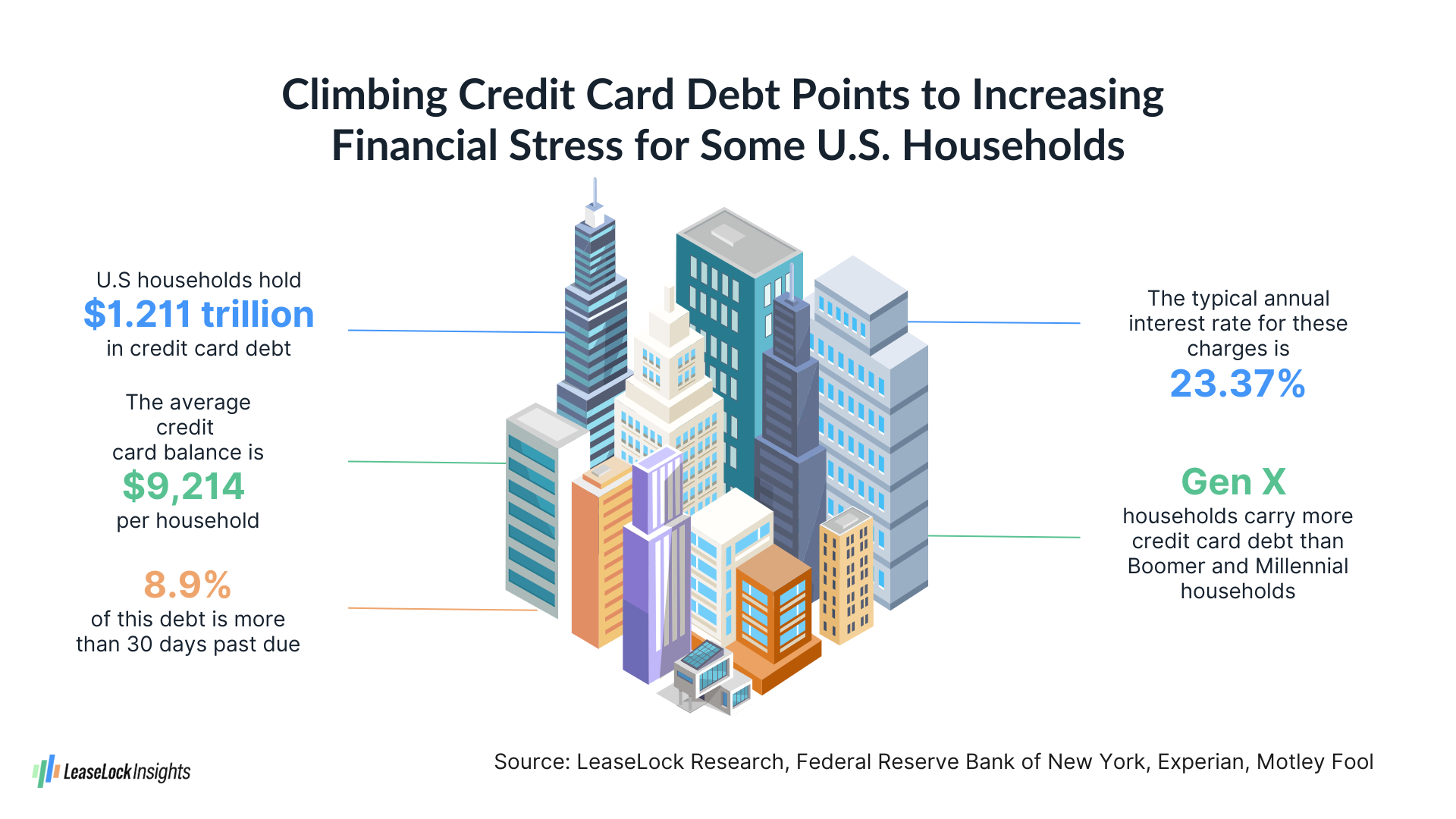

The Fed stats show that U.S. households are carrying $1.211 trillion in credit card debt, up about 7% on an annual basis and up a stunning 57% from the recent low seen in 2021. That 2021 nadir registered after the government provided Covid-related assistance that allowed some households to replace lost wages or otherwise improve their financial situations. Outstanding credit card debt averages more than $9,200 per household, according to Motley Fool calculations.

Just under 9% of U.S. credit card debt is 30 days past due, including just over 7% that is at least 90 days late. Delinquencies are rising steadily from the recent lows registered in late 2021 to early 2022 (about 4% 30 days past due and about 3% 90 days or more past due). Encouragingly, however, delinquencies are nowhere near the highs seen in the Great Financial Crisis of 2009-2010 (nearly 14% 30 days past due and about 11% 90 days past due).

One of the reasons that credit card debt is concerning is that interest rates on this debt are so much higher than auto loan or mortgage debt. The Fed places today’s average annual interest rate for credit card debt at more than 23%.

Adding a little further color to the credit card debt picture, Experian reports balances per household much higher for Gen Xers than for their older and younger counterparts. Those figures are perhaps influenced by the fact that the Gen X populace is now 45 to 60 years old, meaning that many are in their peak earnings years.

Regardless of whether consumers do or do not change their spending patterns meaningfully, the increased uncertainty about the economy’s prospects could have an impact on the rental housing sector’s resident retention statistics. When there’s uncertainty about the future, many people momentarily freeze and do nothing. That tendency toward inaction limits the likelihood that households reaching the end of current leases will opt to move.

Dampened mobility is particularly important for rental housing revenues at the moment, given that most markets register stronger rent growth for renewal leases than for new resident move-ins.

About LeaseLock

LeaseLock is the only true lease insurance program for rental housing. Our AI-powered underwriting solution – LeaseLock Shield™ – harnesses the power of machine learning to determine the best coverage for each property and portfolio’s specific needs. The result is ultimate protection from write-offs and legal risk as well as reduced operational burden. With over $10 billion in leases insured, LeaseLock is delivering significant benefits to both renters and investors while reshaping the way the industry manages risk. LeaseLock is dedicated to improving housing accessibility by removing financial barriers for renters while protecting against risk. Brand Positioning 1.1 — About Us Please reference the following boilerplates in short, medium, and long lengths.