Consumer Sentiment Drops Ahead of Leasing Season, Potentially Slowing Household Mobility | March 1, 2025

Regardless of whether consumers do or do not change their spending patterns meaningfully, the increased uncertainty about the economy’s prospects could have an impact on the rental housing sector’s resident retention statistics. When there’s uncertainty about the future, many people momentarily freeze and do nothing. That tendency toward inaction limits the likelihood that households reaching the end of current leases will opt to move.

Dampened mobility is particularly important for rental housing revenues at the moment, given that most markets register stronger rent growth for renewal leases than for new resident move-ins.

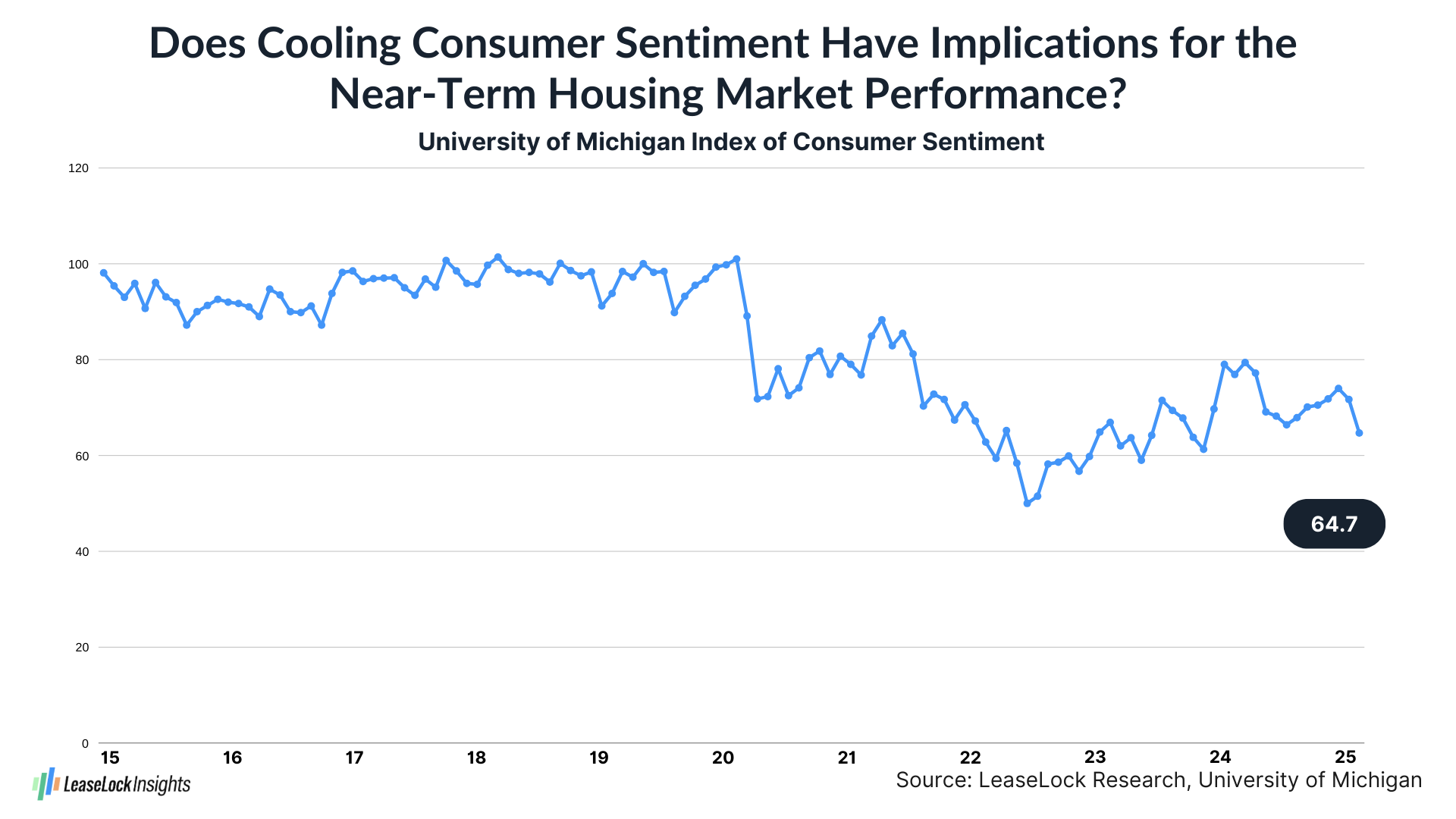

Is cooling consumer confidence right at the start of prime leasing season a red flag for the rental housing sector’s near-term prospects?

There’s a loss of momentum in the readings for both the University of Michigan Consumer Sentiment Index and The Conference Board Consumer Confidence Index. While multiple influences are shaping consumer perspectives on the economy, fear of higher inflation seems to be especially important.

If future inflation worries lead consumers to curb their spending, job growth and household formation could slow, limiting support for apartment leasing activity and maybe hurting home sales even more.

In reality, retail spending remains relatively solid for now, helped because the wealthiest households remain on a spending spree. Increased home equity fueled by rising house prices is one factor that’s allowing the most affluent households to continue to spend. Growing stock market assets also have fueled spending among wealthy households, but that tailwind is looking more tenuous in reflection of more volatility in stock prices.

About LeaseLock

LeaseLock is the only true lease insurance program for rental housing. Our AI-powered underwriting solution – LeaseLock Shield™ – harnesses the power of machine learning to determine the best coverage for each property and portfolio’s specific needs. The result is ultimate protection from write-offs and legal risk as well as reduced operational burden. With over $10 billion in leases insured, LeaseLock is delivering significant benefits to both renters and investors while reshaping the way the industry manages risk. LeaseLock is dedicated to improving housing accessibility by removing financial barriers for renters while protecting against risk. Brand Positioning 1.1 — About Us Please reference the following boilerplates in short, medium, and long lengths.