Are Operators Accountable for Illegal Evictions? What the CFPB Rule Means for Multifamily

It’s estimated that close to 10 million households are behind on their rent payments. In order to prevent a mass eviction crisis, the CDC extended the temporary eviction moratorium through June 30, 2021. To further protect renters, the Consumer Financial Protection Bureau (CFPB) recently issued an interim final rule in support of the CDC’s eviction moratorium, which clarifies that apartment operators must notify renters who are being evicted.

What is the CFPB Rule?

To take effect May 3, the rule requires debt collectors to provide written notice to renters of their rights under the eviction moratorium and prohibits debt collectors from misrepresenting renters’ eligibility for protection from eviction under the moratorium.

If debt collectors evict renters who may have rights under the moratorium without providing notice of such rights — or if they misrepresent renters’ rights under the moratorium — they can now be prosecuted for violations of the Fair Debt Collection Practices Act (FDCPA). They are also now subject to private lawsuits by renters.

The rule does not prohibit the filing of evictions, but it does prohibit the physical removal of a person from the property if the person meets certain eligibility criteria and submits a declaration establishing that they’re unable to make full rental payments and would likely become homeless if evicted.

The CFPB rule is set to last through the duration of the CDC Order, which was extended through June 30, 2021.

How Does the CFPB Rule Apply to Operators?

What does this rule mean for multifamily operators? The CFPB has authority under the FDCPA to “prescribe rules with respect to the collection of debts by debt collectors.” Derived from the Fair Debt Collection Practices Act (FDCPA), the CFPB’s definition of a “debt collector” includes attorneys who engage in eviction proceedings on behalf of landlords or residential property owners to collect unpaid residential rent. Therefore, by extension, “debt collectors” includes property owners and managers.

As NAA President Bob Pinnegar pointed out in his statement regarding the rule, relevant case law may better determine whether or not property managers or management firms are considered “debt collectors.” There are other considerations, such as whether state eviction laws and court processes separate the process to recover possession from actions to cover outstanding rent debt.

Apartment operators should seek legal counsel before proceeding with an eviction to understand compliance obligations.

Eviction Protection Disclosure: How Can Operators Comply With the CFPB Rule?

Provide Notice of Eviction Protections

In the event that an operator chooses to initiate an eviction for non-payment of rent, the FDCPA interim final rule requires the “debt collector” provide clear and conspicuous written notice of the renter’s rights under the CDC order. This notice must be provided on the same date as the eviction notice, or on the date that the eviction action is filed if no eviction notice is required by law.

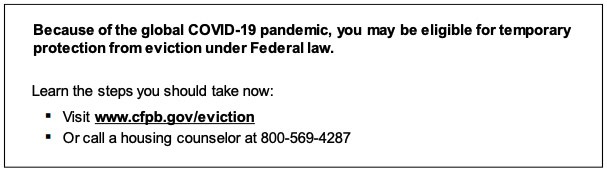

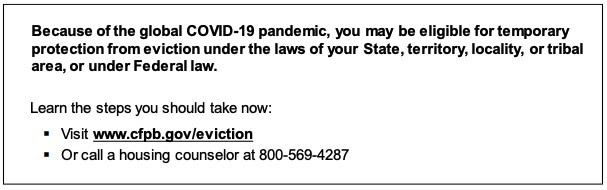

Additionally, the rule requires that debt collectors provide this notice in writing — phone calls, text messages, or emails are not sufficient to meet this requirement. To help satisfy the rule’s disclosure requirements, the CFPB has provided sample language for debt collection.

Eviction Notice Disclosure Language

The CFPB encourages adding the CFPB’s sample disclosure language to an eviction notice. The disclosure is designed to inform renters that they may be eligible for temporary protection from eviction solely under the CDC Order. Below are two examples of the CFPB’s disclosure language:

What Happens If Operators Violate the CFPB Rule?

If debt collectors fail to provide notice to renters, the FDCPA can hold violators liable for actual damages, statutory damages, and attorney fees. Class actions may also be brought against violators. With many state and local governments implementing their own eviction moratoriums, debt collectors may also be required to provide notice of these measures.

How the CFPB Rule Complicates the Legal Landscape

Because the CFPB’s rule extends the CDC’s Order, it prolongs ongoing challenges for rental housing providers while also further complicating compliance efforts due to a patchwork of varying legal requirements. This interim final rule adds even more compliance complexity as federal, state and local eviction moratoriums and emergency rent assistance programs continue to crop up across the nation.

Industry organizations including NAA and NMHC are steadfast in their commitment to combat these policies and instead focus on distributing the nearly $50 billion in federal rental assistance. That said, operators should do their best to understand the ever-evolving legislative landscape. This means operators should know what resources are available to both them and their residents in order to minimize eviction compliance issues.

How Can Operators Help Residents? 5 Steps for Struggling Renters

The CFPB reported that many renters are unaware of their rights under the moratorium, or may not know how to use protections. In order to avoid eviction, the CFPB has outlined steps that at-risk renters can take, including:

- Identify free housing help

- Determine CDC protection qualifications

- Download and sign the CDC Eviction Protection Declaration

- Share the signed Declaration with your landlord

- Research state and local eviction moratorium laws

Alternatively, there are other online resources available to renters. Apartment operators can assist their residents by informing them of these steps.

Disclaimer: The information provided in this article does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available are for general informational purposes only. Information in this article may not constitute the most up-to-date legal or other information. This article contains links to other third-party websites. Such links are only for the convenience of the reader, user or browser; LeaseLock does not recommend or endorse the contents of the third-party sites. Readers should contact their local attorney to obtain advice with respect to their particular circumstances. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation.