Elevating Resident Experience Across the 5 Stages of the Apartment Leasing Process

Looking to elevate your firm’s apartment leasing process and resident experience? Doing so requires meeting the modern renter’s demands as well as addressing the major pain points across the entire renter journey 一 from the moment they become a prospect all the way to the move-out experience.

We hosted an educational presentation via the National Apartment Association’s ApartmentVision webinar series to share the preliminary results of our first annual Apartment Visionaries Survey. Conducted in partnership with Grace Hill, we set out to understand the impact of technology-driven leasing on asset performance in a post-pandemic environment.

Our research reveals a number of insights, including:

- Industry benchmark performance

- Patterns across firms and various role types

- Top-cited challenges

- Opportunities for forward-looking operations

Below is the initial analysis of our survey as presented during our webinar, “Creating a Renter Journey with Tech-Driven Leasing,” which you can watch on demand here.

You can also access the full research report — secure a copy by clicking the button below!

[cta_button link=”https://info.leaselock.com/apartment-visionaries-2021-survey-report” text=”Download My Copy”]

3 Biggest Multifamily Challenges in 2021

To set the stage, we posed two broader questions before asking more specific leasing funnel questions. First, we asked about the biggest challenges firms face today. The 3 most-cited challenges for the rental housing industry are:

- Hiring / retaining talent

- Delinquent rent / bad debt

- New / changing legislation

Occupancy was the least selected challenge, which makes sense when we consider that eviction moratoriums have greatly reduced vacancy rates across the nation.

Top NOI Opportunities for Multifamily in 2022

Next, we asked, “Considering the challenges listed above, what are the biggest opportunities for maximizing NOI you seek to leverage?” This open-ended question produced a variety of responses, but here’s a sampling of top NOI growth opportunities:

- Ancillary income

- Technology / automation

- Talent retention

- Resident experience

- Efficiency (talent, tech)

- Rent growth

- Insurance

- Taxes

- Fees

- Amenity pricing

How to Enhance The 5-Stage Apartment Leasing Process

To better inform your resident experience strategy, we analyzed data around what multifamily property owners and operators are doing across the 5 major stages of the renter’s leasing journey. To that end, survey questions were broken out into 5 sections of the leasing funnel:

- Leads & Traffic

- Consideration Phase & Lead Follow-up

- Leases & Applications

- Move-Ins, Occupancy, & Affordability

- Move-Outs, Renewals, & Evictions

Below, we walk through some of the major survey findings along with takeaways for operators to apply at each stage of the apartment leasing process.

1. Leads & Traffic

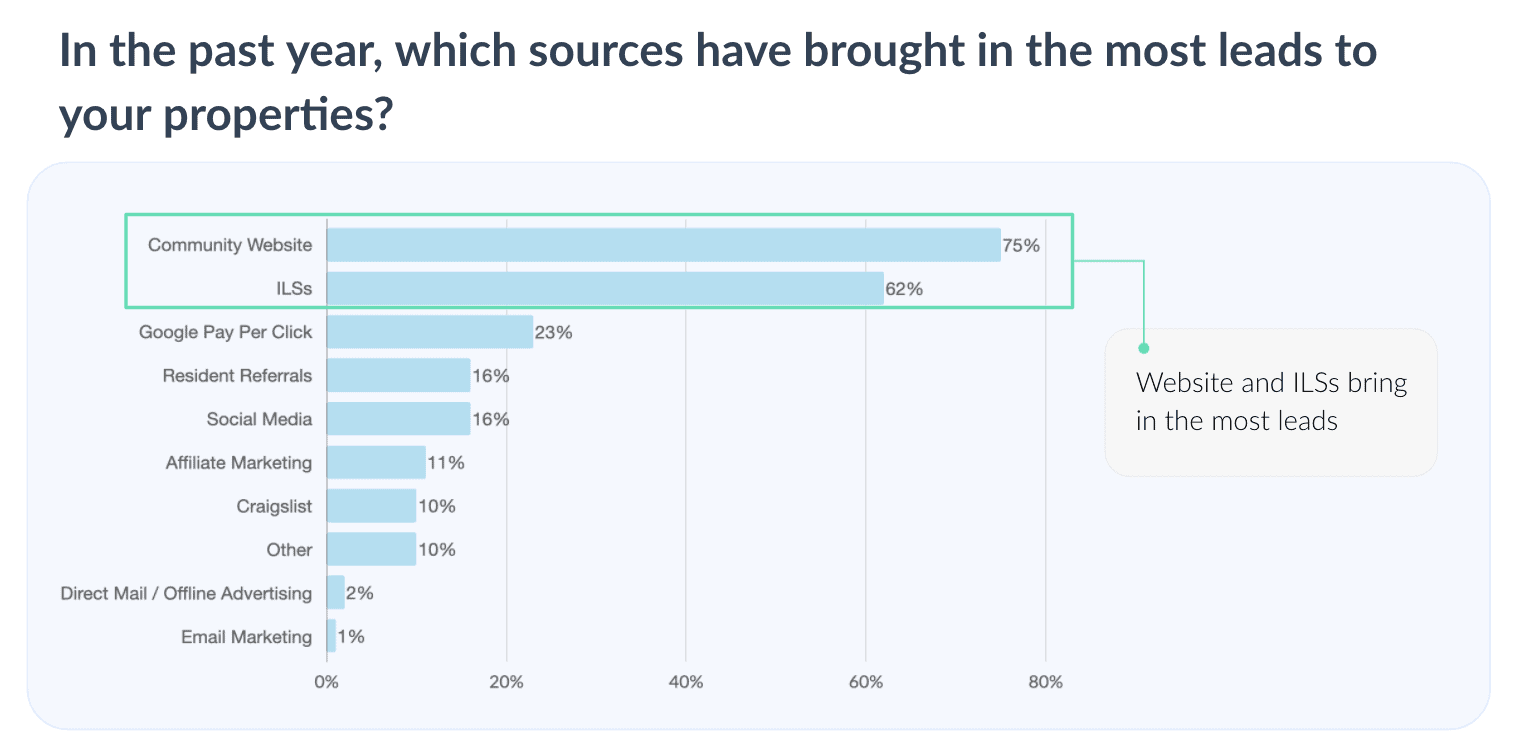

Community Website & ILSs Are Top Lead-Generating Sources

A community’s website and Internet Listing Services (“ILSs”) are cited as the top two sources for leads to properties. It’s important to consider whether website lead source attribution is accurate, as multi-touch attribution can be hard to truly track. In that case, it emphasizes the importance of implementing better lead source tracking solutions. The high percentage that selected ILSs also supports allocating more marketing dollars toward building a presence on top traffic-generating sources.

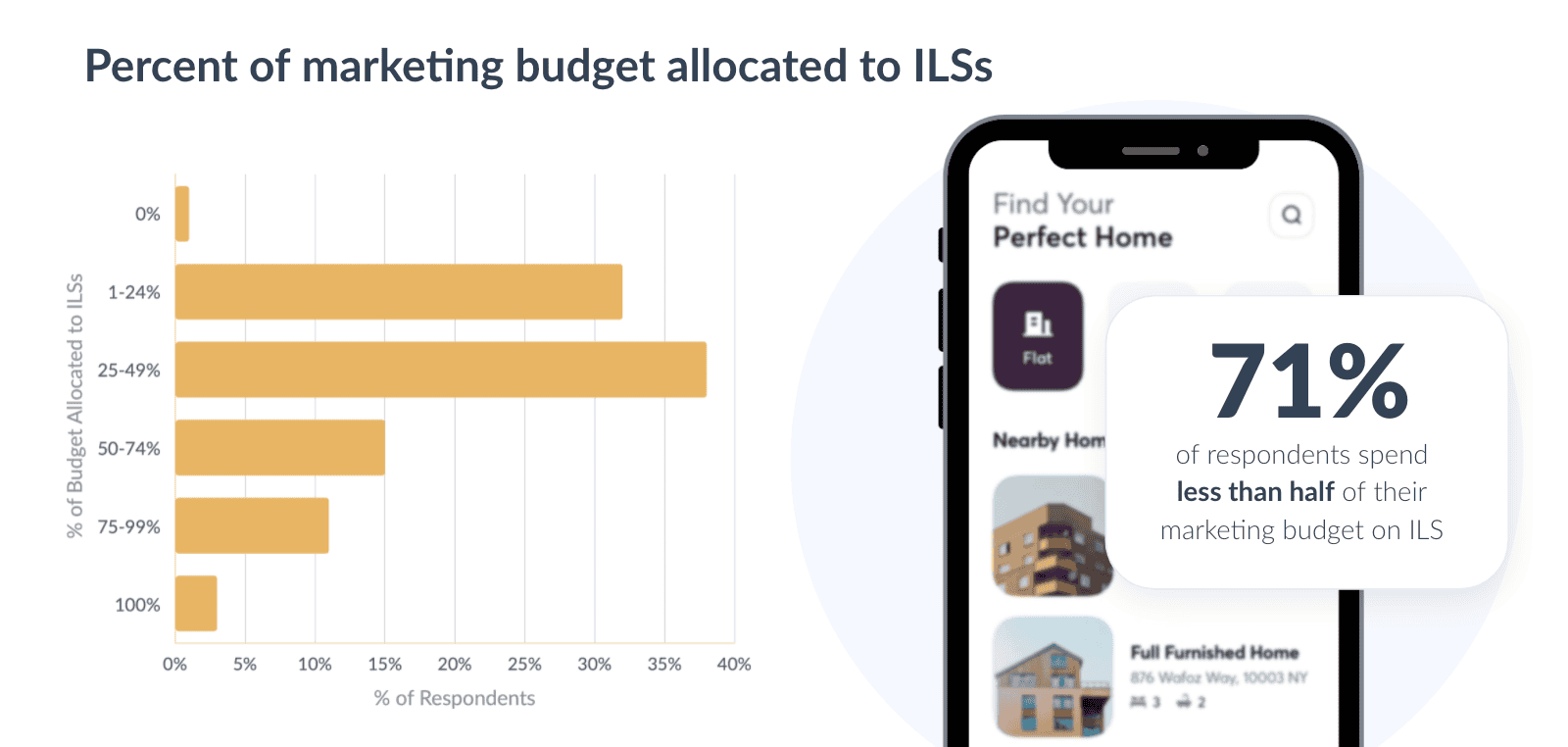

More Than 70% of Apartment Operators Spend Less Than Half Their Marketing Budget on ILSs

Even though 62% cited ILSs as driving the most leads, 71% spend less than half of their marketing budget on that source.

Key Takeaway for Driving More Leads & Traffic

There could be a slight disconnect between the sources cited as bringing in the most leads (community website and ILSs) and the percentage of marketing budget allocated to those channels. While it’s no surprise digital marketing accounts for a large portion of marketing budgets, there may be a missed opportunity to put more spend behind ILSs.

That said, be cautious about your marketing approach with ILSs to ensure your firm spends efficiently and doesn’t steal traffic away from the digital marketing tactics you’re already investing in. This may be the reason we see ILSs producing the most leads but not comprising a significant portion of marketing budgets.

2. Consideration Phase & Lead Followup

Most Tours Occurred In-Person With Leasing Agent Compared to Self-Guided & Virtual Methods

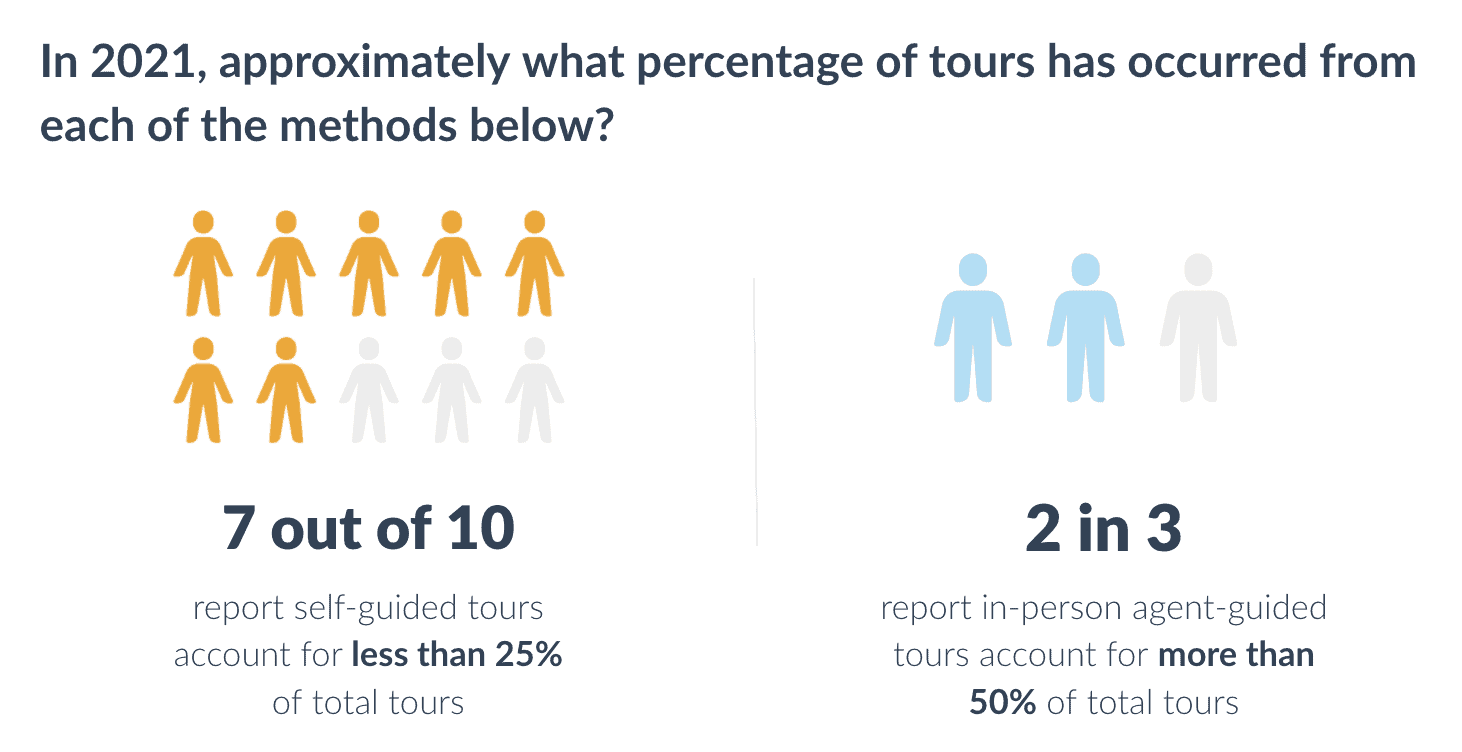

Interestingly, 70% of respondents report that self-guided tours make up less than a quarter of total tours. Whereas at the beginning of the pandemic there was a massive shift toward offering self-guided tours, 67% of respondents report in-person agent-guided tours accounted for more than half of total tours in 2021.

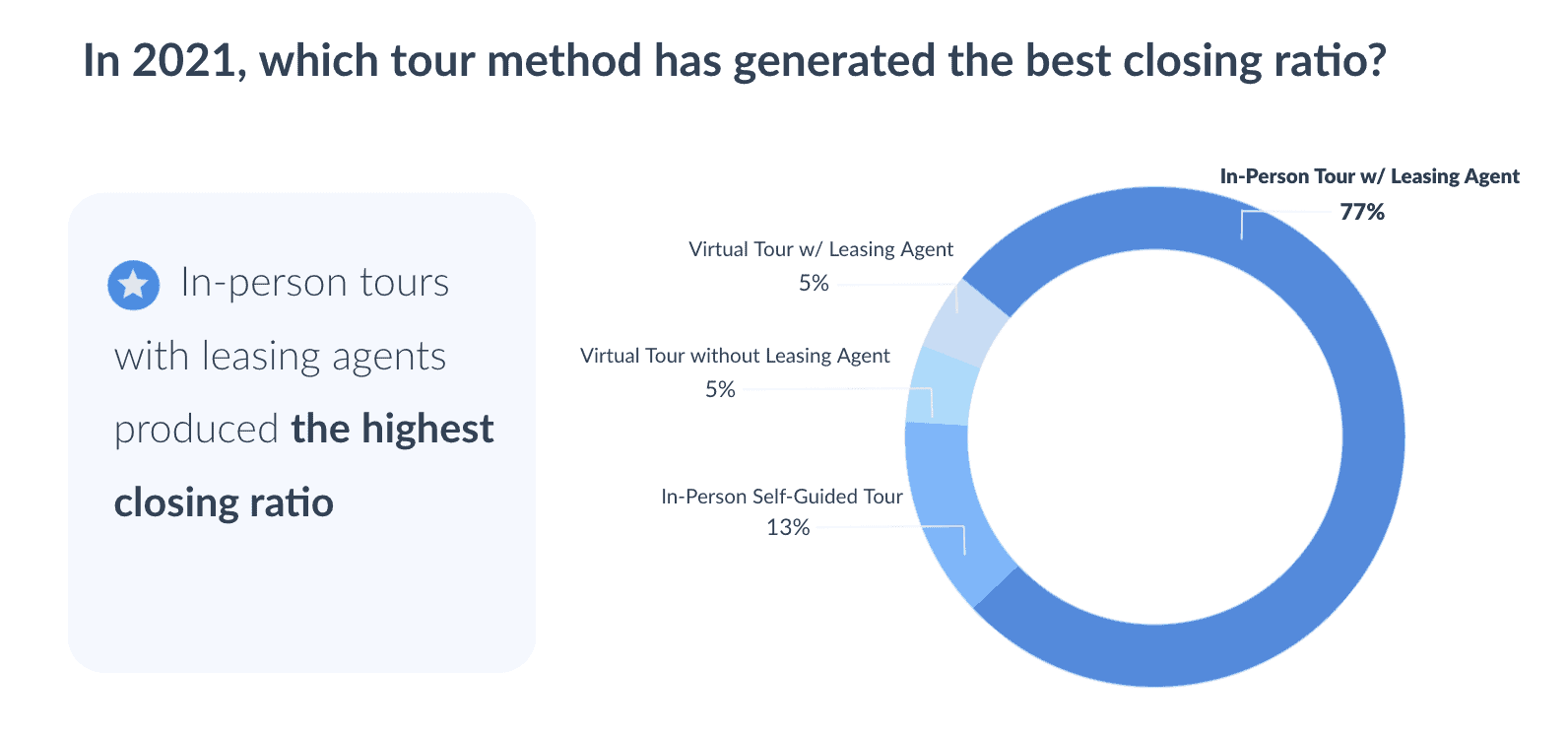

In-Person Tours With Leasing Agent Produce Highest Closing Ratio

Looking at the effectiveness of different tour methods, 77% of respondents indicated that in-person tours with a leasing agent achieved the best closing ratio, demonstrating that while technology has been critical during the pandemic, in-person tours and building personal connections during the leasing process remains vital. This is especially true as COVID-19 vaccines became available, restrictions loosened, and people grew more comfortable with in-person tours.

Key Takeaway for Increasing Lead-to-Lease Conversion

Data shows that renters prefer in-person, and properties see stronger closing ratios when they use in-person tours. Therefore, self-guided tours are not the technology replacement for a lack of talent and turnover on leasing teams. However, self-guided tours remain an area of opportunity in the age of convenience.

3. Leases & Applications

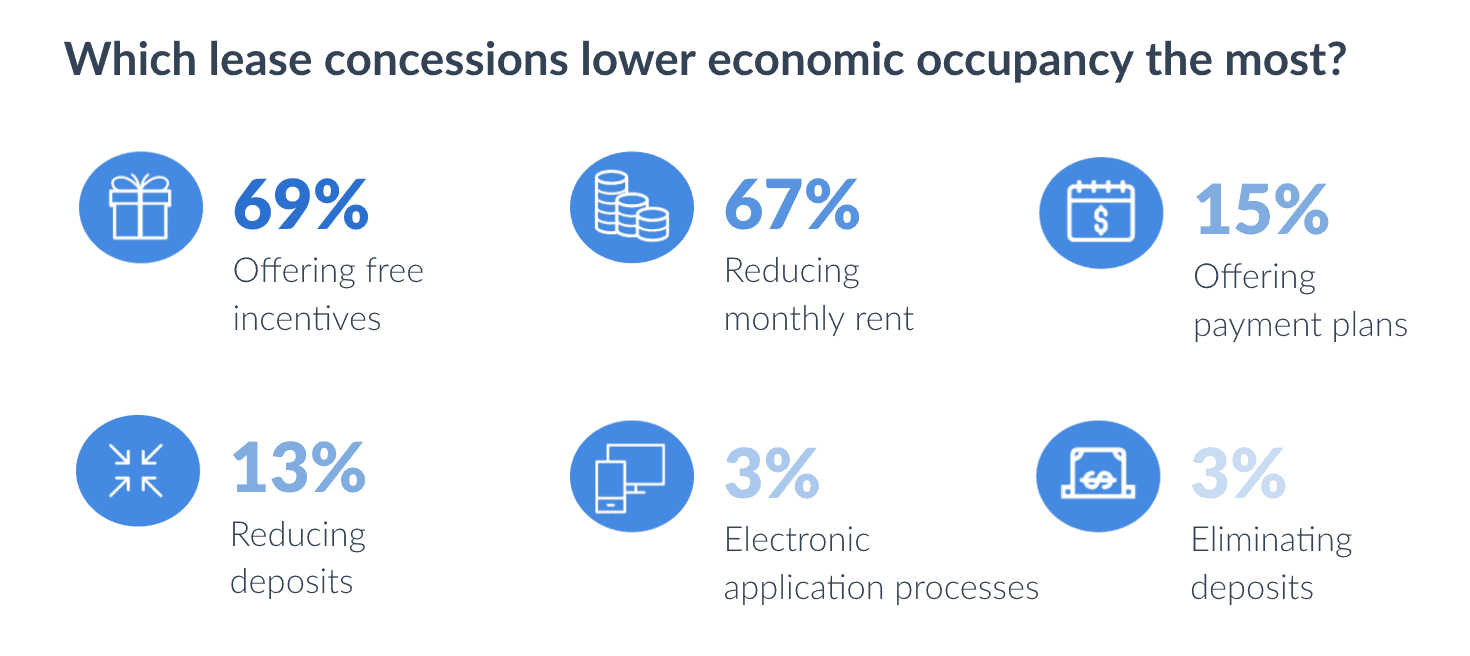

Offering Free Incentives Best Improves Chances of a Potential Renter Signing a Lease

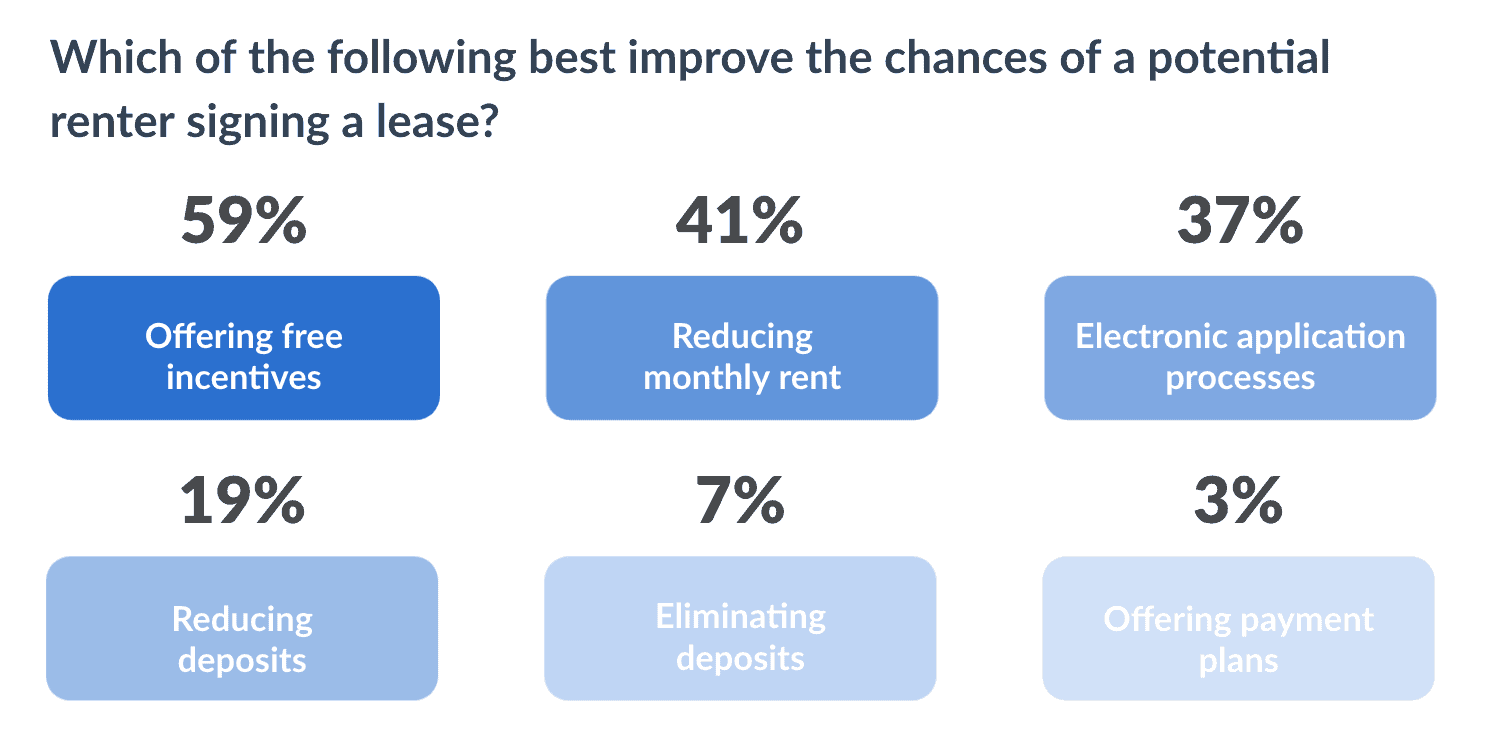

Nearly 60% of respondents said that offering free incentives (e.g., concessions such as ‘first month’s rent free’) most improved the chances of lease signing, followed by 41% who cited reducing monthly rent. Both of these prove that affordability remains an important factor in determining whether renters sign a lease. It’s a good reminder that financially-savvy renters are looking for a good deal.

Owners & Operators Plan to Ramp Up Electronic Application Processes

Almost half of respondents plan to ramp up electronic application processes in 2021, and 30% plan to ramp up free incentive offerings. Also of interest, 18% indicated they would consider reducing deposits, and 10% suggested they would eliminate them altogether.

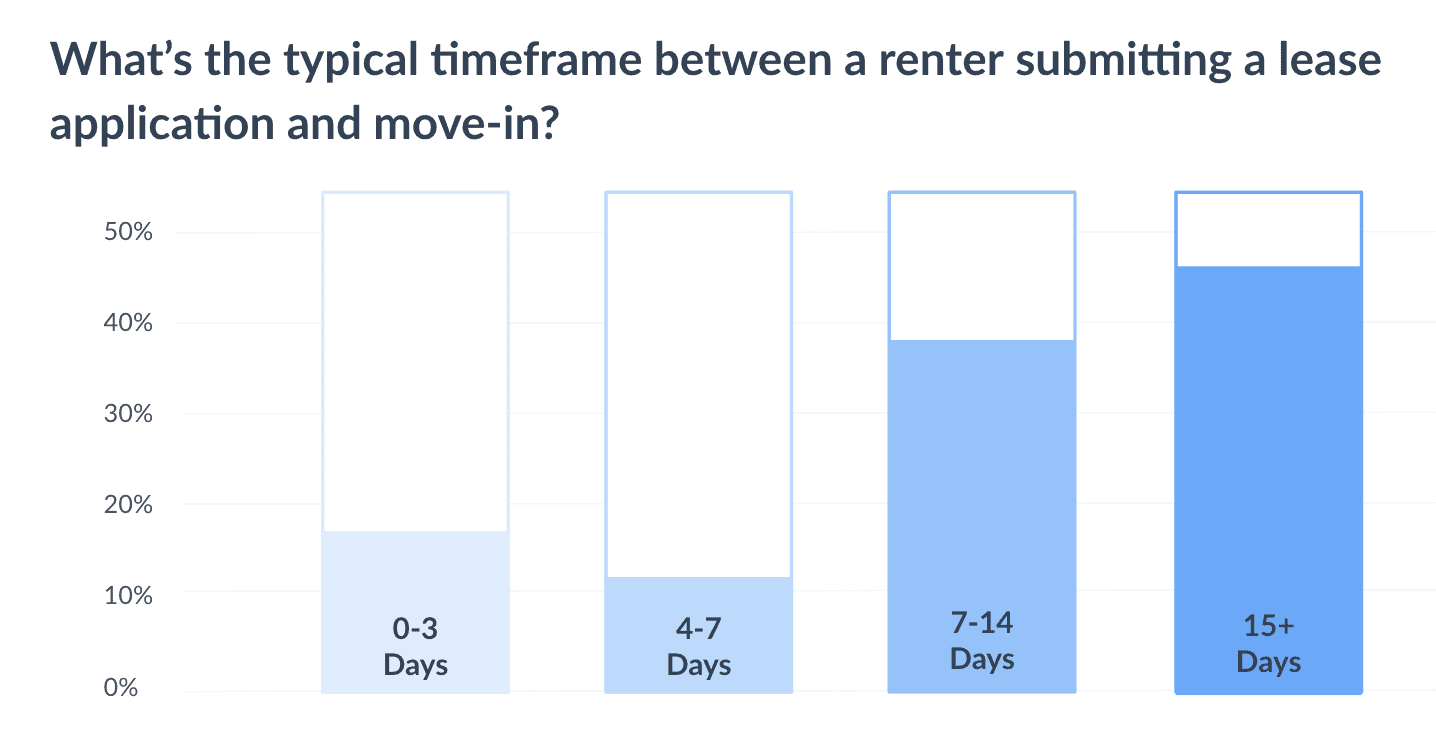

Majority of Application-to-Move-In Time Frames Exceed 7 Days

80% of respondents experienced a lease application-to-move-in time frame of one week or longer — within that group, 15+ days was more the norm. This shows a pain point between these two phases of the renter journey, and an opportunity to leverage integrated solutions to improve quality and timeliness of screening processes, potentially shortening the application-to-move-in time frame.

Key Takeaway for Simplifying Apartment Rental Applications & Increasing Lease Signings

To satisfy renters who demand a fast, simple, safe, and convenient way to apply for an apartment, operators must create a digitally-enabled application process. Therefore, invest in implementing truly integrated solutions to create more native workflows that address both renter and operator pain points during the application process.

4. Move-Ins, Occupancy & Affordability

Free Incentives Lower Economic Occupancy Most

Offering free incentives may be the most popular strategy to improve lease signings among property and regional managers, but among executive leadership, 69% cite this lease concession as hurting economic occupancy the most. Reducing monthly rent is a close second at 67%. Ultimately, neither of these concessions protect NOI.

On the other hand, only 3% indicated that eliminating deposits hurts economic occupancy. This is likely due to the fact that when operators replace deposits with lease insurance, they’re able to protect against bad debt.

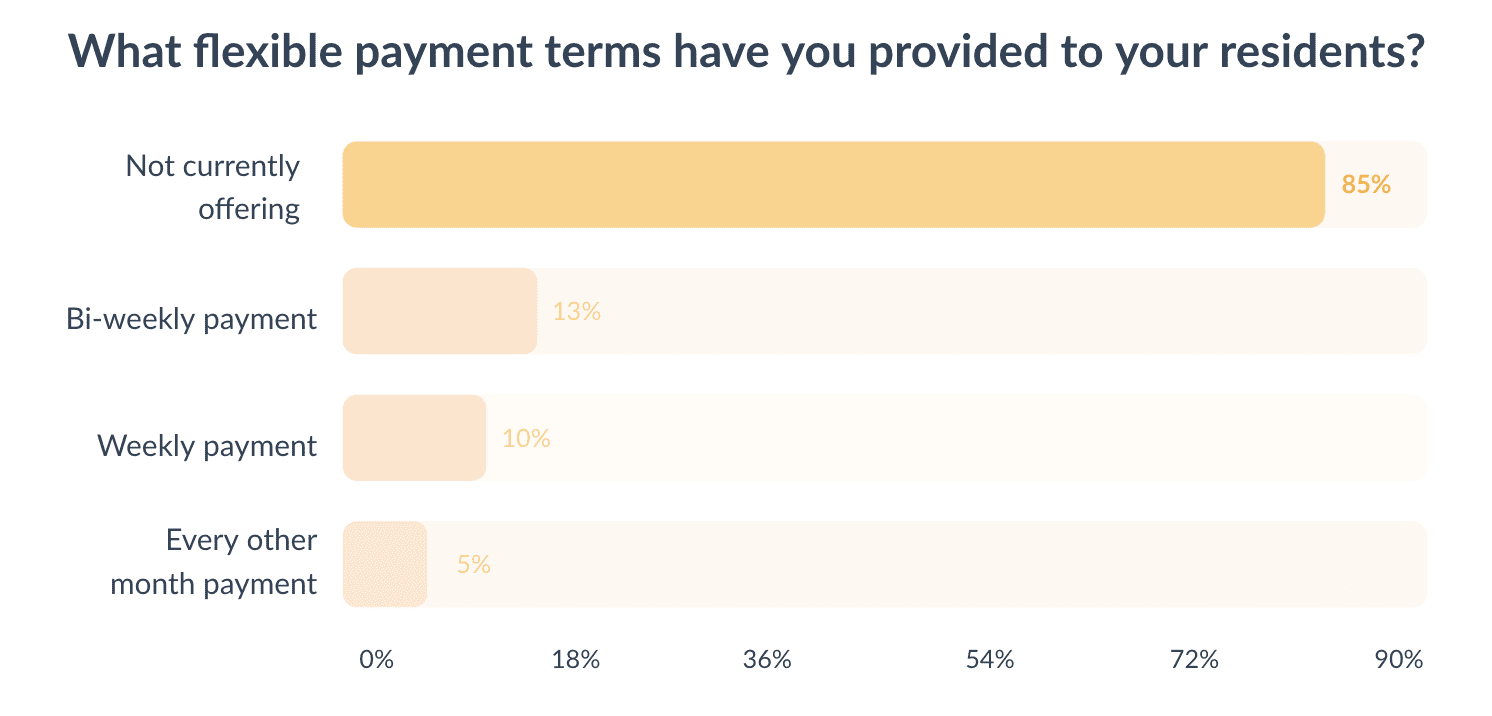

Most Operators Don’t Provide Flexible Rent Payment Terms for Residents

At the onset of the pandemic, a common strategy to help residents impacted immediately by the shutdown was to offer flexible payment terms to address residents’ changing financial needs. When we asked about this in July 2021, 85% of respondents said they don’t currently have flexible payment terms as an option for their residents.

Key Takeaway for Improving Move-In Experience & Renter Affordability

Lease concessions alone, without the right solutions in place, can hurt NOI. Considering the importance of addressing renter’s financial needs and protecting your firm’s economic occupancy, operators should consider offering flexible payment options. In addition, it is important to identify efficient sources of NOI to create income with little to no expense to your property, such as deposit replacement solutions.

5. Move-Outs, Renewals & Evictions

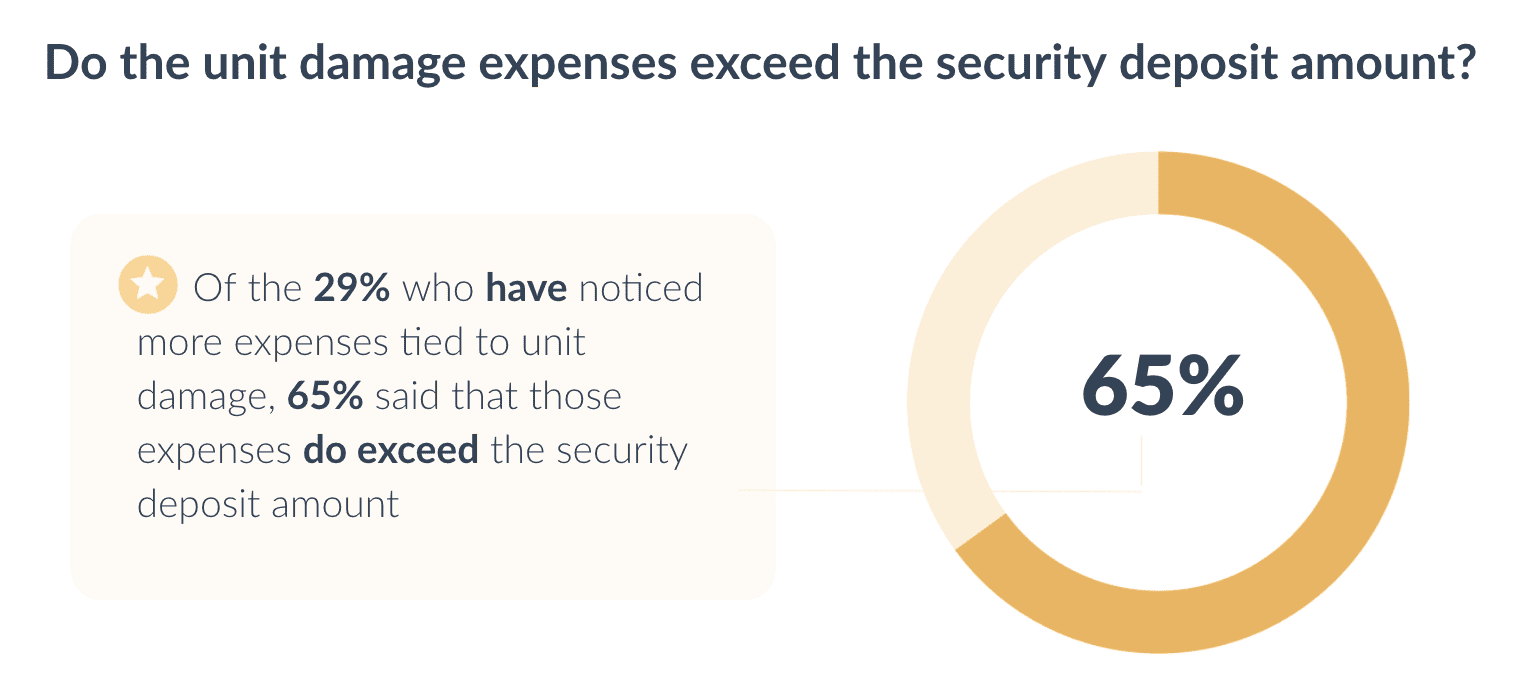

Nearly One-Third Notice More Expenses Tied to Unit Damage

Another impact of the pandemic has been that more people are at home more often. That said, 29% said they noticed more expenses tied to unit damage.

Of the 29% who noticed more expenses tied to unit damage, 65% said that those expenses exceed the security deposit amount. This stresses the importance of reducing bad debt and protecting against both rent loss and damage.

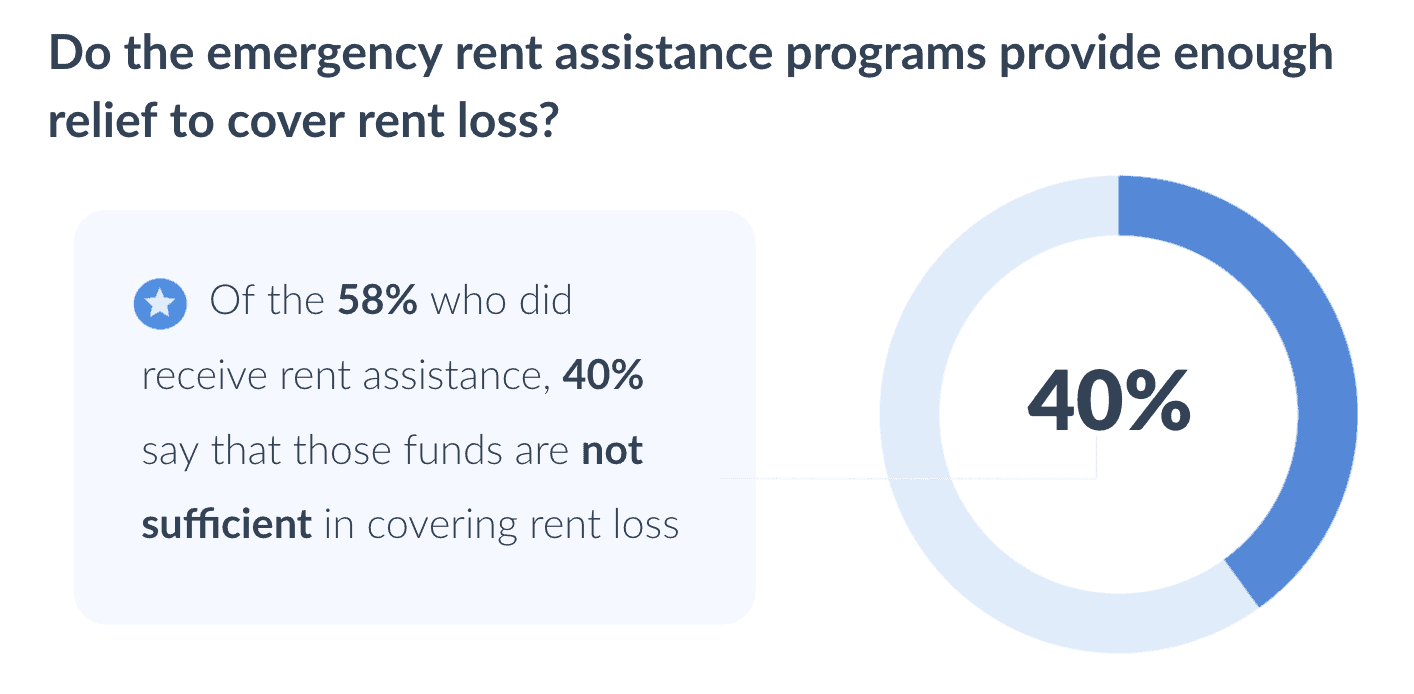

Two-Fifths Claim Rent Assistance Funds Are Not Sufficient in Covering Rent Loss

Of the 58% who said they applied for and received Emergency Rent Assistance Program funds, 40% said that those funds are not sufficient in covering rent loss.

Key Takeaway for Improving Move-Out Experience & Preventing Rent Loss

Invest in solutions that protect your organization against rent loss and negative online reputation (e.g., lease insurance). In addition, take advantage of rent assistance and develop rent relief resources. This means continuing to support the industry’s efforts to ensure rent assistance is distributed efficiently and effectively.

The 2021 Apartment Visionaries Survey Research

In the spirit of educating fellow industry visionaries, LeaseLock and Grace Hill will plan to conduct the Apartment Visionaries Survey on an annual basis. You can access the full research report for a more in-depth analysis of the survey results, as well as insights from leading operators on optimizing the apartment leasing process and resident experience. Download your copy of the report to get it straight to your inbox — visit here.