Apartment Lease-Up Challenges Persist as Deliveries Stay Elevated in 2025

New Supply Is Still Flooding the Market

As of Q3 2025, well over half a million units are moving through the initial lease-up process, according to Yardi Matrix data. While national absorption has been healthy overall, that demand is divided among a record number of new projects, creating major apartment lease-up challenges at the property level.

Rent concessions remain common across most lease-up communities, and the value of those discounts continues to grow, a signal that operators are prioritizing heads-on-beds occupancy strategies over pricing power.

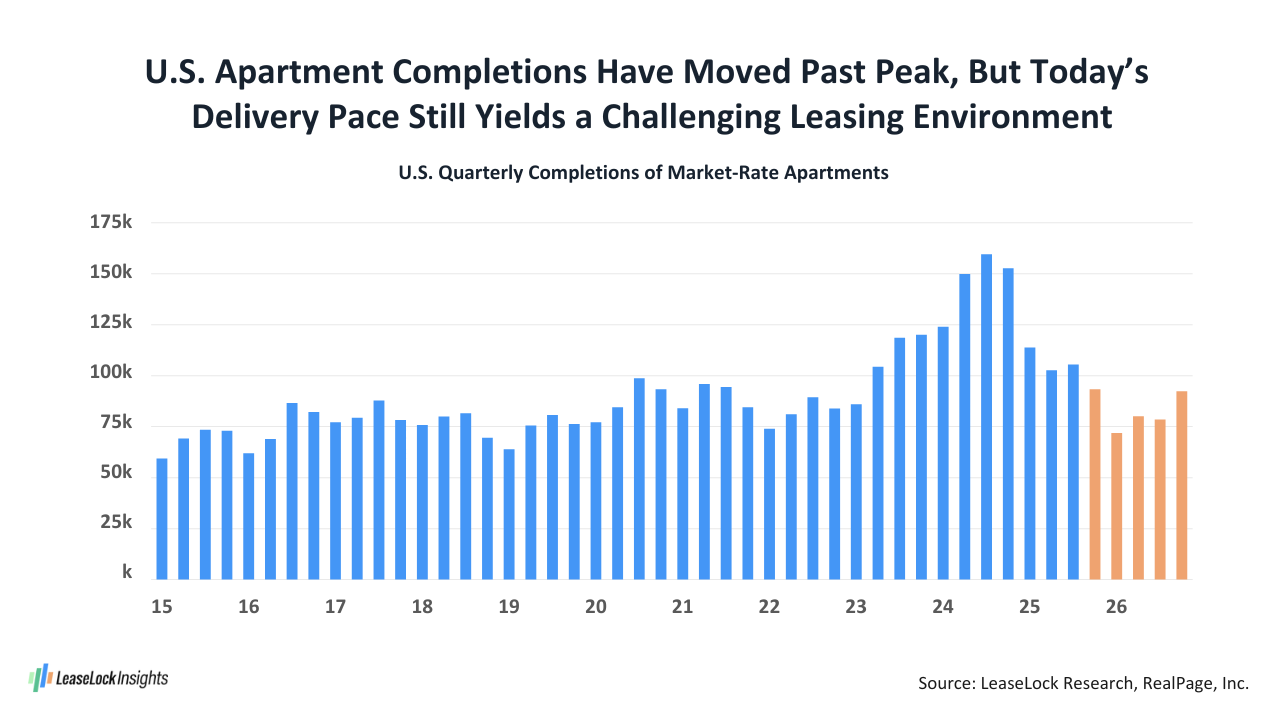

Delivery Volumes Remain Above Historical Norms

Completions have slowed but not enough to relieve pressure. The U.S. is still delivering just over 100,000 units per quarter, down from nearly 150,000 at last year’s peak. That’s well above the 2015-2022 average of 79,000 quarterly deliveries.

Looking ahead, new supply is expected to drop to roughly 81,000 units per quarter in 2026, returning closer to normal. But based on the construction pipeline, true performance momentum for new properties likely won’t return until 2027.

This aligns with insights shared in Apartment Rent Prospects for Late 2025, where slower completions were projected to improve rent growth, though that recovery will take time to materialize.

Demand Is Softening as Job Growth Slows

Compounding the challenge, job production has stalled, creating drag on new household formation and rental demand. Operators are seeing early signs of slower leasing traffic and longer decision cycles.

Even with 300,000+ units absorbed in the first half of 2025, the back half of the year is likely to cool as inflation concerns and consumer caution weigh on activity.

When Relief Might Arrive

The path forward depends heavily on macroeconomic stability and continued moderation in construction activity. If recession is avoided and inflation holds near current levels, developers could see lease-up conditions start to normalize by 2027, but short-term risks remain high.

For now, operators are advised to:

-

Maintain focus on occupancy retention and renewal strategies.

-

Use targeted rent incentives strategically to protect NOI.

-

Leverage deposit replacement from LeaseLock to reduce move-in friction and sustain occupancy through the remainder of 2025.

About LeaseLock

LeaseLock is the only true lease insurance provider for rental housing. Our AI powered underwriting program, LeaseLock ShieldTM, predicts risk and optimizes coverage for properties and portfolios. Owners and operators gain notable profit protection while accelerating leasing, minimizing burden, and removing reputation and legal risk. With over $14 billion in leases insured, LeaseLock is reshaping the way the rental housing industry manages financial risk, while delivering significant benefits to renters. As an accredited GRESB partner, LeaseLock is dedicated to improving housing accessibility by offering renters greater financial flexibility while protecting properties against the risk of bad debt.