It’s post-Labor Day. Summer vacations are now memories, school is back in session, and apartment leasing activity is beginning to slow … unless it doesn’t.

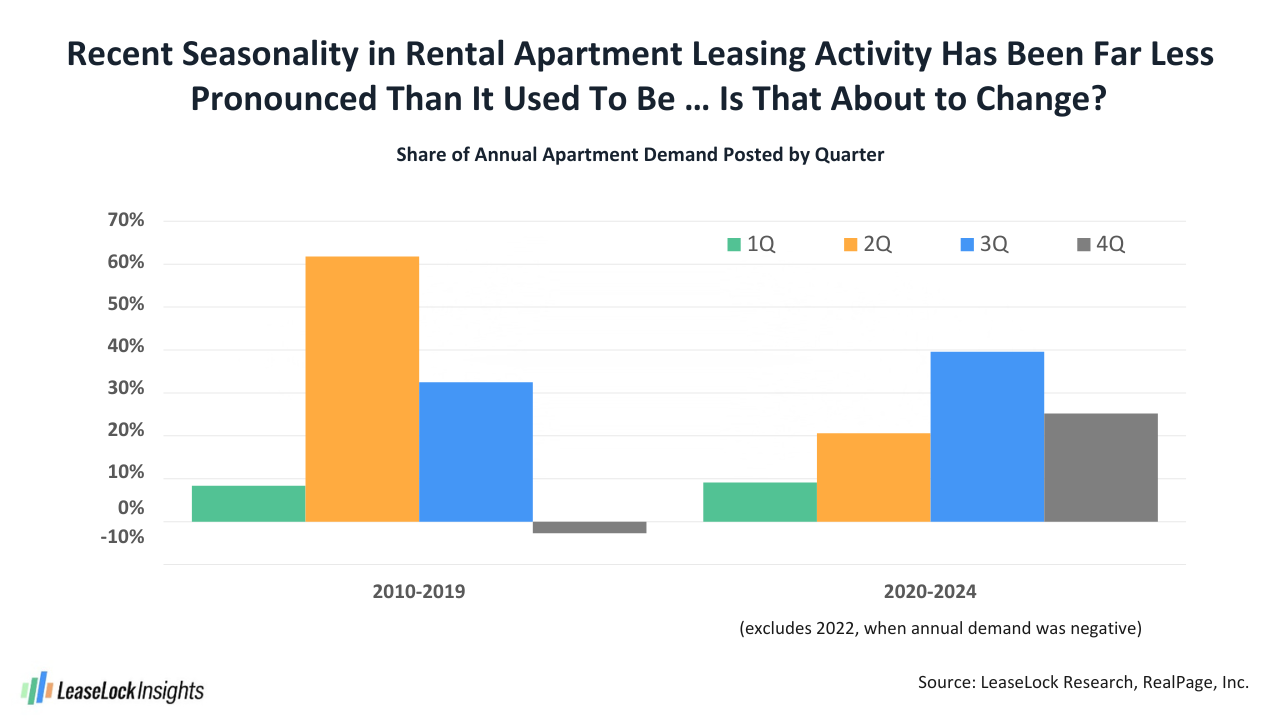

Nearly all the apartment absorption achieved during a calendar year used to register during the spring and summer months. That hasn’t been the case over the past five years, but an inflection in the economy’s performance may cause 2025’s housing demand distribution to revert to the 2010-2019 pattern.

How Apartment Absorption Worked in the 2010s

Looking back to the 2010s decade, a whopping 94% of all apartment demand was captured in the second and third quarters, with second quarter alone typically accounting for more than 60% of all net leasing.

Covid Disrupted the Demand Calendar

That absorption pattern was then drastically disrupted by the arrival of the Covid pandemic at the end of first quarter 2020.

First, we went into lockdown, and nearly no one moved during the second quarter. Then there was a scramble when an unusually large number of households adjusted their living arrangements in the last half of the year. Just over half of 2020’s moves occurred in the third quarter. The fourth quarter – historically a period of slight net move-outs – also proved to be a big demand period, accounting for about 26% the year’s total product absorption.

Recent Absorption Trends in 2025

Since apartment leases tend to run for 12 months, or in some cases a little longer at present, the historically typical pattern of demand distribution was slow to return. Just last year, leasing activity during the back half of the year accounted for 63% of annual apartment absorption, with that demand splitting about evenly between the third and fourth quarters.

Apartment demand achieved during the first half of 2025 surprised to the upside. A little more than 300,000 units were absorbed, blending the demand stats reported by RealPage and CoStar.

Economic Headwinds Threaten Demand in H2 2025

However, it’s now looking like that momentum will be hard to maintain as the year progresses. Job production is stalling, which should slow down new household formation and housing demand. Furthermore, consumers are voicing notable concerns about future price inflation and the negative impact of price bumps on their household budgets.

When economic uncertainty takes hold, many people freeze in place and do nothing.

Return to Pre-Covid Seasonality in Demand

At this point, then, it wouldn’t be surprising to see apartment absorption in the last half of 2025 cut in half from the robust volume achieved in January-June. In turn, the apartment occupancy rate could flatline or even edge down a hair, and – at best – rent growth seems likely to hover at the modest year-over-year increase of about 1% that’s been posted so far in 2025.

It appears that we’re going to flip the script on the apartment demand pattern registered in the post-Covid era, returning to absorption seasonality shifts that were more typical in 2010-2019.

About LeaseLock

LeaseLock is the only true lease insurance provider for rental housing. Our AI powered underwriting program, LeaseLock ShieldTM, predicts risk and optimizes coverage for properties and portfolios. Owners and operators gain notable profit protection while accelerating leasing, minimizing burden, and removing reputation and legal risk. With over $14 billion in leases insured, LeaseLock is reshaping the way the rental housing industry manages financial risk, while delivering significant benefits to renters. As an accredited GRESB partner, LeaseLock is dedicated to improving housing accessibility by offering renters greater financial flexibility while protecting properties against the risk of bad debt.