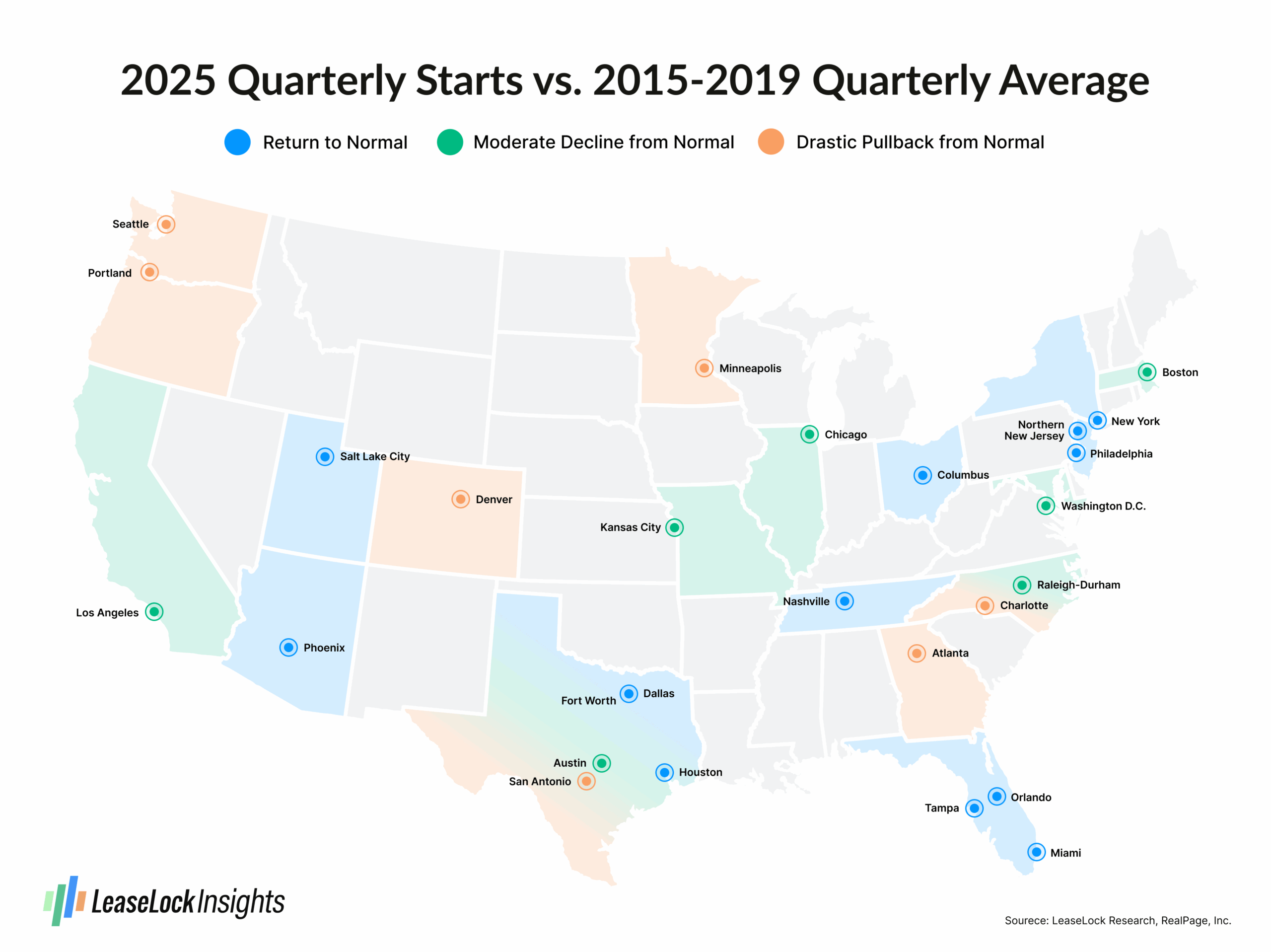

The Cooldown in Apartment Construction Starts Varies Across Markets

Construction starts of market-rate apartments are continuing to lose steam across the nation, dropping notably from recent peak levels nearly everywhere.

While the declines take new project initiations to minuscule volumes in lots of places, the numbers aren’t off the edge of the cliff in all areas. Some locations that have been building hot spots simply are seeing the amount of product on the way back up to tallies more in line with the historical norms.

RealPage’s initial mid-year count placed U.S. second quarter construction starts at just 35,000 or so units, taking the start total for the first half of 2025 to a hair over 100,000 units. While it’s likely that a handful of additional projects will be identified when the stats are revised/updated, the number of units just beginning to come out of the ground are on track to be reduced to levels last seen in 2010-2011, a period when the market was just beginning to come back alive after the Great Financial Crisis.

There are some locations where starts truly are down to virtually nothing. In one of the most extreme cases, this year’s quarterly starts in Portland – notably a place where rent control discourages building – are running at only 100 or so units, compared to the 2015-2019 average of roughly 1,500 units. (The sustained healthy market fundamentals maintained in 2015-2019 make the period an ideal comparison point for more recent activity. This analysis specifically looks at metros where 2015-2019 quarterly starts reached an average of 1,000+ units.)

Quarterly starts this year also are down to less than a third of the 2015-2019 quarterly norm across metros like Atlanta, Charlotte, San Antonio, Minneapolis, Seattle and Denver.

In contrast, quarterly groundbreakings so far this year are almost exactly in line with 2015-2019’s typical levels in Dallas – the market with by far the most absolute starts, 5,500 units per quarter – and in Miami. Similarly, activity is only a hair under the past norm across Phoenix, Northern New Jersey, Fort Worth and Columbus.

Spots registering new building volumes that are down less than a third from the 2015-2019 standard also include Philadelphia, Nashville, New York, Tampa, Houston, Orlando and Salt Lake City.

Most apartment owners and operators are expecting that more modest completion volumes in 2026-2027 will open the door for rent growth to improve notably from the lackluster performances seen in quite a few local markets during the past couple years.

That’s a reasonable base case outlook, but keep in mind that some locations still will be adding enough new units to sustain some competition for top-end deliveries moving through initial lease-up.

About LeaseLock

LeaseLock is the only true lease insurance program for rental housing. Our AI-powered underwriting solution – LeaseLock Shield™ – harnesses the power of machine learning to determine the best coverage for each property and portfolio’s specific needs. The result is ultimate protection from write-offs and legal risk as well as reduced operational burden. With over $10 billion in leases insured, LeaseLock is delivering significant benefits to both renters and investors while reshaping the way the industry manages risk. LeaseLock is dedicated to improving housing accessibility by removing financial barriers for renters while protecting against risk. Brand Positioning 1.1 — About Us Please reference the following boilerplates in short, medium, and long lengths.