Apartment Demand Is Normalizing in 2026 as Supply Eases and Rent Growth Reemerges

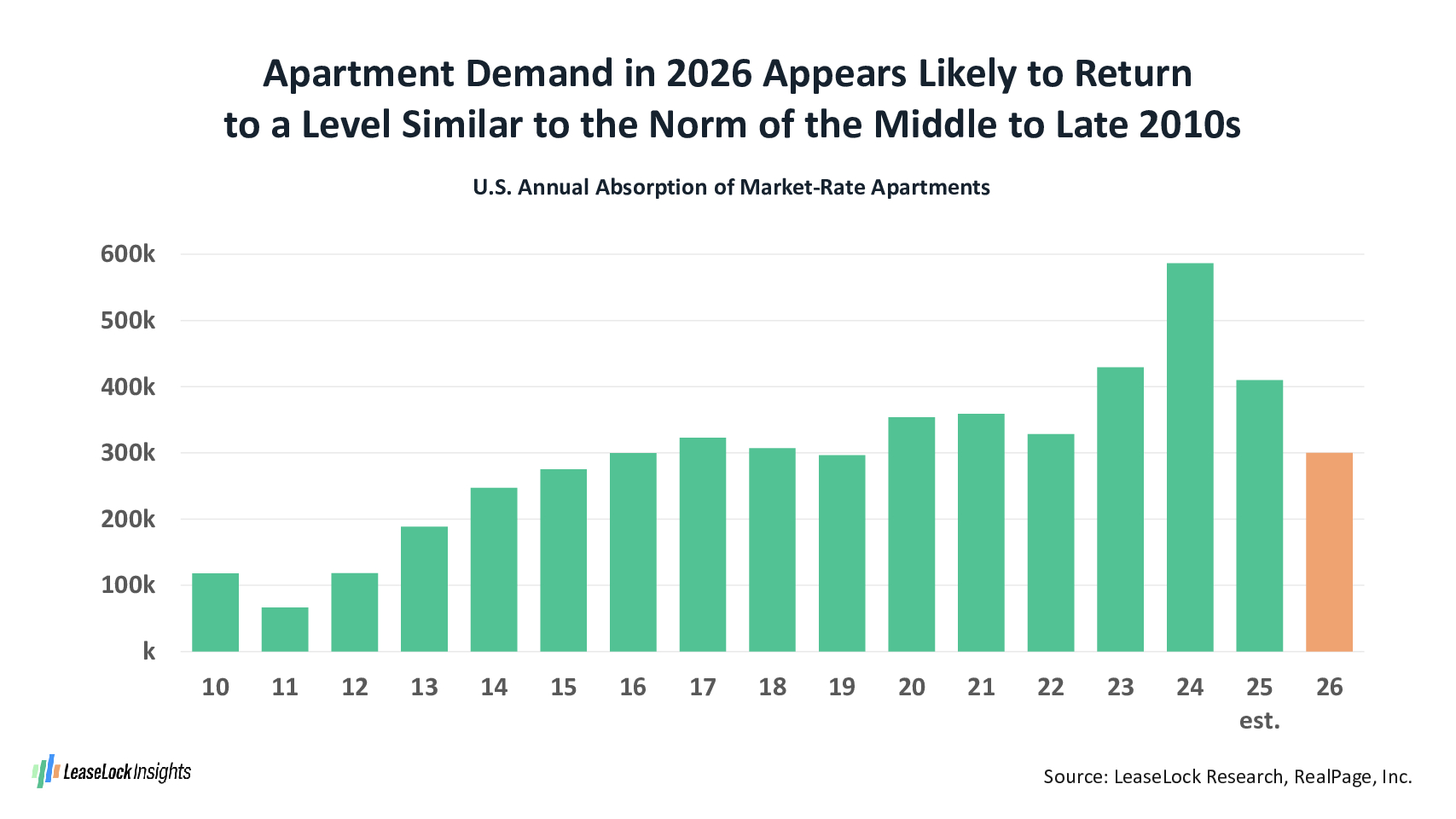

U.S. apartment demand is expected to return to a more typical absorption pace in 2026, with market-rate apartment demand projected to reach approximately 300,000 units for the year.

This forecast reflects a normalization after several years of outsized demand following the pandemic. Apartment absorption peaked in 2024 when occupied unit counts surged by nearly 600,000 units, according to RealPage.

The anticipated level of demand in 2026 closely aligns with the volume of new supply scheduled for delivery. As a result, overall apartment occupancy is expected to edge higher, while rents appear positioned to resume growth following multiple years of essentially flat pricing.

Modest Job Growth Supports Household Formation

The multifamily demand outlook for 2026 is supported by moderate economic expansion and steady job growth. Baseline forecasts call for the addition of approximately 700,000 jobs over the coming year, enough to sustain a healthy pace of new household formation.

Who fills those jobs matters. Young adults forming independent households remain a critical driver of apartment demand. Recent difficulty among new graduates in securing entry-level employment represents a key vulnerability. The unemployment rate for individuals aged 16 to 24 has climbed to 10.6 percent, more than double the rate for the broader labor force, and warrants close monitoring as a leading indicator for rental housing demand.

International immigration also influences apartment absorption, as new arrivals overwhelmingly rent. While immigration volumes are expected to trail historical norms, the resulting drag on demand should be concentrated in specific neighborhoods and in lower-priced properties, rather than significantly reshaping national multifamily performance.

Limited Mobility Continues to Support Apartment Demand

Apartment absorption in 2026 will continue to benefit from reduced renter movement into homeownership. The monthly cost premium associated with buying a home relative to renting has reached record highs. While modest easing may occur as mortgage rates decline slightly and home prices stabilize in select markets, affordability conditions are unlikely to shift enough to spark a major wave of home purchases.

Economic uncertainty further reinforces renter hesitation. When households lack clarity around future employment or financial conditions, they tend to postpone major lifestyle decisions, including moving or buying a home.

That said, resident retention may be approaching its peak. Renewal rent growth has outpaced move-in rent increases for several years, creating scenarios where in-place rents exceed publicly marketed prices for new residents. As renewal pricing continues to normalize, comparison shopping among existing residents could increase in 2026 relative to recent years.

Apartment Supply Growth Eases Meaningfully

New apartment supply is expected to cool notably in 2026. Market-rate deliveries are projected to total approximately 323,000 units, down roughly one-third from the 477,000-unit annual average recorded between 2023 and 2025.

While supply volumes remain elevated by historical standards, the slowdown should ease competitive pressure. Property owners and operators may begin pulling back on concessions and rent discounts as absorption stabilizes and lease-up conditions gradually improve.

The Big Picture for the Apartment Market in 2026

Multifamily operators will continue to face a challenging but improving operating environment in 2026. While conditions remain less favorable than during peak expansion years, market headwinds are easing relative to the pressures experienced in recent cycles.

Operators that rely on data-driven pricing, disciplined risk management, and a clear understanding of renter financial capacity are best positioned to perform well during this transitional period, setting the stage for stronger growth opportunities in 2027 and 2028.

About LeaseLock

LeaseLock is the only true lease insurance provider for rental housing. Our AI powered underwriting program, LeaseLock ShieldTM, predicts risk and optimizes coverage for properties and portfolios. Owners and operators gain notable profit protection while accelerating leasing, minimizing burden, and removing reputation and legal risk. With over $14 billion in leases insured, LeaseLock is reshaping the way the rental housing industry manages financial risk, while delivering significant benefits to renters. As an accredited GRESB partner, LeaseLock is dedicated to improving housing accessibility by offering renters greater financial flexibility while protecting properties against the risk of bad debt.