A mix of both good news and bad news has shaped apartment market performance in 2025, with early-year fundamentals painting a complex picture for the rental housing sector.

Solid demand in the face of stunning economic uncertainty is a big positive, allowing occupancy to climb about 90 basis points. (Keep in mind that occupancy usually stabilizes in the third quarter and then backtracks as the year concludes. Calendar 2025’s occupancy shift should be slightly upward, but not to the degree seen in the year-to-date performance calculation.) In another very encouraging trend, resident retention at lease expiration has been sky high across most markets, allowing rental housing owners and operators to bump renewal lease rents at levels in line with the historical norm, even when supply increases have continued to run well above the past average.

On the other hand, move-in lease rent growth has been sluggish at roughly 1.8% year-to-date, held back by minimal increases seen when pricing power normally peaks during the second quarter. (As with occupancy, there’s seasonality to the rent growth results, with the pattern normally including some backtracking during the fourth quarter. Year-to-date rent growth between 1.5% and 2% points to a calendar 2025 price increase likely to land at 1% to 1.5%, rather than the 2% to 3% annual price escalation that many forecasters were predicting as of the beginning of the year.)

Performance results across individual metros for 2025’s initial half for the most part align with expectations. For example, most industry experts came into the year anticipating that New York and metros in the Midwest – especially Chicago – would dominate the top tier of results, and that’s generally proven to be true. At the other end of the spectrum, Phoenix and especially Austin looked to be the country’s real laggards, and, yes, they’re right there at the bottom of the list for overall momentum.

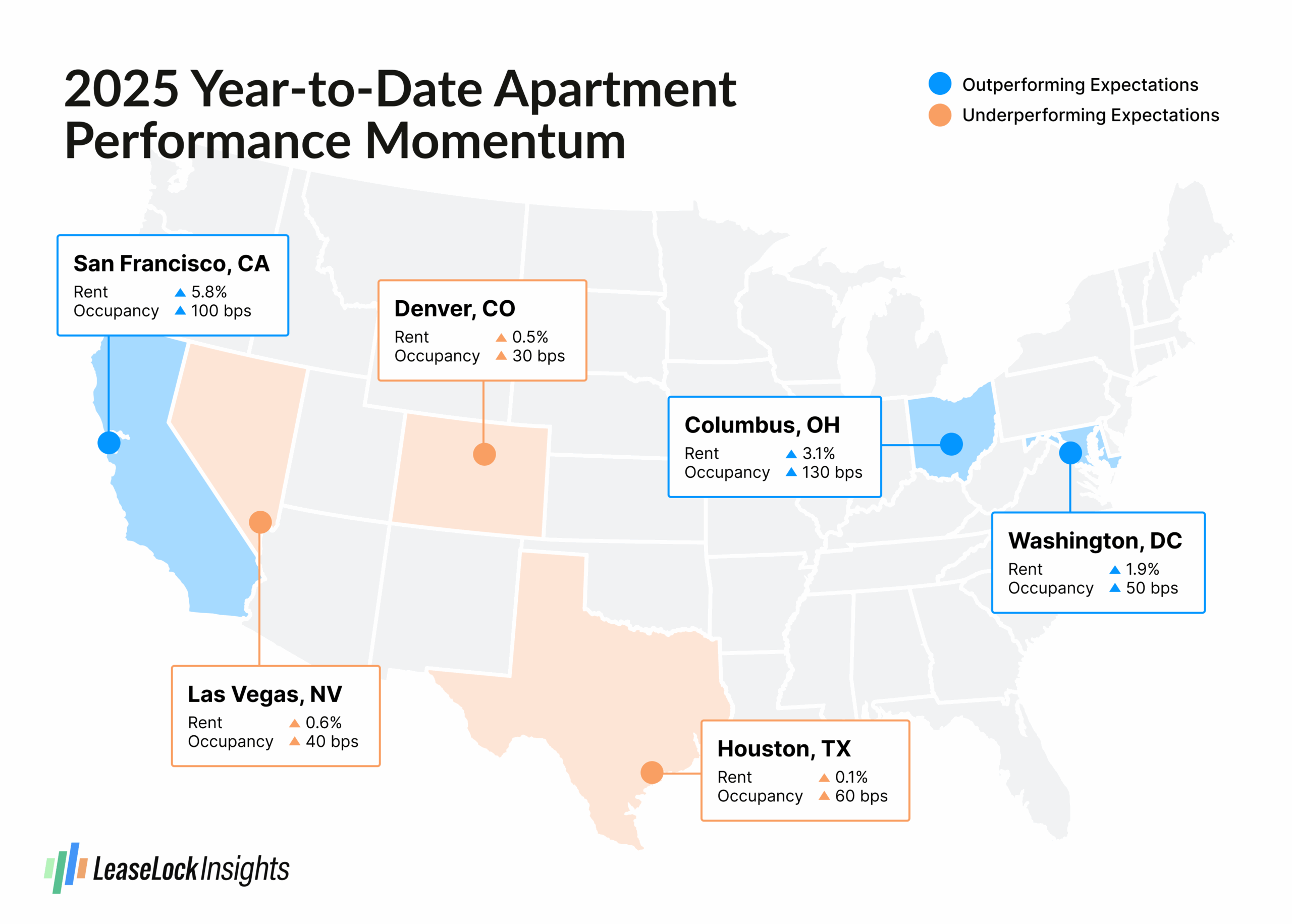

But where are the surprises, both good and bad? Here are a handful of metro-level standouts.

San Francisco’s apartment market has really caught fire this year, with rents up roughly 5.8% so far and occupancy up about 100 basis points (bps). Average monthly rent is back to some $3,500, finally returning to its pre-Covid peak, far after other parts of the country realized that recovery. Neighboring San Jose is posting similar results.

While performance strength across the Midwest is the norm, Columbus might not be expected to maintain the results seen elsewhere across the region, since it’s the one spot adding new supply at levels similar to the inventory growth occurring in Sun Belt locations. In fact, however, stunningly robust demand has pushed up the Columbus occupancy rate by 130 bps so far this year, in turn allowing rents to climb 3.1% year-to-date.

Washington, D.C. came into 2025 as one of the country’s stronger rent growth and occupancy performers. However, some seemed to think that results would crater once federal government job cuts began to be announced. Instead, metro Washington rents are up 1.9% so far this year, and occupancy – already tight – has inched up another 50 bps.

Switching gears, Denver has been a real disappointment for quite a few apartment owners and operators this year. While rents are up a hair, 0.5%, so far in 2025, there’s real danger that price cuts in the second half of the year could lead to flat results or even slight backtracking on an annual basis. Similarly, a minor occupancy bump of 30 bps for the first half of 2025 might not end up being sustainable. Big completions are part of the story in Denver. But the real challenge has come from somewhat sluggish demand, as economic growth has stalled to a greater degree than has been seen in other locations where construction has been very active.

Las Vegas registers mild year-to-date improvements in both rents, up 0.6%, and occupancy, up 40 bps. What makes these results lackluster is that this was one of the few locations across the Sun Belt and Mountain-Desert metros adding a modest block of new supply. With softness emerging in the hospitality sector generally and international tourism specifically, the Las Vegas economy suddenly lacks the vitality that could fuel the progress that was expected across key housing sector fundamentals.

Let’s finish the list of disappointing performers with Houston, and this one’s ranking definitely depends on perspective. While occupancy has ticked up by 60 bps so far in 2025, the overall rate is still relatively low at just over 94%. Furthermore, rents have inched ahead by only a hair, just 0.1%. Those figures are better than the results seen in Dallas-Fort Worth, San Antonio and especially Austin, but Houston entered 2025 seeming dramatically better positioned than its Texas counterparts given faster economic growth and notably more restrained building. Indeed, some were expecting Houston to contend for the title of the nation’s most improved performer this year.

These half dozen metros will be spots to watch during the remainder of 2025, as apartment sector performance trends to date haven’t exactly followed the playbook that was in place at the beginning of the year.

About LeaseLock

LeaseLock is the only true lease insurance program for rental housing. Our AI-powered underwriting solution LeaseLock Shield™ harnesses the power of machine learning to determine the best coverage for each property and portfolio’s specific needs. The result is ultimate protection from write-offs and legal risk as well as reduced operational burden. With over $14 billion in leases insured, LeaseLock is delivering significant benefits to both renters and investors while reshaping the way the industry manages risk. LeaseLock is dedicated to improving housing accessibility by removing financial barriers for renters while protecting against risk.