Renter Retention Reaches 55.1% in Q1 2025 as Move-Out Rates Decline Nationwide | March 23, 2025

Renters aren’t moving around as much as they have in the past. More than half of the nation’s apartment renters are opting to remain in their current units when leases expire, and residents of single-family home rentals tend to stay in place even more frequently than their apartment renter counterparts.

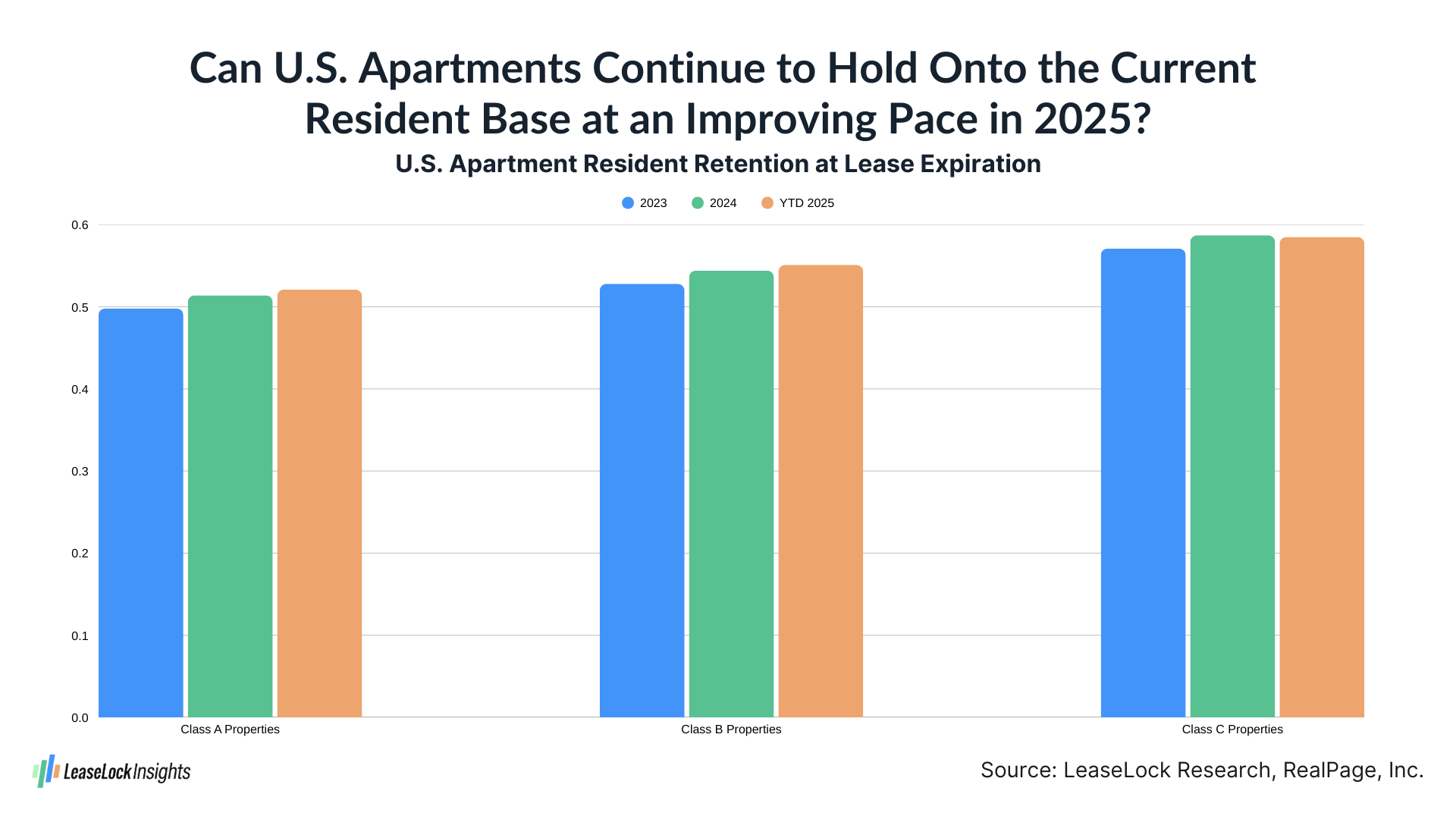

During 2024, 54.6% of U.S. apartment renter households were retained as residents when their initial leases expired, according to stats from RealPage, Inc. That resident retention ratio climbed by 1.6 percentage points over 2023’s results, despite the near-record volume of supply that was delivered during the past year. New completions tend to encourage mobility, as those stock additions generally are offered at discounted rents that can pull some households out of the already existing product inventory.

Preliminary figures for 1Q 2025 show the resident retention ratio bumping up to 55.1%, rising another 0.5 percentage points from 2024’s average and 1.7 percentage points from the early 2024 result.

Lower-end Class C apartments seem likely to continue to post the highest resident retention levels in the near term, but the potential return of higher inflation could become a concern for those living in these communities.

Substantial further new supply should once more keep resident retention in upscale Class A projects below the norm for all communities. That’s especially true in select Sun Belt metros, most notably the building hubs of Charlotte, Raleigh-Durham, Nashville, Austin and Phoenix.

About LeaseLock

LeaseLock is the only true lease insurance program for rental housing. Our AI-powered underwriting solution – LeaseLock Shield™ – harnesses the power of machine learning to determine the best coverage for each property and portfolio’s specific needs. The result is ultimate protection from write-offs and legal risk as well as reduced operational burden. With over $10 billion in leases insured, LeaseLock is delivering significant benefits to both renters and investors while reshaping the way the industry manages risk. LeaseLock is dedicated to improving housing accessibility by removing financial barriers for renters while protecting against risk. Brand Positioning 1.1 — About Us Please reference the following boilerplates in short, medium, and long lengths.