June 1st Rent Payments Start to Slip, Growing Number of Renters Seek Relief

A new month has begun, and it’s time to re-evaluate how American renters are holding up amid the economic downturn.

Although states have begun to loosen stay-at-home orders and businesses are partially reopening, unemployment has hit an unprecedented high. Paired with pending eviction moratorium expirations and a patchwork of depleting emergency rent funding, COVID-19 continues to test the multifamily industry.

In the beginning of May, rent payment behavior started strong. As we moved through the month, rent payments rapidly declined, and evidence of growing struggle among Class C residents began to emerge. June 1st rent payment data suggests that economic cracks are deepening, and will stress rental housing unless more comprehensive relief is provided.

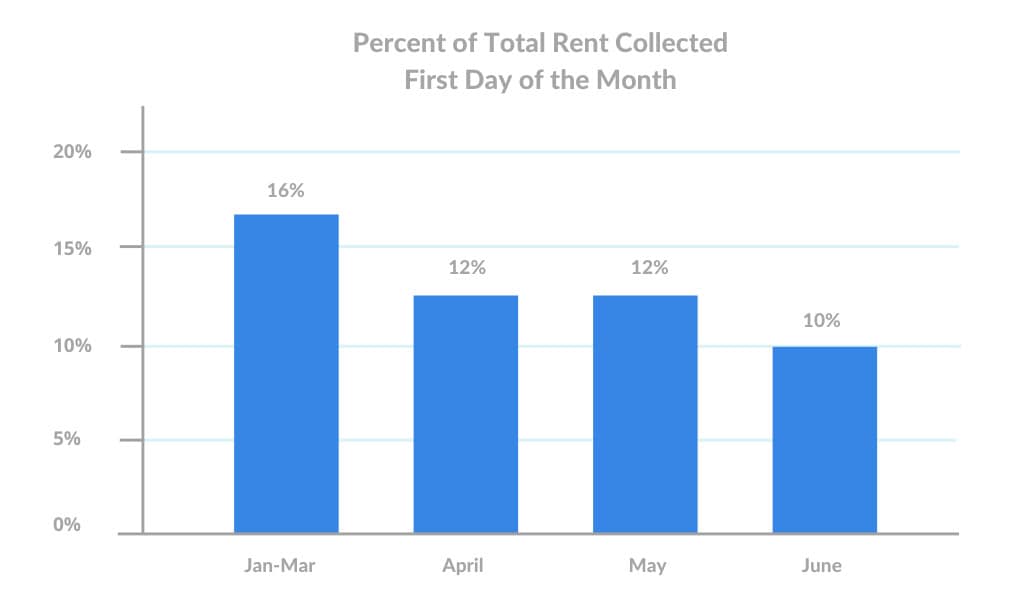

After Several Months of Stability, June 1st Rent Payments Take Slight Dip

While rent payments have yet to fully recover since COVID-19 set in, April and May rents held steady. After federal relief checks were cut and unemployment benefits were padded, renters prioritized putting funds toward rent payments.

However, as predicted in our analysis of Class C rent payments in May, strains on working class Americans created ripple effects on the rest of the economy — and has started extending to the rest of the apartment industry.

First day rent payments in June saw a 2 percentage point drop in total rent collected compared to May and April — and a 6 percentage point drop compared to the pre-COVID average.

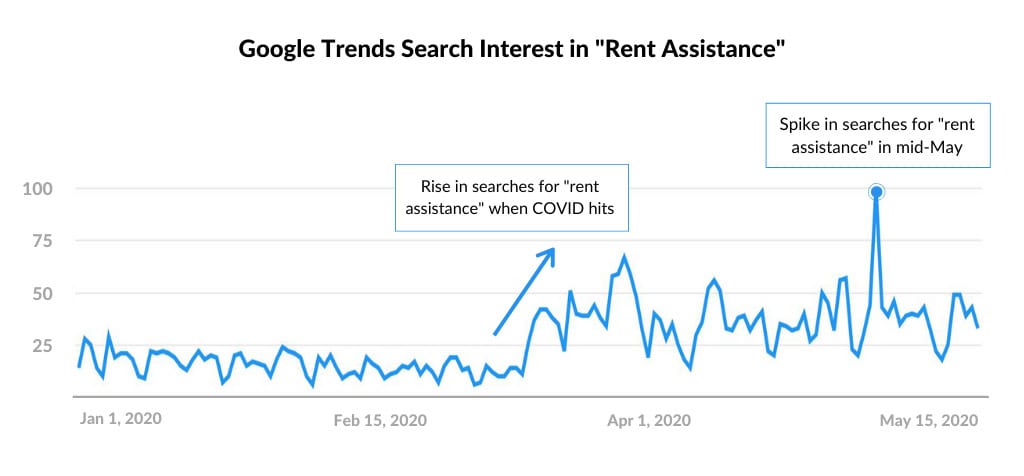

Growing Number of Residents Seeking Rent Assistance

Unemployment continues to climb in the US — the Bureau of Labor Statistics estimates just under 15%, while analysts at Goldman Sachs are estimating over 20% unemployment. With federal relief checks spent and bolstered unemployment benefits set to expire next month, Americans are starting to feel the financial strain.

A growing number of renters are seeking rent assistance, with Google showing over double the search interest in “rent assistance” since April. Searches for this term also spiked again in Mid-May, suggesting renters were concerned about making rent in the lead up to June.

While April saw a slight surge in end-of-the-month rent payments, May did not see a similar spike, suggesting renters might be holding cash on hand closer to the belt.

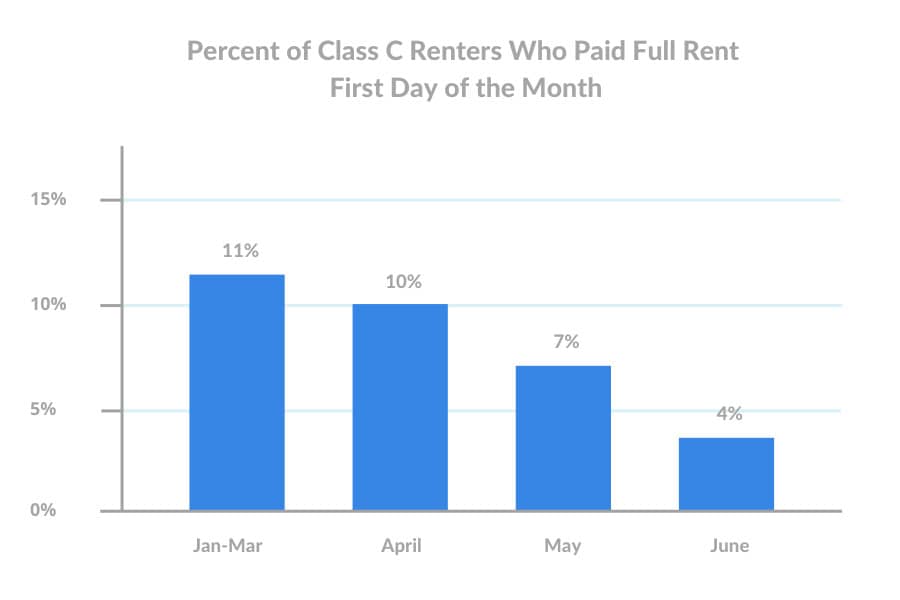

Class C Rent Payments Continue to Drop

As expected, rent payments at Class C properties continue to decrease. Traditionally, Class C properties house working class residents, who were more greatly impacted by recent service industry lay-offs.

After slipping downward for the last two months, Class C properties saw another 3 percentage point drop in first-of-the-month rent payments.

California Sees Drop In Rent Payments, Seattle Stabilizes

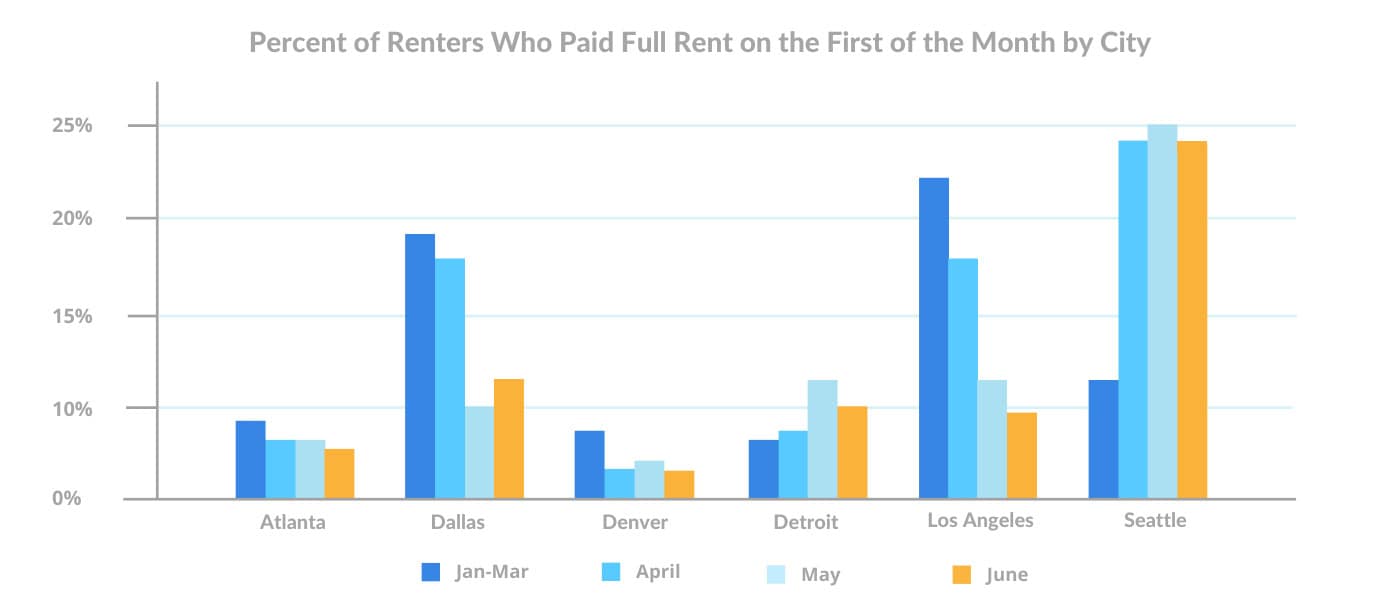

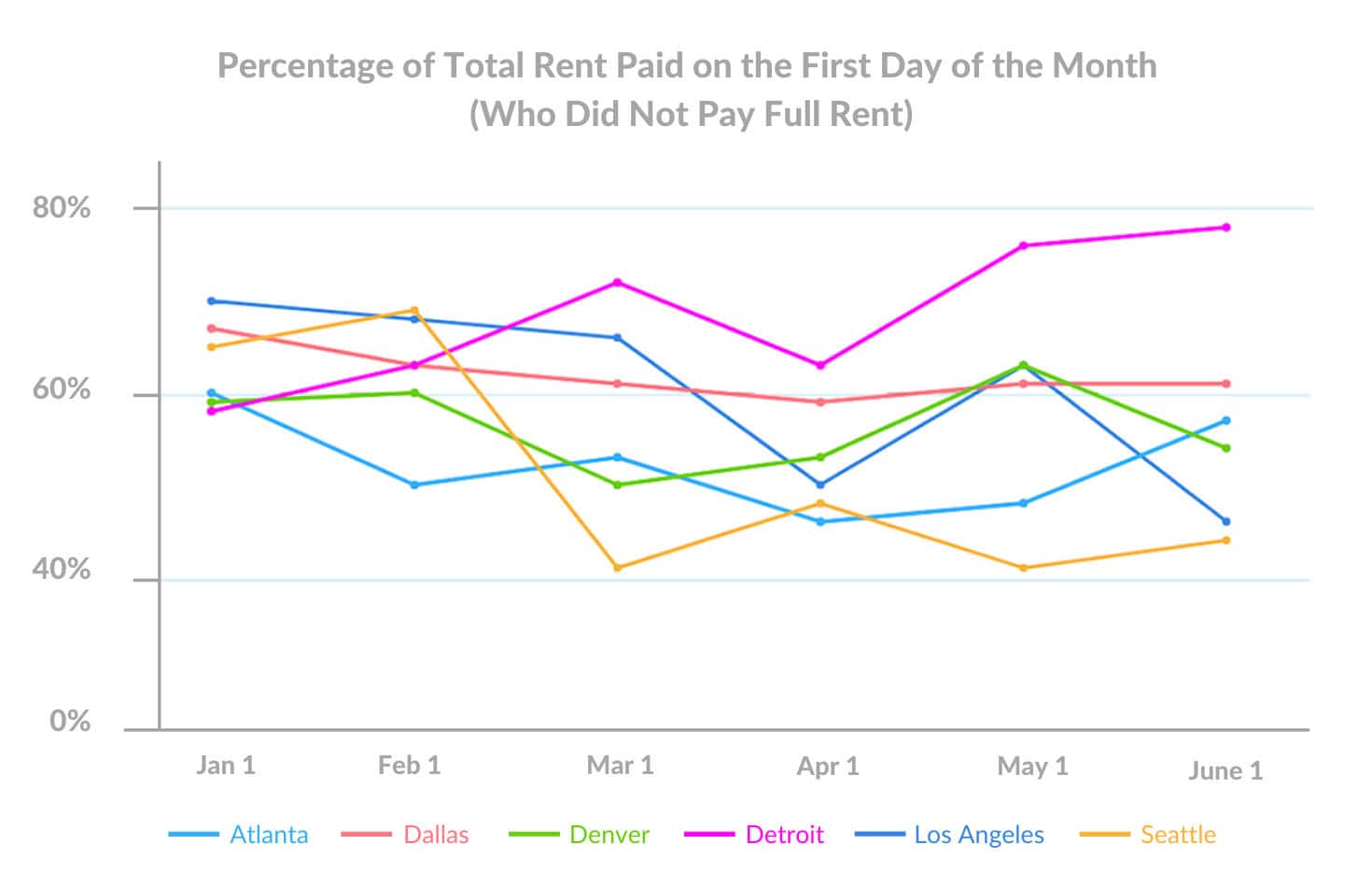

As the economic climate worsens, some regions in particular have been hit hard. Partial payments can still be seen across several metros, with a month-over-month decline in the percentage of renters making full rent payments on June 1st in Los Angeles.

In Seattle, on the other hand, the percentage of full rent payers has held relatively steady. This is likely due to Seattle being one of the first metros hit hard by COVID-19, which triggered a response by operators to devise payment plans for affected renters.

Looking at partial payment data, we see that Los Angeles shows signs of financial hardship. While the overall percentage of total rent paid on the first of the month has declined 5% since last month, Los Angeles has experienced a nearly 20% decrease. This drop is perhaps attributed to rising unemployment, a lack of rental assistance, federal benefits running out, and recent protests.

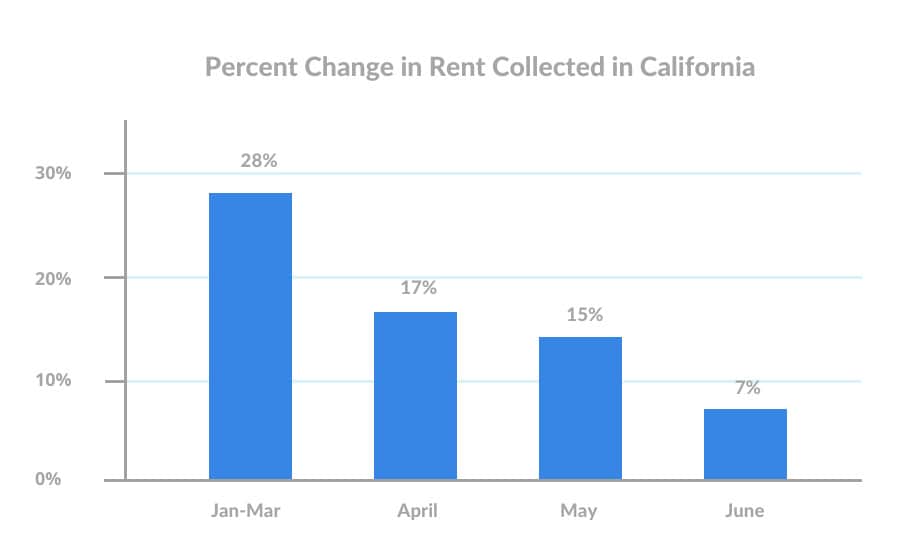

At the state level, California is also showing drops in rent collected, with steady month-over-month decreases each month since April and a 21% differential from the average. Compared to May 1st rent payments, there’s been an 8% drop in the percentage of rent collected in the state.

Regional data suggest that renters are still trying to pay rent, even if in partial amounts, and operators are offering financial flexibility. Even so, we’re seeing a decrease in overall payments and a lower portion of total rent collected, indicating that both state and local economies are suffering at the hands of a worsening economy.

What Does This Mean for Multifamily?

There’s no question that the pandemic has strained the U.S. economy. This early dip in June rent payments suggests a continued decline in rent payment behavior as the month continues, especially barring government relief. A growing number of renters are seeking rent assistance, but not enough programs exist to support this need. While several states have pulled together a patchwork of rent assistance programs, funding and pay-outs have been inconsistent.

Apartment communities and their residents still need immediate federal rent funds to help prevent a potential rental housing crisis. Multifamily operators and associations across the country have been rallying behind a proposed $100 billion rent relief bill to help America’s renters as part of the HEROES Act. The bill passed the House floor in May, but it is expected to face opposition in the Senate.

We will be covering this story as it unfolds — keep an eye out for our next rent payment analysis early next week, after the rent grace period ends (traditionally the first five days of the month).

Important statistical note: Despite the measured payment fluctuations based on the sample set, the variance is within normal statistical range. In other words, the changes are not necessarily significant enough to attribute specifically to COVID-19 versus normal fluctuations expected across the data set. Please reference full Methodology below.

Methodology

Rent payment data is actual transactional data sourced from integrations with property management systems in the multifamily industry.

Analysis includes a 105,070 unit sample from 1,029,428 live units under management by LeaseLock clients. Data is nationwide, representing over half of the NMHC Top 10 property managers in the country and all asset classes (A, B and C). Asset class composition: class A (36%), class B (55%) class C (9%).

All data has been anonymized to remove personally identifiable information for renters and property managers.