COVID-19 Rent Relief Programs from NMHC Top 50 Apartment Operators

As the world continues to combat the spread of COVID-19, non-essential businesses are being forced to shut down and civilians are being ordered to shelter-in-place across the US. Inevitably, the unemployment rate has sky-rocketed, leaving many renters, legislators, and multifamily operators worried about rent.

President of the National Multifamily Housing Council, Doug Bibby, recently wrote an opinion piece making a plea for renters to be accountable and make their payments to prevent a potential housing catastrophe.

According to National Apartment Association President and CEO, Robert Pinnegar, “To minimize the damage, NAA is urging those of our nation’s 40 million renters who’ve been financially unaffected by COVID-19 to make their rent payments in full and on time. Paying rent ultimately keeps people in their homes by ensuring housing providers can meet their own financial obligations and keep the entire apartment community afloat in these troubling times.”

In Response to Downward Trend in April Rent Payments, Operators Work to Provide COVID-19 Rent Relief

We’ve tracked April rent payment data closely, and observed a nationwide decrease in full rent payments in April compared to the average, along with growing movement towards partial payments and deferred payment plans. Many apartment operators are working hard to support renters in making their payments, and devising creative solutions to keep reliable residents in place.

How are top operators ensuring those financially impacted by COVID-19 will receive the necessary rent relief? And how are they providing that rental support to better safeguard their entire community?

How the Rental Housing Industry Has Responded to the COVID-19 Crisis

Operators have spent the last several weeks preparing for the sudden hardship that their communities now face. Across social media, email, discussion forums, and the press, we’re seeing an overwhelming response from property management companies, apartment associations, state governments, and many other rental housing organizations to assemble and circulate COVID-19 resident support resources.

We’ve rounded up key COVID-19 rent relief programs being implemented by several of the NMHC Top 50 apartment managers, as well as organizations such as the NMHC and NAA.

COVID-19 Rent Relief Programs & Flexible Payment Plans

As recommended by the NMHC, implementing customized payment plans has been a popular strategy among top apartment firms. NAA has also released a set of best practices on rent collection amid COVID-19, including templated forms for a payment plan agreement and notice of temporary waiver of late fees.

Lincoln Property Management, for example, mentioned in a letter to its residents that rent relief efforts included payment plan options and other policies designed to alleviate financial burdens for those affected.

Irvine Company is enabling renters to defer 50% of their April and May rent payments over a six month period, interest-free. All they have to do is “request rent assist” to create a new payment schedule. In addition, Irvine Company froze rents and renewal increases through June 1, 2020, is offering short-term lease extensions, and temporarily halted all eviction activity through June 1, 2020.

Equity Residential halted evictions for 90 days for those who can document that they’ve been financially harmed by the COVID-19 crisis, and is offering lease renewals with no rent increases over the next three months as well as payment plans to help those in need of assistance.

Essex is another operator that allows renters to fill out a request form if they have a COVID-19 related financial hardship that inhibits their ability to pay rent.

RAM Partners made a statement asking those experiencing financial hardship to reach out to their community manager to discuss options.

AvalonBay outlined new options to help renters through financial hardship, including account credits, flexible transfers without penalty, and payment plan options.

The Bainbridge Companies has contacted all their residents to discuss alternative payment plans and is waiving late fees for those who experienced financial loss as a result of COVID-19, and has paused rent increases. They have also shared valuable resources for residents seeking assistance.

Bridge Investment Group has developed a COVID-19 Financial Hardship Assistance Program in which residents can work with their property’s staff to develop a rent payment plan that will permit a deferral of a portion of April and/or May rent with payment due over the remainder of their lease term. Bridge will also not pursue eviction filings for the non-payment of rent during the pandemic.

Unique Rental Assistance Initiatives

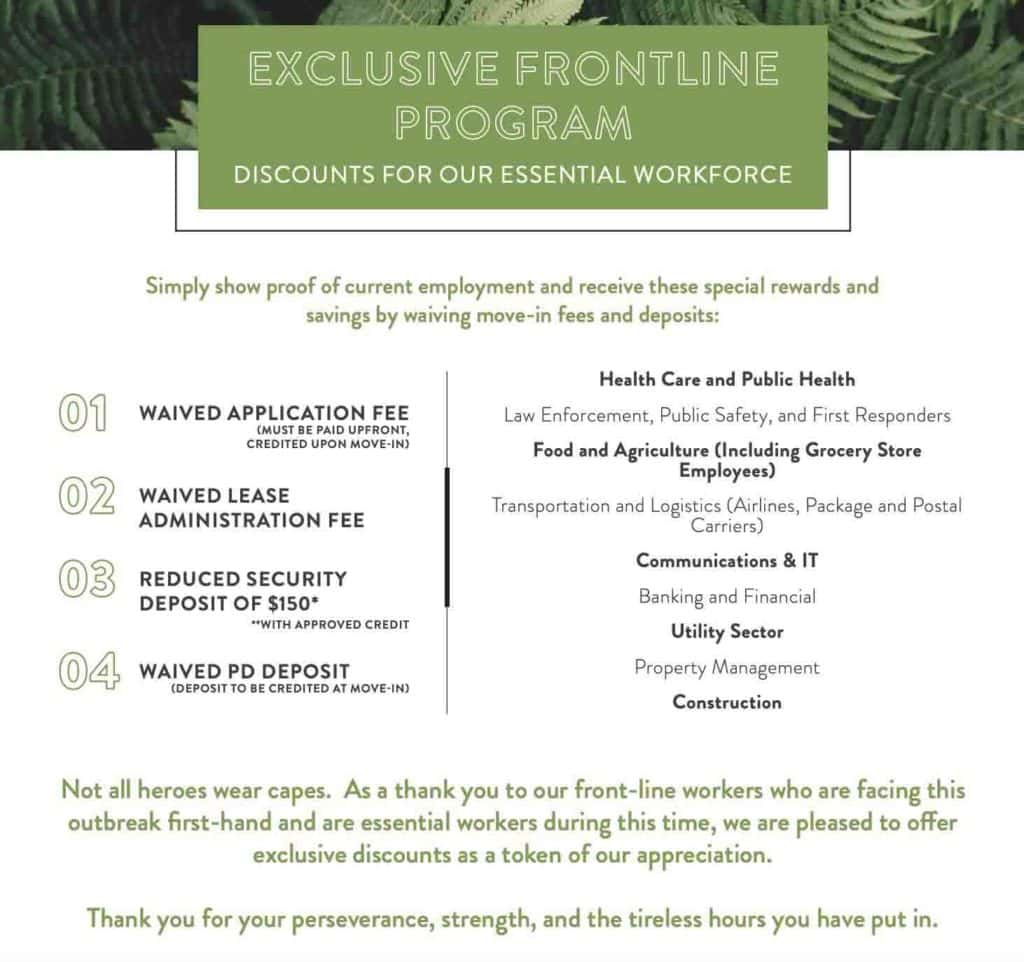

Village Green has implemented its Exclusive Frontline Program which grants move-in discounts for renters who are members of the essential workforce. By waiving move-in fees and deposits for those working on the frontline, Village Green is proactive in supporting the essential workforce.

In a charitable move, Camden Property Trust established a $5 million Resident Relief Fund for COVID-19 Pandemic under which residents who can show COVID-19 related income losses are eligible for up to $2,000 per household. The fund intends to provide financial assistance for living expenses like food, utilities, medical expenses, childcare, insurance, or transportation.

Federal/State/Local Community & Financial Resources for COVID-19 Rent Relief

Many apartment firms have been diligently providing residents with information on government resources regarding direct payments, unemployment benefits, and food banks. They’ve also provided community and financial resources including mental health help, small business loans, children programs, job opportunities, internet access, insurance options, work-from-home tools, and more.

Alliance Residential created a hub for federal, state, and local resources including government relief programs and COVID-19 resident resources. FPI Management also has a list of government resources specifically addressing wage replacement.

BH Management Services created a COVID-19 Resource Page with links to unemployment materials, economic impact payment information, coronavirus information by state, and links to local (Florida) resources.

In Equity Residential’s dedicated blog post, the firm outlines various community non-profits and financial resources offered by the state and federal government, including links to financial assistance programs and unemployment benefits information.

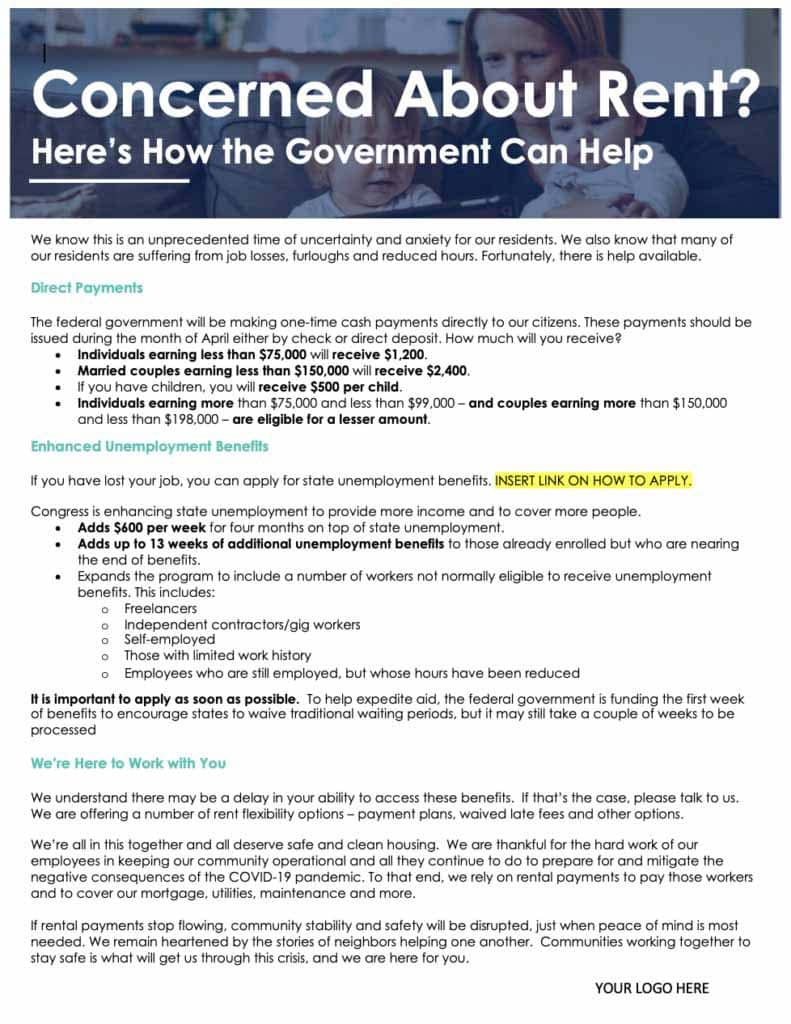

Pegasus Residential created a one-sheet detailing how the government can help those concerned about rent. It outlines information on direct payments and enhanced unemployment benefits.

JMG Realty put together a Resident Resource List linking to different non-profit organizations, as well as a directory of relevant CDC information.

General COVID-19 Resident Resources

WinnCompanies has a website popup informing residents that they can type in their zip code to perform a localized search for COVID-19 related resources. This quickly narrows down resources based on a renter’s geographical location.

Bridge Investment Group said in its COVID-19 Update that they’re monitoring resources available to impacted renters by maintaining a list for each of the states they operate in.

On top of building an extensive hub for Coronavirus Resources for Apartment Firms, the NMHC has rallied industry support around its COVID-19 Rental Relief campaign. In the NMHC resource center, operators can find helpful templates for communicating with residents regarding rent flexibility, federal assistance, and rent obligations.

The NMHC also released a document that aims to help residents understand the newly passed federal resources available to help them meet their financial obligations (and it can be customized by apartment operators).

Calls for Congressional Action

Both the NMHC and NAA have been proactive in fighting to protect both renters and apartment operators. In their March 13th letter to the House and Senate, they called upon lawmakers to provide direct financial assistance to renters.

Nearly a month later, the two organizations sent another letter to Congress regarding COVID-19 Relief Phase 4 which called out the need for additional relief and stimulus legislation, including help for rental housing providers, housing professionals, and residents. The NMHC is urging people to tell Congress that COVID-19 rent relief for the housing industry and residents is essential.The NAA’s positioning statement echoes this sentiment, and is encouraging others to contact their Member of Congress and demand Congress protect apartment communities.

Congress is also considering a $100 billion rental assistance fund to support renters in making their payments, which would also ensure owners can continue paying their mortgages. We will continue to monitor this bill and provide updates as we learn more. The more resources we share in times of uncertainty, the better off all our communities will be.

One thing is certain: the more information we share in challenging times, the better off all of our communities will be. “One of the really powerful things we’re witnessing is the way the industry is coming together,” says Dana Caudell, President of Property Management at The Bainbridge Companies. “It’s not about competition right now, it’s about how we can best help our residents and operate our businesses in these uncertain times – and if someone has a great idea or resource, we’re going to share it.”