U.S. Apartment Demand Remains Robust in First Half of 2025, Surpassing New Supply in Many Markets

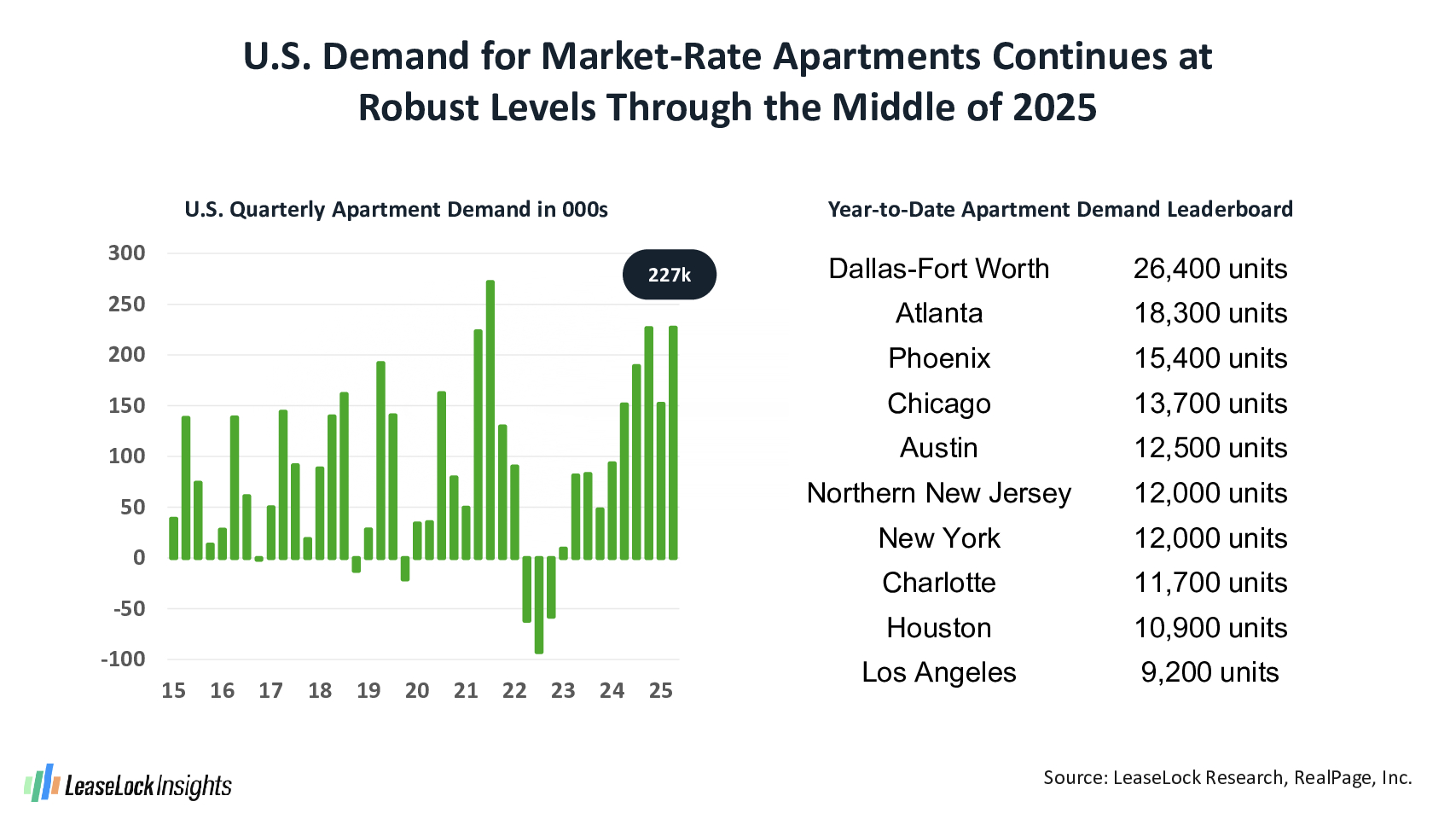

The U.S. continues to add renter households at a fast pace. The number of occupied market-rate apartments jumped by roughly 227,000 units during 2025’s second quarter, according to stats from RealPage, Inc., taking demand for the first half of the year to 379,000 units.

Helping support this absorption of rental units, job production and household formation continue at a substantial clip, despite concerns about what may lie ahead for the economy.

Also, resident retention at initial lease expiration is holding very strong, as loss of renters to home purchase remains far below the historical norm. Most move-ins, then, equate to additional net demand, rather than replacements of households leaving for other housing options.

While new apartment deliveries remain elevated relative to the past average, addition levels are moving past peak. Thus, demand now is beginning to surpass new supply tallies in most locations. Nationally, completions totaled some 108,000 units during the second quarter, taking year-to-date additions to 225,000 units.

Dallas-Fort Worth continues to rank as the country’s top market for apartment demand, with product absorption reaching 15,700 units in the second quarter and a whopping 26,400 units in 2025’s first half. DFW’s recent demand far surpasses the year-to-date volume in the second most active leasing hot spot: 18,300 units in Atlanta.

Additional metros registering demand for at least 10,000 units so far in 2025 are Phoenix, Chicago, Austin, Northern New Jersey, New York, Charlotte and Houston.

With most economists anticipating that job additions will slow during the coming months, it seems unlikely that apartment demand in 2025’s second half can match the big numbers posted in the past six months.

However, absorption still seems likely to end up well above the historically typical volume, partly because property owners and operators are employing a heads-on-beds strategy. Many are now willing to forgo meaningful rent growth in order to push occupancy as high as possible, in case future demand stumbles more than seems likely in today’s near-term outlook.

These strong results contribute to one of the most surprising apartment demand trends in 2025; absorption levels exceeding supply in many key metros, despite persistent economic headwinds.

About LeaseLock

LeaseLock is the only true lease insurance program for rental housing. Our AI-powered underwriting solution LeaseLock Shield™ harnesses the power of machine learning to determine the best coverage for each property and portfolio’s specific needs. The result is ultimate protection from write-offs and legal risk as well as reduced operational burden. With over $14 billion in leases insured, LeaseLock is delivering significant benefits to both renters and investors while reshaping the way the industry manages risk. LeaseLock is dedicated to improving housing accessibility by removing financial barriers for renters while protecting against risk.