High-Paying Job Growth Slows Sharply, Raising Questions for Housing Demand | April 2, 2025

With the release of new employment stats, many are digging through the data to see if there’s any cooling that stems from the implementation of tariffs or the cuts occurring in federal government positions.

When analyzing the latest info, it’s also worthwhile to look for any differences that show up in results for the high-paying employment sectors versus their counterparts where salaries are more moderate.

Those comparatively high-paying job categories are Professional/Business Services, Finance and Information. (Information is the sector where most tech industry jobs are counted.)

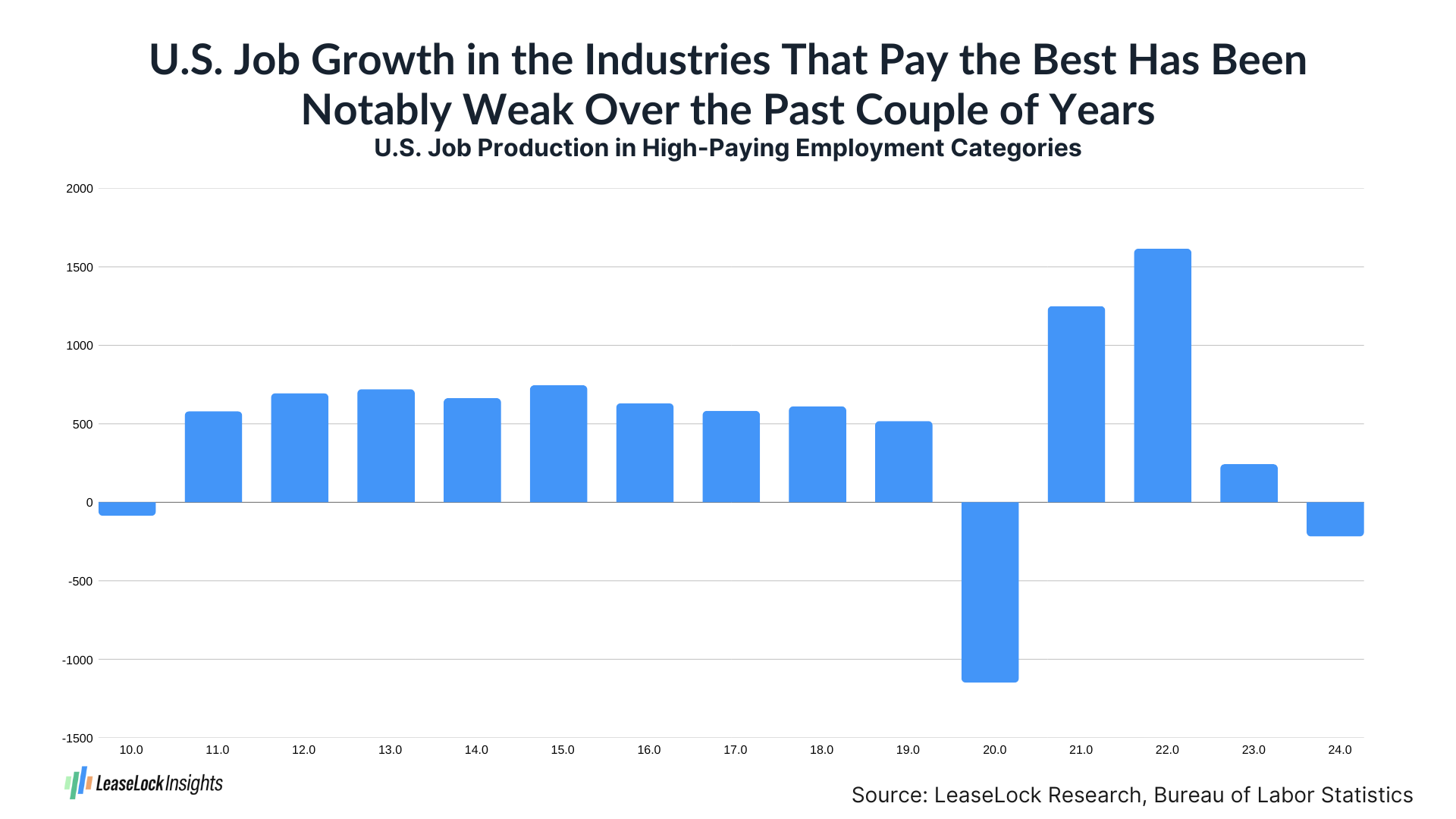

Beginning during the recovery from the Great Financial Crisis through 2022, the high-paying job sectors were the economy’s stars, accounting for 28% of all jobs added in comparison to the 22% share of all existing employment comprised of Professional/Business Services, Finance and Information positions. Even during the periods of overall downsizing seen in 2010 and 2020, the high-paying job sectors accounted for disproportionately small shares of total employment loss.

In 2023, however, the high-paying industries contributed just 7% of total job expansion. In an even more stunning turn, those industries then downsized by 218,000 positions during 2024, when overall employment growth came in at more than 2 million jobs.

How do the variances in job performance by industry influence the housing sector? The top wage earners obviously are more likely to be able to afford single-family home purchase. At the same time, they help fuel demand for luxury apartments, whereas those earning middle-range to bottom-end salaries are the core audience for Class B and C rentals.

Given the number of upscale new apartment deliveries moving through the initial lease-up process right now, rental market fundamentals would really benefit from a rebound in growth of Professional/Business Services, Finance and Information jobs.

About LeaseLock

LeaseLock is the only true lease insurance program for rental housing. Our AI-powered underwriting solution – LeaseLock Shield™ – harnesses the power of machine learning to determine the best coverage for each property and portfolio’s specific needs. The result is ultimate protection from write-offs and legal risk as well as reduced operational burden. With over $10 billion in leases insured, LeaseLock is delivering significant benefits to both renters and investors while reshaping the way the industry manages risk. LeaseLock is dedicated to improving housing accessibility by removing financial barriers for renters while protecting against risk. Brand Positioning 1.1 — About Us Please reference the following boilerplates in short, medium, and long lengths.