July Rent Payments Decline, Signaling Distress Among Renters

- Renters show signs of financial insecurity, with July rent payments dipping 8% MoM.

- Class C rent payments are 8% lower than last month.

- Searches for “rent assistance” spike again as federal benefits near expiration.

At the close of the July rent grace period, the impact of COVID-19 on both residents and multifamily operators is still profound. In our June Rent Payment Report, we analyzed how rent payment behavior held steady as the U.S. experienced a rebound in employment. July 1st rent payments also started off stronger than June 1st.

Now, we’re observing a drop in July rent payments — the same month that federal benefits are set to expire — as the strength of the U.S. economy wavers in the wake of a resurgent pandemic.

Our latest report explores rent payment behavior through the July grace period (July 1 – 5) based on actual transaction data sourced in real-time from multifamily property management systems.

July Rent Payments Drop As Federal Assistance Nears Expiration

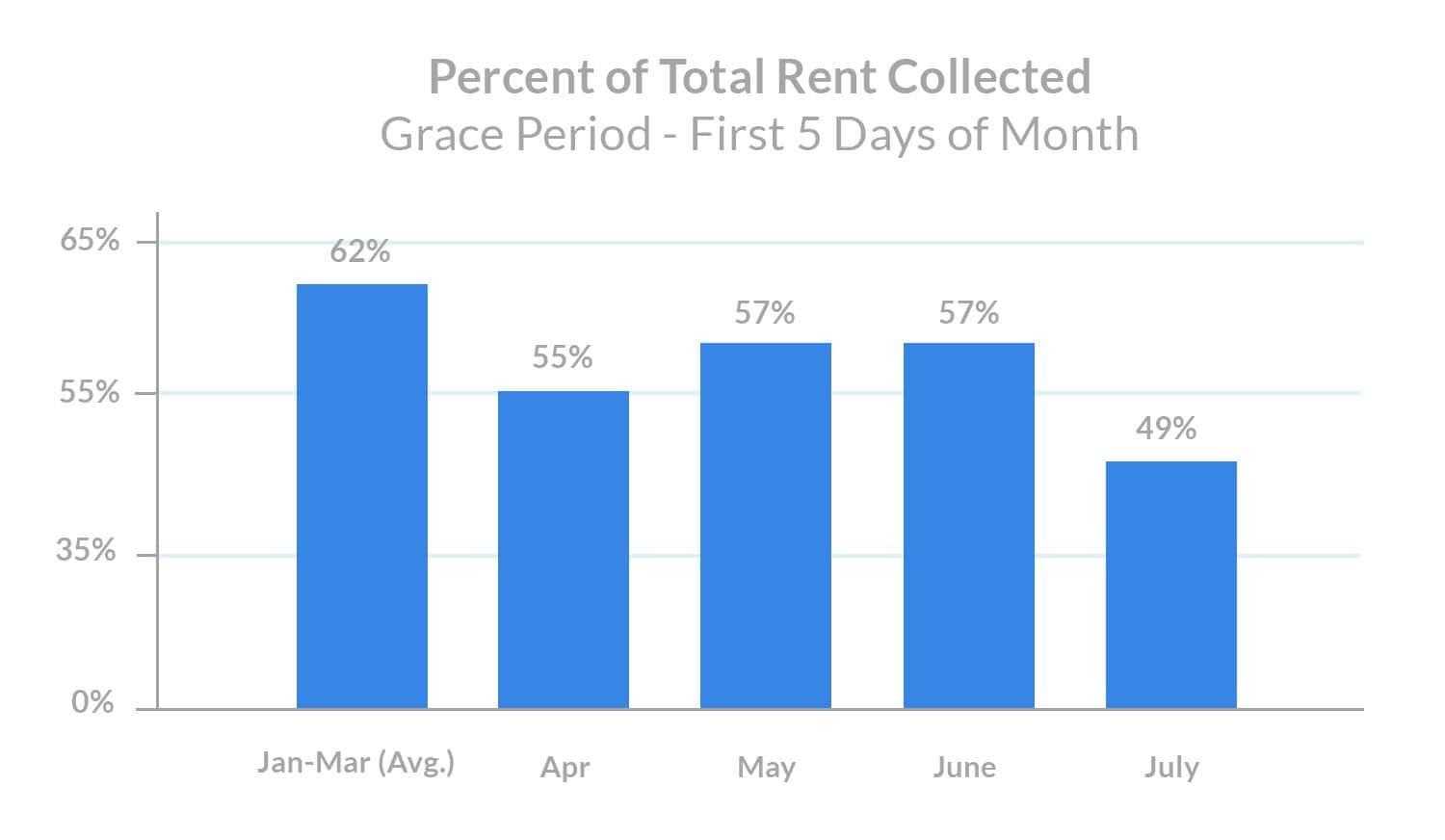

Looking at the total percent of rent collected during the July grace period (typically the first 5 calendar days of the month) compared to the same time period in June, we see rent payments dipped 8% month-on-month.

Rent payments are still lower than pre-pandemic levels — the percent of rent collected in July is 13 percentage points lower than the pre-COVID average grace period. This comes during the same month that many federal benefits are due to expire.

Class C Renters Struggle to Pay July Rent

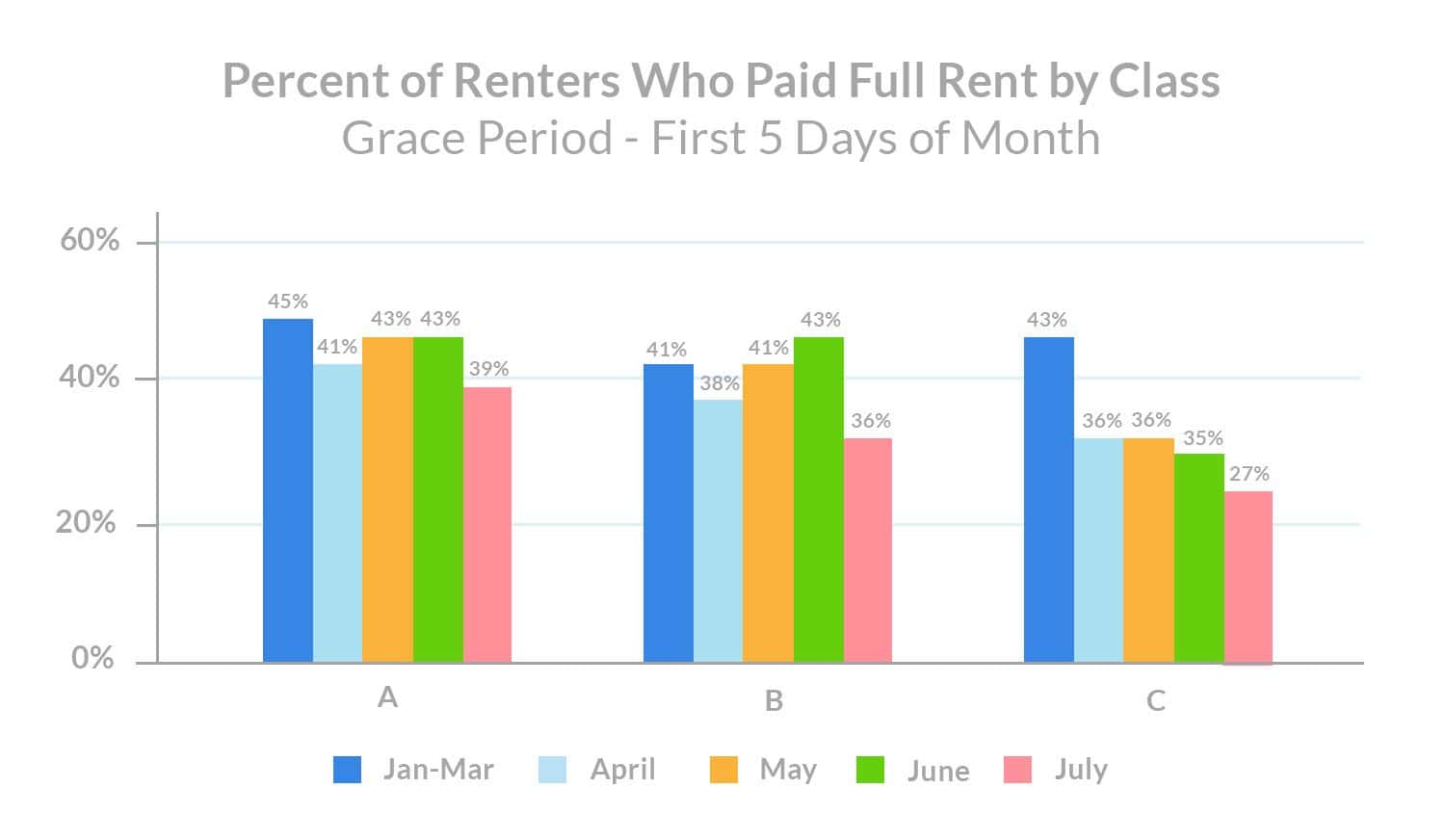

While June rent payments stabilized among Class C residents, July payments are faring worse—especially compared to Class A and Class B renters. Class C rent payments have slipped 8% since last month, drawing a 16 percentage point differential from the pre-COVID average.

The stability seen in June was likely due in part to businesses re-opening and employment seeing a subsequent lift, especially within retail and travel sectors. However, as states across the nation begin to shut down again, service industry workers are first in line to suffer financial hardship.

According to Bob Pinnegar, president and CEO of the National Apartment Association, “Class C properties are a cause for concern. We are closely watching developments in the Class C properties.”

The combination of dwindling unemployment benefits and the rolling back of state re-openings spells out the dire need for direct rental assistance.

Importance of Rent Assistance Persists

Many rental housing experts continue to advocate for emergency rent relief, but so far, available funding has been insufficient. Pinnegar has expressed his support for a federal rent assistance program, saying, “The government must step in with effective housing policy, like direct emergency rental assistance, to ensure families remain in their homes and rental housing providers can continue to provide quality housing.”

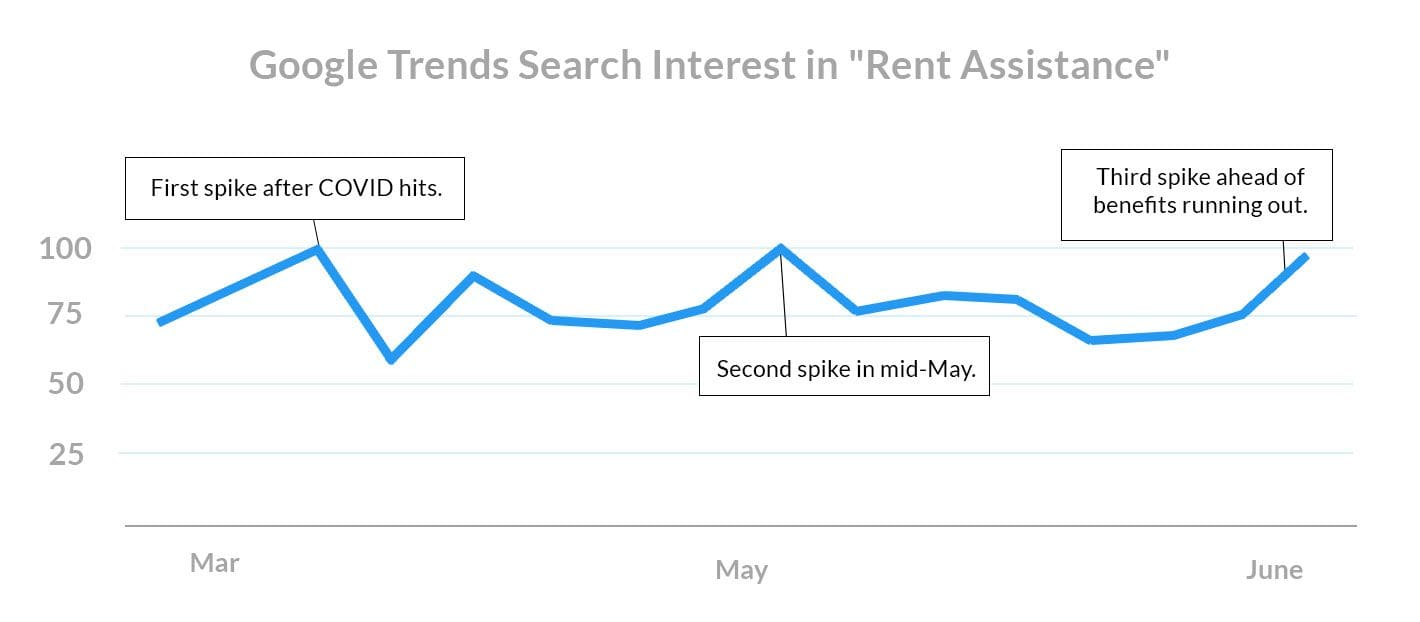

The unemployment rate seemed to be letting up last month, but with businesses being forced to re-close, many workers will inevitably face unemployment or furloughs again. In addition, $600 a week of additional federal benefits will soon run out. These factors, combined with general uncertainty, have caused rent affordability concerns to resurface.

Google search trends indicate that like last month, interest in “rent assistance” in July remains top-of-mind. In fact, the term has seen its third spike since the onset of COVID-19, proving the continuous need for such a program as unemployment threatens to climb back up.

California & Texas Unable to Recover

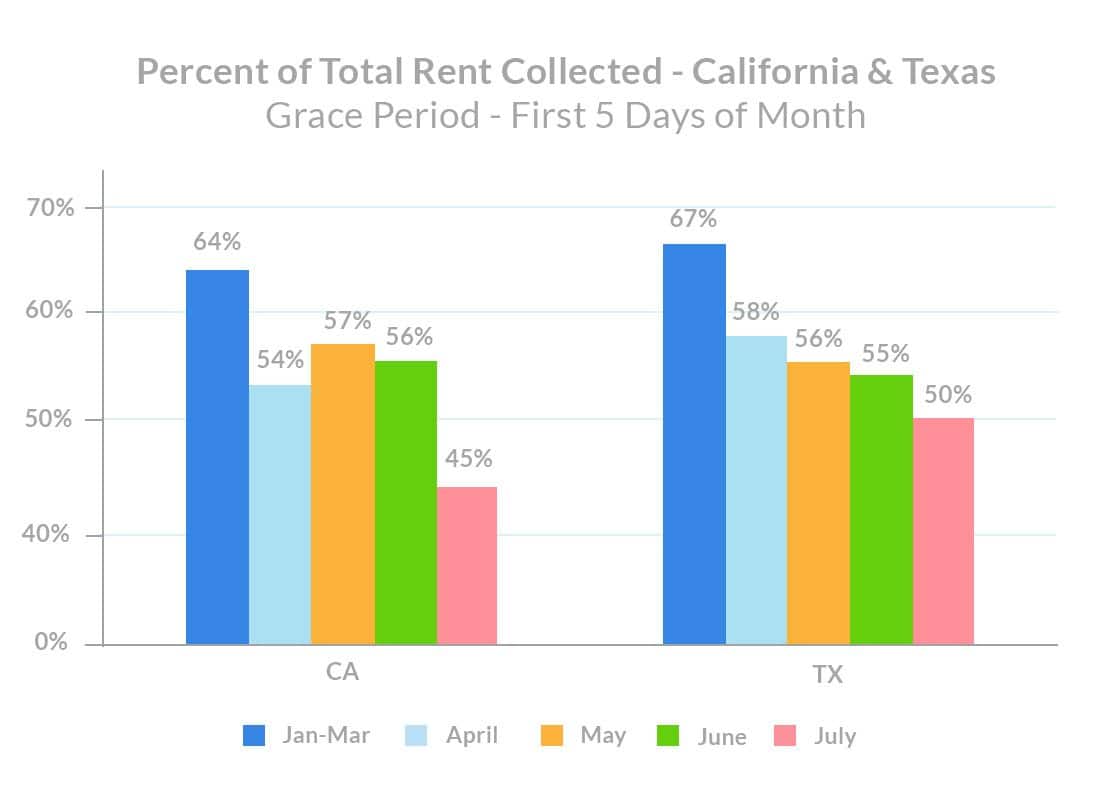

Both Texas and California have had trouble recovering from COVID, and following hasty June re-openings and a subsequent spurt in COVID cases, both states have seen big percentage drops in July rent payments.

In California, rent payments have declined since May, with an 11% dip from June to July—about a week after a rent relief bill cleared the California Senate allowing renters 14 years of emergency relief.

In Texas, rent payments have steadily declined each month since COVID struck, with the latest month-over-month drop falling 5%. The drop in rent payments in Texas comes shortly after Governor Greg Abbott announced a roll-back in business re-openings near the end of June.

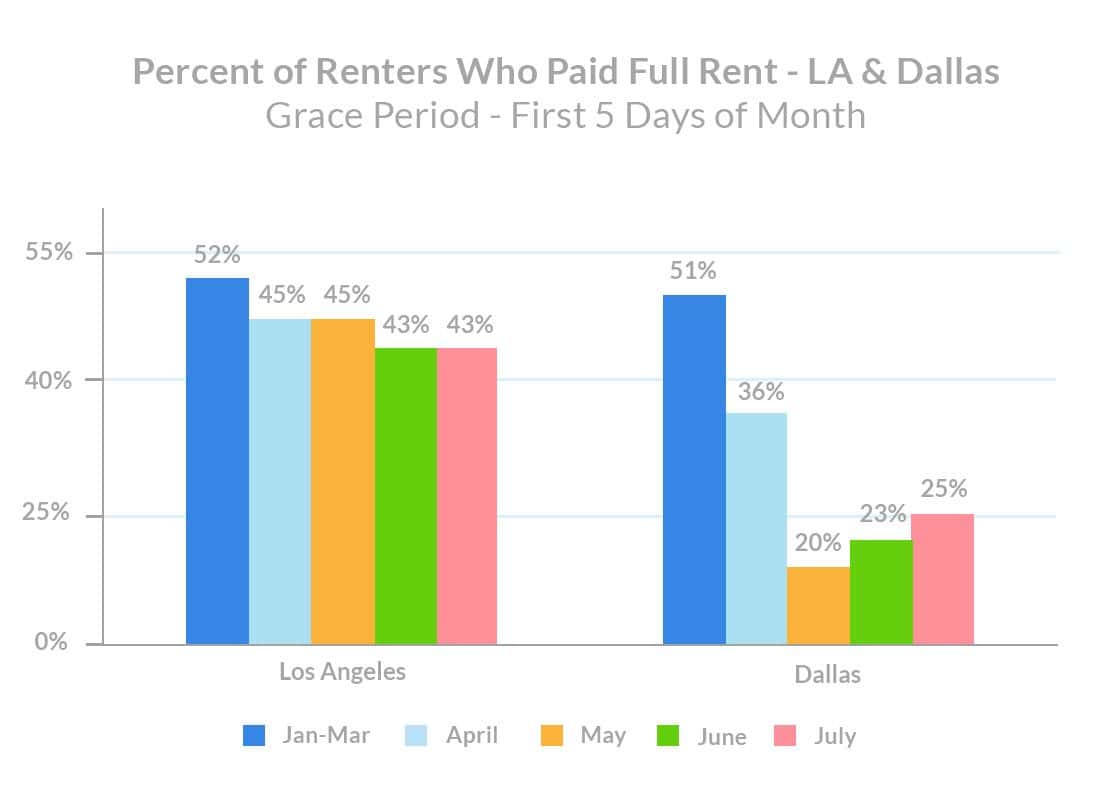

Los Angeles Continues Downward Trend, Dallas Sees Slight Recovery

As we explored in our June 1 analysis, renters in Los Angeles continue to struggle to make rent payments. With unemployment nearing 21%, the city finally approved a $100 million renter relief program in the end of June—however, some industry experts argue the funds are not enough to support renters and property managers. Now, new shutdowns across the city threaten to stall LA’s efforts to recover.

The city of Dallas, on the other hand, has seen a gradual recovery since May when it experienced its sharpest decline. The 3% month-over-month gain can be attributed to rental assistance and the city’s decision to allow Dallas residents 60 days to pay off unpaid rent if affected by COVID, but the percent of renters who are paying rent is still more than 25% down from the average.

What Will August Rent Payments Look Like?

In light of businesses shuttering again and the fast-approaching expiration date of unemployment benefits, the drop in July rent payments—especially among Class C residents—is a wake-up call for multifamily as well as legislators. Will August rent payments experience even greater losses? Check back next month for an in-depth report on rent payment behavior.

Important statistical note: Despite the measured payment fluctuations based on the sample set, the variance is within normal statistical range. In other words, the changes are not necessarily significant enough to attribute specifically to COVID-19 versus normal fluctuations expected across the data set. Please reference full Methodology below.

Methodology

Rent payment data is actual transactional data sourced from integrations with property management systems in the multifamily industry.

Analysis includes a 105,070 unit sample from 1,029,428 live units under management by LeaseLock clients. Data is nationwide, representing over half of the NMHC Top 10 property managers in the country and all asset classes (A, B and C). Asset class composition: class A (37%), class B (48%) class C (15%).

All data has been anonymized to remove personally identifiable information for renters and property managers.